TaxTank and Rentomise

Managing your investment property can feel like a full-time job. You’re juggling agents, chasing compliance, handling tenant issues, and trying to stay on top of changing regulations. Even with tools like TaxTank helping you track deductions and maximise returns, the day-to-day grind of property management can slow you down.

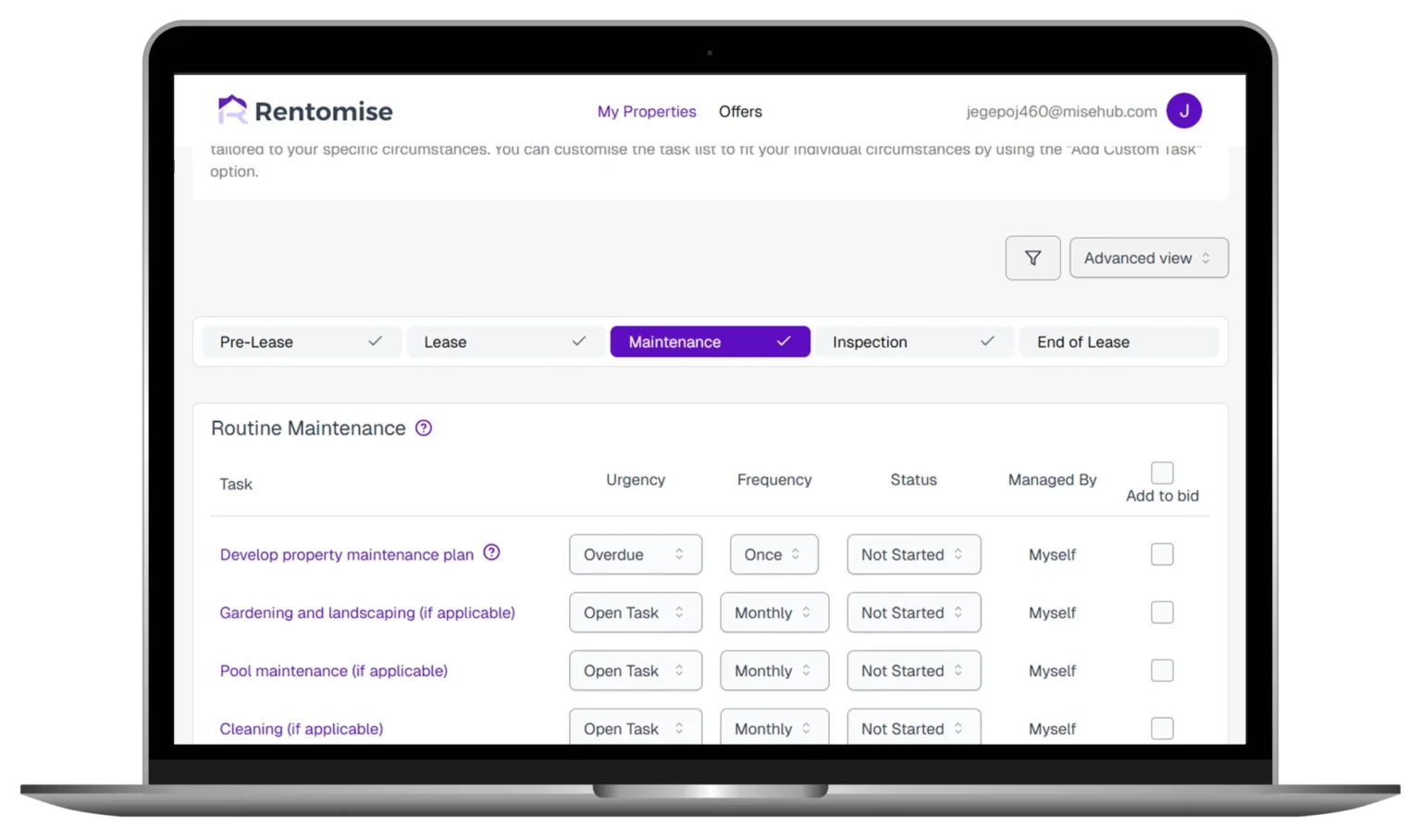

That’s why we’ve partnered with Rentomise, Australia’s first selective property management marketplace. It puts you, the landlord, in complete control. You choose exactly what tasks you want help with, when you need it, and who you want to work with. From full-service management to just ticking off compliance or inspections, it’s entirely up to you.

And the best part? It’s 100% free for landlords.

Rentomise is here to help you reduce stress, stay compliant, and keep more money in your pocket, all without giving up control of your investment.

Why we partnered with Rentomise

Property management in Australia hasn’t changed much in decades. You’re either fully DIY or locked into expensive, one-size-fits-all management contracts that don’t always suit your needs.

Rentomise takes a smarter approach. Just like TaxTank has modernised tax tracking for property investors, Rentomise brings a new way to manage your rentals. It’s flexible, transparent, and built for modern landlords who want more choice and less hassle.

You can browse qualified property managers, pick and choose the services you need, and skip the ones you don’t. Whether it’s help with inspections, compliance, leases or ongoing maintenance, Rentomise lets you take back control of your portfolio without doing everything yourself.

It also offers tools and support to help tenants who need a hand, creating better outcomes for everyone involved.

What you get with the TaxTank and Rentomise partnership

This isn’t just another add-on. It’s a smarter way to manage your rentals alongside your tax. If you’re a landlord looking for more flexibility, better returns or just a little less stress, Rentomise is well worth a look.

- Completely free for landlords

- Access a marketplace of qualified property professionals

- Only pay for the tasks you choose to outsource

- More visibility and control over your property

- Reduce vacancy periods

No lock-in contracts. No inflated management fees. Just the help you want, when you want it.

Learn more about Property Investment

Want to better understand your cover and why it matters? Check out these helpful reads:

Top 5 Property Accounting Software in Australia (2025 Update)

Managing your investment property finances is no small task. Between tracking rental income, mortgage interest, depreciation, maintenance, and tax implications, it’s easy to lose clarity without the right property accounting

How Smarter Property Management Can Help Maximise Rental Returns and Minimise Risk

As a landlord in today’s dynamic market, you’re constantly balancing the books. Your goal is to maximise returns on your investment while navigating an increasingly complex landscape of tax compliance,

How to Choose the Right Property Accountant in Australia (Hint: Software Is Key)

When it comes to managing investment properties, finding the right property accountant is as important as choosing the right property. With ever-changing ATO regulations, complex deductions, and increasing audit activity,

Investment Property Deductions Guide to Maximise Returns in 2025

Many property investors leave money on the table simply because they don’t fully understand investment property deductions. Without claiming eligible expenses, like depreciation, borrowing expenses, land tax, and maintenance costs,