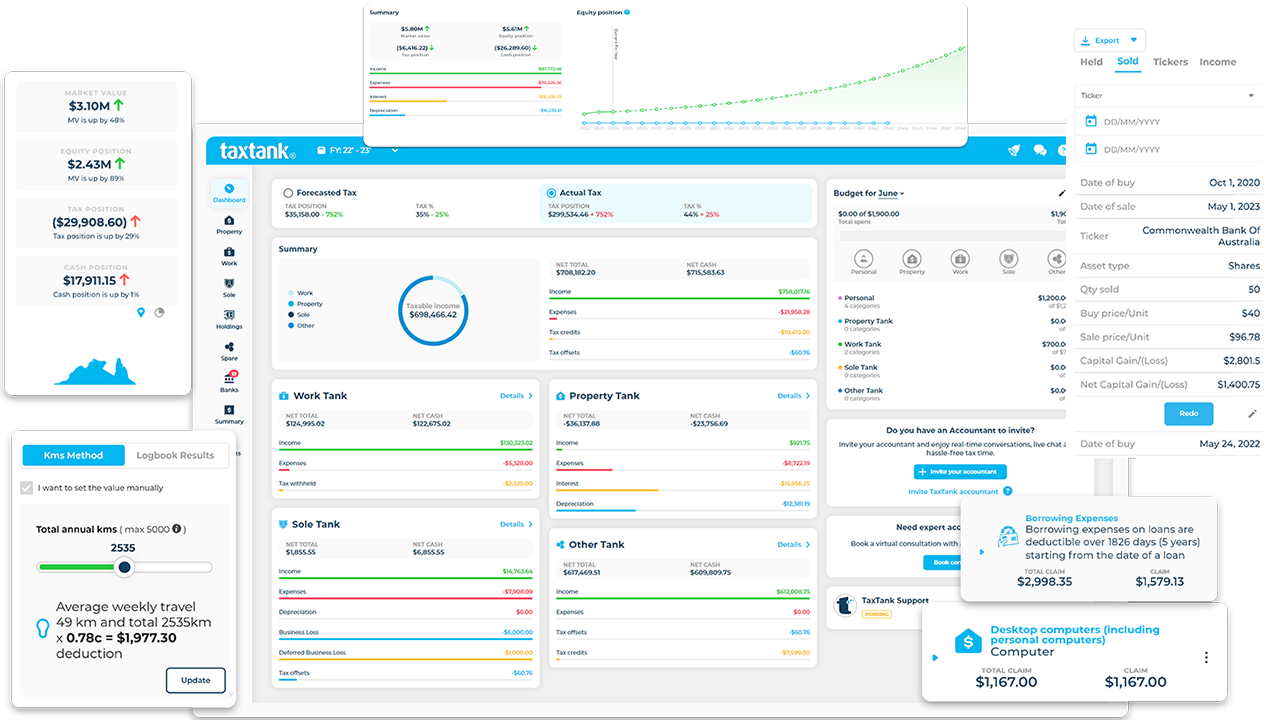

Tax software that lets you control your money and simplify your tax

You don’t have to open new accounts or give away a portion of your income to handle your taxes. With TaxTank, all your tax needs are covered, ensuring compliance and optimised deductions.

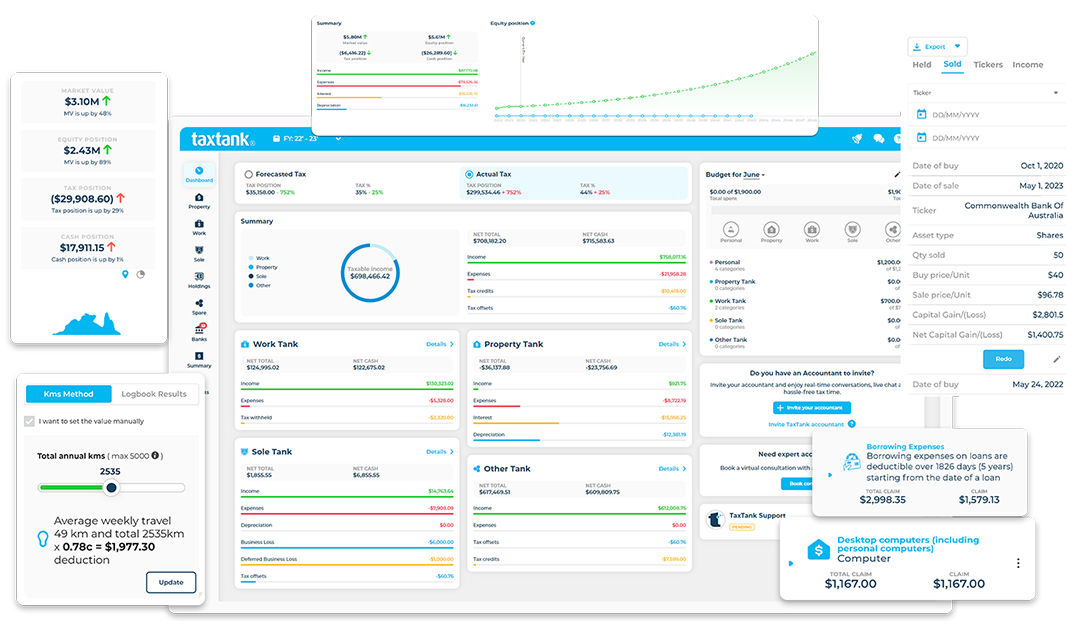

Starting at just $9 per month, TaxTank offers seamless management for your sole trader business, including auto invoicing, business reporting, and automated tax calculations so you know how much tax to pay.

What you get with TaxTank

Based on Australian tax law, TaxTank stands out as the best alternative to Hnry. It streamlines the management of taxes for sole traders, providing thorough oversight throughout the year, enabling you to concentrate on your business with assurance.

- Live bank feeds and automated expense allocation

- Instant invoicing, send and match to bank transactions

- Depreciation for business assets

- Simple vehicle expense claims

- Real time BAS reporting

- Document storage for receipts and important documents

- Management of all other income types (PAYG, rental etc)

- Portoflio management for property, shares and crypto

- Complete financial oversight

What you get with Hnry

- Access to Hnry's app to upload receipts and send invoices

- Automated tax calculations and payments by their accountants

- Expenses management approved by their accountants

- Lodgement of tax returns on your behalf

- Communication with the ATO should you have any issues

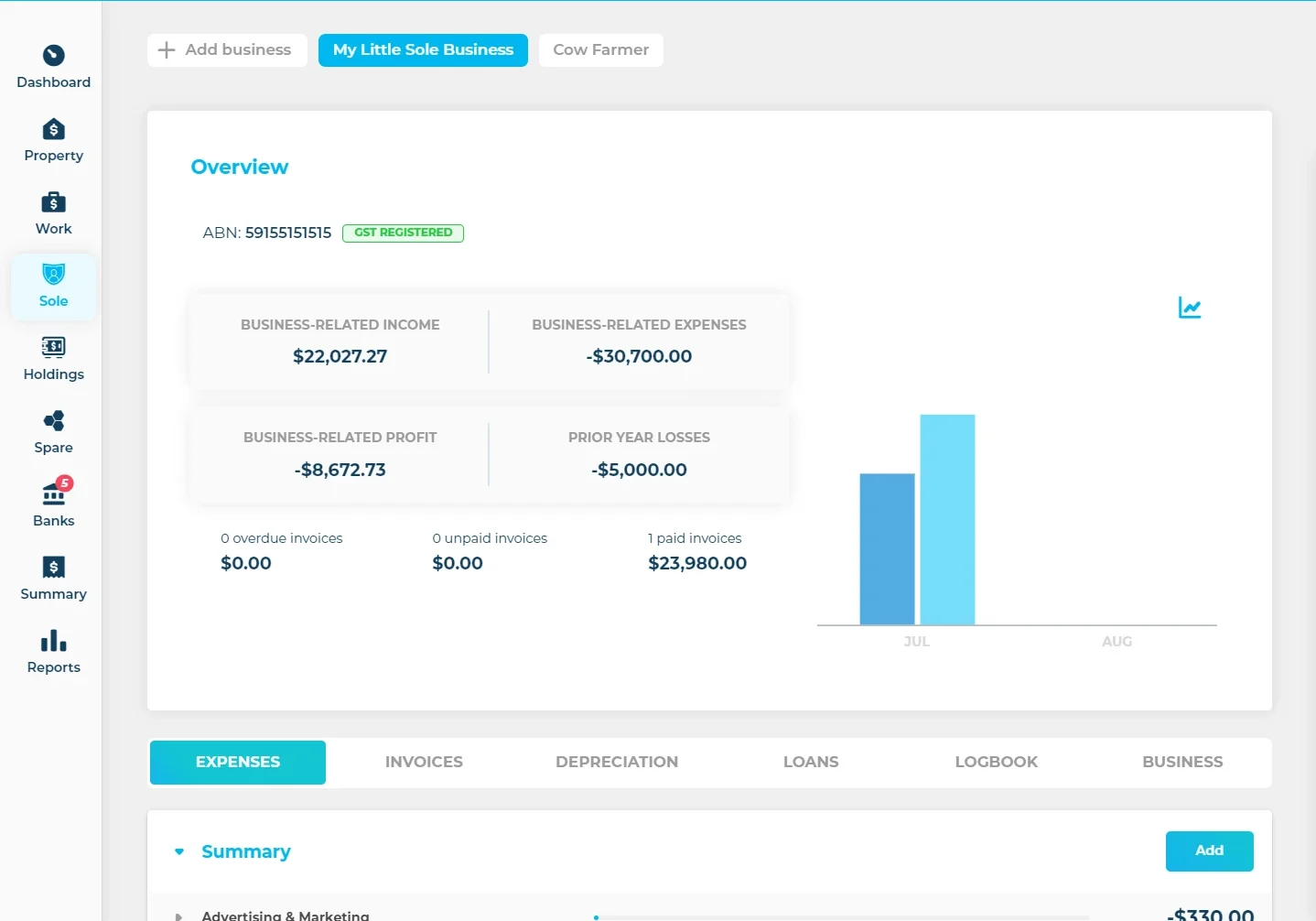

You will also need;

- To open a Hnry trust account and use this account for all business payments

- Keep a manual log of your other incomes to upload them into Hnry

- Keep a manual log of all your expenses to upload them into Hnry

- Manage your personal finances separately

The best alternative to Hnry

TaxTank is the only software on the market where you can see your tax position all year round. Here’s how we compare to using Hnry for your sole trader business needs.

TaxTank

- Help to navigate Australian tax system

- Simplified tax preparation

- Live tax position so you know how much tax to pay

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of business assets

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

Hnry

TaxTank

- Help to navigate Australian tax system

- Simplified tax preparation

- Live tax position so you know how much tax to pay

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of business assets

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

Hnry

TaxTank

- Help navigating tax system

- Simplified tax preparation

- Live tax position

- Live bank feeds

- Automated expenses

- Automated depreciation

- Complete tax oversight

- Document storage

- Tax deductible fees

TaxTank

Hnry

Sign up now and unlock the benefits of managing your tax live throughout the year instead waiting until the end of financial year mad rush.

Pricing

TaxTank is built as a modular system so you only pay for what you need.

Sole Tank is just $9 a month and you can manage up to 6 businesses under your ABN.

- Free Trial

- No Credit Card Required

- Cancel Anytime

SOLE TANK

Simply add Sole Tank so you can manage sole trader income and expenses.

$9/month

Paid Annually

Frequently asked questions

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

Can I add more than one business into TaxTank?

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

If you have both sole trader income and PAYG income, we would recommend you look at using Work Tank and Sole Tank together so you can understand your complete tax position. Our live tax summary will keep you be informed of your tax throughout the year so there are no more tax surprises when it comes to the end of financial year.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.