Online tax accountant for easy tax preparation

We are thrilled to announce our partnership with ITP Accountanting Professionsals (ITP) to bring you an exclusive online tax accountant service tailored for all TaxTank subscribers. With ITP’s renowned expertise, we aim to maximise your returns, minimise your stress, and eliminate the hassle of tax time.

Exceptional accounting support tailored to your needs

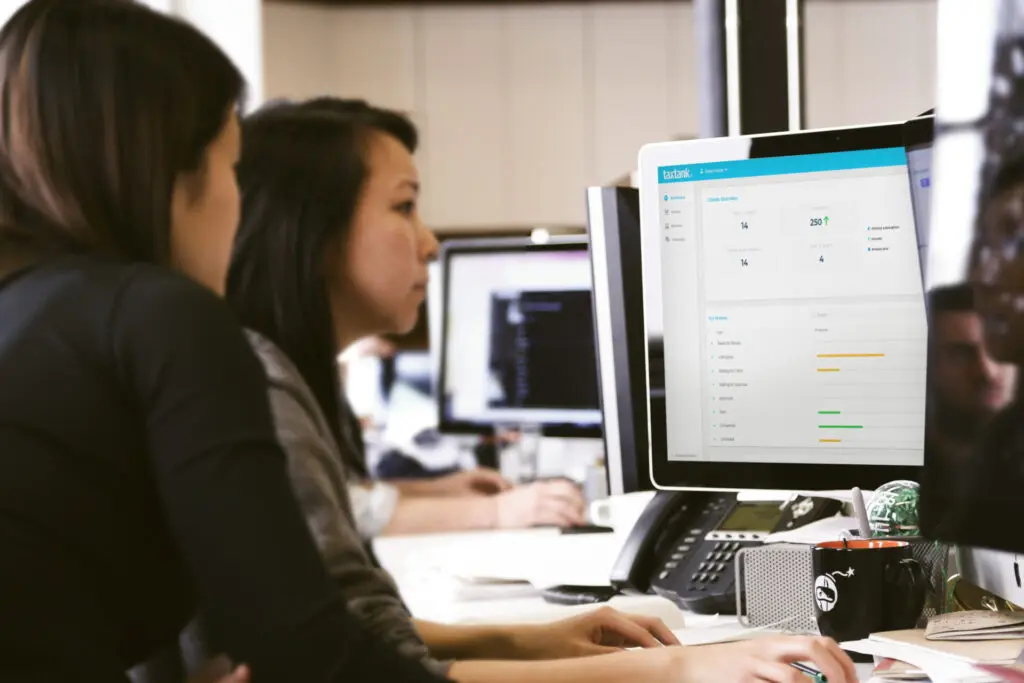

Our team of expert tax accountants, in collaboration with ITP, specialises in investment property, capital gains, and sole trader accounting. With their extensive knowledge and experience, you can trust that your financial matters are in capable hands.

Moreover, by utilising TaxTank to manage your income and expenses throughout the year, we save valuable time when preparing tax returns. These savings are passed on to you, creating a win-win situation.

Unlock our online tax accountant services

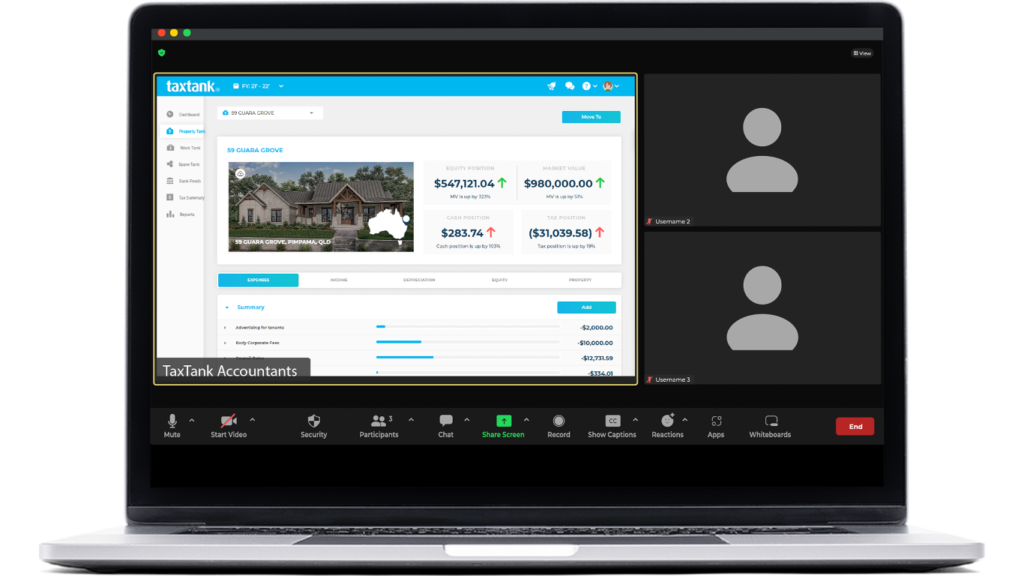

Gain the expertise you need, right from the comfort of your home. Whether you have tax-related questions, need assistance with onboarding, or want personalised one-on-one time to review your TaxTank schedules before self-lodging, we’ve got you covered.

Benefit from a secure 15- or 30-minute consultation starting at just $49 and gain peace of mind knowing that you’re always informed.

Streamline your tax season with annual reviews and lodgements

Experience a fast, seamless, and cost-effective lodgement service that rewards your TaxTank efforts throughout the year. Our partnership with ITP brings expert tax services and TaxTank’s technology to the virtual realm. It all starts with a 15-minute consultation that sets the stage for personalised service. With us, you’ll receive the best of both worlds at tax time.

Sign up now and unlock the benefits of online accounting. Let us take care of your financials while you focus on what you do best.

Sign up now and unlock the benefits of online accounting. Let us take care of your financials while you focus on what you do best.

Why choose our Tax Accountants?

Confidence

Our collaboration with ITP adds confidence by ensuring accurate allocations, cross-checking with ATO data, and providing comprehensive consultation.

Convenience

Access online tax accountants from anywhere, eliminating the need for in-person meetings or impersonal emails, saving time and hassle.

Cost-effectiveness

Pay only for the time you need with an experienced accountant, ensuring cost-effectiveness for quick questions or in-depth discussions.

Technology-driven Efficiency

Leverage TaxTank’s advanced accounting tools and reporting to streamline processes and enhance efficiency.

Collaboration

Real-time access to financial data via TaxTank eliminates reliance on historic data and improves service quality.

Real Time Update

Stay informed throughout the process as our tax accountants provide real-time updates on your tax return.

Our pricing packages

Our tax return pricing model is stackable: start with the Basic Tax Return and add any additional schedules based on your personal tax return needs.

Partnering with ITP, we ensure you receive exceptional service and support for a stress-free tax season.

- Student Tax Return $79

Applies to individuals under 21 or full-time student under 25

- Includes an initial 15-minute virtual consultation

- PAYG and standard pre-fill incomes, including dividends and employee share schemes Work related deductions, including self-education (no dollar value limit on deductions)

- Basic Tax Return $129

- Includes an initial 15-minute virtual consultation

- PAYG and standard pre-fill incomes, including dividends and employee share schemes Work related deductions, including self-education (no dollar value limit on deductions)

- Hands on Assistance $65

Hands-on tax time help preparing for a review at the EOFY

- Add Property Schedules $55

Price is per schedule

- Rental income and expenses

- Depreciation

- Add a Capital Gains Tax Schedule $40

Price is per schedule

- Unlimited assets (single entry in the tax return)

- Add Business Schedule $85

Price is per schedule

- Sole trader business income and expenses

- Depreciation

- BAS

- Add Other Schedule $15

Price is per schedule

- Motor vehicle logbook

- Other Income: Managed Fund, Trust, Partnership, Personal Services Income, Foreign Income/Pension Personal super contribution claim

Pricing listed above is for TaxTank subscribers only. All prices are inclusive of GST.

Other Tax Accountant services available

Need some tax advice? We’ve mad it even easier with ITP’s personalised services.

Choose from our flexible options of 15 or 30-minute consultations, designed to cater to your specific needs and time constraints.

Whether you have quick questions or require an in-depth analysis, our tax consultation services are tailored to provide you with the guidance you need to achieve your financial goals.

- 15 Minute Tax Accountant Consultation $49

Includes a 15 minute consultation with an ITP expert tax accountant.

- 30 Minute Tax Accountant Consultation $98

Includes a 30 minute consultation with an ITP expert tax accountant.

- Hands on assistance $65

Need extra help preparing your TaxTank account for review? No problem, we can help get you up to date. Price is per 30 minutes of support.

Frequently asked questions

No, our discounted services are only available to TaxTank subscribers. The reduced prices are are there to reward those who have managed their tax throughout the year.

At this stage our services are 100% available online. However, if you connect with an ITP accountant in your area, they may do in office bookings.

Absolutely! The first review session gives our accounting partners the time to review what you’ve done and to guide you through the next steps.

We are about empowering everyday Australians to proactively managing their tax. By using TaxTank throughout the year, you will not only save time and stress getting everything ready at the end of financial year but also rewarded with discounted fees.