Property portfolio software for effortless property tax management

Simplify how you manage your property tax with powerful, purpose-built Property Portfolio Software. With TaxTank, you can manage your entire portfolio in one place—including investment properties, your home, and even properties held in trusts or companies.

Stay on top of your finances, maximise deductions, and access real-time insights to make smarter investment decisions—all while keeping your property tax low.

The #1 property portfolio software for smart investors

Whether you own one investment property or a full portfolio, TaxTank gives you everything you need to track performance, stay compliant, and reduce your tax with ease.

Join thousands of property investors across Australia who are already saving time, money and stress with TaxTank—Australia’s most trusted Property Portfolio Software.

We have used Xero for my properties but for specific property functionality TaxTank is better and the pricing far outweighs what we were paying. If I could give 10/10 I would. Thank you so much!!!

Bel Austin

Take control with powerful features

TaxTank is Australia’s only dedicated Property Portfolio Software designed for property investors to manage tax year-round. Track performance, monitor your real-time tax position, and store receipts and documents in one secure, audit-ready platform. With smart automation, TaxTank ensures you claim every eligible deduction—accurately and on time.

Financial Oversight

Get a full view of your financial position all year round to make smarter money decisions.

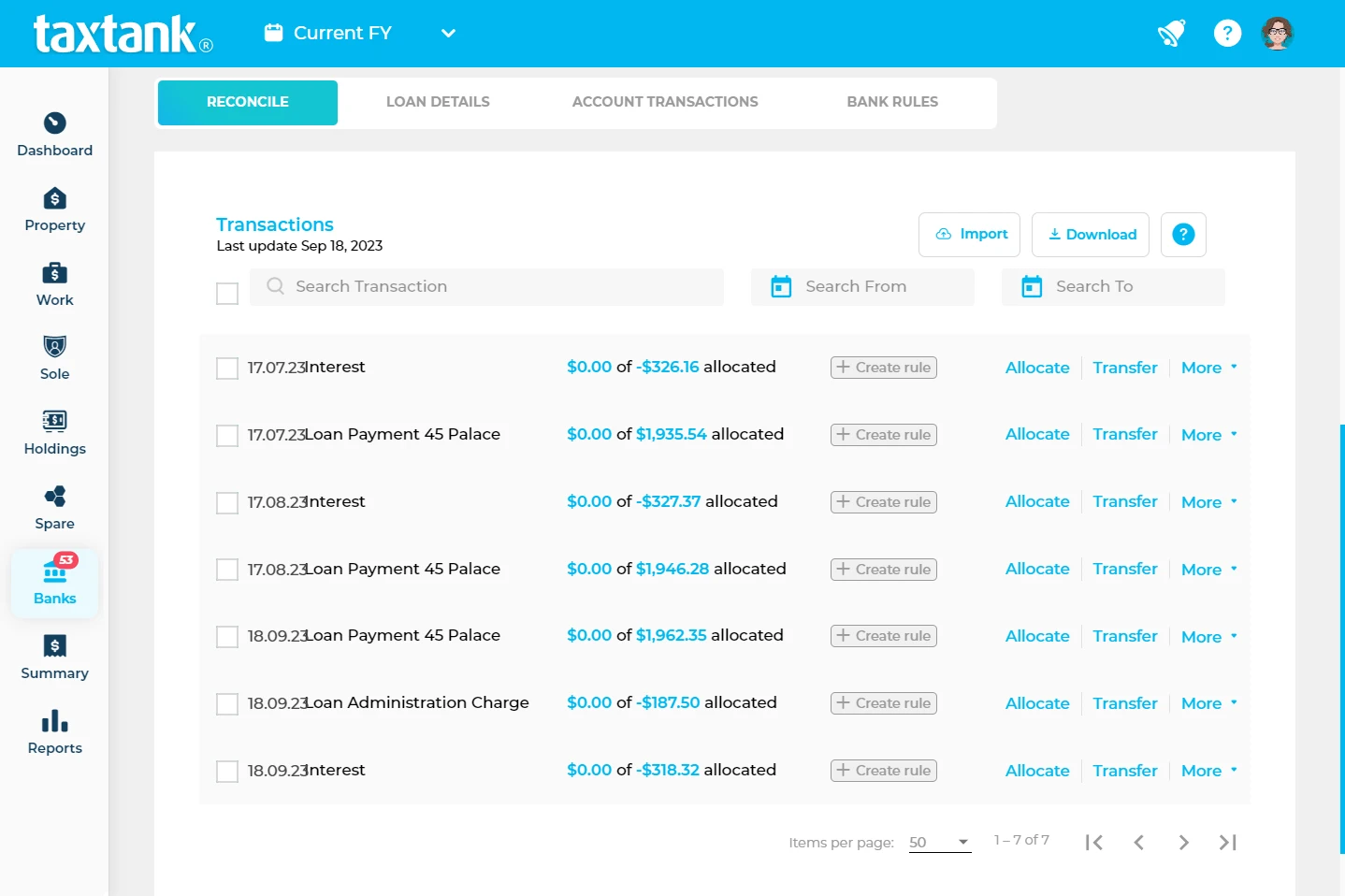

Live Bank Feeds

Connect your bank for automatic transaction tracking with Open Banking.

Automated Tax Tools

Set and forget with smart rules that automatically allocate income and expenses.

Depreciation & CGT Tools

Access hassle-free tools to help you unlock tax benefits with confidence.

Maximise Deductions

Get real-time insights into your tax position to identify deduction opportunities.

Easy Collaboration

Share access with co-owners, accountants and advisors to streamline compliance.

Secure Document Storage

Attach receipts, warranties and statements to create an organised digital audit trail.

Peace Of Mind

Know your tax position any day of the year—no more last-minute stress.

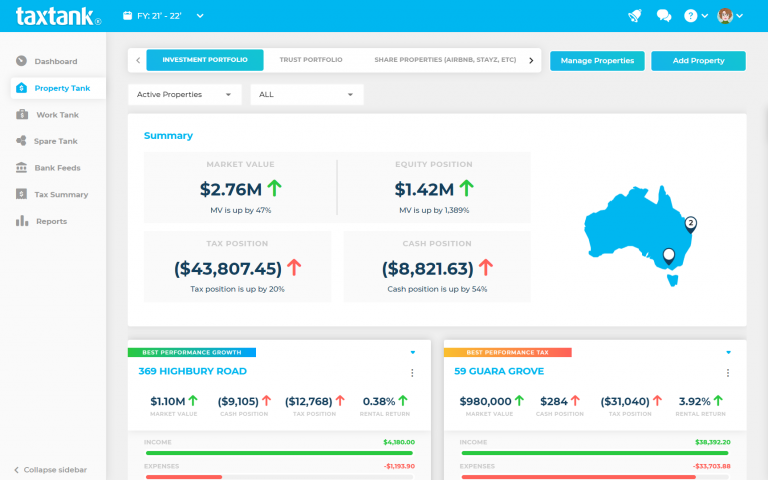

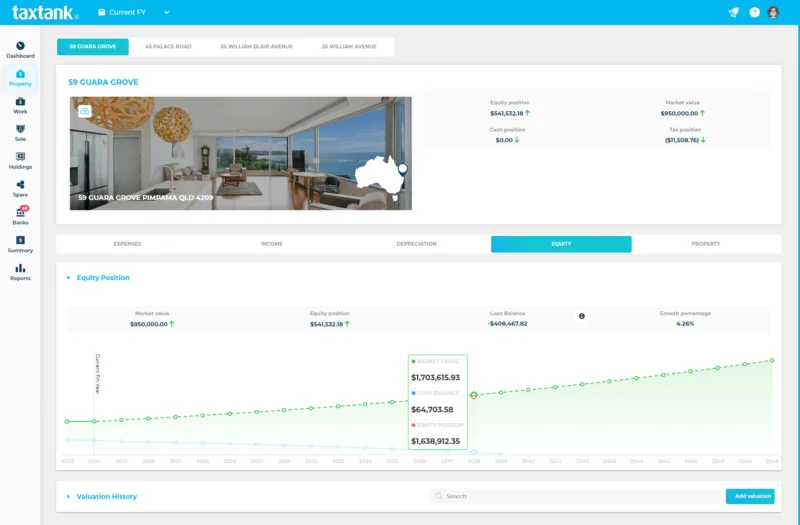

Real-time performance and property tax insights

TaxTank delivers live insights into the tax and cash position of every property in your portfolio, showing what each property costs to hold and how it impacts your return. Make confident, data-driven decisions that optimise your portfolio’s performance.

Our CoreLogic integration lets you forecast growth and equity over time. From rental returns and equity to detailed reports, TaxTank puts full portfolio visibility in your hands.

Stay ATO compliant without the headache

With 9 out of 10 rental property claims containing errors, TaxTank helps you get it right.

Live bank feeds ensure no deduction is missed, and our smart tools calculate everything accurately—so you stay compliant, stress-free.

Understand exactly what’s happening across your portfolio, and reduce your tax bill with total confidence.

Manage your entire property portfolio in one place

Group properties into customised portfolios for a crystal-clear view of equity, growth and tax, no matter the ownership structure. TaxTank’s intuitive Property Portfolio Software helps you manage your strategy with total clarity and control.

Investment Properties

Track income, expenses and performance by property and ownership type.

Share Accommodation

Calculate deductions correctly with tools built for shared spaces.

Vacant Land

Capitalise expenses automatically to minimise Capital Gains Tax.

Trusts & Companies

Centralise entity-managed properties for seamless oversight.

Principle Place of Residence (PPOR)

Record home expenses now, and convert to investment later if needed.

Ready to simplify your property tax? Ditch the spreadsheets and discover smarter Property Portfolio Software with TaxTank.

It's easy to get started

Getting started with TaxTank is simple and affordable. For just $15/month, you get access to all the essential tools you need to manage your property portfolio and tax.

- Free Trial

- No Credit Card Required

- Cancel Anytime

PROPERTY TANK

Simply add Property Tank so you can monitor your whole property portfolio in one place. You can manage up to 5 properties for only $15* a month.

$15/month

Paid Annually

ADDITIONAL

PROPERTIES

Have more than 5 properties? No problem, you can add as many as you like with our property add-on.

$3/month

Paid Annually

Trusted by Property Investors across Australia

It's literally about 10 minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”

Frequently asked questions

Property Portfolio Software like TaxTank allows you to manage all your properties in one place. It tracks your tax and cash positions in real-time, ensures accurate deductions with live bank feeds, and stores all your documents for easy access. With built-in smart tools, you’ll be able to make better, more informed decisions to maximise your deductions, minimise tax, and monitor the performance of your entire property portfolio efficiently.

Absolutely it is worth adding your own house. You can keep a really accurate budget and look at updated market values and growth predictions. Plus if you change your main residence to an investment property in the future, you will have your records in the one place.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

Yes you can. The beauty of TaxTank is that you can record these changes accurately and when they happen so you can future proof yourself should the ATO have any questions.

Yes absolutely, you can use our Share Properties calculator and it will accurately work out the percentage required to allocate and report accurately to the ATO.

Yes, you can! TaxTank lets you setup portfolio’s that don’t impact tax (like Trusts, SMSF’s & your own home).

By answering a few simple questions TaxTank works out your percentage of claim which auto applies to property expenses and eliminates mistakes. If things change you simply update your answers – we have totally got you covered!

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.