Managing rental properties in Australia can be an overwhelming task, especially when it comes to keeping track of income, expenses, and tax obligations. That’s where rental property accounting software comes into play. Among the many available options, TaxTank stands out as the most innovative and user-friendly choice for individual Australian taxpayers looking to streamline their property portfolio management and optimise their tax strategy.

Unlike other platforms, TaxTank offers an all-in-one solution specifically designed for Australians, ensuring that both rental property investors get real-time insights into their tax position throughout the year. No more year-end surprises or confusing spreadsheets—TaxTank makes rental property accounting and tax compliance effortless. Let’s dive into what makes TaxTank the best rental property accounting software for Australian investors.

Why Investors Need Smart Rental Property Accounting Software

Investment properties are an excellent way to generate passive income, but managing them often comes with financial complexities. From recording rental income to tracking expenses and depreciation, property investors must navigate a maze of financial obligations. Manual bookkeeping and traditional spreadsheets can be error-prone, leaving landlords exposed to costly mistakes.

With the Australian Tax Office (ATO) scrutinising rental income more than ever, there’s a growing demand for tools that not only simplify tax compliance but also ensure accurate reporting. TaxTank meets this need by providing powerful automation features, allowing users to focus on growing their portfolios without getting bogged down in paperwork.

TaxTank: Built for Australian Taxpayers

One of the standout features of TaxTank is that it’s tailored to Australian tax laws. TaxTank consolidates over 6,000 pages of Australian tax legislation into a simple, user-friendly platform. This means no more flipping through complex tax documents or trying to interpret ambiguous tax rulings. With TaxTank, you get automatic calculations for capital gains tax (CGT), depreciation, and property-related expenses—everything you need to stay on top of your tax obligations.

This tailored approach is especially beneficial for Australian landlords, as the software is updated in real-time to reflect ATO changes. Unlike generic global platforms, TaxTank ensures that Australian property investors are always compliant with the latest regulations, giving peace of mind and the best financial outcomes.

Real-Time Tax Position: A Game Changer for Investors

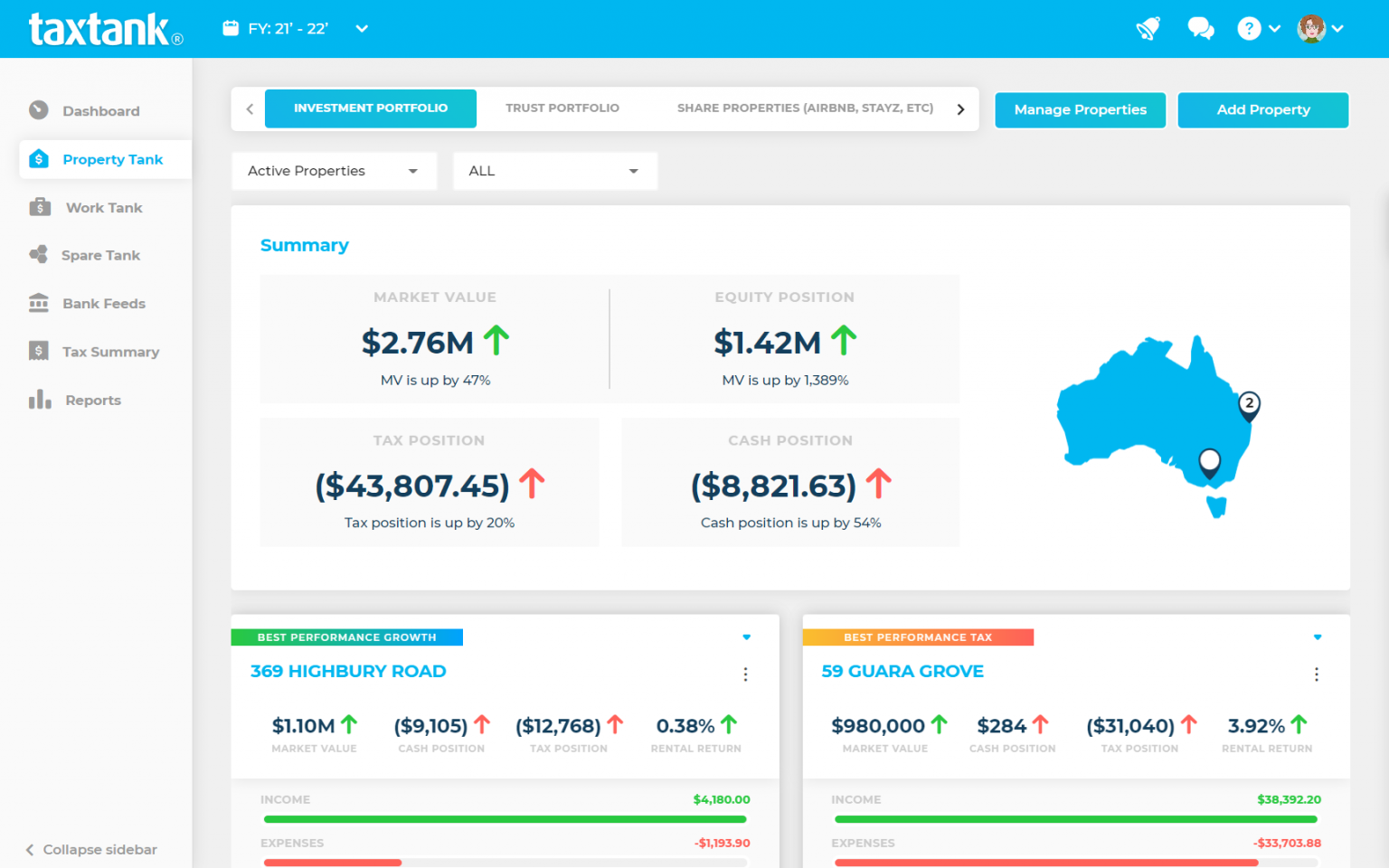

Perhaps the most unique feature of TaxTank is its ability to provide real-time tax calculations. Many property investors dread the end of the financial year when they finally confront their tax liabilities, often leading to unpleasant surprises. With TaxTank, users get real-time updates on their tax obligations throughout the year. This level of transparency ensures that investors can make informed decisions about their portfolios with up-to-the-minute tax insights.

TaxTank’s live tax calculator allows users to see their potential refunds or tax debts immediately after inputting their data. Whether you own one rental property or an entire portfolio, this feature eliminates guesswork and empowers users to make better financial decisions throughout the year.

Comprehensive Expense Management: No Detail Left Behind

Managing rental property expenses is crucial to maximising your returns. Unfortunately, many property investors miss out on valuable tax deductions due to poor record-keeping or confusion about what’s deductible. TaxTank eliminates these problems by offering a detailed and comprehensive expense management tool.

The platform lets you automatically track and categorise all your property-related expenses, from repairs and maintenance to insurance and property management fees. What sets TaxTank apart from other software is its ability to integrate with your bank accounts through Open Banking, ensuring that no expense goes unaccounted for. With just a few clicks, you can log and categorise all your expenses, ensuring you claim every deduction you’re entitled to.

Depreciation Schedules and Capital Gains Tax Calculations

Depreciation is one of the most overlooked aspects of property ownership, yet it can provide substantial tax savings. TaxTank has built-in features that automatically calculate and apply depreciation schedules for your rental properties. By accurately tracking the decline in value of your property’s assets—like appliances, fixtures, and fittings—you can significantly reduce your taxable income.

When it comes time to sell a property, calculating capital gains tax (CGT) can be incredibly complex. TaxTank simplifies this process by automatically generating CGT reports, ensuring that you don’t overpay or underpay your tax obligations when selling a property. This level of accuracy is a must for property investors who want to maximise their returns while staying compliant with Australian tax laws.

Seamless Integration with Financial Institutions

TaxTank understands that time is money, which is why it offers seamless integration with major Australian banks and financial institutions through Open Banking. This allows for automatic syncing of income and expenses, ensuring your data is always up to date. Instead of manually inputting transactions, TaxTank pulls in your financial data and updates your tax position in real-time.

This integration also makes it easier to reconcile your bank statements with your rental income and property expenses, offering a holistic view of your financial health. By automating these tedious tasks, TaxTank frees up time for property investors to focus on growing their investments.

A User-Friendly Interface That Anyone Can Use

One of the biggest challenges property investors face with rental property accounting software is usability. Many platforms are designed with accountants in mind, making them difficult for the average property owner to navigate. TaxTank eliminates this hurdle with an intuitive, user-friendly interface that requires no prior accounting knowledge.

From the moment you log in, it’s clear that TaxTank was built for ease of use. The dashboard provides a clear overview of your financial position, tax obligations, and property portfolio overview.

Why TaxTank is the Best Rental Property Accounting Software in Australia

With its robust feature set and user-friendly design, TaxTank has earned its place as the top choice for rental property accounting software in Australia. Unlike other platforms, TaxTank is built with Australian property investors in mind, offering a level of customisation and functionality that other software simply can’t match. From real-time tax calculations to seamless expense tracking, depreciation schedules, and capital gains tax reporting, TaxTank offers everything property investors need to stay compliant and maximise their returns.

If you’re looking for a smarter, simpler way to manage your rental properties and optimise your tax strategy, TaxTank is the best rental property accounting software solution available on the Australian market. Don’t waste time with outdated software or generic platforms. Start with a 14 day free trial of TaxTank and take control of your property tax with confidence.