TaxTank and Sharesight

The integration that puts investors in control!

For years, property investors have been left behind, forced to rely on spreadsheets, manual tax calculations, and software never intended for them, while share traders enjoyed automated tracking and real-time insights. As the ATO ramps up real-time data matching, the gap has widened, leaving property investors scrambling to stay ahead of unexpected tax bills and missing out on valuable deductions.

That’s why we’re excited to share the new TaxTank and Sharesight integration that brings real-time tax automation and world-class investment tracking under one roof. Together, we’re eliminating tedious manual tasks, centralising your entire portfolio, and putting you in control of your tax position year-round.

Why we chose Sharesight

Tax and investment data can’t remain in silos if investors are to make informed, proactive decisions. We chose Sharesight because it has revolutionised investment tracking for share investors, providing seamless aggregation of multiple portfolios, automatic dividend tracking, and comprehensive performance reporting, capabilities that property investors have been sorely missing – until now.

By integrating with Sharesight, TaxTank can finally extend the same level of automation and clarity to property portfolios, ensuring that no asset class is left behind. Investors benefit from:

- A truly integrated experience that unites property with other investment categories.

- Real-time tax insights that provide up-to-date information on CGT, deductions, and cash flow.

- A forward-thinking approach that focuses on keeping you ahead of the ATO—not reacting when it’s too late.

This partnership isn’t just about filling a gap, it’s about shaping the future of tax and investment management so every investor, whether holding shares, ETFs, crypto, or property, can grow their wealth with confidence and clarity.

How TaxTank and Sharesight work together

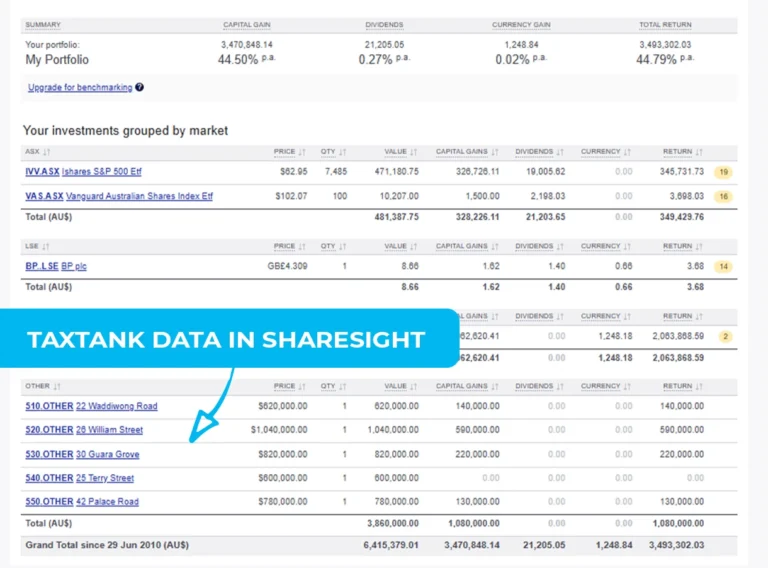

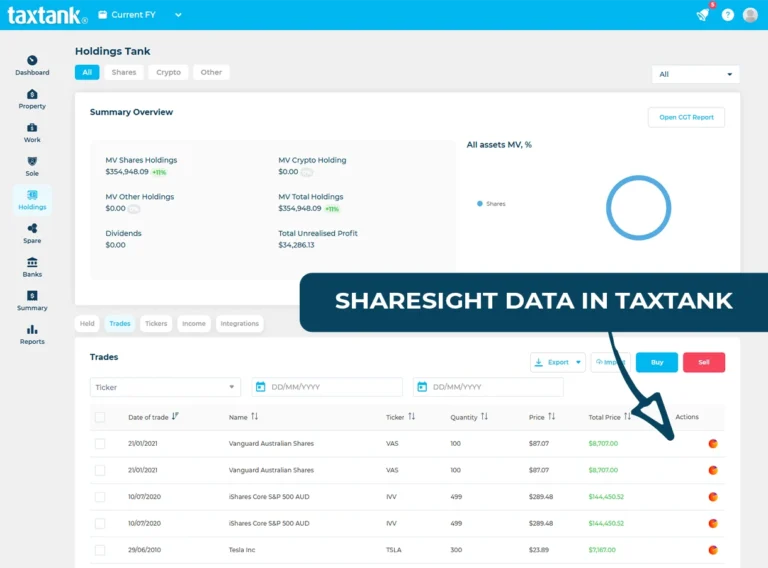

Sharesight is the go-to share portfolio tracker, but property tax tracking has always been a manual headache. The TaxTank and Sharesight integration bridges the gap, offering investors a fully automated, tax-savvy investment management solution.

- No manual data entry: Automatically create properties as custom investments in Sharesight.

- Real-time portfolio insights: Track rental income, market values, and CGT positions alongside your shares.

- Complete investment performance: View all asset classes in one place for a full financial picture.

- Automated CGT tracking: Seamlessly calculate CGT across property, shares, ETFs, and crypto.

- Live tax insights: Always know where you stand with real-time tax visibility across all investment classes.

- Year-round tax reporting: Save time and money with effortless, ATO-ready reports.

- Automated investment & tax reporting: eliminate spreadsheets with real-time data syncing.

- Live tax position tracking: gain daily insights into CGT, deductions, and cash flow for proactive planning.

- Easy advisor collaboration: share up-to-date figures with accountants for smarter, data-driven decisions.

Why investors should connect TaxTank and Sharesight

This isn’t just another integration, it’s a game-changer for investors managing diverse portfolios.

One Dashboard for Everything

Forget juggling multiple platforms. Now, property, shares, ETFs, crypto, and sole trader income are tracked in one seamless dashboard, providing a live view of tax and investment performance year-round.

Tax Planning, Not Just Tax Lodging

The ATO is watching in real time – shouldn’t you be? Instead of waiting until tax time, TaxTank + Sharesight let you monitor your tax position daily, so you can plan proactively, maximise deductions, and avoid tax-time surprises.

Built for Property Investors - Not Businesses!

Business accounting software was never designed for property portfolios. TaxTank automates negative gearing, borrowing expenses, depreciation schedules, LVR tracking, and real-time CGT calculations to give individuals, property owners and investors the tools they need.

Smarter CGT Tracking That Actually Works for Property

Most platforms stop at simple CGT calculations. TaxTank takes it further, automating 6,000 pages of tax legislation, automatically applying grandfathering provisions, cost base adjustments, and CGT concessions based on property usage, ownership structure, and tax legislation.

Easy, Year-Round Advisor Collaboration

ATO-Ready Compliance Without the Stress

With automated transaction syncing, built-in tax law tracking, and audit protection, investors can confidently manage tax compliance and minimize risks without endless paperwork.

Take control of your investment portfolio with TaxTank and Sharesight. Sign up for TaxTank today and streamline your investments by effortlessly tracking your property and share portfolios in one place.

How to connect TaxTank and Sharesight

Integrating Sharesight with TaxTank is quick and easy, bringing together your share portfolio and property investment data in one powerful platform. With just a few simple steps, you’ll be able to track both asset classes, gain real-time tax insights and manage your investments with seamless automation. Watch this video to see how easy it is to connect your accounts and start simplifying your tax and investment management today!

What our customers say

Don’t just take our word for it.

See what our customers have to say about TaxTank.

It's literally about 10 minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”