Track, manage and stay ahead of Capital Gains Tax

Keep your shares, crypto, and unlisted assets in check, all in one place with TaxTank’s Holdings Tank.

TaxTank is your go-to tool for tracking performance, staying compliant, and calculating Capital Gains Tax (CGT) accurately with zero spreadsheets and no last-minute panic.

Automated CGT tracking for smart investors

Whether you’re trading every week or just holding long term, TaxTank gives you full visibility over your portfolio, live CGT calculations, and automatic capital loss tracking all year round.

No more chasing reports across platforms, and no more guesswork when it comes to tax time. Just simple, automated tools that do the heavy lifting for you.

TaxTank made CGT simple after selling shares. Never going back to doing it manually!

Adhish Guruwacharya

One dashboard. All your investments.

TaxTank is built for everyday investors and tax-savvy traders alike. With powerful automation, live reports, and seamless integrations, it’s never been easier to track your capital gains and income in one secure place.

Full Portfolio Oversight

Track shares, crypto, and unlisted assets in one place, including those held in trusts or companies.

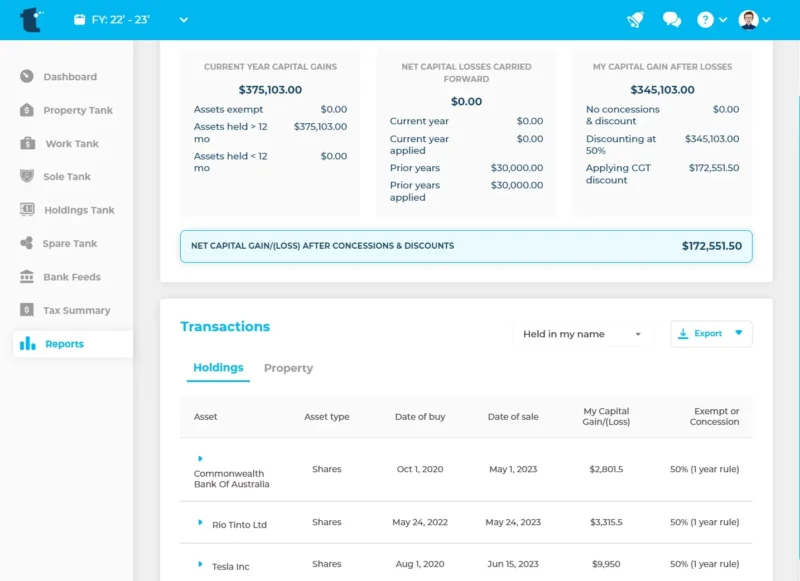

Live CGT Reports

Get a real-time view of your CGT position across your entire portfolio without scrambling at tax time.

CGT Calculations

Every sale, swap or disposal is calculated for you, including concessions, exemptions, and carry-forward losses.

Sharesight Integration

Sync your trading history automatically and keep your portfolio up to date with no double handling.

Income & Expense Tracking

Easily track dividends, staking, interest, and other investment income, plus any related expenses.

Custom Tickers

Add unlisted assets and custom investments so you never lose sight of your full financial picture.

Capital Loss Carry Forwards

We automatically track your capital losses so you can offset them against future gains without lifting a finger.

Secure Document Storage

Attach receipts, document, statements and even warranties for a secure record that never fades.

Smarter tax planning, year round

TaxTank’s live CGT report gives you the full picture before the end of the financial year, not just after. Know where you stand, explore scenarios, and plan ahead with better data.

And because your records are stored securely and permanently, you’ll always be ready if the ATO comes knocking.

Get started in minutes with no credit card required. You’ll see how effortless it can be to stay compliant, avoid tax stress, and take control of your CGT all year round.

Easily manage shares, crypto and custom assets

Shares & ETFs

Track performance, manage dividends, and calculate CGT automatically.

Cryptocurrency

Easily record buys, sells, swaps and staking income across multiple wallets and exchanges.

Unlisted Assets

Customise tickers for any asset class such as art, collectibles, private equity and more.

Trusts & Companies

Track holdings owned in different entities with clear, separate reporting and oversight.

It's easy to get started

Getting started with TaxTank is simple and affordable. With pricing starting from just $6 per month, you can access all the specialised tools you need to manage your sole trader tax effectively.

- Free Trial

- No Credit Card Required

- Cancel Anytime

HOLDINGS TANK

Simply add Holdings Tank so you can Track shares, crypto and custom assets with unlimited trades and assets.

$6/month*

Paid Annually

Paid Annually

Frequently asked questions

Holdings Tank is ideal for everyday investors who want a clear, accurate, and automated view of their portfolio and tax position year-round. It’s perfect for individuals who buy and hold or trade across:

ASX-listed shares and ETFs

Major global exchanges (NASDAQ, NYSE, FTSE)

Cryptocurrency assets (buy, sell, swap)

It’s built for investors who want to track performance, manage CGT, and stay tax-ready — without messy spreadsheets.

Holdings Tank is not currently suitable for investors operating in complex or specialised trading environments, including:

Options trading

Futures and derivatives

CFDs and leveraged platforms

Short selling

Margin lending with complex adjustments

Professional share traders (as defined by the ATO)

These investment styles involve specialised tax outcomes or real-time adjustments outside Holdings Tank’s current scope.

Professional traders are taxed differently. Their trades are usually treated as revenue transactions rather than capital gains. Holdings Tank is built for capital gains tracking, aligning with most Australian investors who invest for wealth rather than as a trading business.

Corporate actions like dividends, splits, and consolidations are supported via manual allocations. Automation through the ASX data feeds is coming soon. More complex events tied to derivatives or structured products are not supported yet.

Not yet. Holdings Tank currently supports shares, crypto, and unlisted assets. More asset types are coming in the future.

You can import your trades via CSV import, but they need to be formatted to meet our requirements. Some reports may also need custom tickers. If a format isn’t supported, you’ll be notified when importing.

Yes, for shares, crypto, and unlisted assets. It calculates capital gains, losses, and performance. Complex trading strategies may not be fully covered yet.

Yes if you only need to use TaxTank for your shares and crypto, then it’s just $6 per month. If you have any other income, then you can also add on those Tanks too.

No, unlike other platforms we don’t restrict the numbers of assets you can add or sell. Our capital gains tax report is available all year round at not charge as well.

Yes, our available tickers include ASX, NYSE, TSX, HKEX, SGX & LSE.

Yes you absolutely can. Simply download the CSV template in the software and then you can upload as many as you need to.

Absolutely! Our capital gains tax calculator and reports are fully compliant with the ATO.

Ditch the spreadsheets. Know your tax position all year round

TaxTank gives you full control over your capital gains tax. Try it free for 14 days and see how easy tax can be.