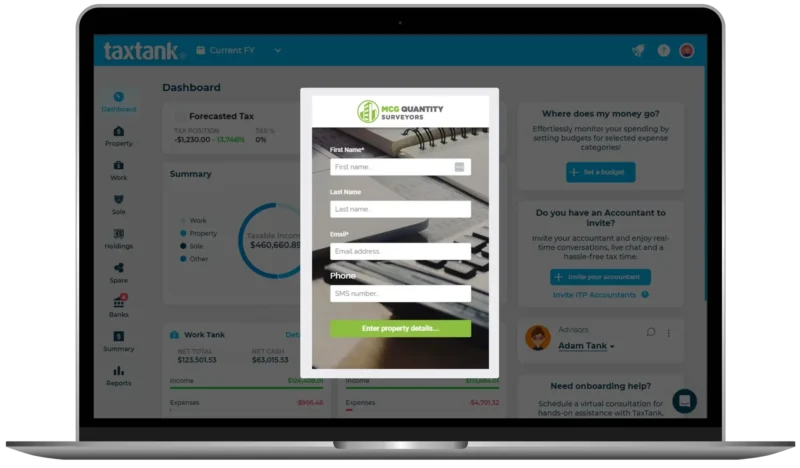

TaxTank and MCG Quantity Surveyors

TaxTank has joined forces with MCG Quantity Surveyors, one of Australia’s leading experts in depreciation reporting, to help property investors unlock thousands in hidden deductions. Together, we’re making it easier than ever to claim every eligible cent – with top-tier reports, seamless integration, and a special discounted rate just for TaxTank subscribers.

Why we partnered with MCG Quantity Surveyors

As a savvy property investor, you know that depreciation can deliver serious annual savings – but only if it’s done right. MCG doesn’t cut corners. They conduct on-site inspections to identify every single depreciable item, from major appliances to the finer details others often miss. Their ATO-compliant, 40-year reports are prepared by registered tax agents and typically uncover thousands in first-year deductions.

Even better? MCG stands by their numbers with a “double their fee” guarantee – if they can’t find at least twice the schedule cost in first-year deductions, you won’t pay a cent.

What you get with the TaxTank and MCG Quantity Surveyors' Partnership

As a valued TaxTank subscriber, you’ll enjoy:

- A discounted flat rate of $550 per residential property

- A premium, ATO-compliant depreciation schedule

- A fast 7–10 day turnaround after inspection

Whether you’re growing your portfolio or just getting started, this partnership is designed to help you get more from your property – with less admin.

Claim every cent you're entitled to!

Don’t let missed deductions eat into your investment returns. MCG’s detailed on-site inspections and 40-year reports uncover thousands in potential tax savings – and now you can access them at a discounted rate, only through TaxTank.

Learn more about Property Depreciation

Want to better understand property depreciation? Check out these helpful reads:

Investment Property Deductions Guide to Maximise Returns in 2025

Many property investors leave money on the table simply because they don’t fully understand investment property deductions. Without claiming eligible expenses, like depreciation, borrowing expenses, land tax, and maintenance costs,

Decode the ATO Depreciation Guidelines for Investment Properties

Repairs, Capital, and Initial Repairs: Understanding the ATO’s Depreciation Guidelines (Before They Do It for You) The ATO depreciation guidelines are key to property investment, determining what you can and

Depreciation for Investment Properties in Australia

When it comes to investment properties, depreciation is your unsung hero. It’s a powerful way to save on tax, boost your cash flow, and make your property work harder for