Cut down on accounting fees at tax time with our automated smart calculations that make property deductions easy

TaxTank makes tax time easier, allowing you to save on accounting fees with our automated smart calculations that calculate capital gains tax and depreciation for properties, work expenses, capital works and DIY projects.

As seen in

What you get with a traditional accountant

- Access to a trained professional who understands Australia's complicated tax laws

- Access to yearly tax planning (either in your annual fees or at an addtional cost)

- Personalised service tailored to individual circumstances

- Lodgement of tax returns on your behalf

- Lodgement of late tax returns if you've missed the deadline

- Communication with the ATO should you have any issues

You will also need;

- Spreadsheet or document to track your expenses

- Spreadsheet or document to manage rental income and expenses

- Software to calculate your capital gains tax

- Software to calculate your depreciation schedules

- Somewhere to store your receipts for compliance with the ATO

Investment Property Spreadsheet

This investment property spreadsheet will let you easily track your income and expenses for your property portfolio so you can claim every possible deduction.

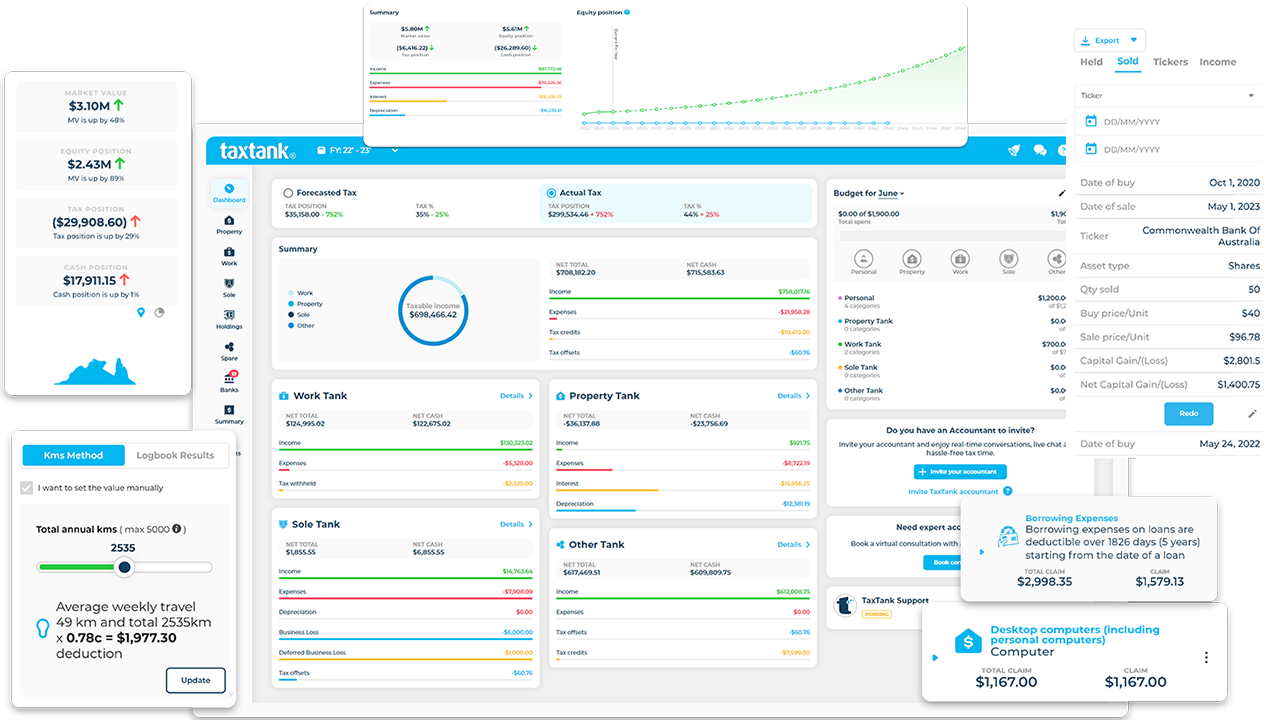

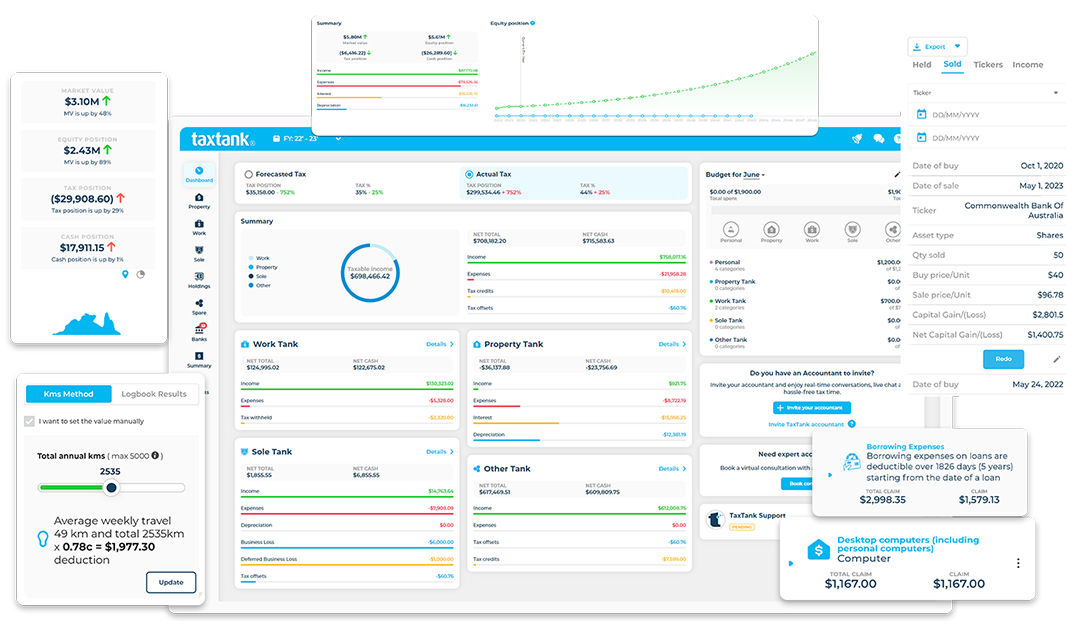

What you get with TaxTank

Underpinned by Australian tax law, our automated smart calculations ensure you claim everything you are entitled to without worrying that you’re making a mistake or missing out. TaxTank gives you the power to manage your own tax affairs, claim every possible deduction and completely taking the hassle out of tax time.

- Live bank feeds to ensure nothing is missed

- Automatic calculations for all expense types

- Depreciation for work expenses, properties and DIY projects

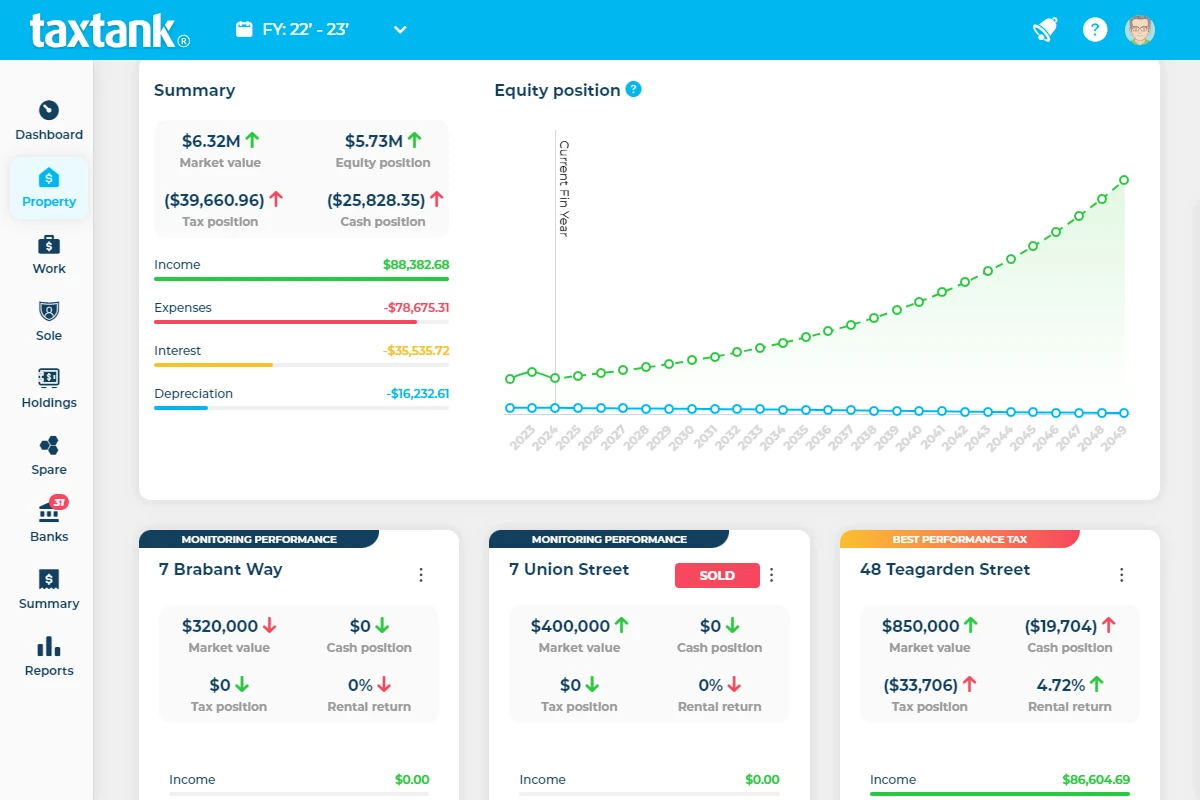

- Complete oversight of your property portfolio

- Capital Gains Tax calculators for property, shares and crypto

- Real time reporting across your tax and personal finance

- Document storage for receipts and important documents

- Monthly budget tracking to keep on track of your finance

- Plus so much more, including automation features......

The best alternative to a traditional accountant

TaxTank is the only software on the market where you can see your tax position all year round. Here’s how we compare with working with a traditional accountant. *hint, with TaxTank you can do both if you really want to 😉

TaxTank

- Help to navigate Australian tax system

- Simplified tax preparation

- Live tax position all year round for all income types

- Live bank feeds through Open Banking

- Property performance comparisons (growth & tax)

- Automated property depreciation & borrowing expenses

- Permanent document storage

- Tax deductible fees

TaxTank

Accountant

TaxTank

- Help to navigate Australian tax system

- Simplified tax preparation

- Live tax position all year round for all income types

- Live bank feeds through Open Banking

- Property performance comparisons (growth & tax)

- Automated property depreciation & borrowing expenses

- Permanent document storage

- Tax deductible fees

TaxTank

Accountant

TaxTank

- Help navigating tax system

- Simplified tax preparation

- Live tax position all year round

- Live bank feeds

- Property performance

- Property depreciation

- Permanent document storage

- Tax deductible fees

TaxTank

Accountant

Sign up now and unlock the benefits of managing your tax live throughout the year instead waiting until the end of financial year mad rush.

It's easy to get started

TaxTank has been built as a modular system so you only pay for what you need.

You can start with any Tank that suits your needs and then add more as your financial situation requires.

PROPERTY TANK

Manage property income and expenses

$15/month*

WORK TANK

Manage work income and expenses

$9/month*

SOLE TANK

Manage sole trader income and expenses

$9/month*

MONEY TANK

Manage budgets, cash flow and financial goals

$6/month*

HOLDINGS TANK

Manage CGT for shares, crypto and other assets

$6/month*

SPARE TANK

Upload important documents and receipts

FREE WITH ANY PAID TANK

Frequently asked questions

TaxTank has been built as a modular system so you only pay for what you need. Starting from just $6 per month, you can start with any Tank that suits your needs and then add more as your financial situation requires.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.

The quick amswer is yes. You can read more about how they do this in our blog article ‘Can the ATO access your bank account’.