Managing personal money management in Australia has never been more important. With rising living costs, shifting tax rules and increasingly complex financial lives, Australians need a tool that provides clarity, control and actionable insights. TaxTank delivers this by combining real-time tax guidance, automated tracking, budgeting, savings planning and everyday money management features, all in one place.

A Complete View of Your Finances

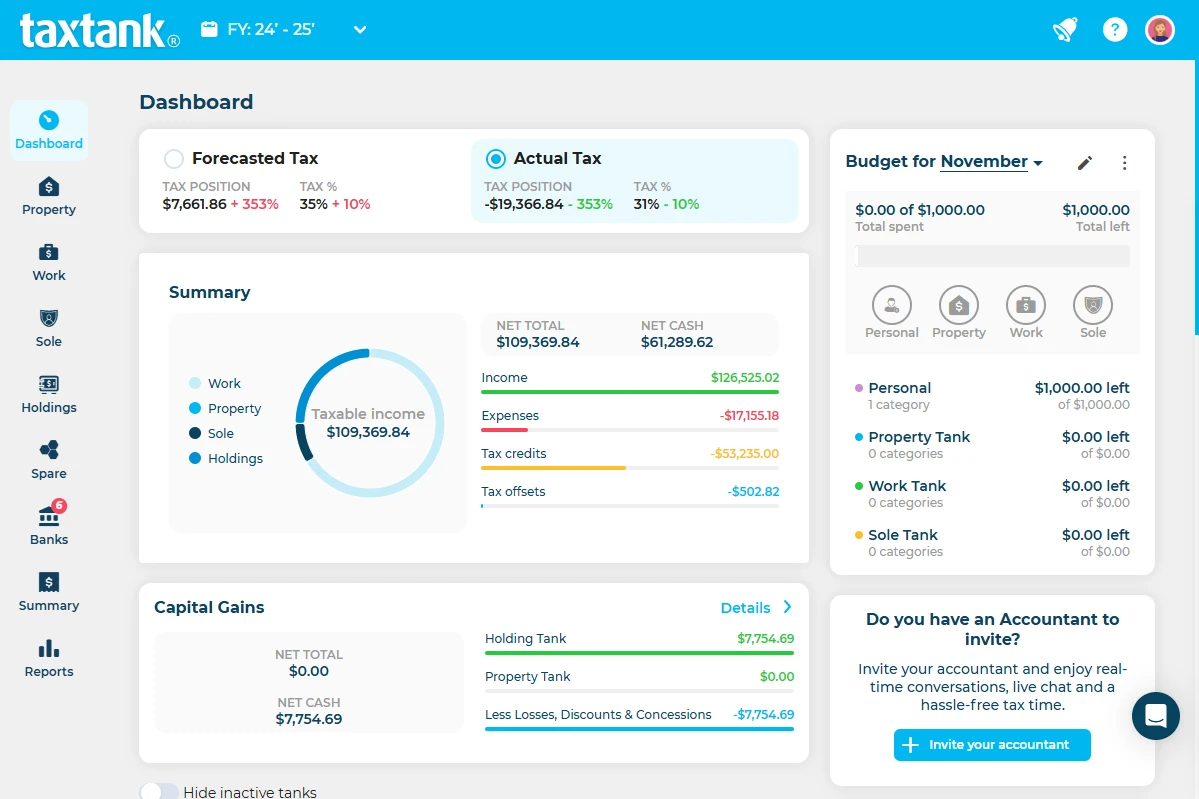

Most money apps show only spending or account balances. TaxTank gives you a full picture of your finances, linking accounts, categorising transactions and tracking both income and expenses in real time.

You can see daily spending, weekly trends and monthly patterns, giving you insight into where your money goes and how it aligns with your goals. Whether it’s everyday budgeting, tracking bills, or planning for bigger expenses, TaxTank helps you make informed decisions across your financial life.

Automated Tracking for Smarter Money Management

Automation is key to strong personal money management. TaxTank connects to your bank accounts securely, bringing in transactions automatically. It uses the rules you create to catch recurring payments, tidy up your transactions, and sort everything into the right categories.

This means:

- Spending is tracked automatically

- Personal and work-related expenses are separated clearly

- Overspending alerts and cash flow insights are available in real time

With less time spent on admin, you can focus on making smarter financial decisions and staying on top of your money.

Budgeting, Savings and Planning Made Simple

Budgeting is more effective when it’s connected to your real spending habits. TaxTank makes this simple by providing:

- Flexible budgets that reflect your income and expenses

- Savings goal tracking for holidays, home deposits or emergency funds

- Cash flow forecasts so you know what to expect in coming weeks or months

By combining everyday spending with forward planning, you can confidently manage your money without guesswork or stress.

Integrated Tax and Investment Insights

Unlike typical budgeting apps, TaxTank incorporates Australian tax rules directly into your financial overview. It automatically tracks deductions, updates tax estimates in real time, and provides clear reporting at the end of the financial year.

For Australians with investment properties, shares or crypto, TaxTank also allows:

- Tracking of rental income, loans, and property expenses

- Automatic monitoring of share and crypto portfolios

- Calculation of capital gains and performance metrics

This integration ensures that your everyday spending, savings and investments all contribute to a clear view of your financial position.

Understand Your Spending and Build Better Habits

Spending insights are central to effective personal money management. TaxTank breaks down your spending by category, tracks trends over time, and identifies areas for potential savings.

You can spot unnecessary subscriptions, recurring costs or habits that drain your budget, giving you the tools to make smarter decisions. Over time, these insights help you create healthier financial habits and achieve your goals faster.

Forward Planning for Financial Confidence

Strong money management isn’t just about tracking what has already happened. TaxTank lets you plan for the future with tools to:

- Forecast cash flow and upcoming bills

- Estimate tax obligations throughout the year

- Set, monitor and adjust savings goals

- Track progress on long-term investments or property

By seeing your money in context, you can make proactive choices rather than reactive ones, reducing stress and improving financial outcomes.

Secure, Australian-Based Platform

All of your financial data is stored securely in Australia, using encrypted open banking connections. TaxTank gives you full control over who can see your data, ensuring your information is protected while remaining accessible and actionable.

Why TaxTank Leads in Personal Money Management

Australians need more than a simple budgeting app. TaxTank stands out by combining:

- Real-time tax insights

- Automatic bank feeds and transaction categorisation

- Budgeting, cash flow and savings tools

- Investment and property tracking

- Forward-looking financial planning

- Australian-based security and compliance

The combination of everyday money management with tax visibility and financial planning makes TaxTank a complete solution for personal money management.

A Smarter Way to Manage Money in Australia

Personal money management is about clarity, confidence and control. TaxTank provides a seamless, integrated platform where spending, savings, investments and tax are all tracked and understood in real time.

For Australians who want to stay on top of their finances without juggling multiple apps, TaxTank offers a modern, practical and intelligent way to manage money every day.

With TaxTank, your money works smarter, your goals stay on track, and you can make decisions with confidence all year round.

Take Control of Your Finances Today

Ready to make managing your money simple and stress-free? Sign up for TaxTank today and experience the best app for personal money management in Australia. Track your spending, plan your savings, monitor your investments, and get real-time tax insights—all in one place. Take the first step towards smarter financial decisions and peace of mind today.

FAQs – The Best Personal Money Management App in Australia

Q: What makes TaxTank the best personal money management app in Australia?

A: TaxTank offers real-time spending tracking, budgeting, savings goal monitoring, tax insights, and investment management—all tailored to Australian financial rules. It gives a complete picture of your money in one easy-to-use platform.

Q: How does TaxTank simplify personal money management for Australians?

A: TaxTank automatically imports transactions, categorises spending, tracks deductions, forecasts cash flow, and provides alerts. This reduces admin and helps you make smarter financial decisions.

Q: Can I track both personal and business finances in TaxTank?

A: Yes. TaxTank allows you to track both personal and business accounts, making it ideal for employees, sole traders, contractors, or anyone juggling multiple income streams.

Q: Does TaxTank work with Australian banks?

A: Absolutely. TaxTank connects via secure Open Banking to all major Australian banks, ensuring your transactions flow in automatically for accurate personal money management.

Q: Can I manage investments like property, shares, or crypto with TaxTank?

A: Yes. You can track property income, loan interest, depreciation, share and crypto trades, and calculate capital gains – all integrated with your budgeting and spending.

Q: How does TaxTank help with Australian tax?

A: TaxTank tracks income, expenses, and deductions throughout the year. It provides live tax estimates and prepares summaries for easier tax lodgement, helping you avoid surprises.

Q: Can I set budgets and savings goals in TaxTank?

A: Definitely. You can create flexible budgets, track your spending patterns, set personal or household savings targets, and receive notifications to help you stay on track.

Q: Can I forecast my cash flow and plan ahead?

A: Yes. TaxTank allows you to forecast income, bills, tax obligations, and future expenses so you can plan ahead and make confident financial decisions.

Q: Is TaxTank suitable for property investors?

A: Absolutely. TaxTank helps investors track rental income, expenses, property values, and loan interest. All data integrates with your overall personal money management dashboard.

Q: Can I access TaxTank on both mobile and desktop?

A: Yes. TaxTank is fully responsive, allowing you to manage finances anywhere, anytime, from desktop, tablet, or mobile.

Q: How does TaxTank help reduce financial stress?

A: By giving you a clear, real-time view of your spending, savings, investments, and tax position, TaxTank removes uncertainty and helps you make informed decisions without juggling multiple apps or spreadsheets.

Q: How do I get started with TaxTank?

A: Simply sign up for your 14 day free trial, connect your accounts via secure open banking, and start tracking your finances. TaxTank guides you step by step to set budgets, savings goals, and monitor your personal money management efficiently.