Managing property investments in Australia has evolved significantly, with a plethora of property portfolio apps designed to simplify every aspect of property management. Whether you’re a seasoned investor or just starting out, the right property portfolio app can help you optimise your portfolio, track your finances, and stay compliant with tax obligations. Here’s an in-depth look at the top 5 property portfolio apps in Australia that are leading the charge in 2024.

1. TaxTank: Your Ultimate Tax and Investment Management Partner

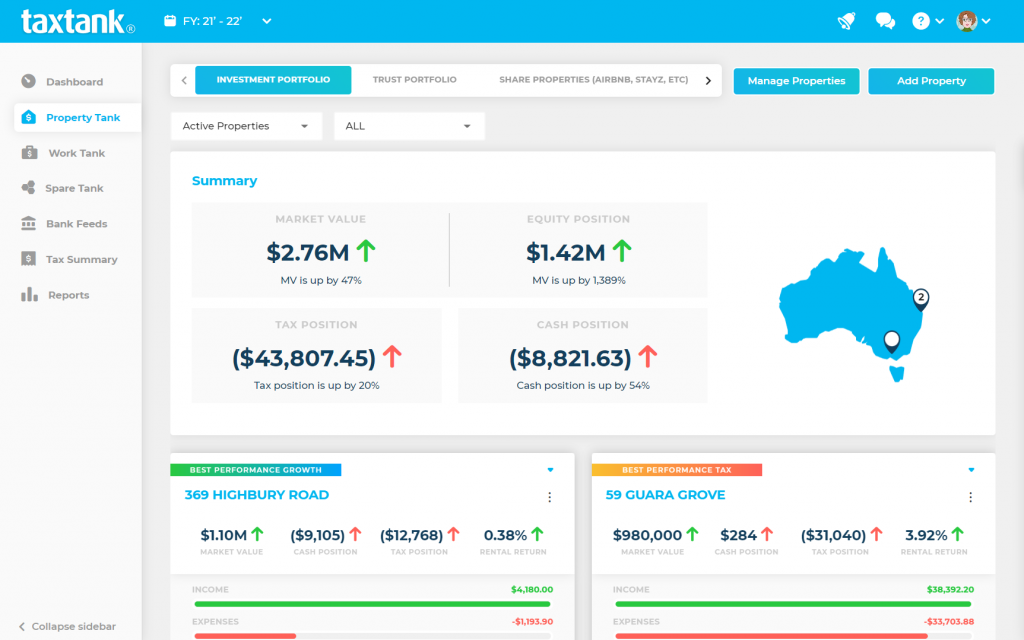

TaxTank is an essential tool for any Australian property investor, offering a comprehensive suite of features that goes beyond traditional property management. What sets TaxTank apart is its focus on tax optimisation and investment performance tracking, making it an indispensable asset for anyone serious about maximising their property returns.

At the core of TaxTank is its real-time tax calculator, which allows investors to see the tax implications of their decisions instantly. Whether you’ve purchasing a new property, sold an existing one, or made significant renovations, TaxTank shows you how these actions have affected your tax and financial position live throughout the year. This transparency is crucial for strategic planning and helps you make informed decisions that benefit your bottom line.

TaxTank’s ability to provide ATO-compliant reporting ensures that you stay on top of your obligations, reducing the risk of errors that could lead to costly penalties. With the ATO’s focus on property investors, it is now even more important to get this right. The property portfolio app also offers powerful analytics tools that allow you to monitor your portfolio’s performance, track rental income, expenses, and equity, and generate detailed reports that make tax time a breeze.

For investors who want to take full control of their financial future, TaxTank provides a level of insight and efficiency that other property portfolio apps simply can’t match.

Pricing: The Property Tank is $15 per month for 5 properties. Additional properties can be added for $3 each.

2. PropertyMe: All-in-One Property Management

PropertyMe continues to be a good choice for property management in Australia, particularly for those managing multiple properties. Its cloud-based platform offers a centralised dashboard where investors can manage everything from tenant communication to operational management with ease.

One of PropertyMe’s standout features is its automated workflows, which streamline processes like rent collection, maintenance tracking, and lease management. These automated systems reduce the manual workload for landlords and property managers, freeing up time to focus on growing the portfolio.

PropertyMe does offer integration with Xero, which is beneficial for syncing financial data and generating basic reports. While popular, Xero often falls short of delivering the specialised tools required for effective tax management and detailed financial oversight specific to property investments.

PropertyMe’s strengths lie in its property management features, but when it comes to tax optimisation and advanced financial reporting, relying solely on Xero could leave gaps in your financial strategy.

For those who need a solution to property management, PropertyMe’s extensive features and user-friendly interface make it a contender among property portfolio apps.

Pricing: The Basic plan starts at $242 per month billed by 100-property increments.

3. Re-Leased: The Professional’s Choice for Commercial and Residential Portfolios

Re-Leased is a game-changer for investors who manage both residential and commercial properties. Designed with professional property managers in mind, Re-Leased offers a powerful platform that can handle the complexities of mixed portfolios.

The app’s lease management tools are particularly impressive, providing detailed tracking of lease terms, renewals, and compliance requirements. This ensures that you never miss a critical date or task, which is crucial for maintaining strong tenant relationships and avoiding costly legal issues.

Re-Leased also excels in financial management, offering detailed reporting tools that allow you to track income, expenses, and cash flow across your entire portfolio. The app’s cloud-based nature means you can access your data from anywhere, making it easy to stay on top of your properties no matter where you are.

With its focus on both residential and commercial properties, Re-Leased is ideal for investors with diverse portfolios who need a comprehensive management solution. This makes it one of the leading property portfolio apps for mixed-use investments.

Pricing: Plans start from $333 per month for businesses below 25 tenancies.

4. PropertyTree: Simplified Residential Property Management

For those focused solely on residential property, PropertyTree offers a streamlined and efficient management experience. It’s designed to be intuitive, making it an excellent choice for individual landlords or smaller property management firms.

PropertyTree’s automated communication features ensure that tenants are kept informed about rent due dates, maintenance issues, and lease renewals. This reduces the time and effort required to manage tenant relationships and helps maintain high occupancy rates.

The app also provides robust financial tracking tools, allowing you to monitor rental income, expenses, and cash flow with ease. With its comprehensive reporting capabilities, PropertyTree makes it simple to prepare for tax time and keep your finances in order throughout the year.

For residential landlords looking for a focused and user-friendly property portfolio app, PropertyTree is a reliable option that covers all the bases.

Pricing: From $126 per month (excluding GST).

5. Managed App: The Modern Way to Manage Property

Managed App is one of the newer entrants in the Australian property management scene, but it’s quickly gaining popularity thanks to its innovative approach to property management and rent collection. This app is particularly appealing to tech-savvy investors who want a modern, streamlined experience.

One of Managed App’s standout features is its real-time payment system, which allows for instant rent payments and disbursements. This reduces the waiting time for funds and provides greater financial flexibility for landlords. The app also offers comprehensive tenant management features, including digital lease signing, maintenance requests, and communication tools, all housed within a sleek, user-friendly interface.

Managed App’s focus on automation and efficiency makes it an attractive choice for investors looking to reduce the manual tasks associated with property management. Its innovative features and ease of use make it a strong contender in the property portfolio app space.

Pricing: Free to use for owners. Agencies and Property Managers pay a minimum of $165 per month.

Conclusion: Choosing the Best Property Portfolio App

In today’s fast-paced property market, having the right tools at your disposal is essential for maximising returns and staying ahead of the curve. Whether you’re looking to optimise your tax strategy with TaxTank, streamline your operations with PropertyMe, or take advantage of cutting-edge technology with Managed App, the options available today are better than ever.

However, if you’re serious about taking control of your financial future and ensuring that your property investments are managed efficiently and effectively, TaxTank is the clear choice. With its focus on tax optimisation, real-time financial insights, and comprehensive reporting, TaxTank offers everything you need to stay ahead in the property game.

Ready to maximise your returns and simplify your property management? Sign up for TaxTank today and experience the ultimate property portfolio app designed for Australian investors.