The best alternative to Etax Accountants

When it comes to managing your taxes, services like Etax Accountants may seem convenient, but they fall short in providing the year-round support and attention that taxpayers need to maximise their deductions. While Etax offers an online app for inputting tax data, their services are limited to reviewing your return at the end of the year, meaning many valuable deductions could slip through the cracks. If you’re looking for an alternative to Etax Accountants that offers more comprehensive, real-time tax management, TaxTank is the solution.

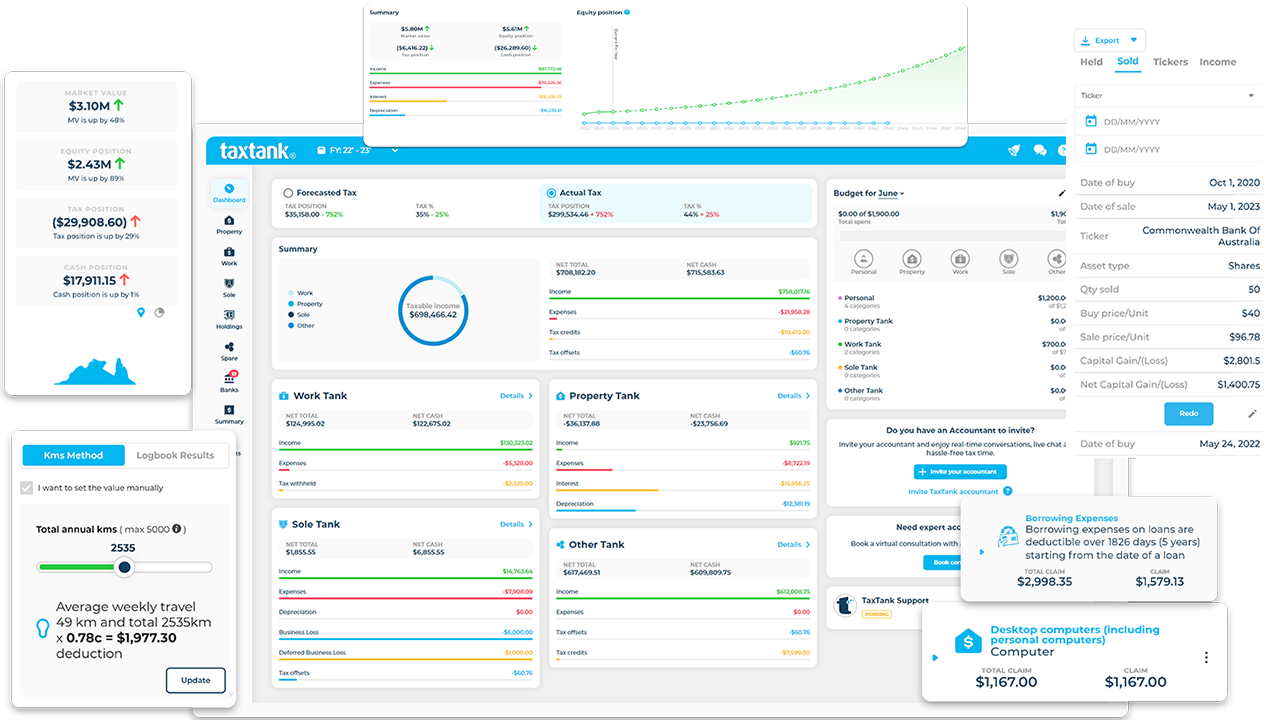

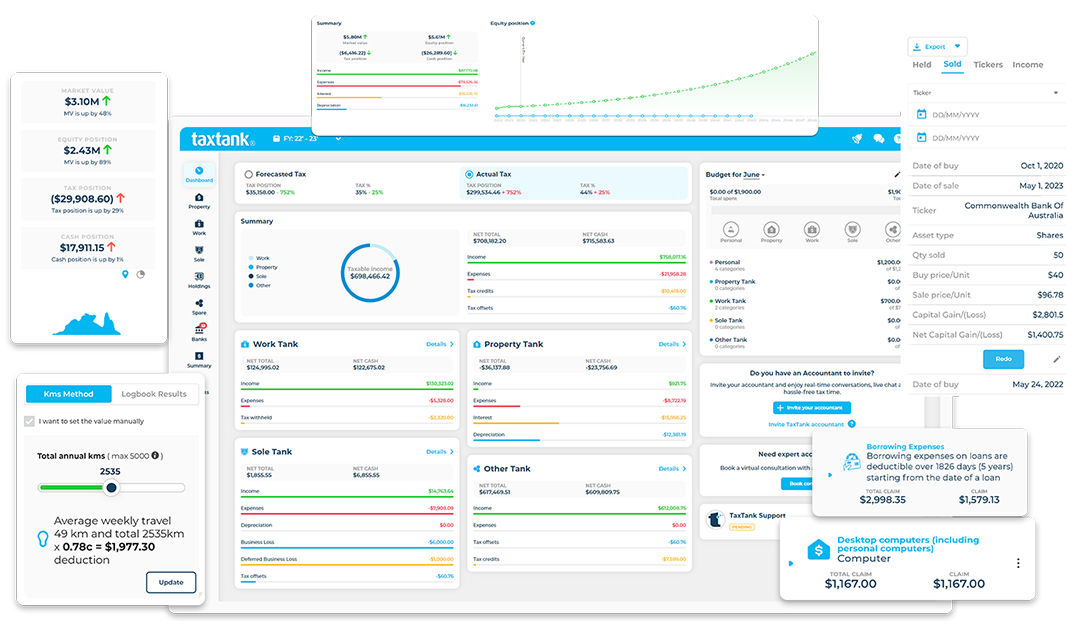

What you get with TaxTank

Underpinned by Australian tax law, our automated smart calculations ensure you claim everything you are entitled to without worrying that you’re making a mistake or missing out. TaxTank gives you the power to manage your own tax affairs, claim every possible deduction and completely taking the hassle out of tax time.

- Live bank feeds to ensure nothing is missed

- Automatic calculations for all expense types

- Depreciation for work expenses, properties and DIY projects

- Complete oversight of your property portfolio

- Capital Gains Tax calculators for property, shares and crypto

- Invoice management and business tools for sole traders

- Real time reporting across your tax and personal finance

- Document storage for receipts and important documents

- MyTax report so you an self-lodge confidently

- Monthly budget tracking to keep on track of your finance

- Partnership with ITP Accountants should you wish to engage an accountant to review your tax return

- Plus so much more, including automation features......

What you get with Etax Accountants

- Online platform to enter your tax data

- Estimated tax return based on your data entry

- Access to an accountant to review your tax return before lodging

- Lodgement of tax returns on your behalf

- Lodgement of late tax returns if you've missed the deadline

You will also need;

- Spreadsheet or document to track your expenses

- Spreadsheet to manage vehicle logbooks and WFH hours

- Invoice management tool

- Capital Gains Tax calculator

- Software to manage investments

The best alternative to Etax Accountants

TaxTank is the only software on the market where you can see your tax position all year round. Here’s how we compare with working with Etax Accountants.

TaxTank

- Automated income and expense management

- Simplified tax preparation

- Live tax position all year round for all income types

- Live bank feeds through Open Banking

- Property performance comparisons (growth & tax)

- Automated property depreciation & borrowing expenses

- Permanent document storage

- Tax deductible fees

TaxTank

Etax

TaxTank

- Live income and expenses

- Simplified tax preparation

- Live tax position all year round

- Live bank feeds

- Property performance

- Property depreciation

- Permanent document storage

- Tax deductible fees

TaxTank

Etax

Sign up now and unlock the benefits of managing your tax live throughout the year instead waiting until the end of financial year mad rush.

It's easy to get started

TaxTank has been built as a modular system so you only pay for what you need.

You can start with any Tank that suits your needs and then add more as your financial situation requires.

Annual

Monthly

12% discount

Work Tank

Use live bank feeds, built in tax tools, logbooks, document storage and live tax reports, including MyTax so you can self-lodge your tax return. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- Vehicle Logbook

- WFH Log

- Work Depreciation

- Document Storage

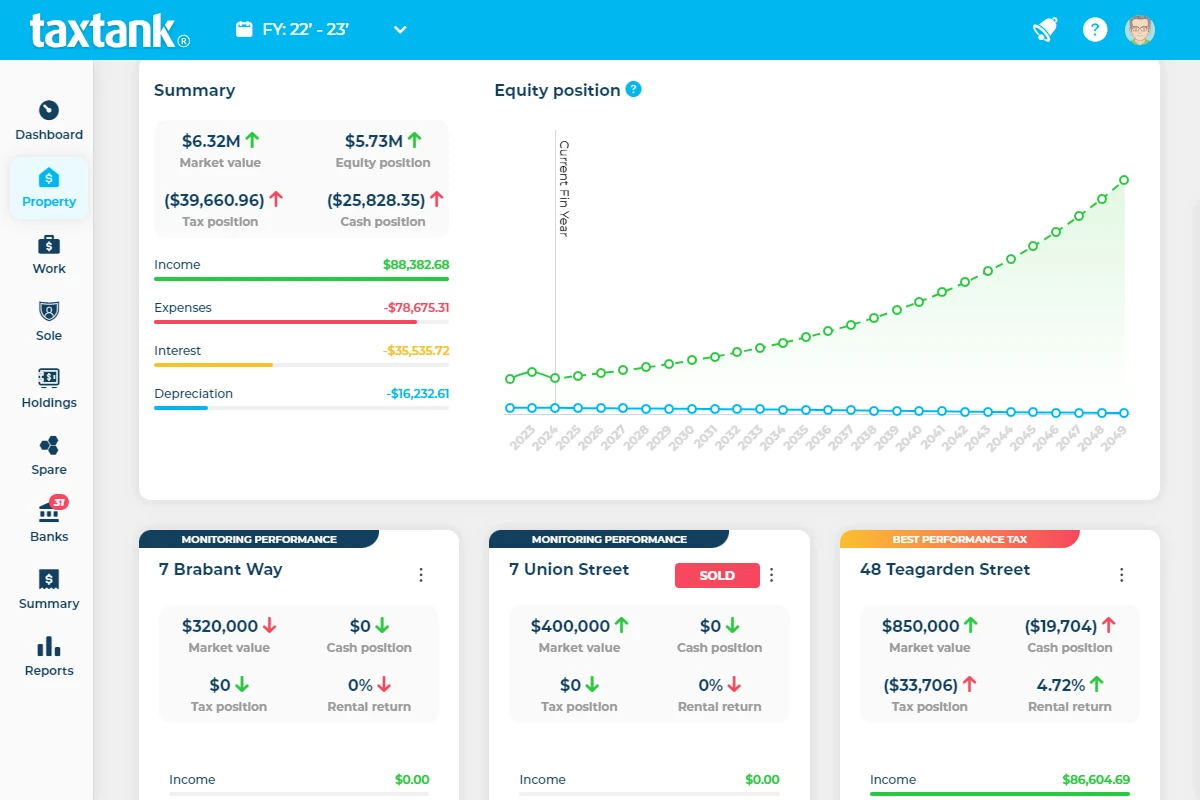

Property Tank

Ditch the spreadsheets and manage your whole property portfolio in one place – including investment properties, your home and properties owned in trusts. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- CGT Calculator

- Low Value Pool Reports

- Property Schedules

- Property Depreciation

- Monitor Equity

- Borrowing Calculator

- Manage 5 properties

- Document Storage

Sole Tank

Manage your sole trader income seamlessly with auto invoicing, business reporting and smart tools so you know exactly how much tax you have to pay. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- BAS Reports

- Invoice Management

- Manage 6 businesses

- Track prior year losses

- Vehicle Logbook

- Document Storage

- Business Depreciation

Holdings Tank

Monitor your stocks, shares and cryptocurrencies so you track your portfolio value in real time and calculate any Capital Gains or losses automatically if you sell. - 100% Tax Deductible

- Monitor shares

- Monitor cryptos

- Monitor other assets

- Live Tax Summary

- myTax Report

- Document Storage

All Tanks

Utilise all tanks to manage your incomes, expenses, properties and investments whilst securely storing receipts and documents for better decision-making. - 100% Tax Deductible

- 15% discount

- Everything in Work Tank

- Everything in Property Tank

- Everything in Sole Tank

- Everything in Holdings Tank

Work Tank

Use live bank feeds, built in tax tools, logbooks, document storage and live tax reports, including MyTax so you can self-lodge your tax return. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- Vehicle Logbook

- WFH Log

- Work Depreciation

- Document Storage

Property Tank

Ditch the spreadsheets and manage your whole property portfolio in one place – including investment properties, your home and properties owned in trusts. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- CGT Calculator

- Low Value Pool Reports

- Property Schedules

- Property Depreciation

- Monitor Equity

- Borrowing Calculator

- Manage 5 properties

- Document Storage

Sole Tank

Manage your sole trader income seamlessly with auto invoicing, business reporting and smart tools so you know exactly how much tax you have to pay. - 100% Tax Deductible

- Live Bank Feeds

- Expense Management

- Income Management

- Live Tax Summary

- myTax Report

- BAS Reports

- Invoice Management

- Manage 6 businesses

- Track prior year losses

- Vehicle Logbook

- Document Storage

- Business Depreciation

Holdings Tank

Monitor your stocks, shares and cryptocurrencies so you track your portfolio value in real time and calculate any Capital Gains or losses automatically if you sell. - 100% Tax Deductible

- Monitor shares

- Monitor cryptos

- Monitor other assets

- Live Tax Summary

- myTax Report

- Document Storage

All Tanks

Utilise all tanks to manage your incomes, expenses, properties and investments whilst securely storing receipts and documents for better decision-making. - 100% Tax Deductible

- 15% discount

- Everything in Work Tank

- Everything in Property Tank

- Everything in Sole Tank

- Everything in Holdings Tank

Frequently asked questions

TaxTank’s pricing starts from $6 per month and you only pay for what you need.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.