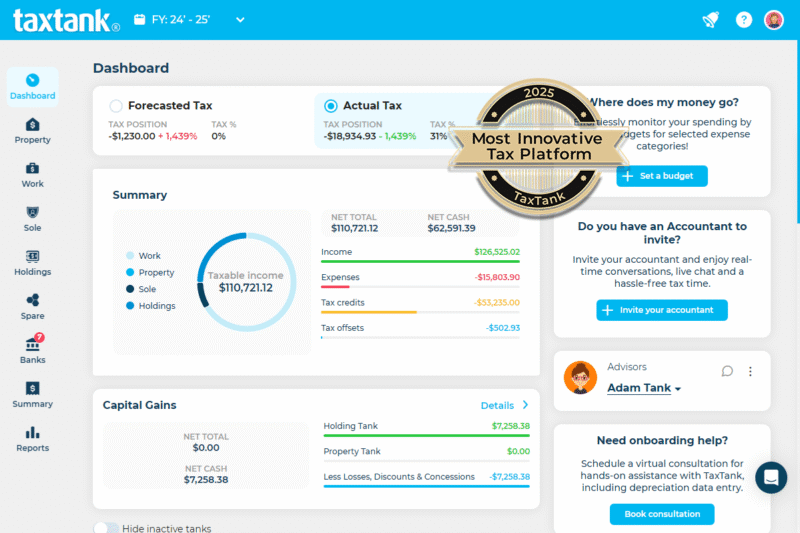

We’re excited to announce that TaxTank has been named The Most Innovative Tax Platform 2025 by WeMoney. It’s recognition we’re proud of because it confirms what our customers already know: TaxTank is changing the way Australians manage their personal tax.

Why personal tax needed a platform built for individuals

Tax software has long been built for accountants and businesses, while individuals were left with few tools beyond spreadsheets, manual record-keeping, once-a-year lodgement or trying to make it fit with business tax tools. Personal tax was treated as an afterthought.

TaxTank flipped that model on its head. We created Australia’s first personal tax platform built purely for individuals. Our mission is to make tax transparent, accurate, and stress-free all year round, not just at tax time.

What makes TaxTank the most innovative personal tax platform

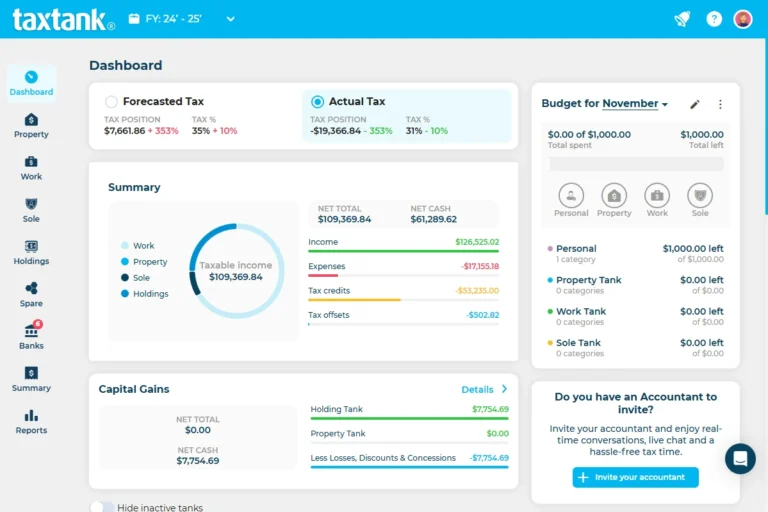

TaxTank combines smart automation with real-time visibility, helping Australians take control of their finances in ways no other software does.

General Tax Tools in our Personal Tax Platform

- Know exactly how much tax you owe, live all year round

- Track your net worth with live tax and equity forecasts

- Connect bank accounts with live feeds for real-time visibility

- Track your HECS/HELP balance and repayments as part of your live tax position

- Plan smarter with a simple monthly budget tool

- Automate recurring transactions with custom rules

- Access a full suite of live tax reports anytime

- Store receipts and documents securely in the Spare Tank

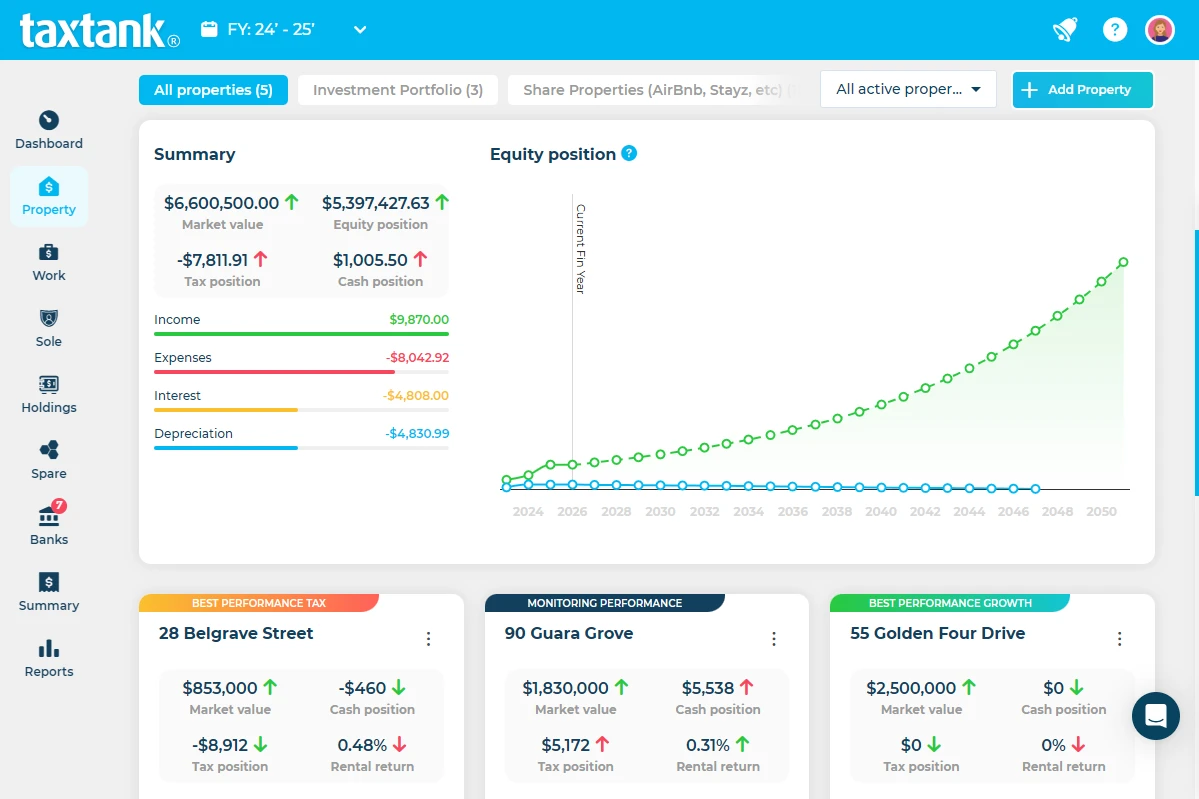

Personal Tax Platform Features for Property Investors

- Manage all properties in one place, regardless of ownership structure

- Track rental income, expenses, tax, and cash flow in real time

- Monitor performance, including capital growth, yields, and LVR

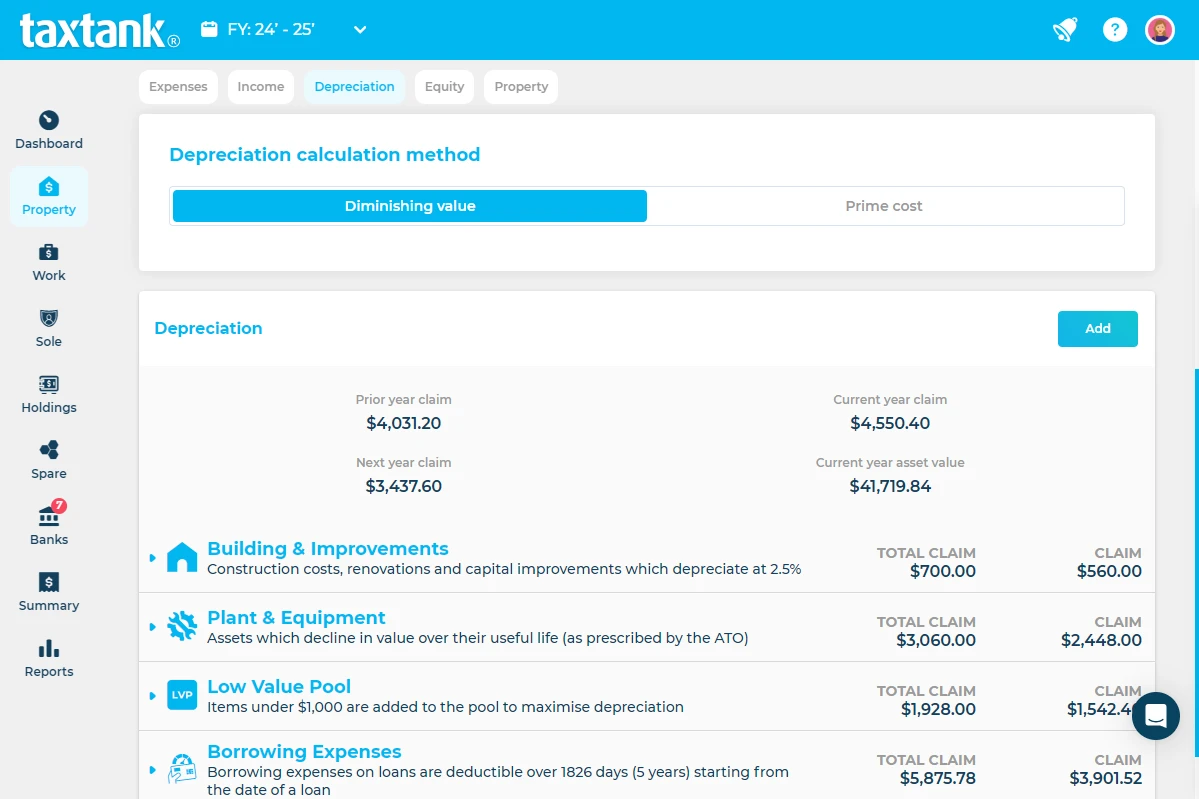

- Maximise claims with automated depreciation

- Create DIY projects for improvements and renovations

- Automate borrowing expenses for loans and refinancing

- Handle shared ownership claims, including Airbnb and room rentals

- Use a real-time CGT calculator to see the impact of selling

- Get live property values powered by CoreLogic

- Calculate borrowing power with the interactive Net Surplus Ratio report

- Instantly generate property tax reports for your accountant

- Store all property records in a dedicated Spare Tank folder

Personal Tax Platform Tools for Shares & Crypto

- Track shares, crypto, and unlisted assets in one place

- Automatically calculate CGT and carry forward capital losses

- Manage dividends, staking, and interest income

- Create custom tickers for unlisted investments

- Access live CGT reports anytime

- Connect with Sharesight to sync trade history seamlessly

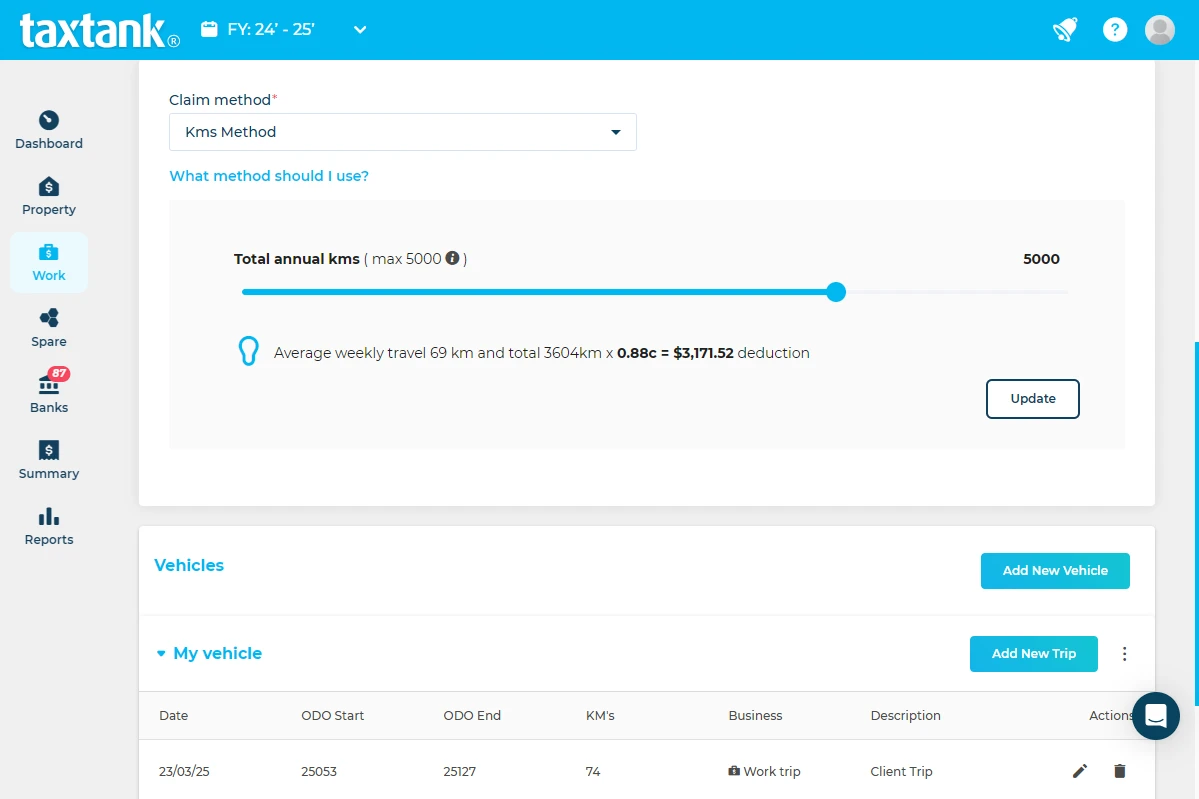

Work Tank: Managing Income & Expenses in One Personal Tax Platform

- See live tax calculations for wages, allowances, and adjustments

- Track trust distributions, partnership income, government payments, and more

- Allocate work-related expenses from live bank feeds

- Keep a compliant home office diary and vehicle logbook

- Manage work-related assets with automated depreciation

- Track vehicle loans and amortisation schedules

- Store all work-related receipts securely in the Spare Tank

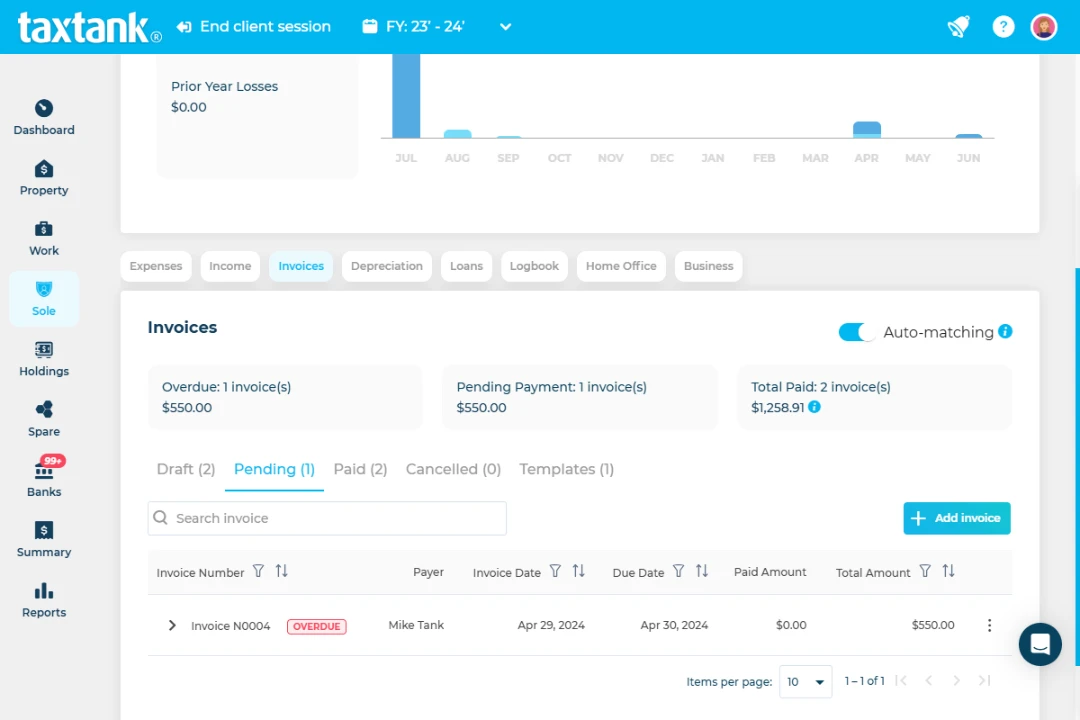

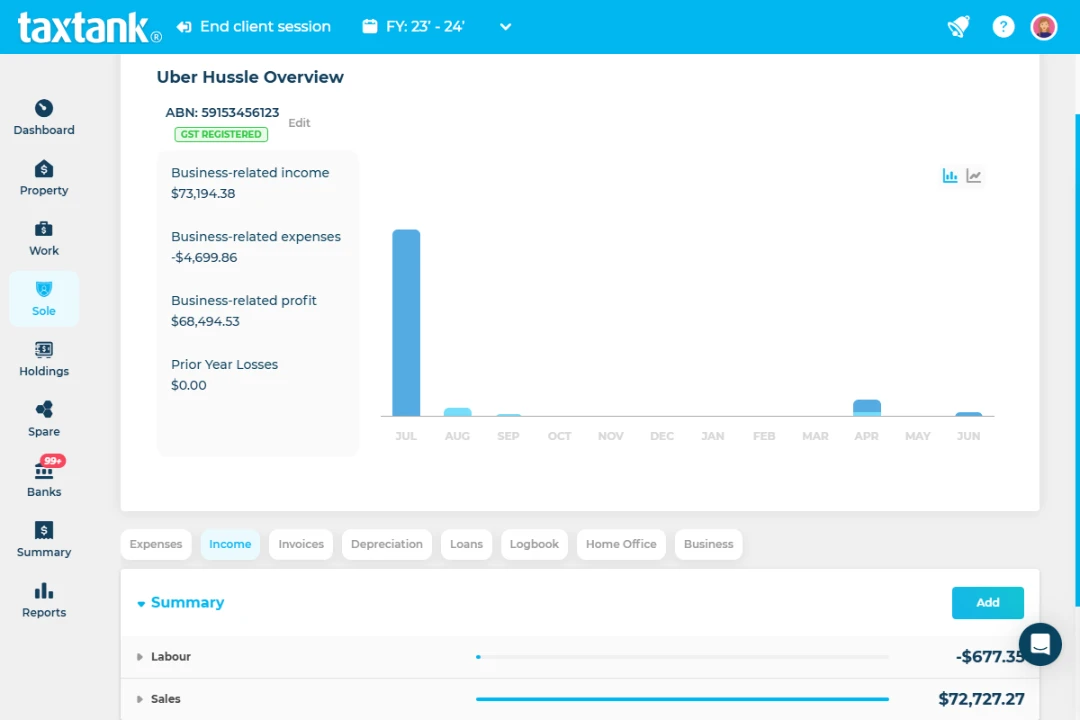

Sole Tank: The Personal Tax Platform for Sole Traders

- Manage multiple sole trader businesses under one subscription

- Create and send professional invoices instantly

- Track PSI income, labour hire, and business expenses

- Use automated depreciation and instant asset write-offs

- Manage home office and vehicle expenses with compliant diaries

- Track vehicle loans with amortisation schedules

- Use the non-commercial loss calculator to see if losses offset income

- Access live BAS reporting to handle GST and ATO lodgements

- View real-time business schedules and reports for easy tax prep

- Store all sole trader documents securely in the Spare Tank

Tax Preparation & Support with the Personal Tax Platform

- Access interactive tax reports all year round

- Invite your accountant or advisor anytime for collaboration

- Lodge faster with clean, complete records

- Use the myTax report to self-lodge with confidence

Why TaxTank Won Most Innovative Tax Platform 2025

TaxTank is the only personal tax platform in Australia. While others focus on accountants or businesses, we have built a platform dedicated to individuals, giving everyday Australians the tools, insights, and confidence to manage their tax all year round.

Innovation is about more than features. It is about solving problems others have ignored and making complex systems accessible to everyone. That is exactly what TaxTank does for personal tax.

Looking ahead

Winning this award is a milestone, but it is also just the beginning. We will continue building on our innovation with new integrations, smarter automation, and even more ways to simplify tax for Australians.

Most importantly, we will keep putting control back in your hands, because tax should work for people, not the other way around.

Ready to experience award-winning innovation?

Being named The Most Innovative Tax Platform 2025 is just the beginning. TaxTank is built to make managing personal tax easier, smarter, and more transparent for every Australian.

Start your free trial today and see why TaxTank is the personal tax platform that changes the way you do tax for good.