Sole trader tax software for effortless tax management

TaxTank helps you manage your side hustle or sole trader tax seamlessly with auto invoicing, business reporting and smart tax tools so you know exactly how much tax you have to pay.

Take control of your sole trader tax and remove the stress

We get it. Running a side hustle or managing your sole trader income can be stressful! Not only are you trying to get your business idea running smoothly, but you’re also trying to manage the paperwork and figure out how much tax you need to pay.

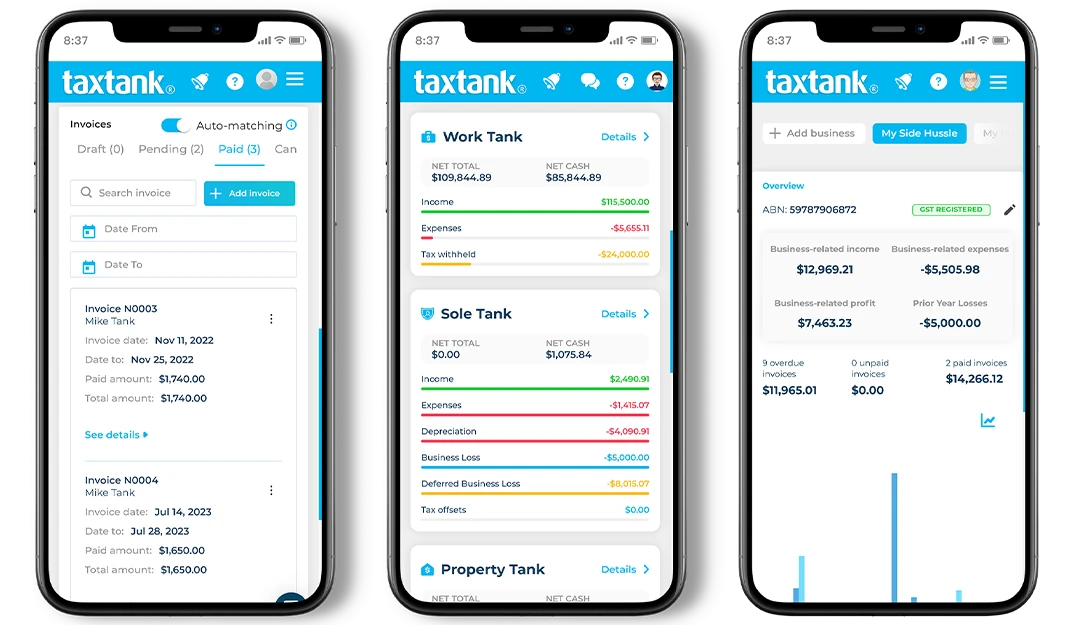

TaxTank helps you manage your business while giving you complete oversight on your tax position all year round.

With everything in one place, you’ll know exactly where you stand – from your income and expenses to your unpaid invoices, BAS, roll forward losses and everything in between.

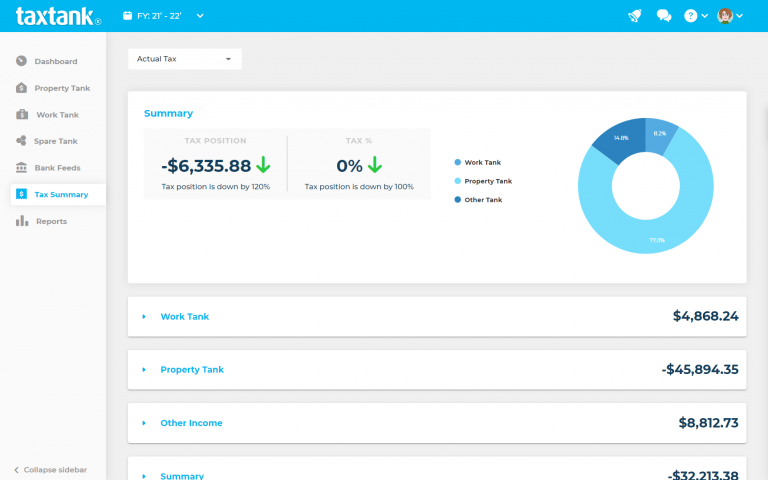

No more tax surprises

We’ve made it easy to instantly find and match your invoices directly to your bank transactions to ensure you’re keeping track of monies paid and outstanding to manage business cashflow.

You can also allocate business expense transactions from live bank feeds to ensure nothing is ever missed or forgotten, plus you can even attach receipts for sound tax management.

And with our tax summary, you’ll be able to see exactly where you stand throughout the year so you don’t have to dread tax time.

What you get with TaxTank

You can now manage your sole trader tax seamlessly with auto invoicing, business reporting and integrated logbooks, as well as smart tax tools to manage deferred losses and the ATO rules to offset tax.

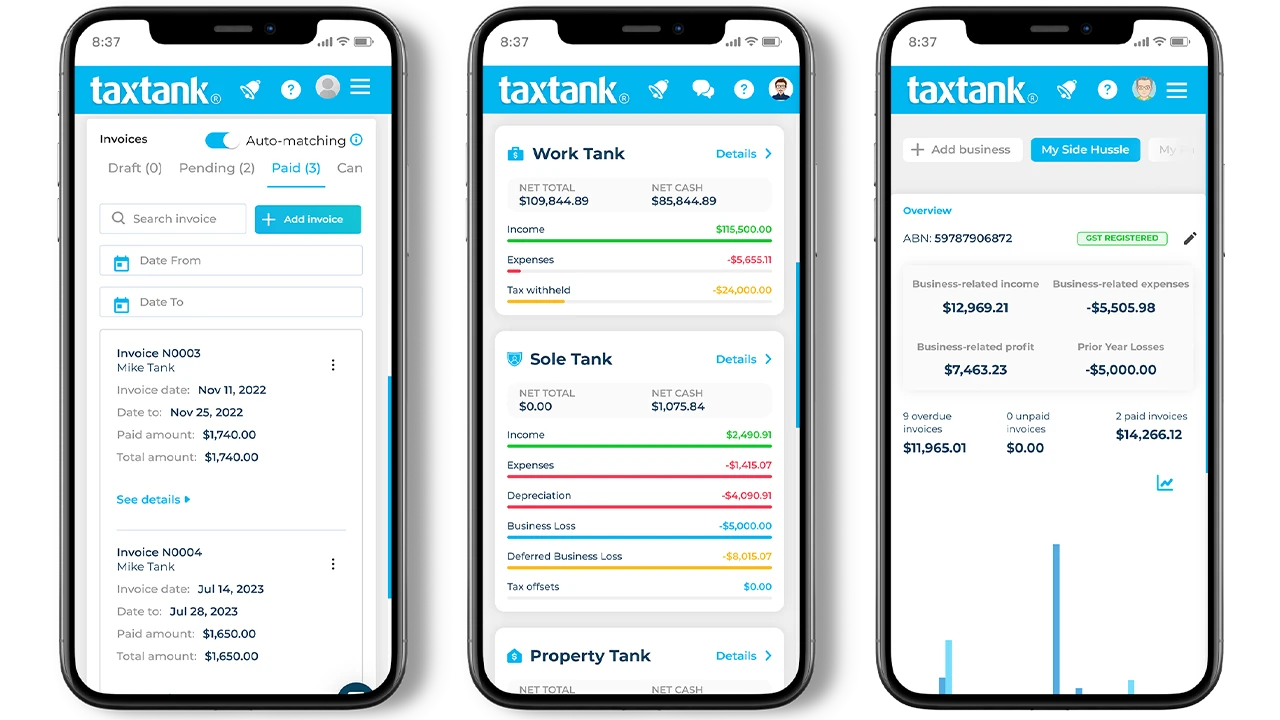

Instant Invoicing

Draft invoices, approve and email directly to your clients. Allocate paid invoices from bank feeds to update your invoice status and keep track of monies owing.

Simple BAS reporting

Registered for GST? No stress, just select your reporting period to see how much GST you’ve collected and paid for simple BAS reporting in seconds.

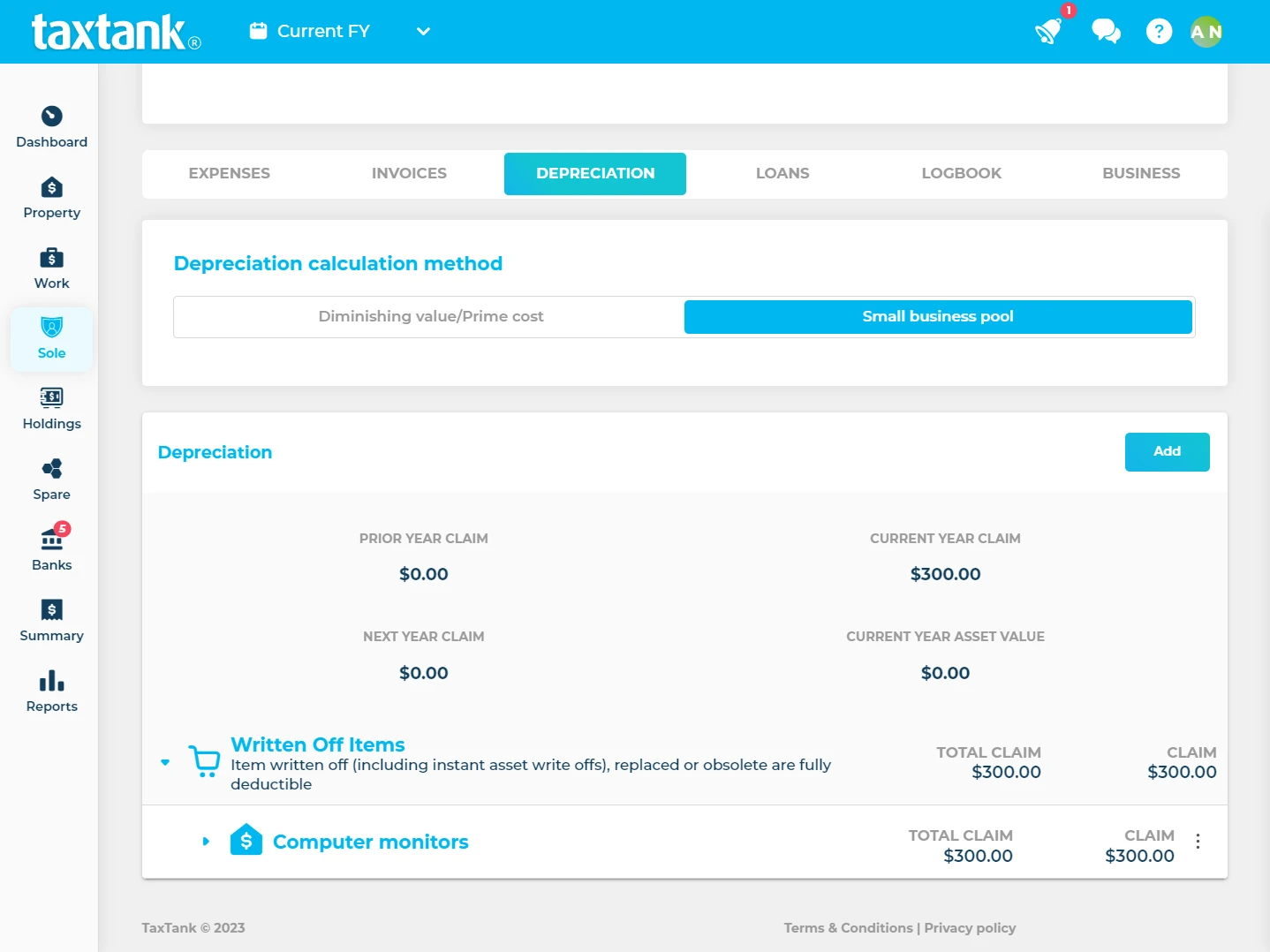

Maximum depreciation

Automated sole trader tax tools to manage all depreciation types, including accelerated depreciation in general pools and instant asset write off concessions.

Track prior year losses

Track prior year business losses to reduce current year profit. Better still, test losses against the ATO rules to potentially offset your other taxable income in a few easy steps.

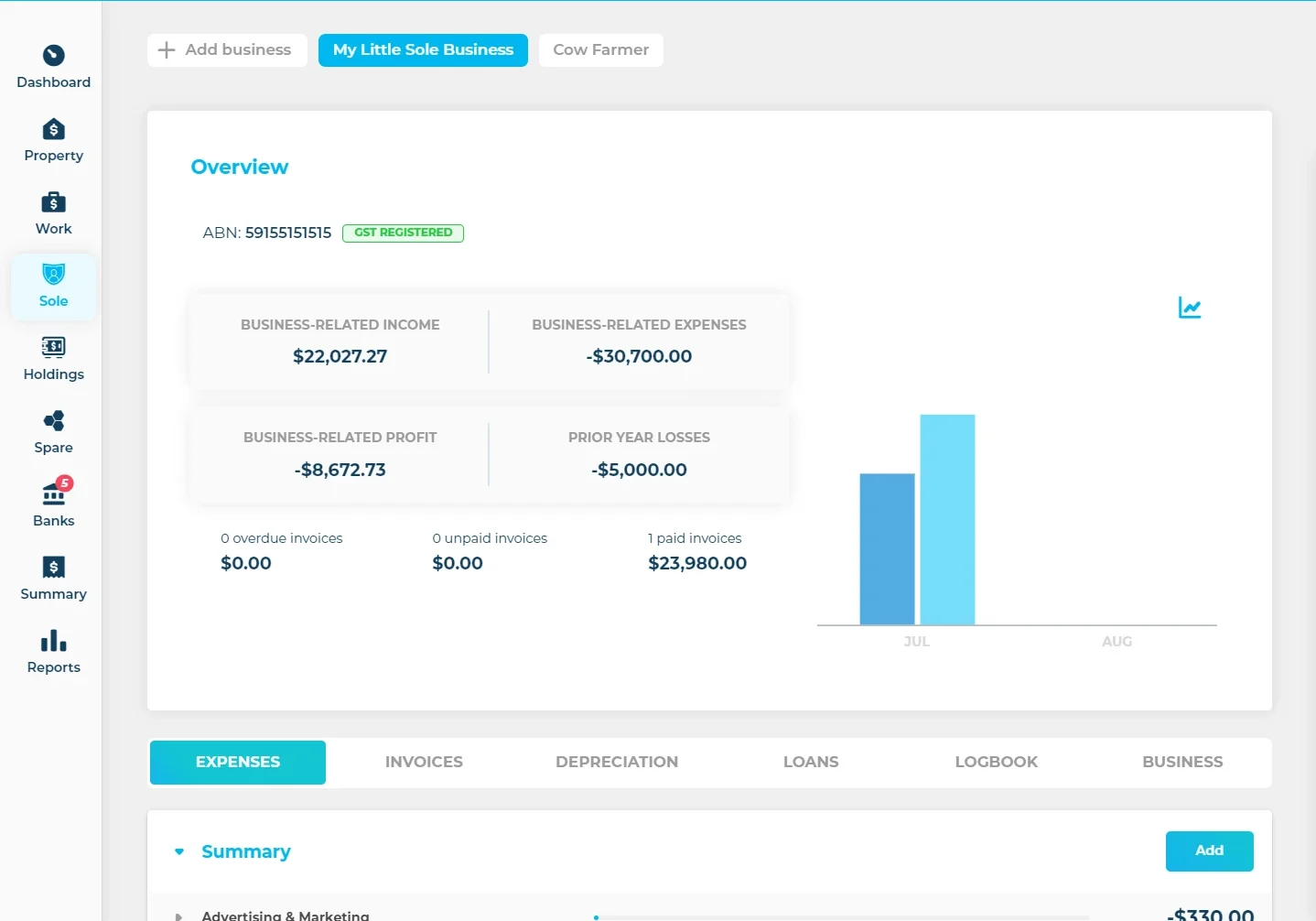

Manage multiple business

Have more than one business running with your ABN? No problem, you can manage up to 6 businesses the ATO currently allows you to operate with.

Match invoice payments

Find and match invoices and expenses from live bank feeds to keep on top of clients and your business cashflow.

Simple vehicle expense claims

Record travel in your logbook and update your vehicle expenses and claims automatically.

Secure document storage

Attach receipts, statements and even warranties for a secure record – that never fades.

Peace of mind

Avoid stress at the end of the financial year and know your sole trader tax position all year round.

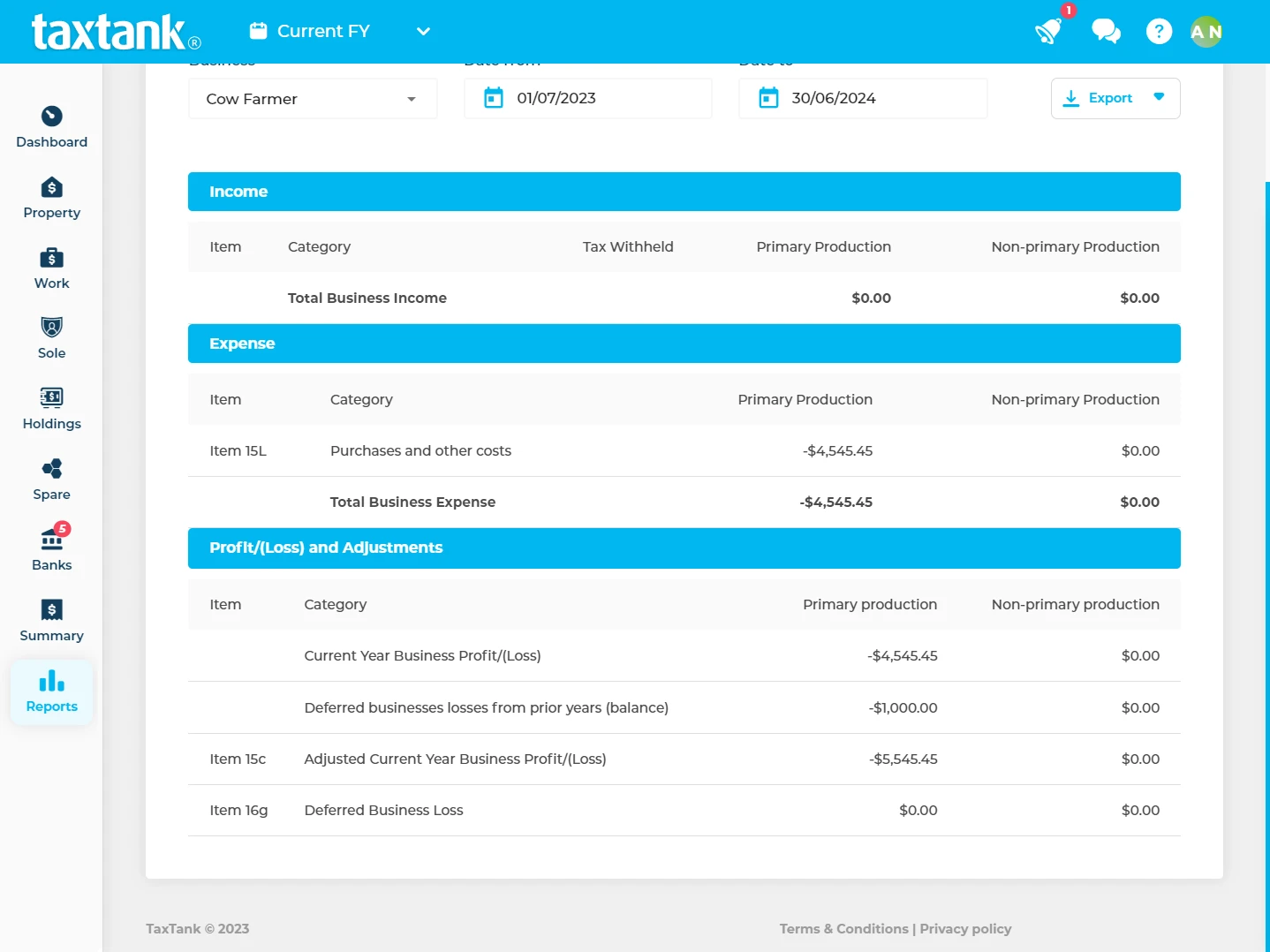

Expert management for Primary Production & Non-Primary Production businesses

Enjoy the flexibility of unlimited Primary Production and Non-Primary Production business and a custom business schedules to streamline tax time. Better still, we have a built-in non-commercial loss test to automatically apply business losses against your other current year income if eligible to ensure you pay the least amount of tax without the confusion.

Accelerated Depreciation Pools

Keeping up with depreciation rules and ever-changing small business concessions just got easy with TaxTank. We’ve grandfathered the old rules and updated the TaxTank with the latest $20,000 instant asset write off to ensure you confidently maximise depreciation on assets at the right time. For Primary Producer businesses we also have write off functionality to easily manage accelerated depreciation on eligible asset types.

Frequently asked questions

Yes absolutely. You can add up to 6 businesses under the same ABN.

If you have both sole trader income and PAYG income, we would recommend you look at using Work Tank and Sole Tank together so you can understand your complete tax position. Our live tax summary will keep you be informed of your tax throughout the year so there are no more tax surprises when it comes to the end of financial year.

We cater to individual taxpayers so unfortunately you won’t be able to manage your company in TaxTank. There are many other platforms that are set up help with managing your company tax so would recommend you take a look at those options.

Not all, that’s why we have come the rescue. Tax has always been so boring and conveluded, we have broken it down into cool software that is super easy to follow and understand. If you can log into your internet banking, you can use TaxTank. But after using it you will be an expert – maybe you could teach your accountant a thing or two?

We wouldn’t make you do that! The sooner the better, why wait for something so good? We would hate to see you miss out on important deductions that could cost you heaps of money.

Yes, TaxTank is 100% tax deductible.

Some tech savvy people out there may be quicker, but for us novices it can take approximately probably 10 minutes if you have your documents handy. If you hve multiple properties, you will need to give yourself more time but a little bit of work will be totally worth it!

Yes absolutely. TaxTank has been to developed to directly associate with all current Australia tax law. TaxTank will also be updated when any changes are made by the ATO.

Don’t miss out on sole trader tax opportunities.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about tax.