One login. Multiple lives. No more workarounds.

Most people don’t have a single financial identity. There’s the personal you.There’s you as a sole trader.There’s you with properties, but in a trust, SMSF or company.And sometimes there’s you,

Most people don’t have a single financial identity. There’s the personal you.There’s you as a sole trader.There’s you with properties, but in a trust, SMSF or company.And sometimes there’s you,

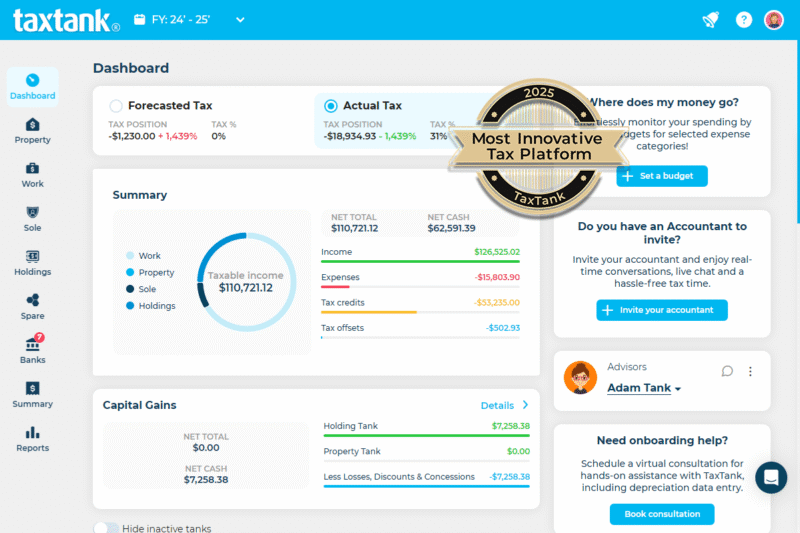

We’re excited to announce that TaxTank has been named The Most Innovative Tax Platform 2025 by WeMoney. It’s recognition we’re proud of because it confirms what our customers already know:

For too long, property investors have been sidelined and stuck with spreadsheets, manual tax calculations, and software that simply was not built for their unique needs. Now, with the ATO’s

At TaxTank, we’re thrilled to announce our new partnership with ITP Accounting Professionals (ITP), Australia’s leading income tax refund specialists. This collaboration marks a significant step forward in delivering a

We are thrilled to introduce the TaxTank Property Widget, an innovative custom white-label product developed in collaboration with Hotspotting, one of Australia’s leading property platforms. This cutting-edge tool seamlessly integrates

Tax time can be a challenge. The ATO’s aim is to collect as much tax as possible. The aim of most Australian taxpayers is to pay only as much as they have to. Navigating the rules is especially difficult for individuals and sole traders that don’t have teams of tax specialists on hand to wade through the requirements. For property investors, the complexities can be quite a burden. 41.9% of total revenue collected in 2020 ($231.2b) was collected from individual taxpayers, excluding property taxes. This is 2.4 times more than businesses paid.

Are you already thinking about the extra money you could be receiving at tax time? Tax time is approaching and for millions of Australians this year could deliver a nice bonus thanks to the boost of a tax offset announced in the recent federal budget.

If just the thought of tax time makes your stress levels rise, you are not alone according to new research conducted by cloud-based tax software, TaxTank.

The recent survey of 1000 Australian taxpayers revealed more than half (56%) find tax time stressful with missed deductions the leading cause of stress ahead of not knowing if they will receive a tax refund or bill and making a mistake.

Australian fintech TaxTank allows property investors to monitor their overall equity, cash position and tax position in real time to make smart investment decisions and maximise their tax deductions. Get their top tax time tips here.

Australian fintech TaxTank allows property investors to monitor their overall equity, cash position and tax position in real time to make smart investment decisions and maximise their tax deductions.

With the real estate environment in Australia changing rapidly with inflation and rising interest rates, property investors will likely have some important decisions to make in the coming months, and cloud-based tax management software TaxTank is here to help.

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation. *All TaxTank Subscriptions are paid for on an annual basis.

Copyright © 2026 TaxTank | All Rights Reserved.