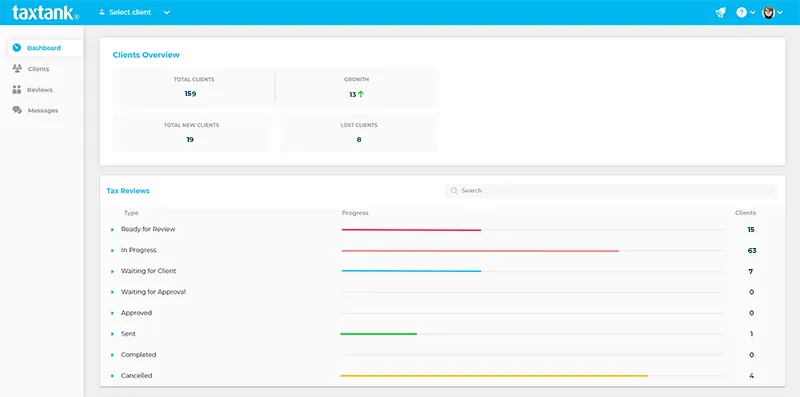

Powerful software to gain instant access to real-time client information

Say goodbye to spreadsheets, shoe boxes of receipts, and endless emails managing individual clients’ tax positions throughout the year. Embrace a revolutionary approach to client collaboration, optimising firm efficiencies, and delivering hassle-free tax time with unparalleled peace of mind. And the best part? It’s completely FREE for firms.

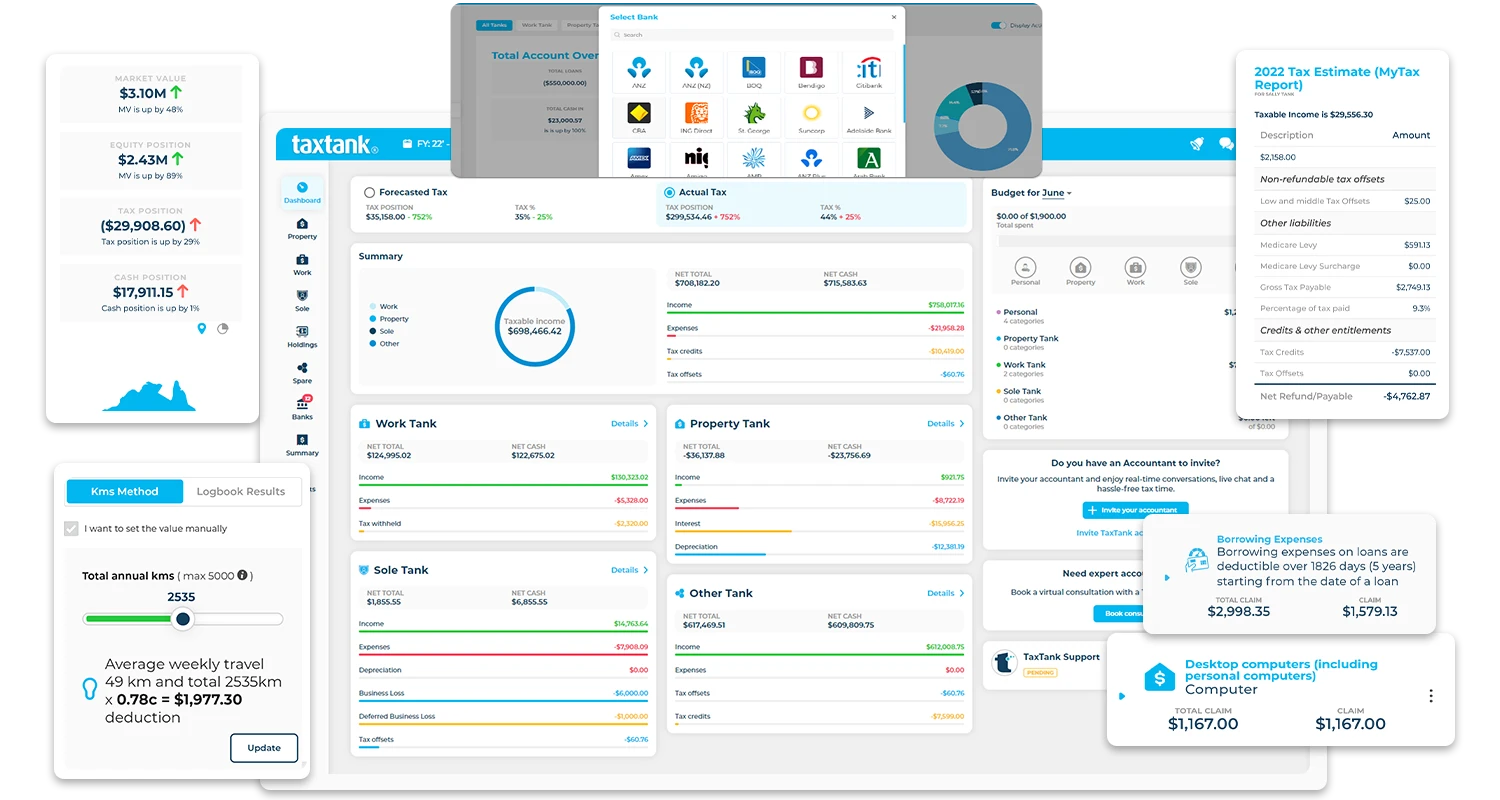

Smart tax tools for maximising deductions and ensuring ATO compliance

No more manual calculations or worrying about missed deductions! TaxTank offers live bank feeds, permanent document storage, auto calculators, and smart tax tools to ensure your clients gain complete oversight of their investments and maximise deductions whilst improving data integrity. You can rest easy knowing that your clients are protected from ATO scrutiny and unnecessary audit adjustments year after year.

The benefits of using TaxTank

Access Real-Time Information

Collaborate with clients like never before to improve efficiency and fight back against ATO automation. Get instant access to live tax, cash & equity positions as well as property schedules, tax reports, including rental returns & LVR to do away with manual forms and cumbersome spreadsheets.

Offer Stand Out Service

Make your services an ongoing source of valuable information to retain and grow your individual client base. You can monitor your clients’ position throughout the year and easily give advice when needed to proactively help them plan and make better decisions for their financial future.

Build Confidence and Trust

Built by an accountant, and underpinned by Australian tax law, TaxTank automatically calculates your clients tax position in real-time. Better still, using live bank feeds to improve data integrity and streamline compliance, you can be confident your clients are accurately claiming every possible deduction.

A unified solution for all income types and asset classes

TaxTank is not just another software, it’s the all-in-one solution that seamlessly covers all income types and asset classes from just $6 per month.

From property investors to sole trader business schedules, work related expenses, shares and cryptocurrencies, TaxTank offers flexible subscriptions around all areas of the individual tax return.

No need to switch between multiple platforms or complicate your workflow. Our seamless integration allows you to handle all aspects of your clients tax efficiently.

How TaxTank works

There are multiple tanks that act like digital containers to organise the different incomes, expenses, properties and investments whilst securely storing receipts and documents year after year to protect against audit from the ATO.

When your clients allocate income and expense items, they’re managing their tax and you can see their adjusting tax position in real time.

Work Tank

Manage your clients’ work income and expenses, updated via live bank feeds. Keep receipts safe by attaching them to transactions, maximising tax deductions and safeguarding against audit issues.

Property Tank

Manage your clients’ property portfolios and use smart tax tools to ensure no opportunity is missed. Easily see each property’s debt, equity and cash position, and simply manage income from sites like Airbnb and Stayz.

Sole Tank

Manage your clients’ sole trader income seamlessly with auto invoicing, business reporting, including unpaid invoices, BAS, roll forward losses, & automated smart tools to let your clients know how much tax they’ll have to pay.

Holdings Tank

Manage your clients stocks, shares and cryptocurrencies so you can track their portfolio value in real time and calculate any Capital Gains or losses automatically. Plus our tax reports are free with no limits on the amount you track.

Spare Tank

Store documents securely in one place, including employment contracts, insurance policies and receipts. You can rest easy knowing your clients’ information is safe and quickly access documents when you need them.

How firms are using TaxTank to grow their services and transform client offerings

Discover how accountants and bookkeepers are incorporating TaxTank into their services to enhance client offerings, streamline tax processes, and create new revenue opportunities. From managing complex property portfolios to helping sole traders go digital, TaxTank has become the go-to solution for professionals looking to provide smarter, more efficient tax management. Explore the real-world case studies below to see how others are leveraging TaxTank to elevate their businesses and offer greater value to their clients.

Syncing business and personal finances

Meet Jane, the powerhouse behind multiple businesses with a side hustle in property investments and a budding share portfolio. Her accountant was stuck juggling business software, spreadsheets, and endless paperwork. Tax planning felt like a guessing game, and no one likes surprises – especially when it comes to tax time.

Solution

Enter TaxTank. While business software managed Jane's company finances, TaxTank stepped in to consolidate everything else - property investments, shares, and personal deductions - into one clear, streamlined platform. With real-time data feeds, Jane's accountant could finally see the full picture, effortlessly integrating personal and business finances. No more jumping between systems or last-minute scrambles. Tax planning transformed into a smooth, strategic process with live insights all year long.

Outcome

With everything in one place, Jane’s accountant turned chaos into calm. Tax planning was now powered by accurate, up-to-date data, uncovering missed deductions and saving hours of manual work. Jane was thrilled with the new-found clarity, and her smarter tax decisions meant more money back in her pocket. Win-win!

Boosting bookkeeping efficiency

Tim, a successful consultant with rental properties on the side, kept his accountant on high alert all year. His business was easy enough to manage, but property bookkeeping and tracking rental expenses were a different story. The accountant was stretched thin, and Tim wanted regular updates on his tax position throughout the year – not just at tax time.

Solution

TaxTank made life easier by consolidating everything- rental income, expenses, depreciation, and personal deductions - into one user-friendly platform. With TaxTank, Tim’s accountant could manage both business and personal finances side by side, and everything stayed on track year-round. No more lost receipts or last-minute tax panic - just real-time visibility across all accounts.

Outcome

Tim’s accountant turned what could’ve been a headache into a huge win, offering paid bookkeeping services and boosting revenue by 15% without extra strain. Clients like Tim were delighted with live tax updates, and tax season became a breeze. Thanks to TaxTank’s real-time insights, everyone came out on top.

Helping sole traders go digital

Sarah runs a small graphic design business, but her finances were a mess. Like many sole traders, she wasn’t keen on forking out over $600 a year for accounting software she didn’t need. Tax time meant scrambling through piles of paper receipts and last-minute stress.

Solution

Sarah’s accountant introduced her to TaxTank’s Sole Tank, designed specifically for sole traders. For just $9 a month, Sarah could digitise her receipts, track income and expenses, manage BAS, and get real-time tax updates. No unnecessary bells and whistles - just the features she needed, all in one affordable package.

Outcome

Sarah quickly adapted to Sole Tank and loved how easy it was to stay on top of things. Tax time became stress-free, and her accountant saved time while Sarah saved money. With Sole Tank, Sarah could focus on what she did best - growing her business - without worrying about her finances.

Simplifying property management

Paul, a property investor, was fed up with the rising costs of accounting software, especially after Xero’s latest price hike. Managing multiple properties across different structures was becoming both complicated and costly, and the business-focused software he was using wasn’t built for property portfolios.

Solution

That’s when Paul’s accountant introduced TaxTank’s Property Tank, designed specifically for property investors. For just $15 a month, Property Tank handled all his properties in any structure, streamlining everything from income and expenses to tax planning in real-time. It was the perfect fit for Paul’s growing portfolio.

Outcome

By switching to Property Tank, Paul saved hundreds of dollars compared to expensive alternatives like Xero. His accountant now had full visibility across his properties, making tax planning more efficient than ever. Paul loved the cost savings, while his accountant appreciated the tailored features, making property management smarter and simpler.

All-in-one financial clarity

Alex, an engineer with rental properties and an investment portfolio, was juggling spreadsheets, paper receipts, and apps that didn’t sync. His accountant was left piecing everything together, turning tax planning into a stressful last-minute ordeal.

Solution

TaxTank was the gamechanger Alex needed. It brought all his finances - work income, rental income, property expenses, investments, and deductions - into one streamlined platform, just like the fancy software businesses use, but better suited for individuals. With real-time data and total transparency, everything was finally in sync.

Outcome

Alex’s accountant could now provide proactive tax advice, no longer limited to end-of-year panic mode. TaxTank gave Alex the clarity and control he needed without the hefty price tag of business software. With less stress and smarter financial planning, Alex and his accountant both came out ahead.

We employed TaxTank’s incredible software as an optional add on for our clients, and it has quickly become an indispensable tool for our company. Not only do we have a far better understanding of property-related tax affairs, but we can now empower our clients to take control of their own tax affairs with our assistance.

TaxTank’s user interface is intuitive, easy to navigate and is categorised by their ‘tanks’, making it effortless for clients to input, track and manage their tax information and view their tax position year-round. The platform offers a wide range of features that allow clients to track expenses, income, depreciation and equity to name a few. Using PAYG and rental income, any deductions and depreciation, the program automatically calculates an incredibly accurate real time tax projection. Not only is the platform easy to navigate, but our clients also have access to a self-service help centre, free tax tools and extensive webinars to support their tax management journey.

Underpinned by Australian tax legislation, TaxTank has assisted our clients in maximising tax deductions and minimising tax paid. Legally, of course! What we love most about TaxTank is the advocacy for and empowerment of Australian taxpayers – this tool is priceless in the fact it guides users to claiming their fair share every financial year.

Mitch Cator & Holly Macdonald

Join the TaxTank community today!

Take your accounting firm’s services to the next level with TaxTank. Elevate your client experience, optimise workflow, and offer the peace of mind clients deserve.

Be the trusted accounting partner, armed with the ultimate solution for comprehensive accounting support.