Navigating the complexities of tax obligations can be challenging for sole traders in Australia. With numerous tax apps on the market, finding the best one that suits your needs is crucial. In this article, we’ll explore the top tax app for sole traders.

Why sole traders need a tax app

As a sole trader, managing your finances efficiently is essential. A tax app can simplify the process by:

Tracking expenses and income: Automatically categorise transactions to ensure you never miss a deductible expense.

Generating reports: Create detailed financial reports that make filing your tax return straightforward.

Staying compliant: Ensure you meet all ATO requirements and avoid costly penalties.

The features that matter

When choosing a tax app for sole traders, consider the following features:

Ease of Use: The app should be intuitive and user-friendly.

Expense Tracking: Automated categorisation of expenses and the ability to manually add transactions.

Income Management: Track your income sources and see your financial health at a glance.

ATO Compliance: Ensure the app keeps you compliant with Australian tax laws.

TaxTank: The ultimate Tax App for sole traders

User-Friendly Interface

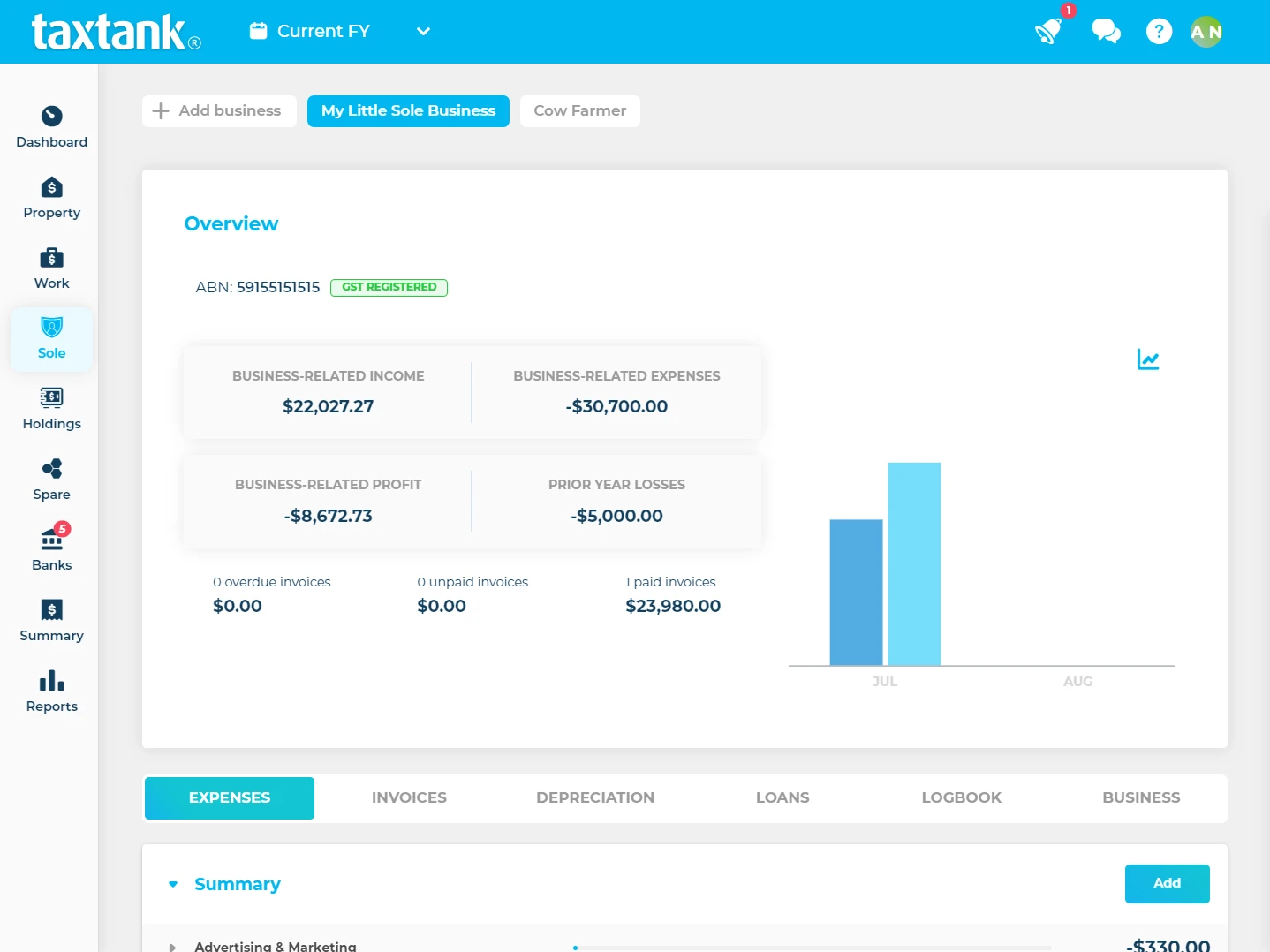

TaxTank offers an intuitive and easy-to-navigate interface, making it accessible even for those who are not tech-savvy. The dashboard provides a clear overview of your financial situation, with quick access to all essential features.

Comprehensive Expense Tracking

One of TaxTank’s standout features is its automated expense tracking. With TaxTank you can connect your bank accounts through Open Banking, and set up automated rules to allocate your transactions as they come in – saving time so you can focus on what really matters. You can also attach receipts, ensuring you never miss a deduction.

Income Management and Invoicing

TaxTank allows you to manage multiple income streams effortlessly. Create and send invoices, track payments, and get an overview of your earnings all from the one app. This feature is especially useful for sole traders with side hustles, as it lets you manage both sole trader and work income for a complete financial and tax summary.

ATO Compliance and Lodgement

Stay compliant with ATO regulations using TaxTank’s comprehensive tools. The app generates all necessary reports and ensures you meet your tax obligations. Additionally, TaxTank produces a MyTax report for easy self-lodging of your tax return. With vehicle logbooks and tracking for home office claims, TaxTank covers all aspects of managing your sole trader finances efficiently.

Affordable Pricing

Starting at just $9 per month for the Sole Trader functionality, TaxTank is an affordable tax app for sole traders. This pricing structure makes it accessible for everybody ensuring you get excellent value for money.

Other Top Tax Apps for Sole Traders

While TaxTank is the top recommendation, several other apps also provide valuable features for sole traders. Here’s a look at some alternatives:

Hnry

Cost – 1% + GST of total income or maximum of $1,500+GST a year

Hnry provides a unique approach to tax management by offering an app for uploading receipts and sending invoices, along with automated tax calculations and payments managed by their in house accountants. Their service includes expense management and tax return lodgement on your behalf, as well as communication with the ATO if needed. However, using Hnry requires opening a Hnry trust account for all business payments and manually logging other incomes and expenses to upload into the system.

QuickBooks Online

Cost – starts from $29 per month

QuickBooks Online is a basic platform for financial management, suitable for sole traders and small businesses. It offers a user-friendly interface, basic reporting features, and integrates with various third-party platforms. With QuickBooks Online, you can track income and expenses, create invoices, and manage cash flow. Additionally, it includes a mobile app for on-the-go management.

Rounded

Cost – starts from $19.95 per month

Rounded is an accounting software focused on customer service, offering an easy-to-use interface and strong invoicing capabilities. It includes time-tracking tools for billable hours and allows users to create professional invoices, track expenses, and manage cash flow.

Xero

Cost – starts from $35 per month

Xero is a straightforward accounting software option for sole traders, providing similar functionality to QuickBooks Online. It integrates with digital banking, allowing for convenient business operations. The mobile app makes financial management easy from anywhere, and it includes features for invoicing, expense tracking, and cash flow management.

Choosing the Right Tax App for Sole Trader Needs

When selecting a tax app, consider your specific business needs and budget. Here are some factors to keep in mind:

Budget: Determine how much you are willing to spend on a tax app. Free options like Wave can be a good starting point for those with limited funds.

Features: Identify the features that are most important to you, such as automated expense tracking, invoicing, or ATO compliance.

User Reviews: Check user reviews to see how others have rated the app’s performance and customer support.

Conclusion

Finding the right tax app for sole traders in Australia is essential for efficient financial management and compliance with tax regulations. While there are many options available, TaxTank stands out as the best choice due to its user-friendly interface, comprehensive features, and affordable pricing. By using TaxTank, you can simplify your tax obligations and focus on growing your sole trader business. Try TaxTank for free for 14 days.