All the features to make tax time simple

TaxTank gives you everything you need to manage tax properly throughout the year, not just at the end of it. Whether you’re a property investor, sole trader, employee, or just like to stay organised, our features keep your income, deductions, assets and tax position up to date in real time.

No guesswork. No spreadsheets. Just smart, practical tools that make tax easy.

Ditch the spreadsheets and get a real-time view of your money, tax and forecasts

Whether you’re planning ahead or playing catch-up, the general features in TaxTank give you visibility over your full financial position. With live tax calculations, bank feeds, budgets and equity forecasts, you’ll always know where you stand.

FOR EVERYONE

- Know exactly how much tax you owe, live all year round

- Track your net worth with live tax and equity forecasts

- Connect bank accounts with live feeds for real-time visibility

- Track your HECS/HELP balance and repayments as part of your live tax position

- Plan smarter with a simple monthly budget tool

- Create rules to automate the allocation of recurring transactions

- Access a full range of live tax reports all year round

- Store and manage all your documents and receipts securely in the Spare Tank

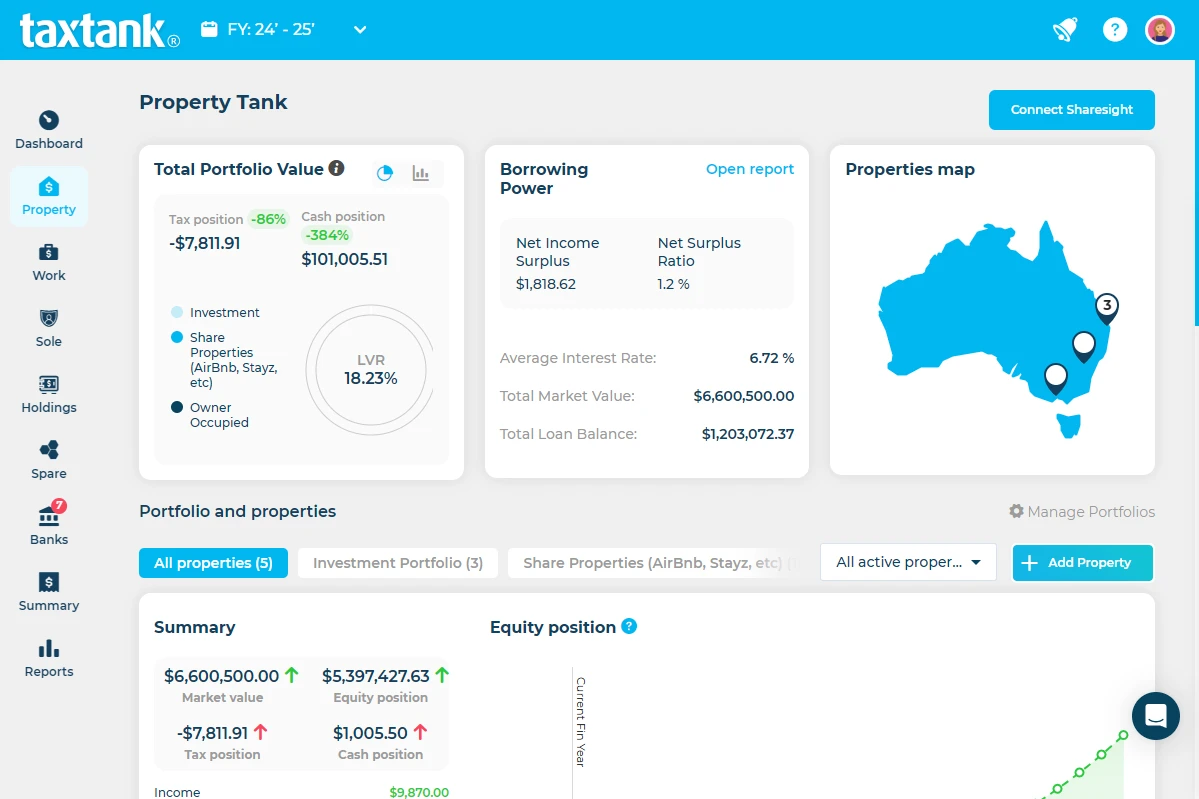

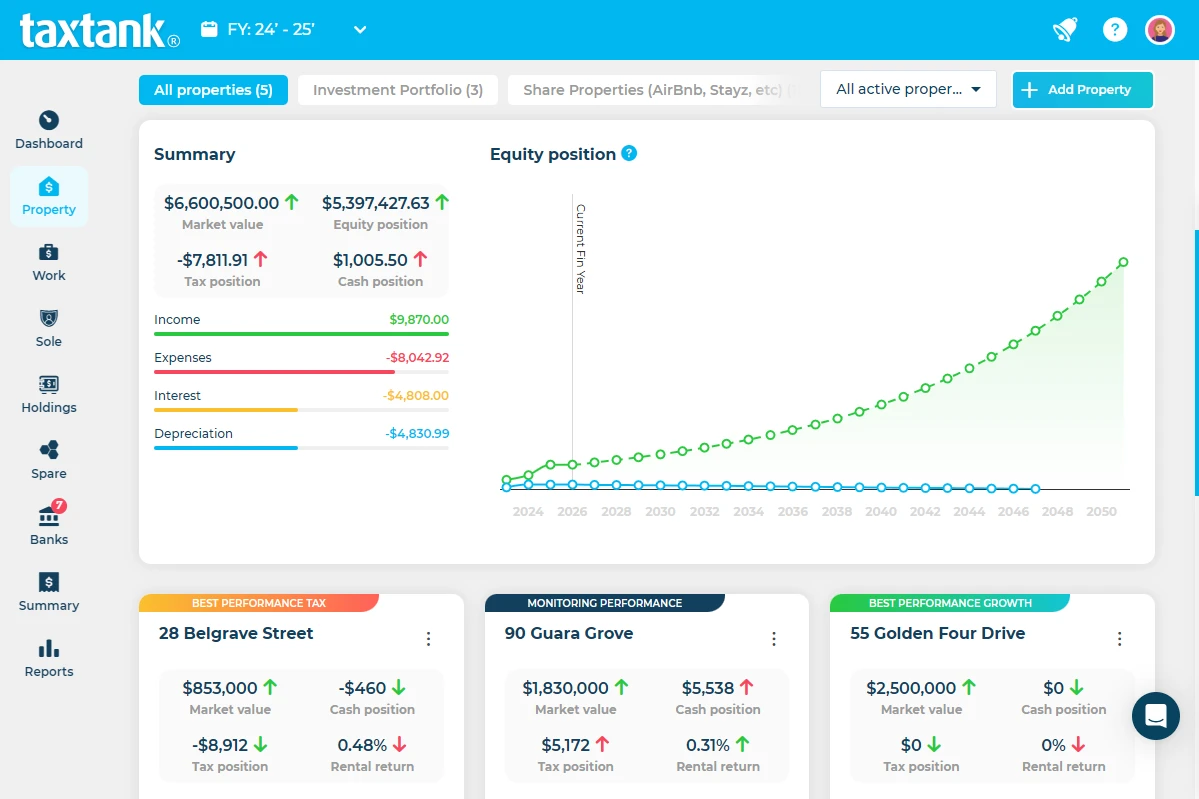

Get the full picture of your property portfolio in one place

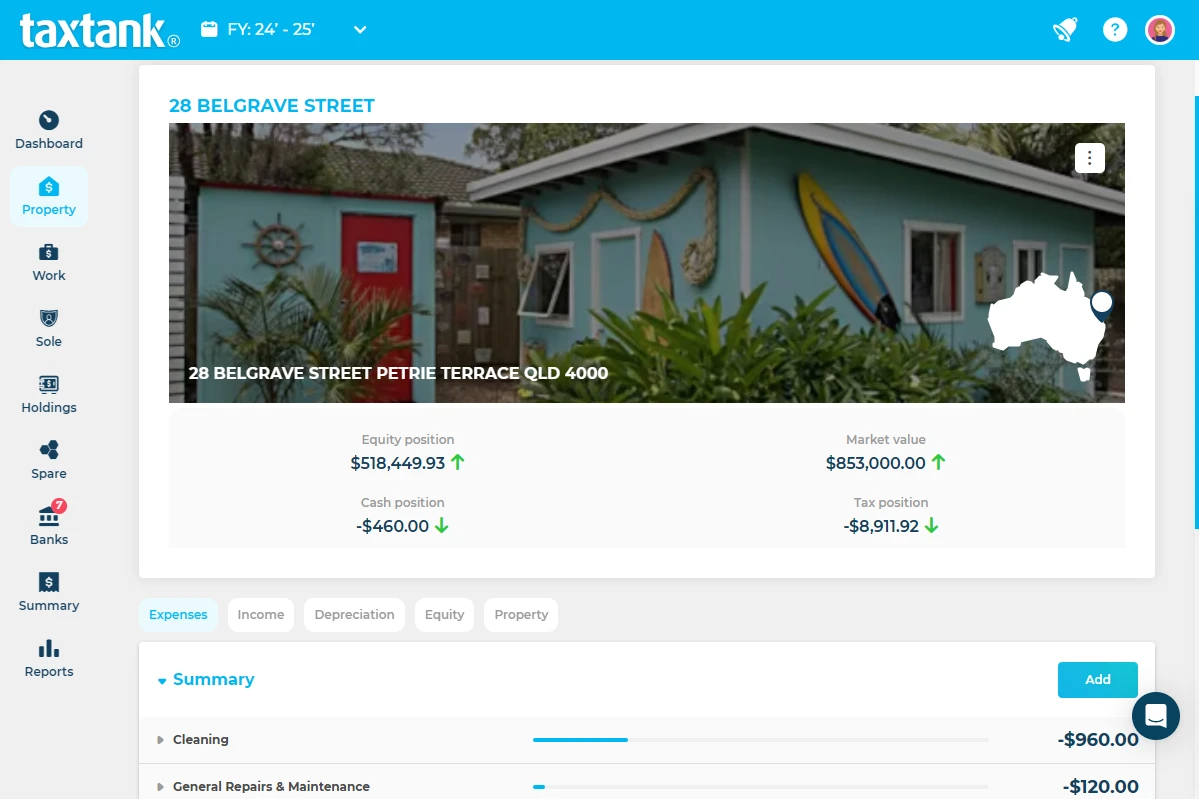

TaxTank takes the headache out of managing investment properties. Track income and expenses in real time, monitor capital growth, automate depreciation, and see the impact on your tax position instantly. Whether you own one property or ten, in your own name or a trust, everything’s in one place

FOR THE PROPERTY INVESTOR

- Manage all properties in one place using Portfolios, regardless of ownership structure

- Track income, expenses, tax, and cash positions in real time

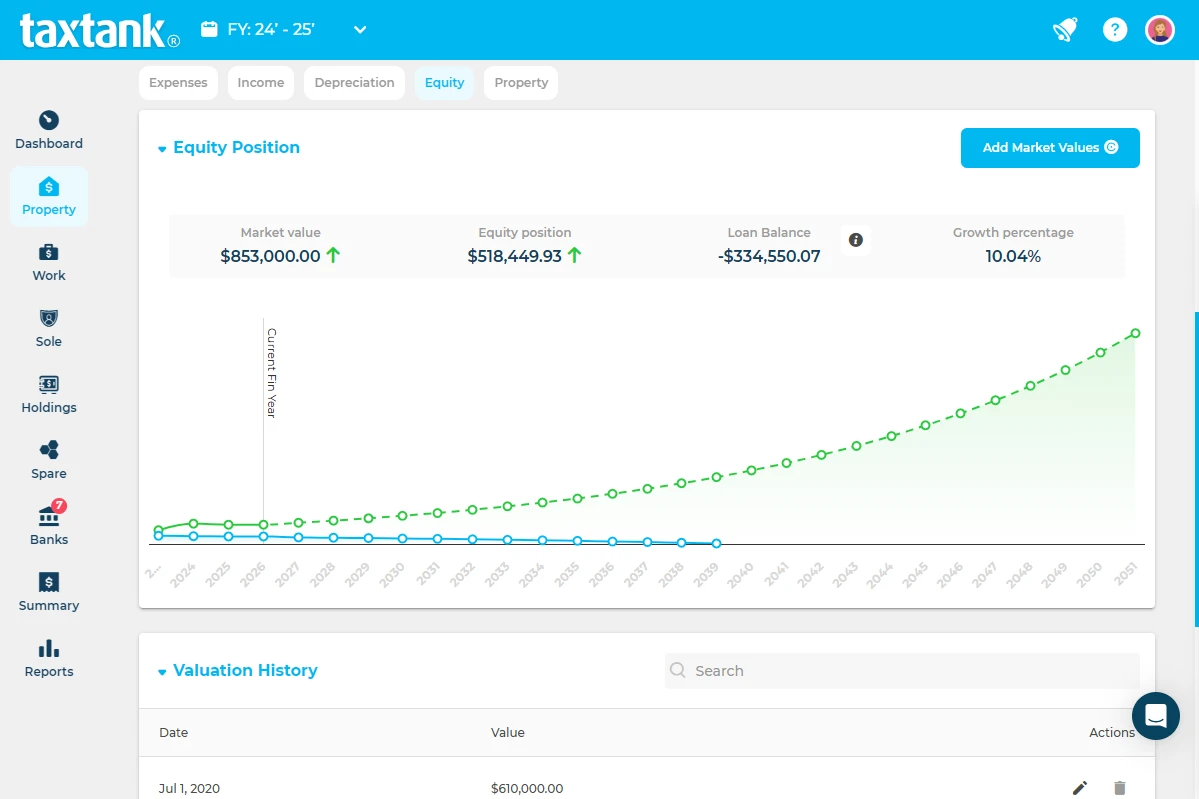

- Monitor performance, including capital growth, LVR, and yields

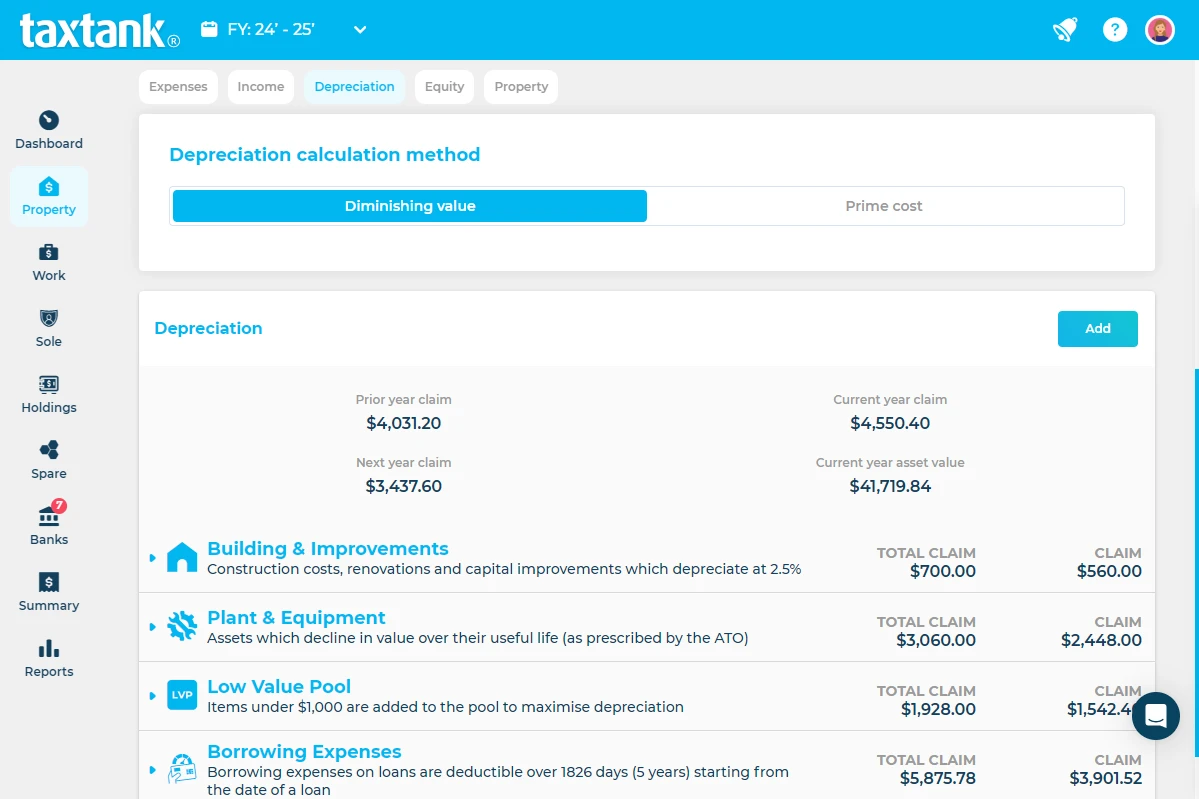

- Maximise claims with automated depreciation

- Create DIY projects to manage structural improvements

- Automate borrowing expenses for loans and refinancing

- Create custom portfolios to track properties in trusts, companies, or your SMSF

- Easily calculate claim percentages for shared properties, including Airbnb, Stayz, and room rentals

- Track expenses in a custom land portfolio before your property is available to rent

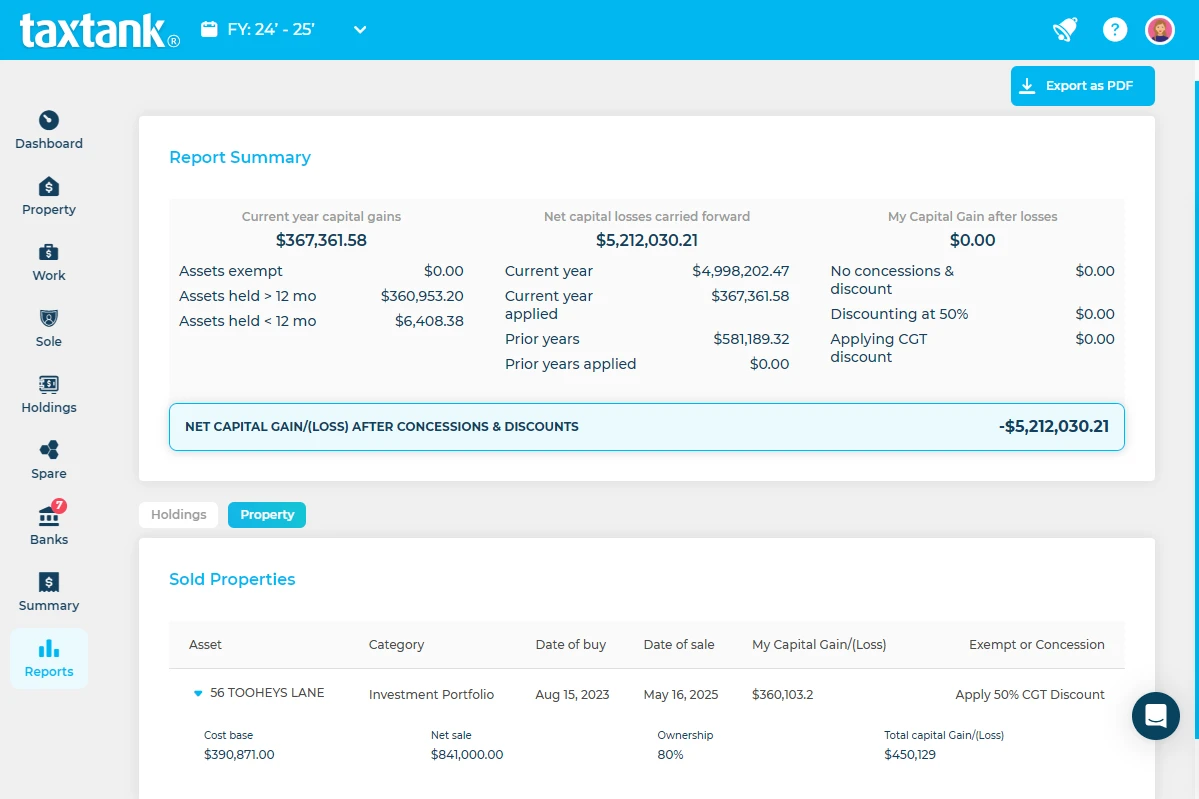

- Use the real-time CGT calculator to see the impact on your tax return

- Update live property values and growth percentages, powered by CoreLogic

- Calculate borrowing power with the interactive Net Surplus Ratio report

- Access instant property tax reports to share with your accountant

- Connect with Sharesight to sync live property data in the Sharesight platform

- Store all property documents securely in the Spare Tank’s dedicated property folder

Make work deductions easy with the right tools to claim, track and stay compliant.

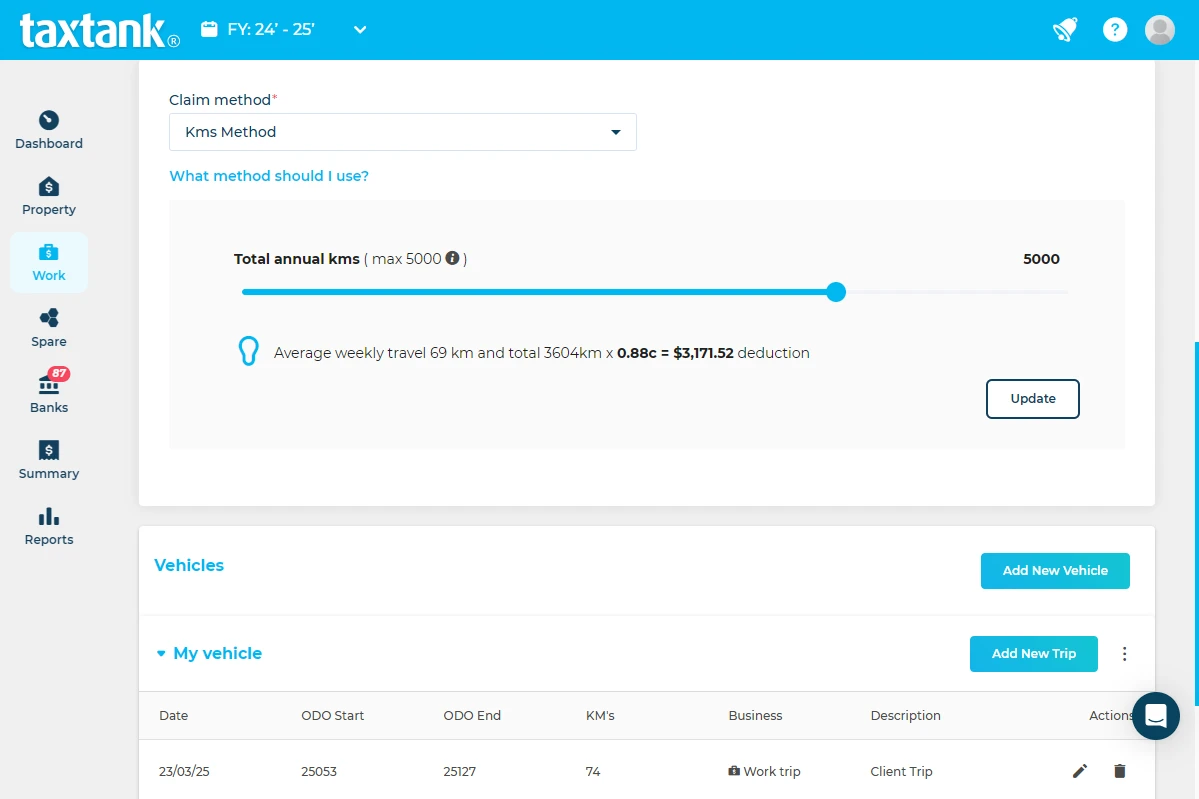

Whether you’re on a salary or earning income from multiple sources, TaxTank helps you keep it all organised. From vehicle logbooks to home office claims, depreciation and live tax forecasting, it’s designed to make work-related tax simple and compliant.

FOR THE EMPLOYEE OR PAYG EARNER

- See live tax calculations to track your estimated tax position year round

- Compare forecasted tax positions against actuals to help with planning

- Track income from trusts, partnerships, directors’ fees, government payments, and more

- Easily manage wage adjustments, like allowances and pre-tax deduction, for accurate reporting

- Allocate work-related expenses from live bank feeds so nothing gets missed

- Log hours and track apportioned expenses with a compliant home office diary

- Track kilometres and expenses with a compliant vehicle logbook

- Manage work-related assets over $300 with automated depreciation

- Use amortisation schedules to manage vehicle loans and interest expenses

- Store all work-related documents and receipts securely in the Spare Tank

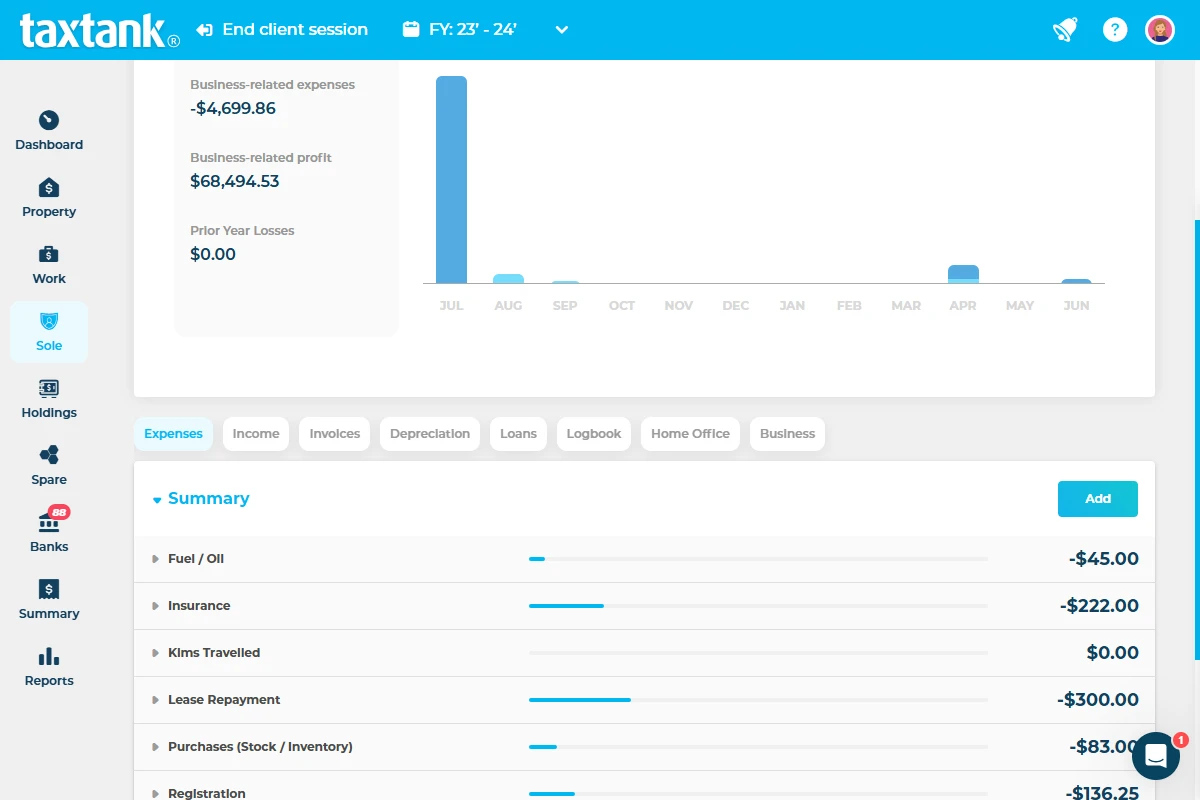

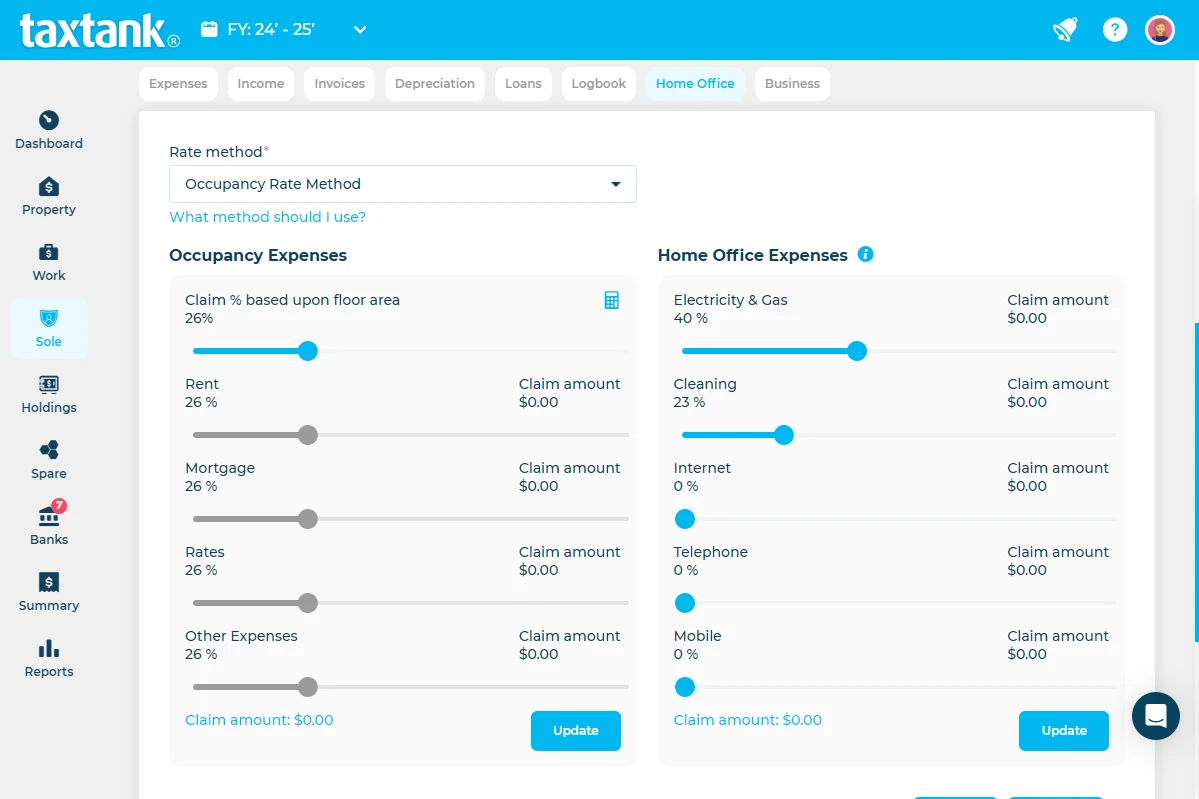

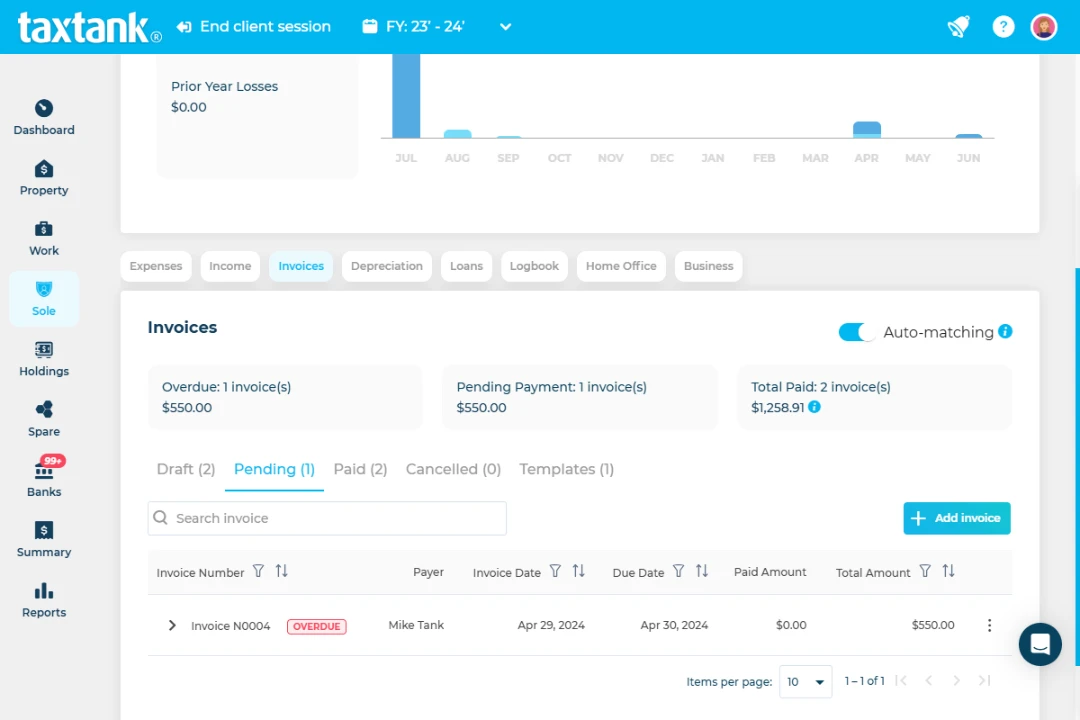

Everything you need to run your sole trader business and stay on top of tax

TaxTank gives sole traders the tools to run their business properly without the overwhelm. From live tax tracking and invoicing to BAS, asset management and home office diaries, you can see your full business position at a glance, and take the stress out of tax time.

FOR THE SOLE TRADER OR SIDE HUSTLER

- Track your live tax position year round to avoid end-of-year surprises

- Manage multiple sole trader businesses under one subscription

- Create and send professional invoices in seconds

- Allocate business expenses from live bank feeds to make sure nothing is missed

- Track PSI income, labour hire, and other assessable income and expenses

- Manage business assets with automated depreciation and instant asset write-offs

- Track apportioned running and occupancy costs with a compliant home office diary

- Log kilometres and manage expenses with a compliant vehicle logbook

- Automate vehicle loan tracking with amortisation schedules

- Use the non-commercial loss calculator to check if losses can offset other income

- Automatically track carry-forward losses so nothing gets overlooked

- Access live BAS reporting to manage GST and ATO lodgements

- Separate primary production and non-primary businesses for accurate reporting

- View real-time business schedules and transaction reports to simplify tax time

- Store all sole trader business documents and receipts securely in the Spare Tank

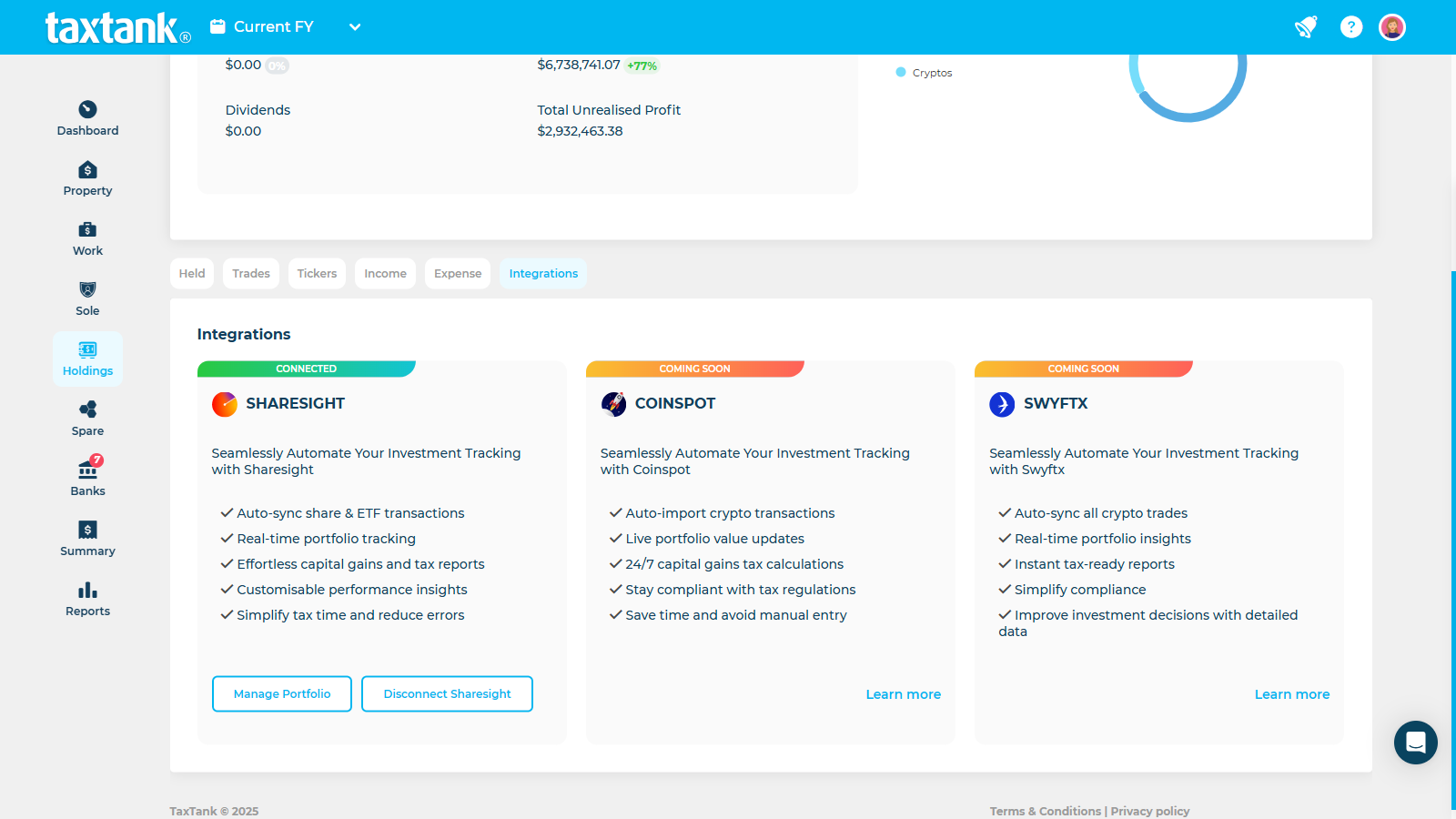

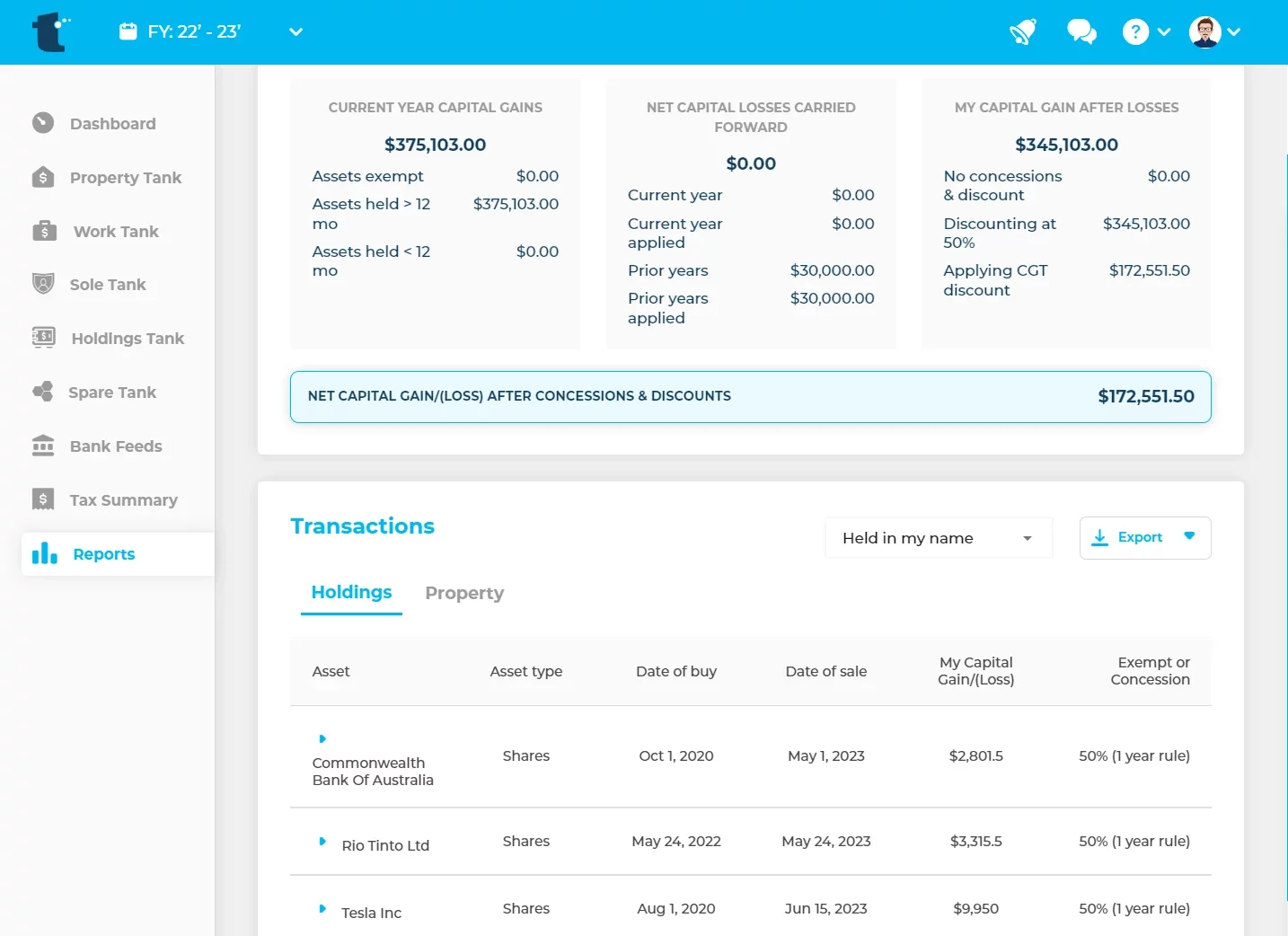

Track your full investment portfolio, including CGT, in one smart dashboard

TaxTank makes it easy to manage shares, crypto and unlisted assets without the usual end-of-year scramble. With automatic CGT tracking, income management, and live performance updates, you’ll have everything you need for better decisions, and a much easier tax return.

FOR THE SHARE, CRYPTO OR GENERAL INVESTOR

- Track the performance of shares, crypto, and unlisted assets in one place

- Automatically calculate CGT for shares, crypto, and other assets

- Manage income and expenses, including dividends, interest, and staking

- Create custom tickers to track unlisted assets or other investments

- Access live CGT reports year round

- Automatically track and carry forward capital losses to offset future gains

- Connect with Sharesight to sync your trade history

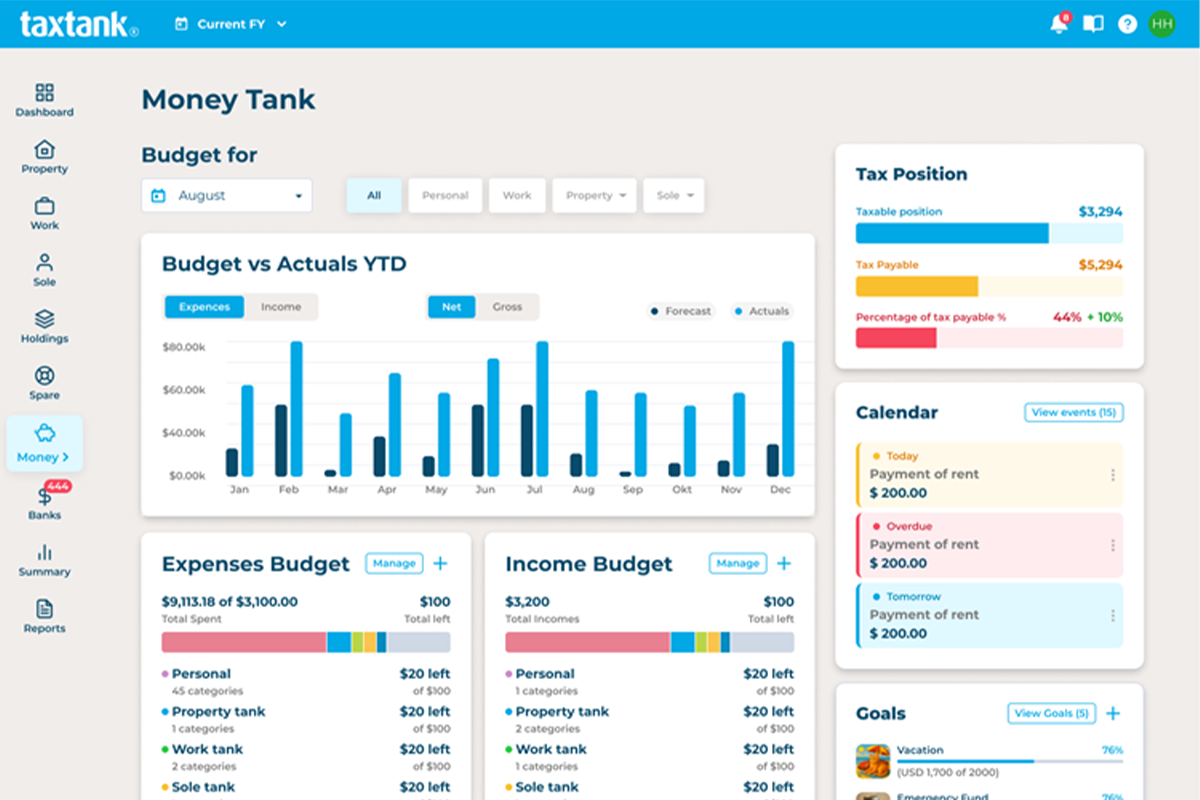

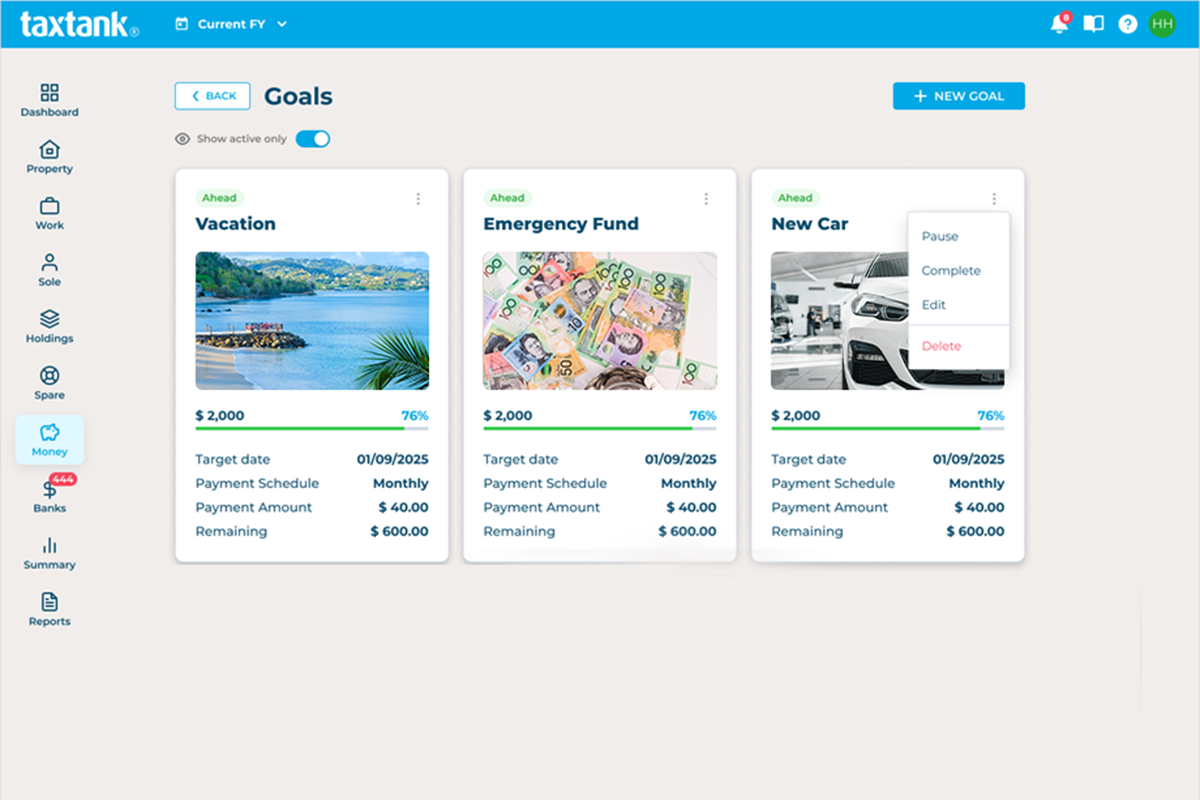

Take control of your financial goals and forecasts

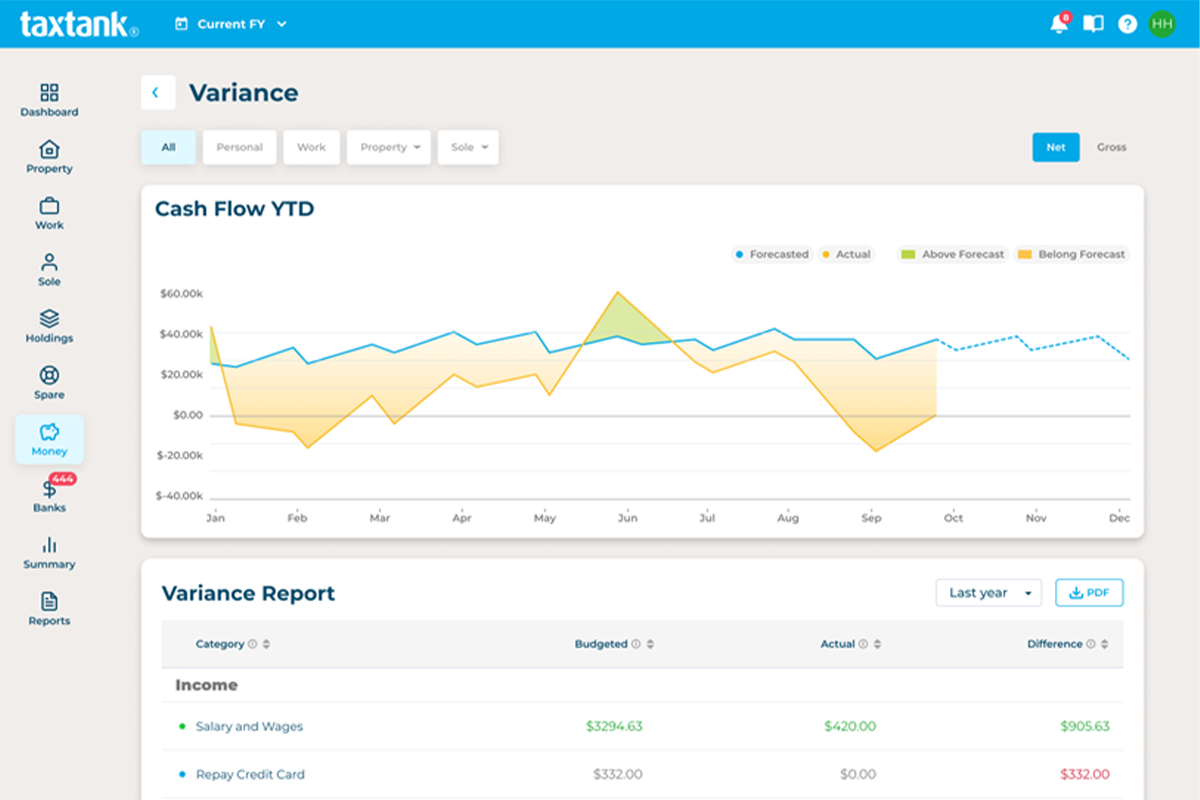

TaxTank brings together all your budgets, bank feeds, and financial goals in one clear dashboard. See your full money story at a glance, track where your income goes, and plan ahead with real-time insights that connect directly to your tax position.

FOR BUDGETING AND FINANCIAL MANAGEMENT

- Track income, expenses, and financial goals in one clear dashboard

- See budgets versus actuals to spot trends and stay in control

- Never miss a payment with automated alerts for upcoming and overdue bills

- Create budgets for any part of your life and monitor progress in real time

- Quickly see where your money is going with easy-to-read visuals

- Plan ahead with a monthly snapshot of income and expenses

- Pair with other TaxTank modules to see the real-time impact of your budgets on tax

No more digging for receipts or waiting until June to figure it all out.

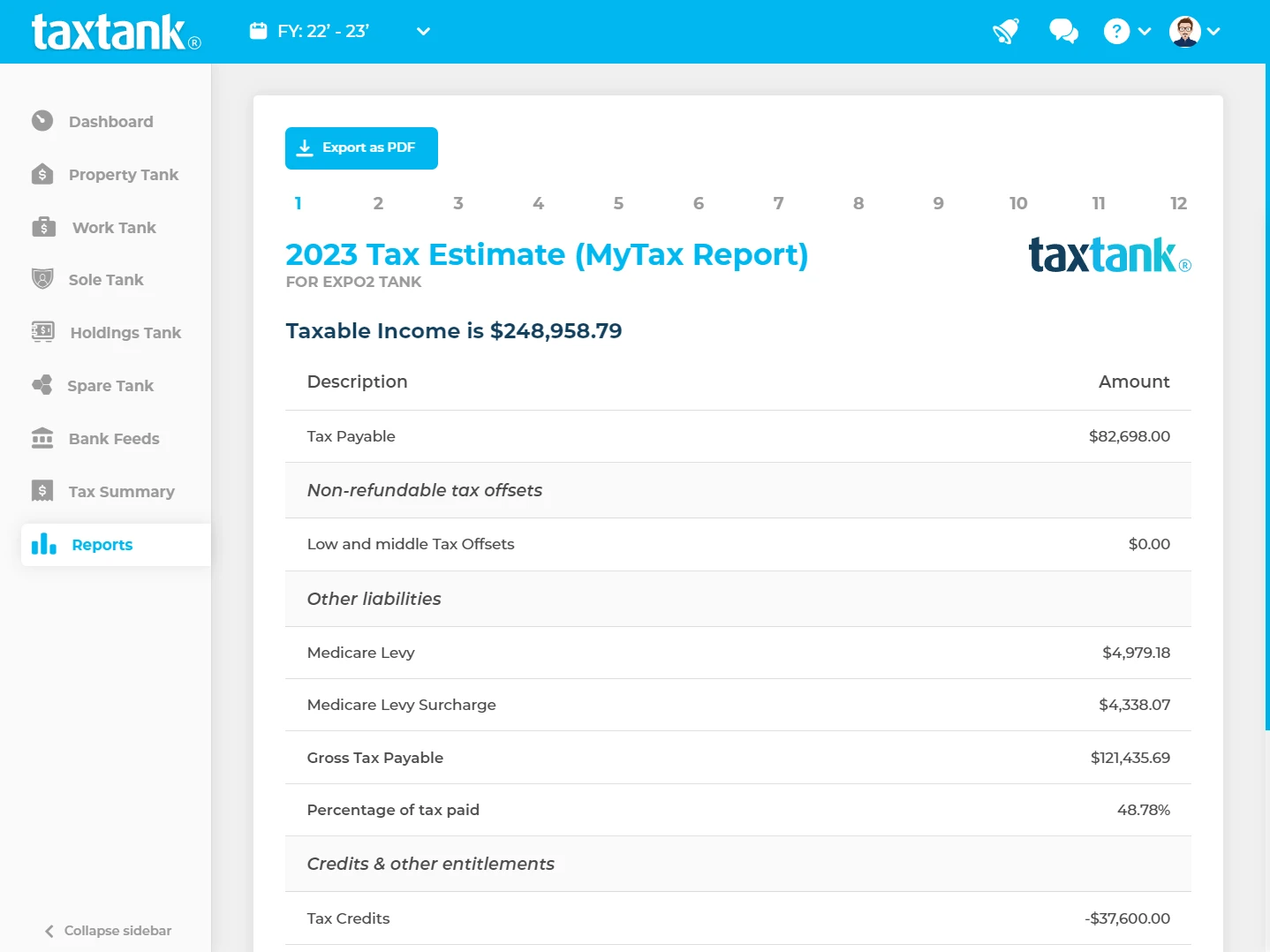

TaxTank helps you stay ready all year. Whether you self-lodge or work with an accountant, your records will be complete, accurate and easy to access. That means faster returns, fewer mistakes, and a lot less stress.

FOR TAX PREPARATION AND SUPPORT

- Access interactive tax reports all year round

- Invite your accountant or advisor anytime for easy collaboration

- Get your return done faster with clean, complete records

- Use the myTax report to self-lodge with confidence

Don’t miss out on tax opportunities.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about tax.