Media Centre

Our media centre is designed to provide journalists, bloggers, and members of the public with easy access to information, images, and videos that showcase TaxTank.

Research and stats on individual taxpayers in Australia.

TaxTank regularly undertakes market research to analyse habits of individual Australian taxpayers, their attitudes towards managing their taxes, sentiment towards the Australian tax system and spending intentions.

Our press releases

Revolutionising Tax Management: TaxTank Partners with ITP Accounting Professionals

At TaxTank, we’re thrilled to announce our new partnership with ITP Accounting Professionals (ITP), Australia’s leading income tax refund specialists. This collaboration marks a significant step forward in delivering a

TaxTank Property Widget Launches in Collaboration with Hotspotting

We are thrilled to introduce the TaxTank Property Widget, an innovative custom white-label product developed in collaboration with Hotspotting, one of Australia’s leading property platforms. This cutting-edge tool seamlessly integrates

Secrets from a Qld Tax Specialist: The top 5 tax tips for Property Investors

Tax time can be a challenge. The ATO’s aim is to collect as much tax as possible. The aim of most Australian taxpayers is to pay only as much as they have to. Navigating the rules is especially difficult for individuals and sole traders that don’t have teams of tax specialists on hand to wade through the requirements. For property investors, the complexities can be quite a burden. 41.9% of total revenue collected in 2020 ($231.2b) was collected from individual taxpayers, excluding property taxes. This is 2.4 times more than businesses paid.

A tax expert’s 5 top tips to maximise what you get back this tax time.

Are you already thinking about the extra money you could be receiving at tax time? Tax time is approaching and for millions of Australians this year could deliver a nice bonus thanks to the boost of a tax offset announced in the recent federal budget.

How to avoid tax time stress and not miss a deduction

If just the thought of tax time makes your stress levels rise, you are not alone according to new research conducted by cloud-based tax software, TaxTank.

The recent survey of 1000 Australian taxpayers revealed more than half (56%) find tax time stressful with missed deductions the leading cause of stress ahead of not knowing if they will receive a tax refund or bill and making a mistake.

Top 3 tax time tips for Property Investors

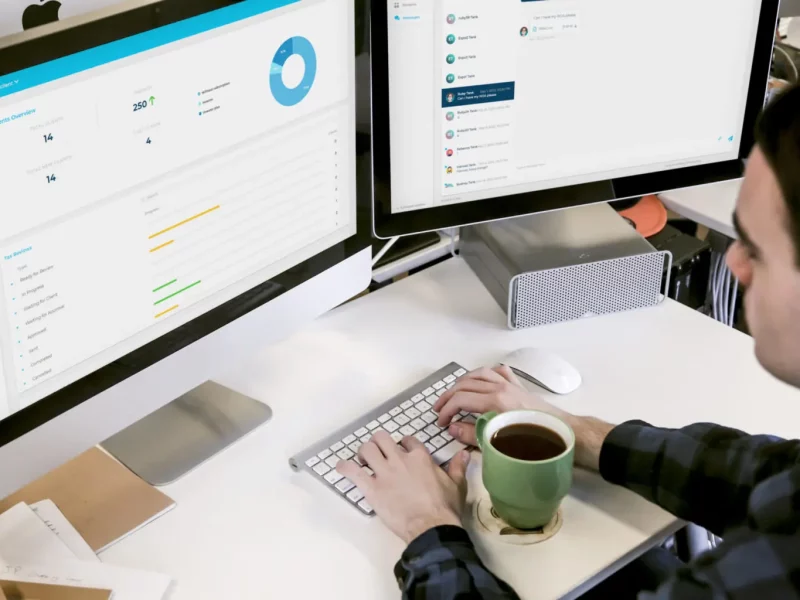

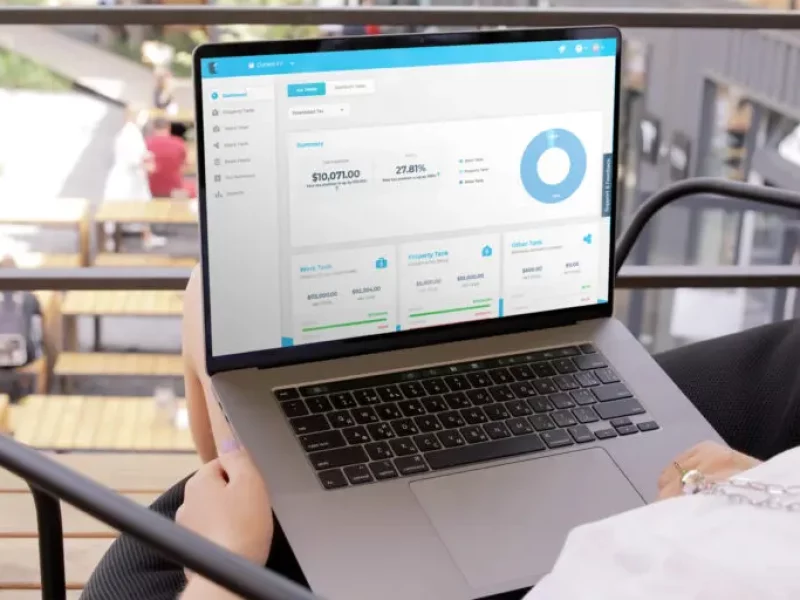

Australian fintech TaxTank allows property investors to monitor their overall equity, cash position and tax position in real time to make smart investment decisions and maximise their tax deductions. Get their top tax time tips here.

The affordable cloud-based tax software every property investor should have

Australian fintech TaxTank allows property investors to monitor their overall equity, cash position and tax position in real time to make smart investment decisions and maximise their tax deductions.

With the real estate environment in Australia changing rapidly with inflation and rising interest rates, property investors will likely have some important decisions to make in the coming months, and cloud-based tax management software TaxTank is here to help.

Prospect of market crash polarising among Aussie property investors

With so much speculation in the air regarding the Australian property market, investors are certainly starting to think about where their portfolios stand and where to next. Research from Australian fintech startup TaxTank shows that investors are of two minds – while 54% list property market crash among their top three concerns, only 22% list it as their primary concern.

Is the ATO’s move towards automation impacting property investor loyalty?

New research reveals that despite 75% of property investors reporting that they will lodge their return through an accountant this year, many are still feeling stressed at tax time.

Over half of Aussie property investors are concerned about rising interest rates

New research reveals that a huge 63% of property investors are feeling concerned about rising interest rates, and with more interest rate rises projected over the next few months, the pressures aren’t going to ease any time soon. The research, commissioned by Australian fintech startup, TaxTank, also showed that 40% of property investors are concerned about the cost of living and more than one in ten fear they may have to sell.

Work-from-home tax deductions top of mind as ATO cracks down

New research from cloud-based tax software TaxTank reveals that 50% of Gen X’s, 40% of Millennials, and 30% of Baby Boomers intend on claiming work-from-home (WFH) expenses this tax year.

The findings coincide with a recent statement from the ATO saying it would scrutinise WFH expenses this tax year with millions of Australians having pivoted to remote and hybrid work environments due to COVID-19.

More than half of Australians ‘fearful’ at tax time

New research reveals that over half of Australians (56%) are worried and fearful when it comes to lodging their tax returns with missed deductions, not knowing whether to expect a tax refund or bill, and making a mistake being flagged as the leading causes.

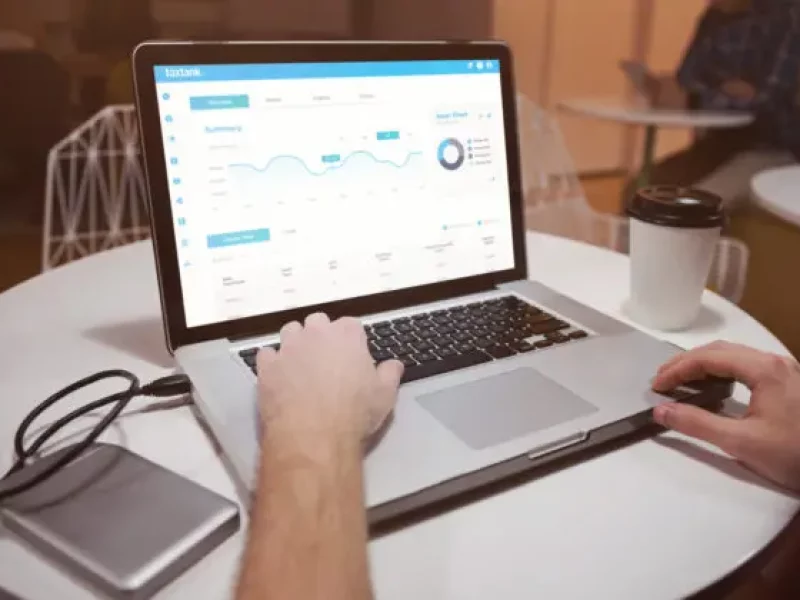

New data shows cost of living savings are top of mind this tax season

Australians plan to save their tax returns this year despite not knowing nor actively planning to maximise what they receive, according to TaxTank

New research from cloud-based tax software TaxTank reveals over half (56%) of Australians find tax time stressful, with the notion of missed deductions causing the greatest degree of anxiety.

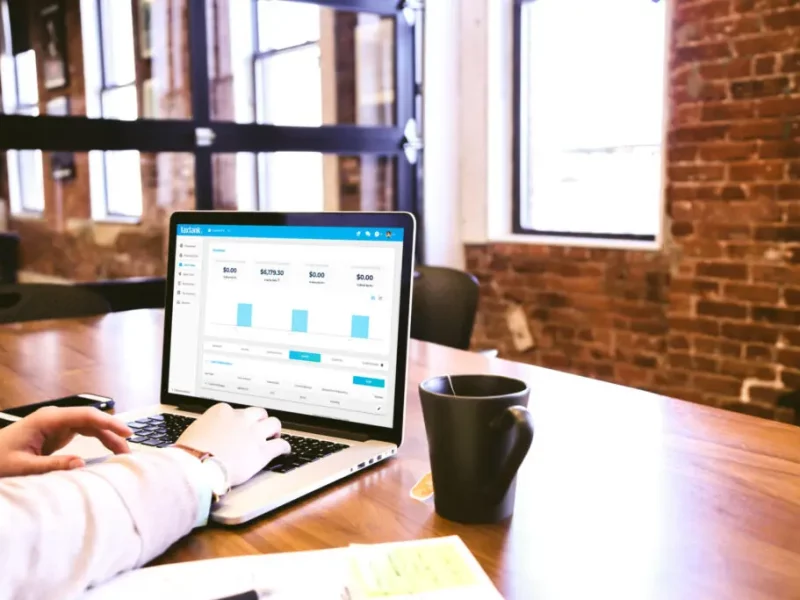

Local accountant creates software to help everyday Australians pay less tax

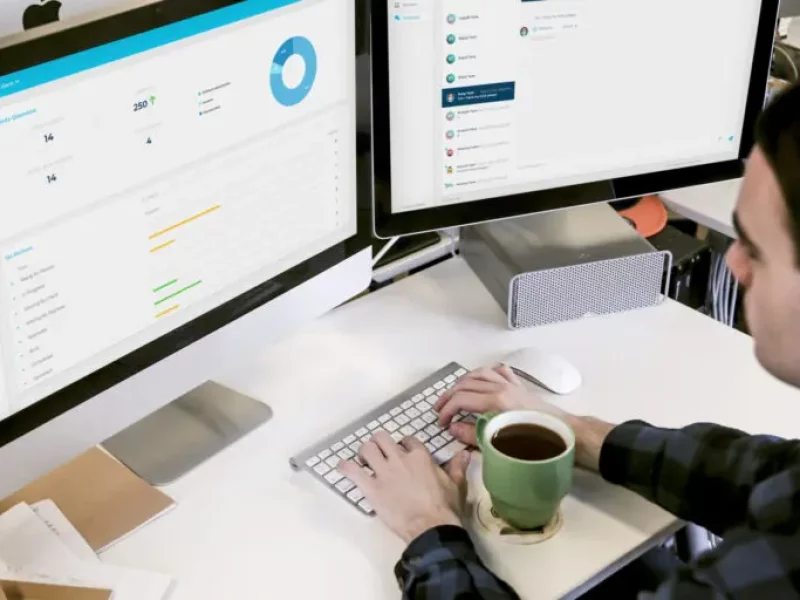

A Gold Coast tax accountant is saving Australians time, stress and money at tax time with a new low-cost, easy to use tech software, TaxTank.

The cloud-based Software-as-a-Service (SaaS) platform transforms tax management and the end of year tax return into an automated, stress free process to help individual taxpayers claim their fair share of the billions refunded each year.

The uncomfortable truth: Why the cost of living package could cost Australians in the future

The Federal Government’s $8.6 billion cost of living package was the centerpiece of this year’s 2022 Federal Budget address. From temporary cuts of the fuel excise, to an expansion of the low and middle-income tax offset, the package contains various support measures aimed at easing rapidly rising cost of living expenses and business input costs.

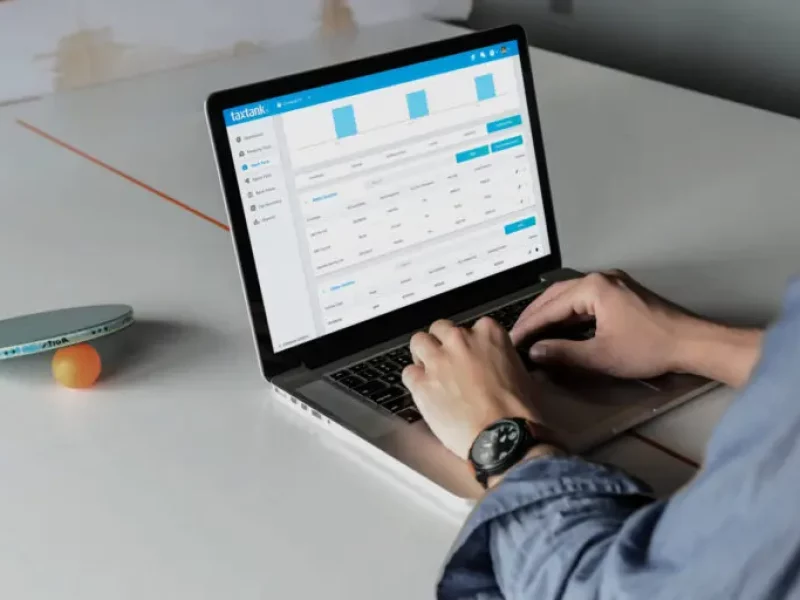

Aussie startup launches new software to help accountants fight back against ATO automation

A Gold Coast startup has officially launched a new tax software to give accounting firms access to powerful tax tools that will transform the way they work and stem the loss of clients to the ATO’s automation tools.

Aussie startup tackles property and investment tax pain

A Gold Coast startup, has officially launched a new tax software to change the way taxpayers monitor, manage and control their tax obligations.

What our customers say

Don’t just take our word for it. See what our customers have to got to say about TaxTank.