All of TaxTank's Features

Discover the features you need for better tax and financial management.

Attach Receipts

The biggest cause for audit adjustment is lack of substantiation! Attaching receipts ensures nothing is lost or faded.

Live Bank Feeds

With Open Banking accreditation and over 160 available banks, ensure nothing is missed with live bank feeds delivered daily.

Live Tax, Cash & Equity Forecasts

Complete oversight! Know exactly how investments will impact your tax position, their holding costs and future potential.

Monthly Budget Planner

Where does my money go? Set monthly budgets and keep on track with personal, work and business expenses.

Permanent Document Storage

Create custom folders to safeguard your important documents in one place.

Need an accountant? We’ve partnered with ITP Accountants to offer an exclusive deal on tax returns to TaxTank subscribers from $79^.

For the Property Investor

TaxTank goes above and beyond by offering features to manage investment properties, property portfolio oversight, and real-time property schedules. The Automated Depreciation for Property and Property CGT Calculator make tax planning a breeze. You can even share expenses with property co-owners hassle-free.

Automated Borrowing Expenses

The most commonly missed deduction! Automate borrowing expenses over 5 years to ensure you don't miss out.

Automated Depreciation for Property

Using ATO prescribed rates and smart automation rules, you'll manage depreciation like a pro. You can even automate DIY projects!

Land Portfolio to Capitalise Expenses

Use the land portfolio to capitalise holdings costs during the build process. Holdings costs are automatically included to reduce CGT on sale.

Manage Investment Properties

Ditch the spreadsheets! Manage all properties in one place, including investment properties, land, share accommodation and properties owned in trusts.

Manage Properties in a SMSF or Trust

Have properties held in a SMSF or Trust? No problem, you can manage them in TaxTank by selected the non-taxable entity.

Real-time Property Schedules

Monitor your property income, expenses and net tax position at any time of year with compliant tax schedules.

Share with Property Co-owners

Save time and share! Invite co-owners to properties as per their ownership percentage and eliminate data entry.

Share Property Calculator

Unlock shared property potential on platforms like Airbnb with our automated calculator, streamlining accurate expense claims effortlessly.

Property Borrowing Power Calculator

Use our Property Borrowing Power Calculator to enable a better understanding of your available cash, borrowing capacity and even average interest rates to enable well-informed borrowing choices.

Property CGT Calculator

Thinking about selling? Want to know the potential tax implication? Calculate the capital gain or loss (CGT) on any property in 3 simple steps.

Property Portfolio Oversight

No more guessing! Monitor portfolio and property performances including growth, tax and equity in real time so you know exactly where you stand.

Property Tax Reports

Compliant property, depreciation and CGT schedules all year round. Plus an interactive transaction report for faster reviews.

For the Crypto or Share Trader

TaxTank's also extends our features to include the ability to centrally manage share and crypto tax, automated CGT calculations, and real-time tax reports.

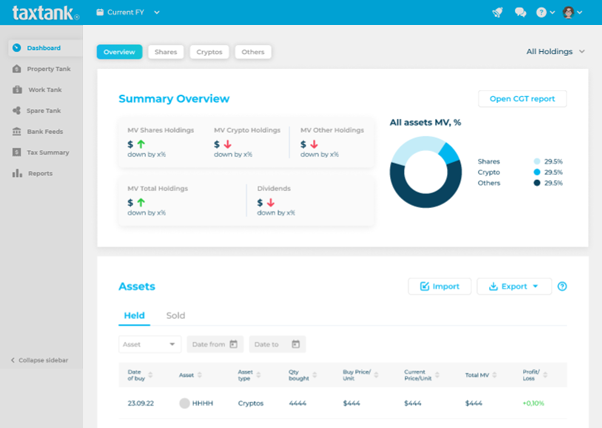

Centrally Manage Share & Crypto Tax

Daily market values and unlimited holdings.

There are no limits on how many shares, cryptocurrency or other assets you add, swap, sell or reinvest.

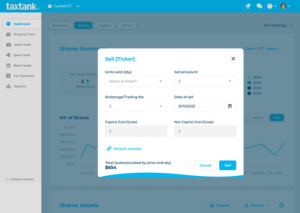

Automated CGT Calculator

Sold shares, crypto, property or other assets?

TaxTank auto calculates capital gains and losses, including concessions and exemptions in real time.

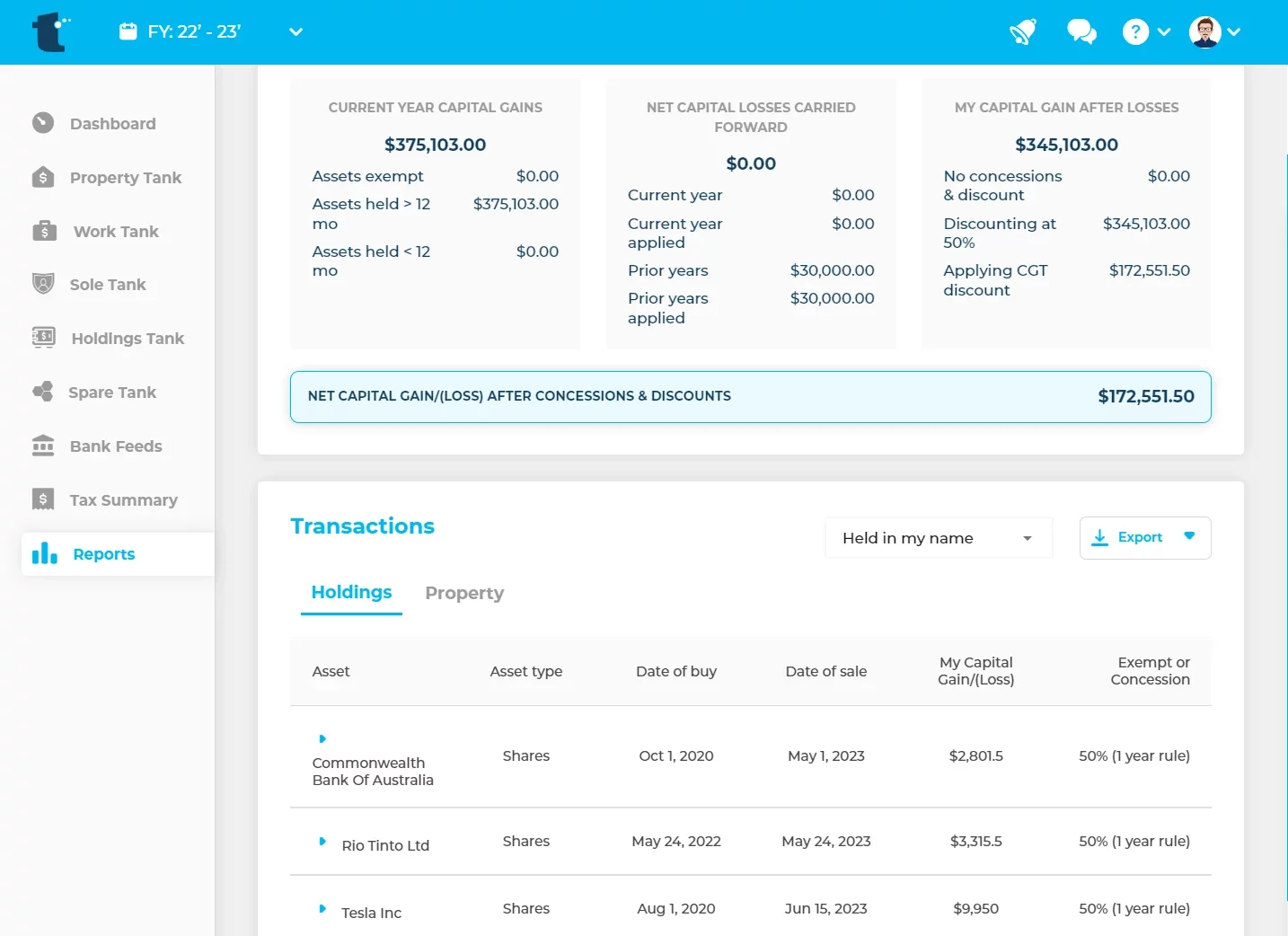

Real-Time Tax Report (CGT)

Don't waste time chasing down multiple reports from multiple platforms or paying hefty fees. TaxTank’s CGT report is fast, free & available all year round.

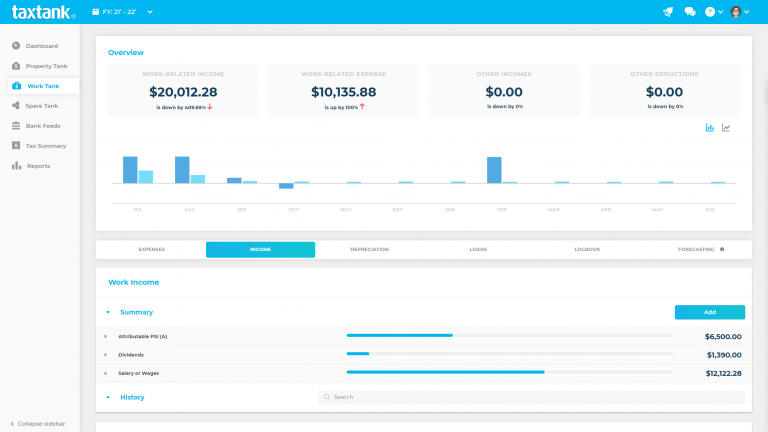

For Employees or PAYG earners

Keeping track of work incomes and expenses is a breeze with features like the Vehicle Logbook & Automated Claims, Home Office Hour Log, and forecasted income management.

Track Work Incomes & Expenses

Minimise tax with live bank feeds and smart tax tools. Confidently claim deductions and make informed decisions control how much tax you pay.

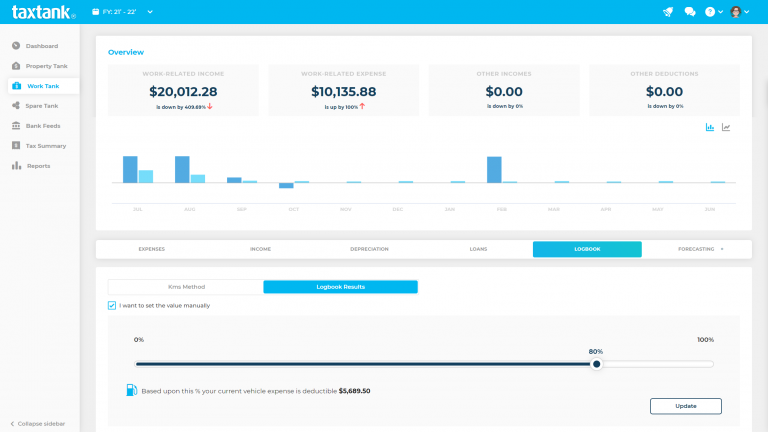

Vehicle Logbook & Automated Claims

Select your method and set your claim to manage vehicle expenses with ease. If your travel changes simply update your logbook and we'll take care of the rest.

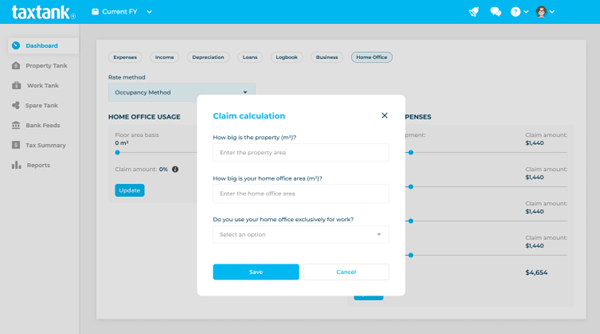

Home Office Diary and Hour Log

Don’t get caught out by new ATO rules. Add your daily home office hours in seconds for a compliant record to substantiate a claim.

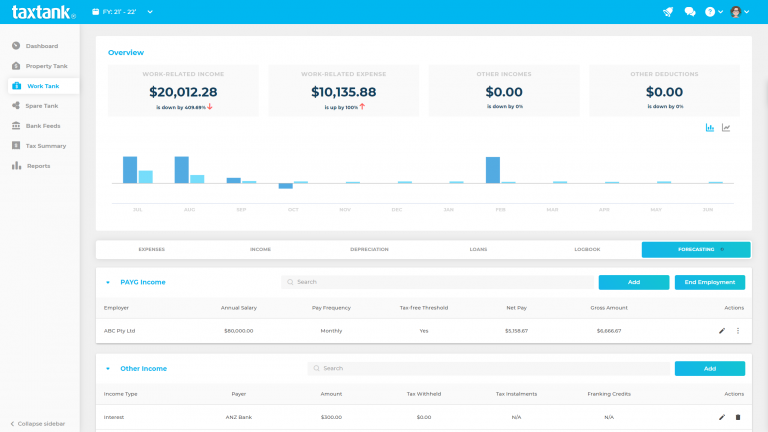

Manage Forecasted Work & Other Incomes

Set forecasts and avoid tax time surprises! Monitor your forecasted tax position against your actual tax position throughout the year.

For the Sole Trader

For sole traders, TaxTank simplifies invoicing, monitors business expenses, and offers real-time business schedules. With TaxTank’s live tax summary, you’ll never have to worry about where you stand with how much tax you owe for your business income – no matter how big or small.

Automated Depreciation for Business

Automated tools to manage all depreciation, including accelerated depreciation in general pools & instant asset write off.

Manage Multiple Businesses

Have more than one sole trader business? Manage multiple primary and non-primary production businesses seamlessly.

Monitor Business Expenses

Are you charging enough? Track expenses by category to monitor profit, pricing and performance.

Non-Commercial Loss Calculator

Can you use your business losses to offset your other taxable income?? Find out in 3 simple steps.

Real-Time Sole Trader Business Schedules

No more tax time surprises! Know how your business profit or loss will impact your tax all year round.

Simple BAS Reporting

Registered for GST? See how much GST you’ve collected and paid for fast simple BAS reporting.

Sole Trader Invoices

Draft, approve and email invoices directly to clients. Allocate paid invoices from bank feeds and keep track of monies owing.

Track Prior Year Business Losses

Don't lose twice! Keep track of prior year losses to reduce current year profits, and minimise tax!

For Easy Tax Preparation

Tax preparation has never been easier with interactive MyTax reports, and you can collaborate effortlessly by inviting your own accountant and unlimited advisors to join the platform.

Access to ITP

Need an accountant? TaxTank has partnered with ITP Accounting Professionals to offer an exclusive service to TaxTank subscribers.

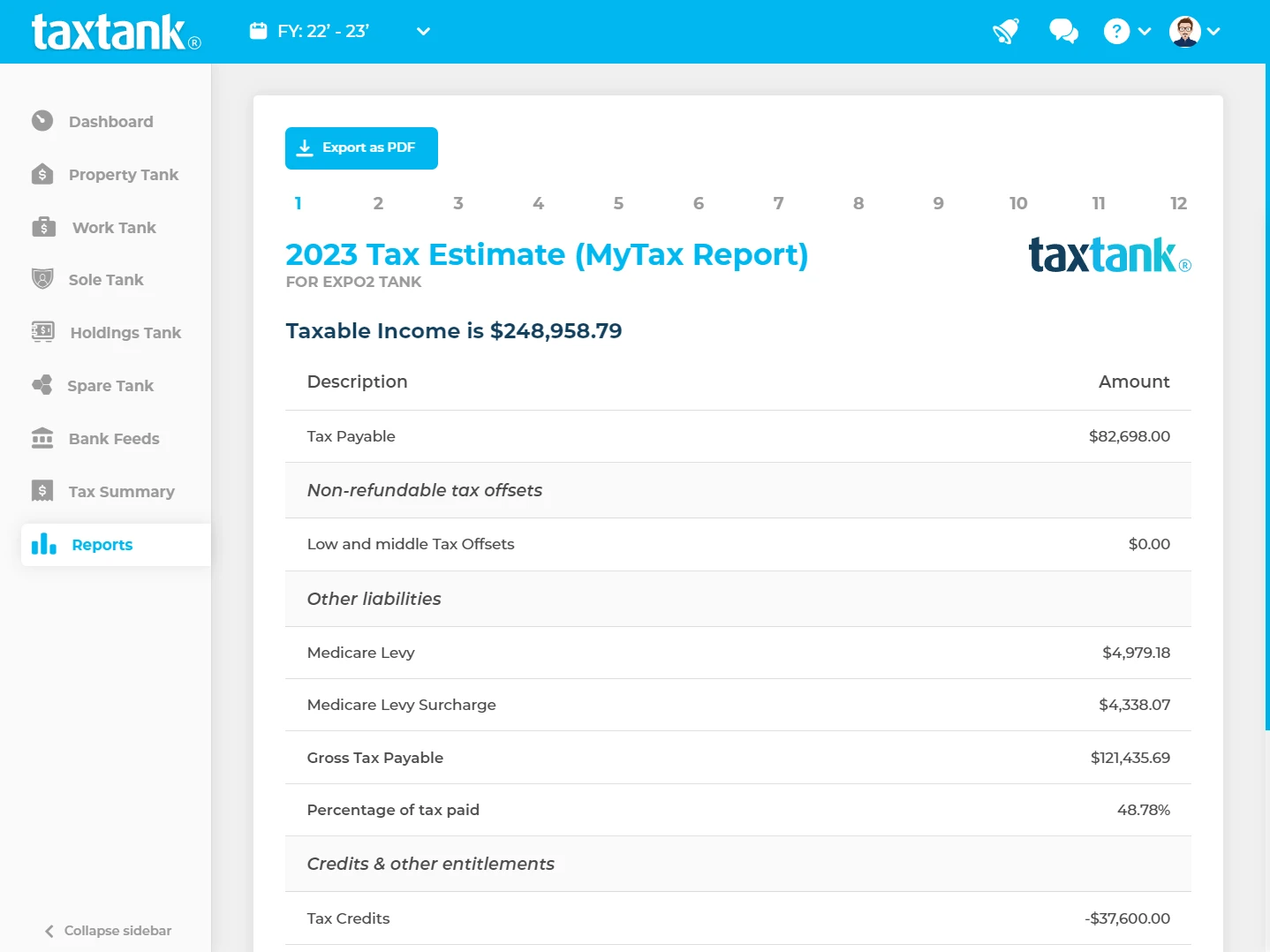

Interactive myTax Report

Do you self lodge? DIY with complete confidence using TaxTank's myTax report.

Invite Your Own Accountant

Invite your accountant and enjoy real-time conversations, live chat and a hassle-free tax time.

Invite Unlimited Advisors

Share with advisors, brokers and property groups to gain real-time advice all year round.

Don’t miss out on tax opportunities.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about tax.