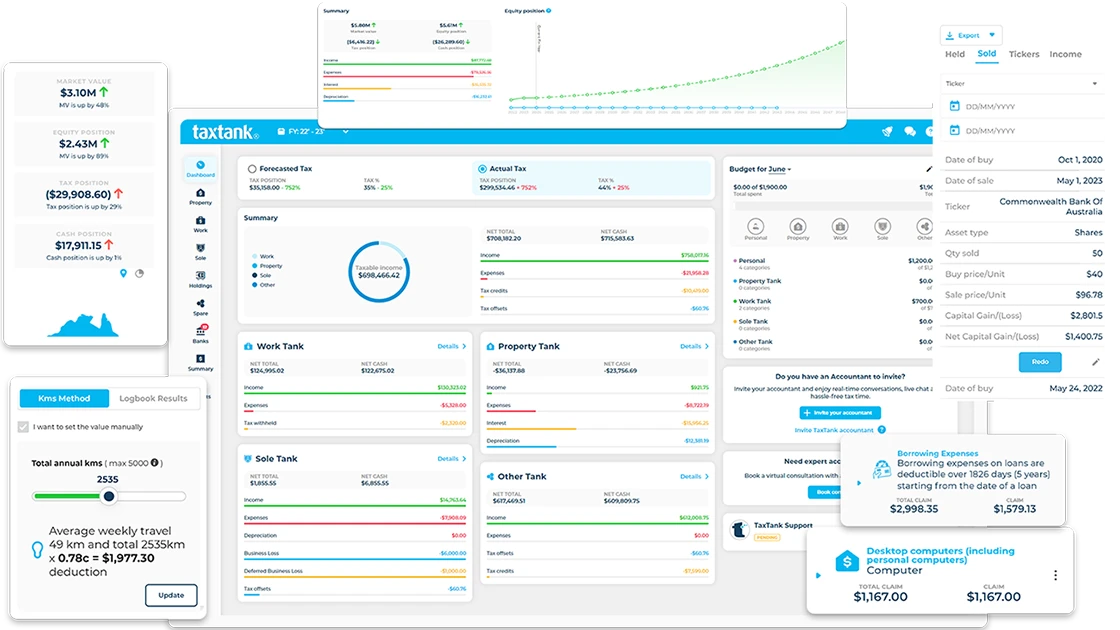

TaxTank is the ultimate tax and personal finance software for anyone looking to take control of their tax and personal finances. Forget about the chaos of spreadsheets and hunting down scattered information.

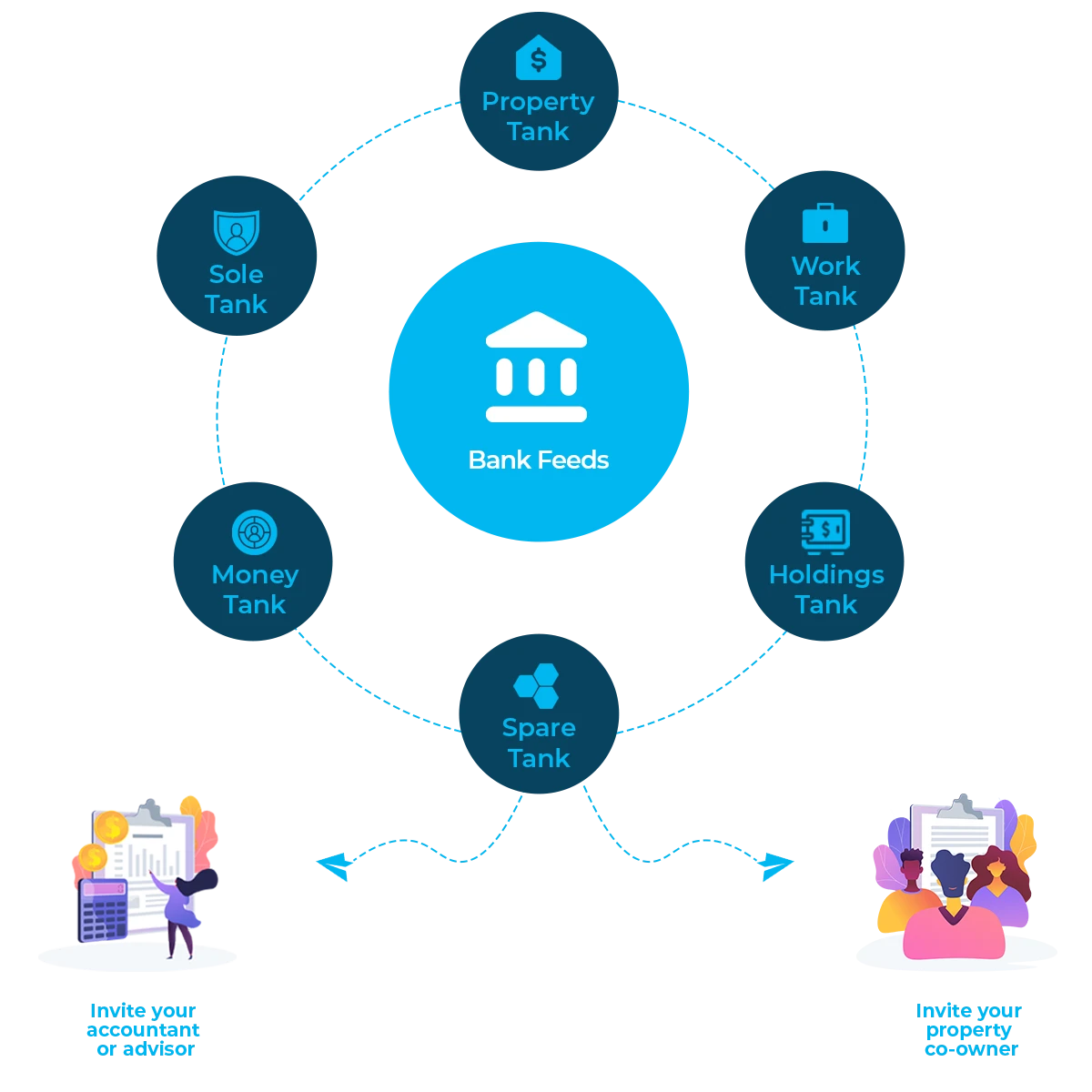

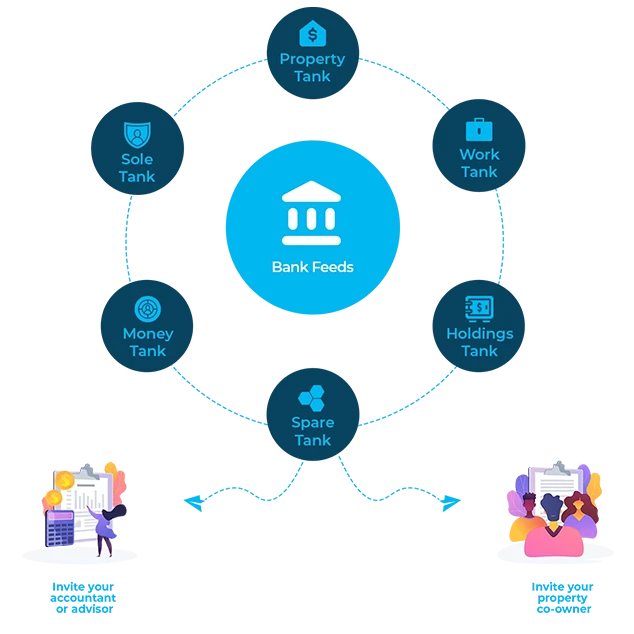

Using live bank feeds, you can easily track your income, expenses, properties, sole trader business, shares, crypto, budgeting and financial goals management in one streamlined hub. Take charge of your tax, manage your finances, and leave the stress behind with TaxTank

Whether you’re an individual looking to maximise work expenses, a property, share or crypto investor wanting full transparency across your portfolio, or a sole trader wanting to manage your business with tax in mind, TaxTank is the only tax and personal finance software you need. And with Money Tank, you can take control of your everyday money like never before — budget smarter, plan ahead, and keep your finances on track all year round.

Backed by Australian tax law, our automated smart calculations make sure you claim everything you’re entitled to, so you never have to worry about missing a deduction or making a mistake. TaxTank puts you in control of your tax and money, taking the hassle out of tax time.

Plus, you can invite your accountant, property group, broker or financial advisor to collaborate live, so everyone can make informed financial decisions together.

Built by accountants, TaxTank uses multiple Tanks — smart digital containers — to organise your income, expenses, properties, and investments, while securely storing receipts and documents year after year, so you’re always protected against ATO audits.

As you allocate transactions from live bank feeds, TaxTank automatically calculates your tax, giving you a clear, real-time view of your finances. It’s the only personal finance software that turns 6,000 pages of complex Australian tax law into one simple, easy-to-use solution.

TaxTank is the only personal finance software in Australia that calculates your real-time tax position every day of the year, while securely storing your receipts and documents to protect you from ATO adjustments. We’ve built in a range of automation tools and smart features to make sure you claim everything you’re entitled to — accurately and effortlessly.

See your financial position all year round so you can make informed decisions about your money.

Ensure nothing is missed with automated live bank feeds using Open Banking.

Automatically allocate income and expenses uses our bank rules so you can set and forget.

Enjoy tax benefits without the hassle, using TaxTank’s simple and smart depreciation and CGT calculators.

Automatic calculations of your estimated tax position to highlight ways to maximise deductions.

Share with property co-owners, accountants and advisors so you can keep on top of everything year round.

Attach receipts, document, statements and even warranties for a secure record that never fades.

Avoid stress at the end of the financial year and know your tax position all year round.

Our pricing starts from as little as $6* per month and is customisable so you only pay for the Tanks that suit your individual needs. TaxTank is also 100% tax deductible 😉 so it’s a win, win.

PROPERTY TANK

Manage property income and expenses

$15/month*

WORK TANK

Manage work income and expenses

$9/month*

SOLE TANK

Manage sole trader income and expenses

$9/month*

MONEY TANK

Manage budgets, cash flow and financial goals

$6/month*

HOLDINGS TANK

Manage CGT for shares, crypto and other assets

$6/month*

SPARE TANK

Upload important documents and receipts

FREE WITH ANY PAID TANK

Don’t just take our word for it.

See what our customers have to say about TaxTank, Australia’s best tax and personal finance software.

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation. *All TaxTank Subscriptions are paid for on an annual basis.

Copyright © 2026 TaxTank | All Rights Reserved.