The #1 alternative to The Property Accountant

Managing property finances is important, but managing only your property finances isn’t the full picture. The Property Accountant gives investors tools to track income and expenses, connect bank feeds, and handle basic depreciation and CGT. It’s a step up from spreadsheets, but it stops short of showing how your property portfolio fits into your whole financial life. It’s also limited when it comes to live data, with bank feeds only available for loan accounts – not transaction accounts or credit cards – which means you’ll still need to manually manage most day-to-day property expenses.

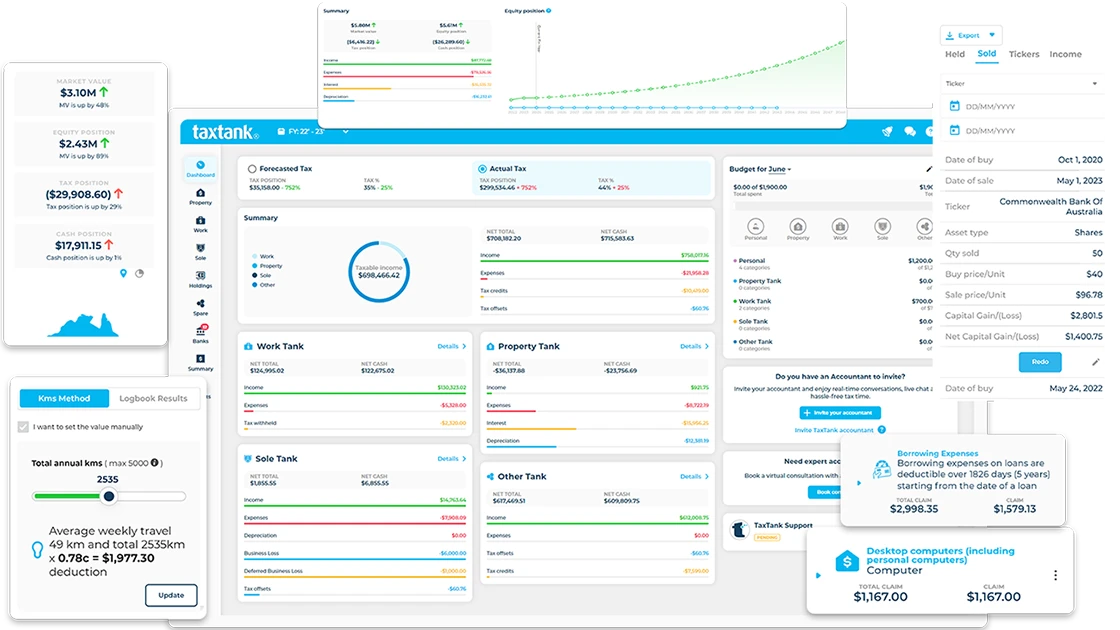

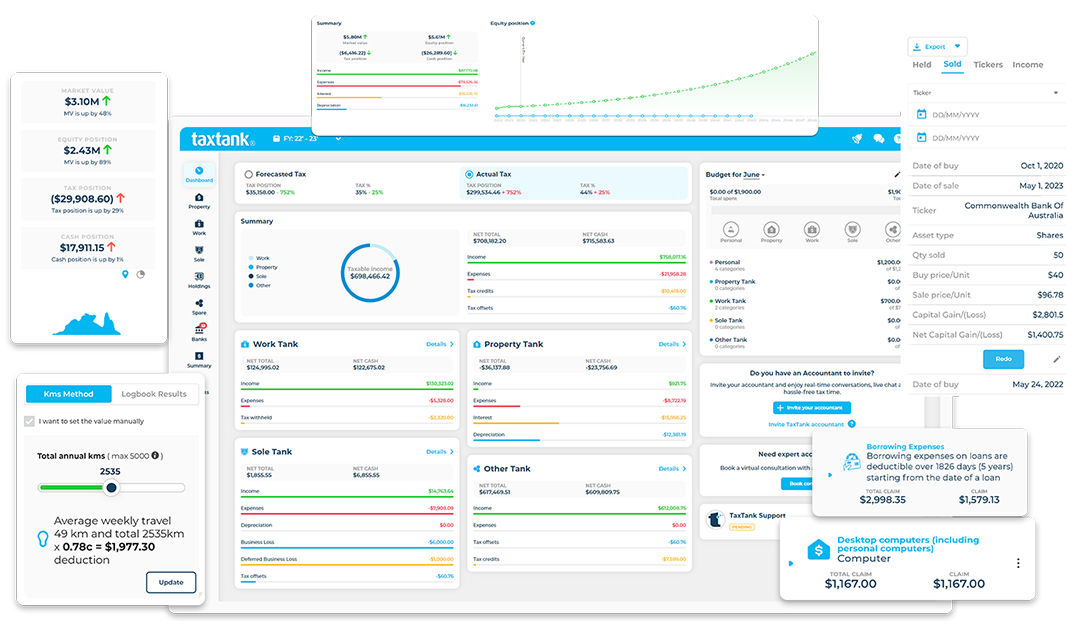

That’s where TaxTank comes in. TaxTank is the smarter, all-in-one alternative that not only manages your property income and expenses, but also integrates your work income, sole trader businesses, shares, and crypto so you can see your live tax position, cash flow, and equity across everything you own.

Why choose an alternative to The Property Accountant?

The Property Accountant is only built to manage the basics of property. It offers live feeds, and report generation, but that’s where it ends. Its depreciation tools are also fairly limited, without support for low value pooling or automatic write-offs for assets under $300, which can mean missing deductions. If you earn income outside of rent, invest in shares or crypto, or simply want to see your tax obligations in real time, you’ll find yourself reaching for other tools – or going back to spreadsheets.

TaxTank does it all in one place.

Whether you’re a property investor, a sole trader, or someone juggling multiple income streams, TaxTank gives you complete, real-time control of your finances with no gaps and no hidden costs.

TaxTank offers a more comprehensive solution than The Property Accountant

Both platforms let you track property income, expenses, and depreciation. But TaxTank is designed for the bigger picture – so you can make smarter, faster decisions with live insights across all your finances.

Real-Time Tax Management

The Property Accountant can generate basic reports, but it doesn’t track your tax position across multiple income types. With TaxTank, you’ll always know how much tax you owe, live all year round with no more waiting until July to find out.

Comprehensive Budget Management

Track your income, spending, and investments all in one place. TaxTank provides a simple yet powerful budget tool that integrates with your tax data, so you can see your full financial picture – tax obligations, savings goals, and all.

Detailed Financial Reporting

TaxTank doesn’t just track your income and expenses, it gives you detailed reports that help you forecast your tax obligations, track your investments, and plan for the future. Think of it like your financial crystal ball.

Automation to Save Time

Gone are the days of manually entering transactions. TaxTank integrates with all bank account types and automatically categorises your transactions, keeping you up to date in real-time. You can even set automated bank rules for recurring payments. So, sit back, relax, and let TaxTank do the heavy lifting.

It's literally a few minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”

Tailored for Property Investors

Property investors, we’ve got you covered. TaxTank gives you live property valuations via CoreLogic, full capital gains tax calculators, detailed depreciation schedules including low value pools and asset write-offs, and complete live bank feeds so you can manage your portfolio effortlessly.

Why TaxTank is the best alternative to The Property Accountant

When it comes to managing property, The Property Accountant does the basics. But when it comes to managing your whole financial life, only TaxTank gives you the tools you need:

- Live tax forecasting across all income types

- Live bank feeds for all account types

- CoreLogic-powered property valuations

- Real-time CGT calculations for property, shares, and crypto

- Full visibility of equity, net worth, and cash flow

The difference? The Property Accountant keeps you in the property lane. TaxTank opens up the whole road.

Ready to go beyond property-only tools and get the full picture? TaxTank gives you smarter, real-time control over your finances and tax – without the guesswork.

How TaxTank compares to The Property Accountant

Looking for a solid alternative to The Property Accountant? TaxTank is a no-brainer.

Here’s how the two platforms stack up side by side:

TaxTank

- Property Income & Expenses Tracking

- Comprehensive Budgeting Tools

- Live bank feeds for all account types

- Automated expenses allocation on bank transactions

- Automated depreciation of assets

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

The Property Accountant

- Limited

- Limited

- Limited

TaxTank

- Property Income and Expense Tracking

- Comprehensive Budgeting Tools

- Live bank feeds for all account types

- Automated expenses allocation on bank transactions

- Automated property depreciation

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

The Property Accountant

- Limited

- Limited

- Limited

TaxTank

- Income & Expenses Tracking

- Budgeting Tools

- Live Bank Feeds for all types

- Automated expenses

- Automated depreciation

- Capital Gains Tax Calculator

- Complete tax oversight

- Document storage

- Tax deductible fees

TaxTank

The Property Accountant

- Limited

- Limited

- Limited

- Limited

It's easy to get started

Our pricing starts from as little as $6 per month and is customisable so you only pay for the Tanks that suit your individual needs. TaxTank is also 100% tax deductible 😉 so it’s a win, win.

- Free Trial

- No Credit Card Required

- Cancel Anytime

PROPERTY TANK

Manage property income and expenses

$15/month*

WORK TANK

Manage work income and expenses

$9/month*

SOLE TANK

Manage sole trader income and expenses

$9/month*

MONEY TANK

Manage budgets, cash flow and financial goals

$6/month*

HOLDINGS TANK

Manage CGT for shares, crypto and other assets

$6/month*

SPARE TANK

Upload important documents and receipts

FREE WITH ANY PAID TANK

Frequently asked questions

While both platforms handle property income, expenses, bank feeds, and depreciation, TaxTank brings everything together in one place with all income types, investments, and tax obligations into one live platform.

Not at all. TaxTank keeps records complete and accurate so your accountant can finalise your return faster (and for less cost).

No. That’s where TaxTank stands apart. You get property plus work, sole trader, shares, crypto, and more – all integrated into your live tax position.

No. It only connects to loan accounts, so you can’t bring in live transactions from your everyday bank or credit card accounts. That means most property-related expenses need to be added manually.

Yes. Both platforms allow collaboration, but with TaxTank you stay in control, with live visibility yourself all year round.

With TaxTank, you always know how much tax you owe across all income types, updated instantly with every transaction. No waiting until tax time, no nasty surprises.

Correct. Both handle depreciation, but The Property Accountant doesn’t include low value pooling or automatic asset write-offs under $300.

TaxTank goes further by automating borrowing expenses, creating DIY projects for improvements, and managing asset depreciation across multiple income sources (work-related, business, property, or investment). You can also write off assets that you replace to ensure you claim everything you’re entitled to.

The Property Accountant provides only summary-level CGT reports. TaxTank includes live, real-time CGT calculations across property, shares, and crypto so you can see your position instantly and plan before you sell.

The Property Accountant lets you track property income and expenses and generate reports. TaxTank includes CoreLogic-powered property values, live equity and LVR calculations, yields, borrowing power reports, and capital growth tracking which gives you a full investment performance picture, not just the numbers you need for tax time.

Yes, TaxTank is perfect for managing multiple properties. From tracking individual income and expenses to calculating deductions and capital gains, Property Tank makes it easy to stay on top of your property portfolio. You can also manage different types of property portfolios like those that are held in trusts, SMSFs or other types of structures.