Sole Trader Tax. Sorted.

Introducing the effortless way to manage tax for side hustlers and sole traders.

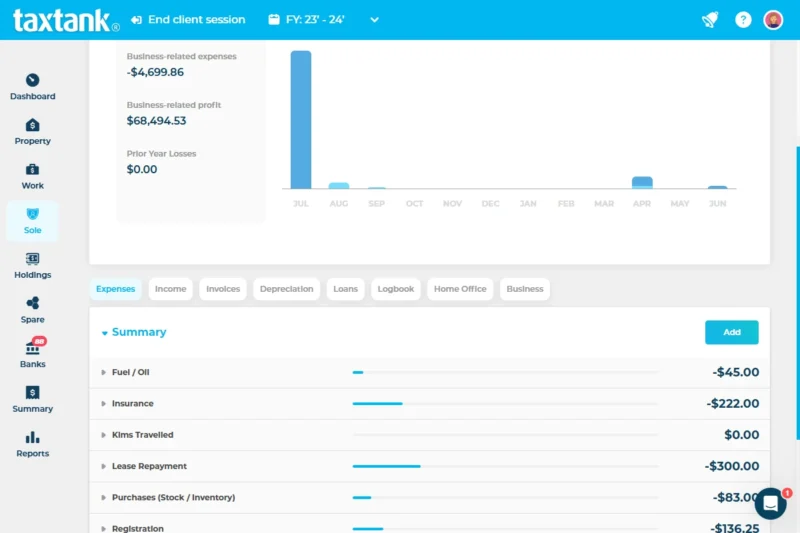

Say goodbye to spreadsheets and tax-time stress. TaxTank helps you stay on top of your business income, invoices, and expenses so you always know exactly how much tax you owe.

Take control of your sole trader tax without the headache

Running your own gig means wearing a lot of hats. Between clients, marketing, and admin, managing tax is often the last thing you want to deal with.

That’s why we created TaxTank. It’s simple, smart, and designed to make sole trader tax management effortless.

For a fraction of the cost of other software, I get all the tools I need to manage my sole trader business and investments efficiently. It’s simple, smart, and effective.

Vinicius Gomes

Take control with powerful sole trader tax features

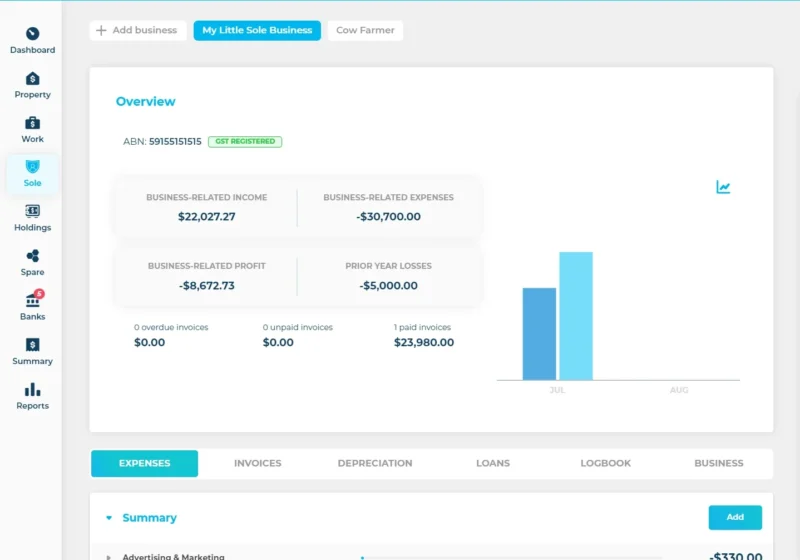

TaxTank is the only Australian tax software that automatically calculates how much tax you owe — all year round. From auto invoicing and business reporting to integrated logbooks and powerful tax tools, TaxTank makes it easy to manage your tax position, track deferred losses, and apply ATO offsets with confidence.

Financial Oversight

Know your financial position in real time so you can make smarter business decisions.

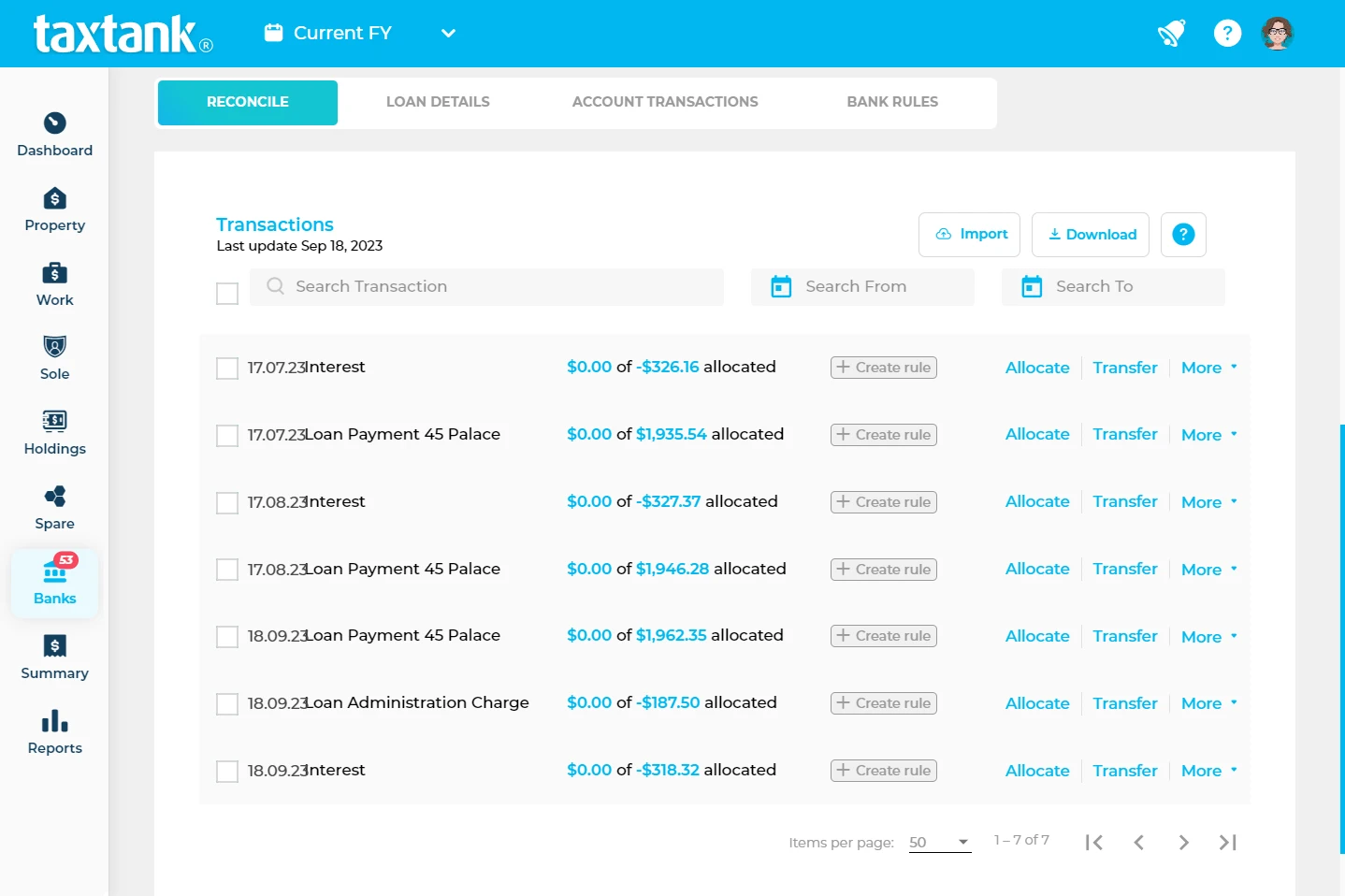

Live Bank Feeds

Ensure nothing is missed with automated live bank feeds using Open Banking.

Automated Tax Tools

Automatically allocate income and expenses using bank rules so you can set and forget.

Depreciation Tools

Claim depreciation on business assets with ease, including small business pools and instant asset write-offs

Maximise Deductions

Automatic calculations of your estimated tax position to show you how much tax you owe.

Easy Collaboration

Share with accountants and advisors so you can keep on top of everything year round.

Secure Document Storage

Attach receipts, document, statements and even warranties for a secure record that never fades.

Peace Of Mind

Avoid stress at the end of the financial year and know your tax position all year round.

No more tax time surprises

Whether you’re building a side hustle or running a full-time solo operation, TaxTank simplifies everything so you can focus on growing your business.

- Create and send invoices in seconds

- Match payments to invoices instantly

- Track every transaction with live bank feeds

- Snap and attach receipts for easy record-keeping

- Automatically calculate GST for BAS

- See how much tax you owe at a glance

- Manage multiple businesses in one account all year round

- Track primary and non-primary production

- Record and offset prior-year losses

- Log vehicle and home office claims

- Manage depreciation for business assets, including instant asset write off and small business pool

Every feature is built to save you time and take the guesswork out of tax.

Stay ATO compliant without the headache

With live bank feeds and smart tax tools, TaxTank captures every deduction and calculates claims correctly so you can stay compliant with confidence.

There’s no more guessing, no more scrambling, and no more risk of missing out.

Take control of your sole trader tax today. Try TaxTank FREE and discover how effortless managing your tax can be!

It's easy to get started

Getting started with TaxTank is simple and affordable. With pricing starting from just $9 per month, you can access all the specialised tools you need to manage your sole trader tax effectively.

- Free Trial

- No Credit Card Required

- Cancel Anytime

SOLE TANK

Simply add Sole Tank so you can manage your sole trader tax in one simple platform.

$9/month

Paid Annually

Paid Annually

Trusted by Sole Traders across Australia

Frequently asked questions

Yes absolutely. You can add up to 6 businesses under the same ABN.

If you have both sole trader income and PAYG income, we would recommend you look at using Work Tank and Sole Tank together so you can understand your complete tax position. Our live tax summary will keep you be informed of your tax throughout the year so there are no more tax surprises when it comes to the end of financial year.

We cater to individual taxpayers so unfortunately you won’t be able to manage your company in TaxTank. There are many other platforms that are set up help with managing your company tax so would recommend you take a look at those options.

Not all, that’s why we have come the rescue. Tax has always been so boring and conveluted, we have broken it down into cool software that is super easy to follow and understand. If you can log into your internet banking, you can use TaxTank. But after using it you will be an expert – maybe you could teach your accountant a thing or two?

We wouldn’t make you do that! The sooner the better, why wait for something so good? We would hate to see you miss out on important deductions that could cost you heaps of money.

Yes, TaxTank is 100% tax deductible.

Some tech savvy people out there may be quicker, but for us novices it can take approximately probably 10 minutes if you have your documents handy. If you hve multiple properties, you will need to give yourself more time but a little bit of work will be totally worth it!

Yes absolutely. TaxTank has been to developed to directly associate with all current Australia tax law. TaxTank will also be updated when any changes are made by the ATO.