The best alternative to Solo by MYOB

If you’re a sole trader, freelancer or self-employed and still using spreadsheets to manage your tax and finances, it’s easy to see why Solo by MYOB might grab your attention. It’s pitched as a simple solution for sole operators — but when you look closer, much of the admin is still manual, and the time savings just aren’t there.

Solo might be a new product from a well-known brand, but if you’re looking for something that actually makes your life easier, TaxTank is the best alternative to Solo by MYOB. Starting at just $9 a month, TaxTank gives you automated invoicing, real-time tax tracking, and smart business reporting — so you can stay in control without the hassle.

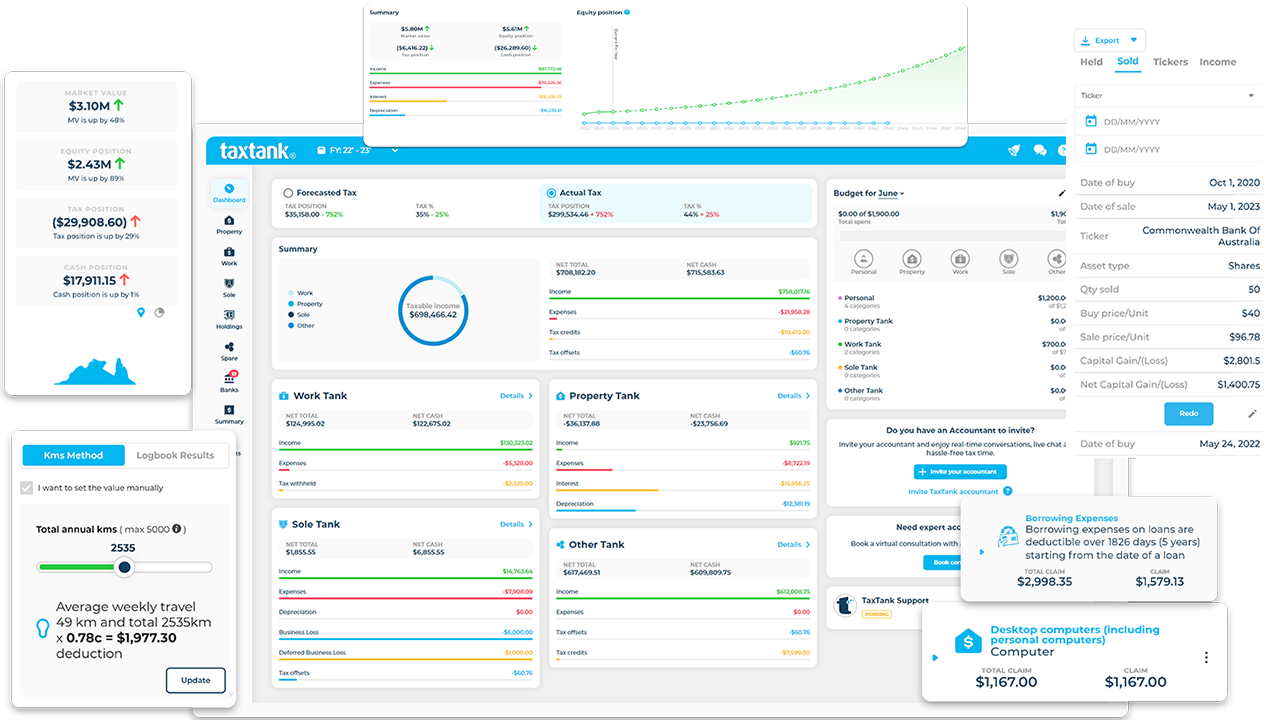

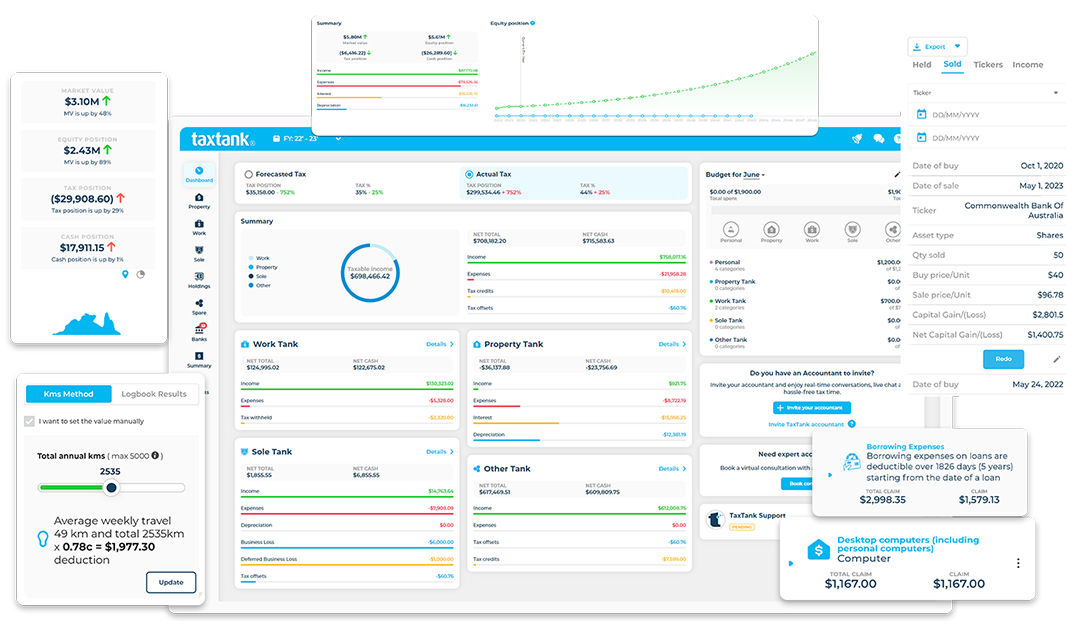

What you get with TaxTank

TaxTank is built specifically for Aussies who want to manage their tax with confidence and clarity. Whether you’re a sole trader, freelancer, content creator or side hustler, it takes the stress out of tax time and helps you stay in control all year round. Designed around Australian tax law and packed with smart features, TaxTank is the best alternative to Solo by MYOB.

- Live bank feeds and automated expense allocation

- Live tax summary to know exactly how much tax to pay

- Instant invoicing, send and match to bank transactions

- Depreciation for assets including Instant Asset Write Offs

- Simple vehicle logbook expense claims

- Automated home office claims with a built-in diary and percentage tracking

- Real time BAS reporting

- Document storage for receipts and important documents

- Management of all other income types (PAYG, rental etc)

- Portoflio management for property, shares and crypto

- Live chat support

- Complete financial oversight

What you get with Solo by MYOB

Solo is MYOB’s new app aimed at sole operators, but in reality, it’s more of an entry point to their broader small business platform. While it’s designed to help simplify admin, many of the key features still rely on manual processes — and it doesn’t cater for a lot of the common tax deductions sole traders can claim when lodging as individuals. That might be fine if you’re just getting started, but for anyone who wants to save time, claim everything they’re entitled to, and stay on top of tax year-round, it may not go far enough.

- App to send invoices and monitor payments

- Connection to 2 live bank feeds only

- Tap to Pay functionality to receive payments

- GST Reports to help with BAS

You will also need;

- Spreadsheet or document to track work from home deductions

- Spreadsheet to manage vehicle logbooks and expenses

- Spreadsheet to track Instant Asset Write Offs

- Depreciation calculator for business assets

- Spreadsheet to track other incomes not related to sole trader business

The best alternative to Solo by MYOB

If you’re comparing tools to help manage tax and admin as a sole trader, it’s not just about price — it’s about value. TaxTank offers more automation, more features that actually save you time, and support that doesn’t leave you hanging.

TaxTank

- Free trial to test suitability

- Automated income and expense management

- GST Tracking for BAS reporting

- Live tax position all year round for all income types

- Live bank feeds through Open Banking

- Vehicle logbook for easy vehicle claims

- Home Office Diary for automed office claims

- Asset depreciation, including instant asset write off

- Accepts Payments

- Desktop and Phone Compatibility

- Permanent document storage

- Live chat support

TaxTank

Solo by MYOB

TaxTank

- Free trial to test suitability

- Live income and expenses

- GST Tracking for BAS reporting

- Live tax position all year round

- Live bank feeds

- Vehicle logbook

- Home office diary

- Asset depreciation

- Accepts Payments

- Desktop and Phone

- Permanent document storage

- Live chat support

TaxTank

Solo

Sign up now and unlock the benefits of managing your sole trader tax live throughout the year instead waiting until the end of financial year mad rush.

Pricing

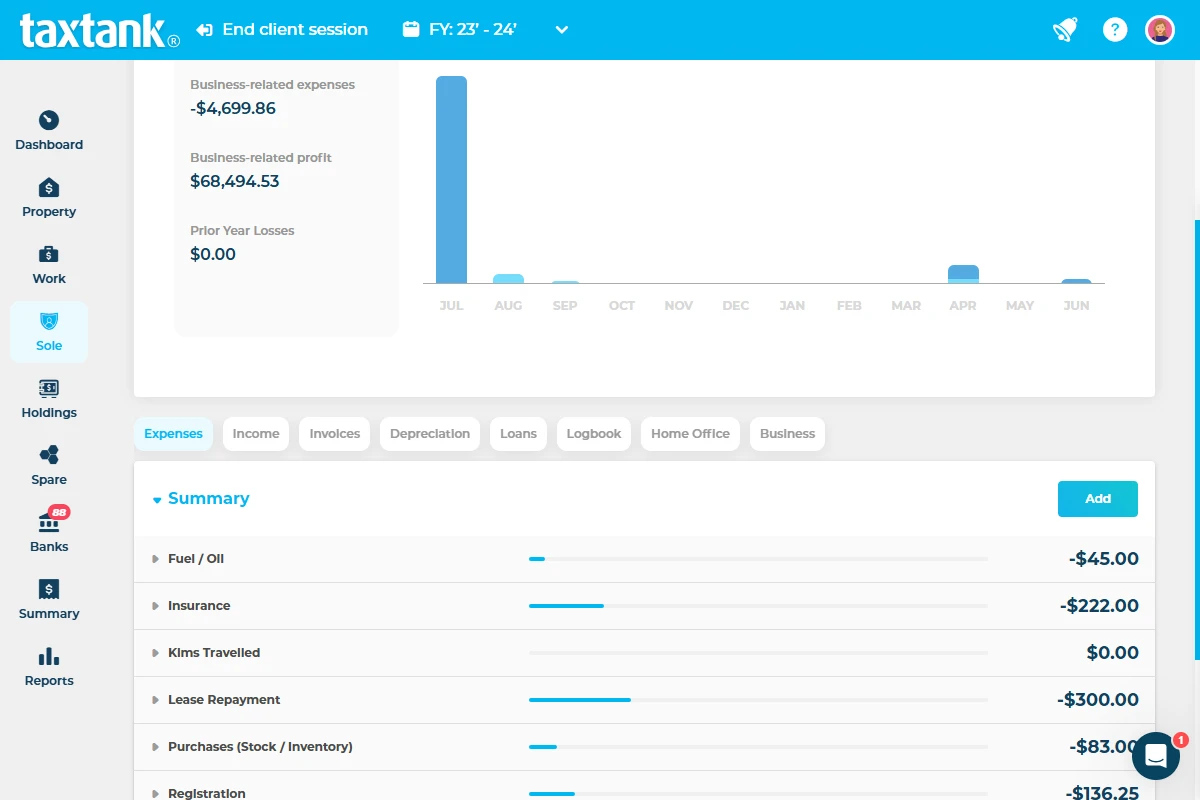

TaxTank is built as a modular system so you only pay for what you need.

Sole Tank is just $9 a month and you can manage up to 6 businesses under your ABN.

- Free Trial

- No Credit Card Required

- Cancel Anytime

SOLE TANK

Simply add Sole Tank so you can manage sole trader income and expenses.

$9/month

Paid Annually

Frequently asked questions

Yes it’s free to trial for 14 days. You can explore the platform before entering any payment details. No lock-in, no surprises.

Not necessarily. TaxTank empowers you to understand and manage your own finances, but you can still share your reports with your accountant at tax time or lodge using our myTax report.

Absolutely. You can track everything in one place — from work as an employee to side hustles and beyond.

Not at all. It’s built for everyday Aussies — intuitive, straightforward, and designed to make tax simple.

Unlike Solo, TaxTank offers deeper tax features like real-time tracking, automated calculations, and deduction tools. Compared to Xero, it’s simpler, more affordable, and built specifically for sole traders, not small businesses.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.