Investing in property can be a powerful path to financial freedom, but it comes with risks. For property investors, understanding property investor tax rules and managing your finances properly is key to maximising returns and avoiding costly mistakes.

A smart place to start is by knowing what not to do. Here are 5 common property investor tax mistakes you should avoid.

1. Failing to Plan Your Property Investor Tax

The property market is always changing, so risks are inevitable. Planning ahead for your property investor tax obligations ensures you’re financially, mentally, and emotionally prepared.

When property investors fail to plan, they plan to fail. Anticipate interest rate changes, periods without tenants, and unexpected expenses. Preparing for your tax position throughout the year brings potential issues into the present so you can act before they become problems.

2. Making Uninformed, Emotional Tax Decisions

Do you know your real-time property investor tax position? Many investors don’t, and this can lead to emotional or poorly informed decisions when buying or selling property.

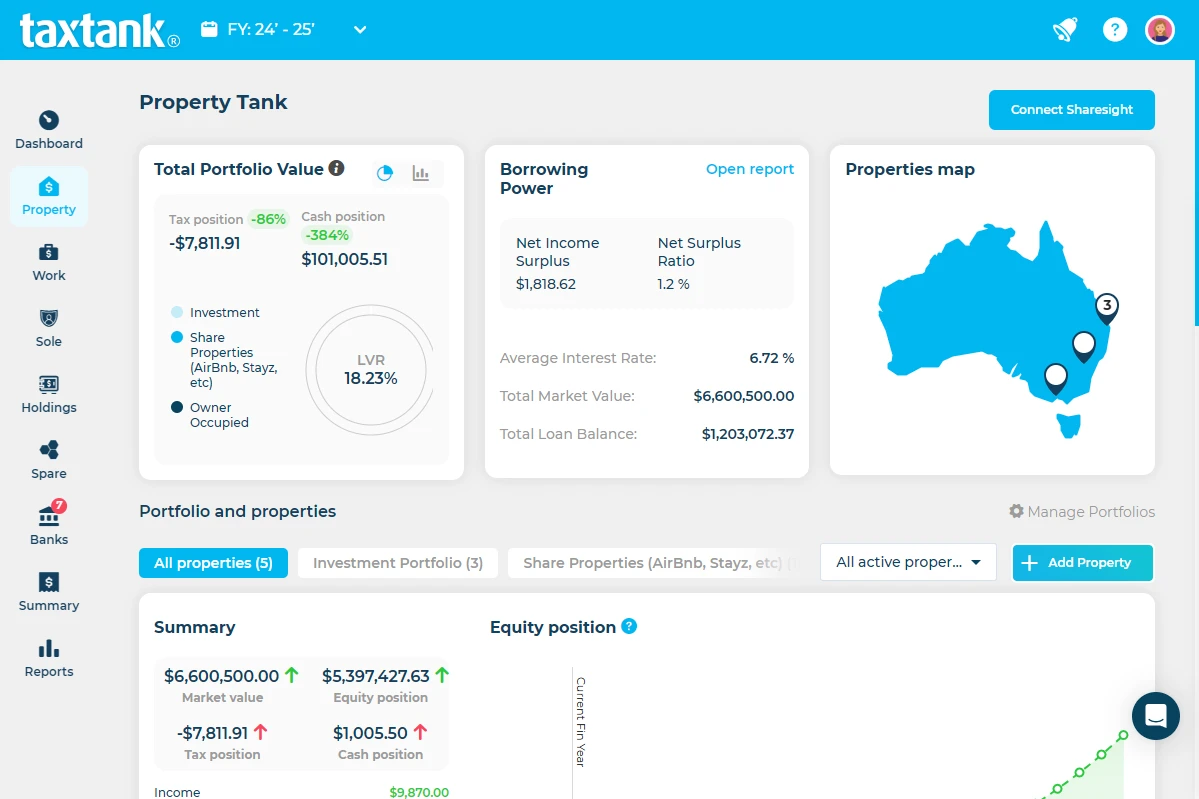

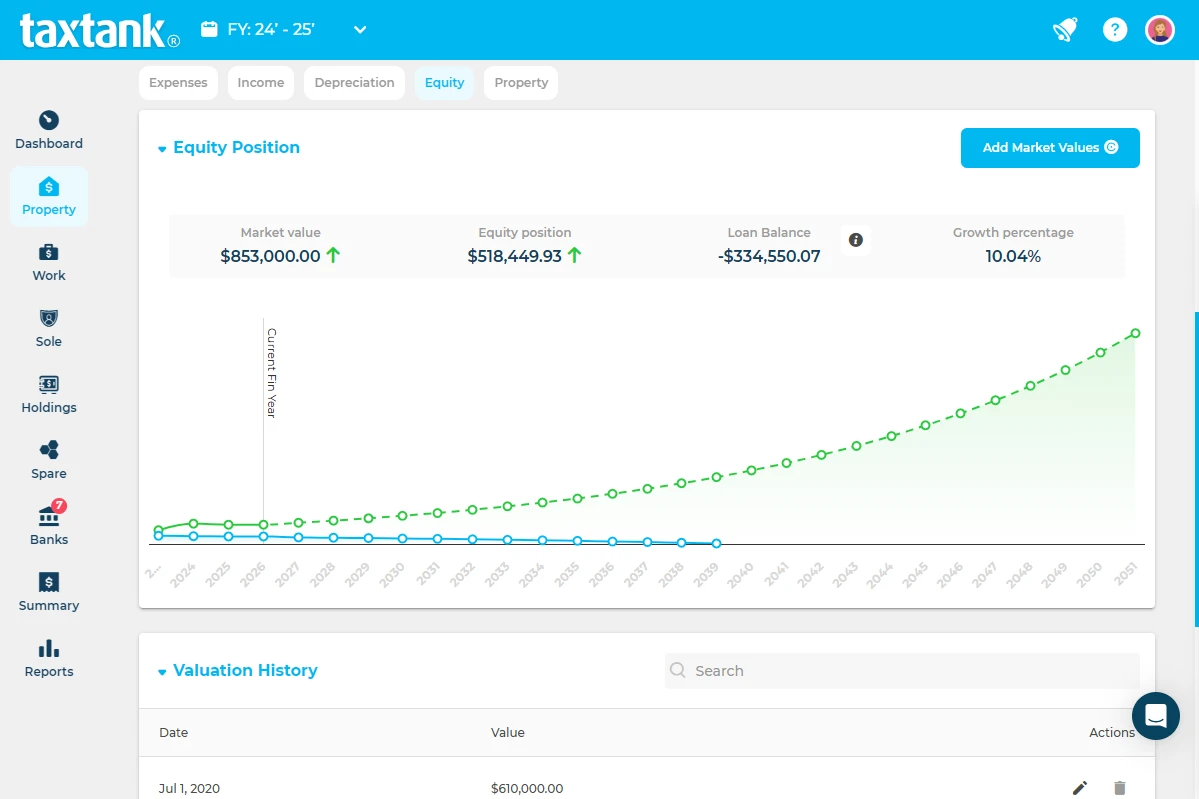

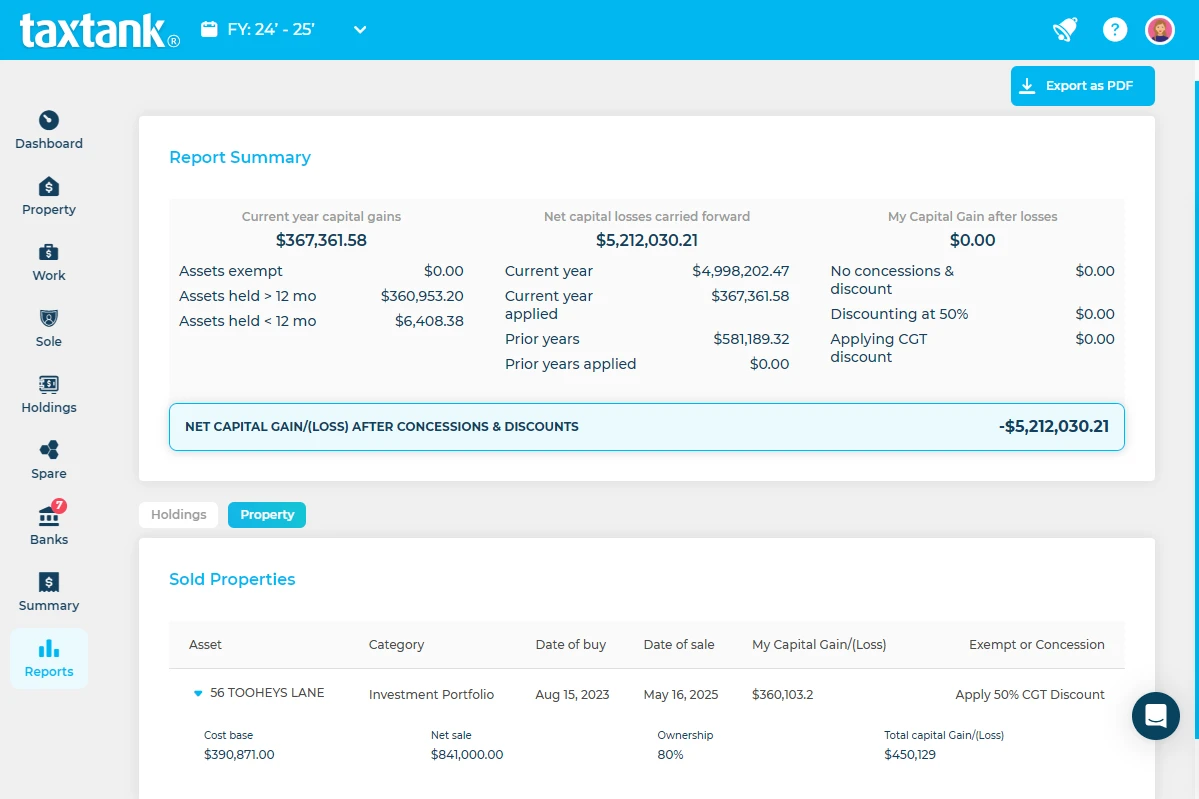

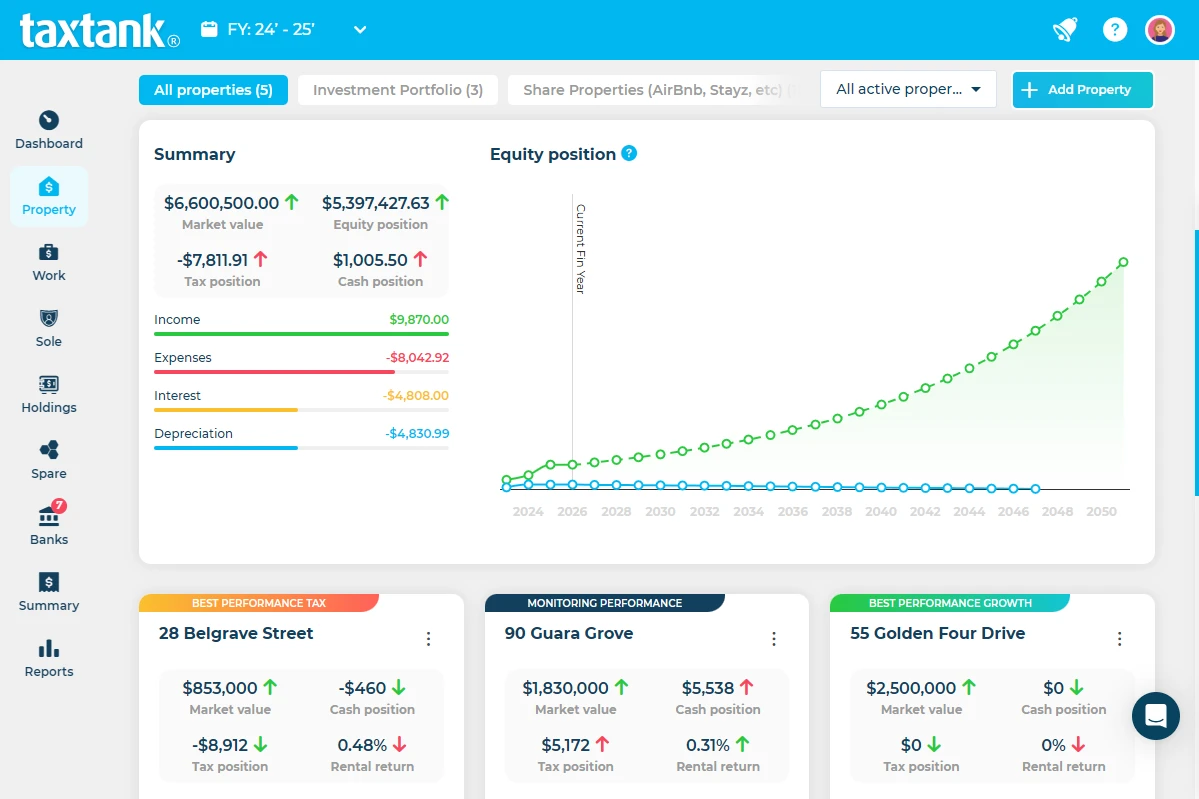

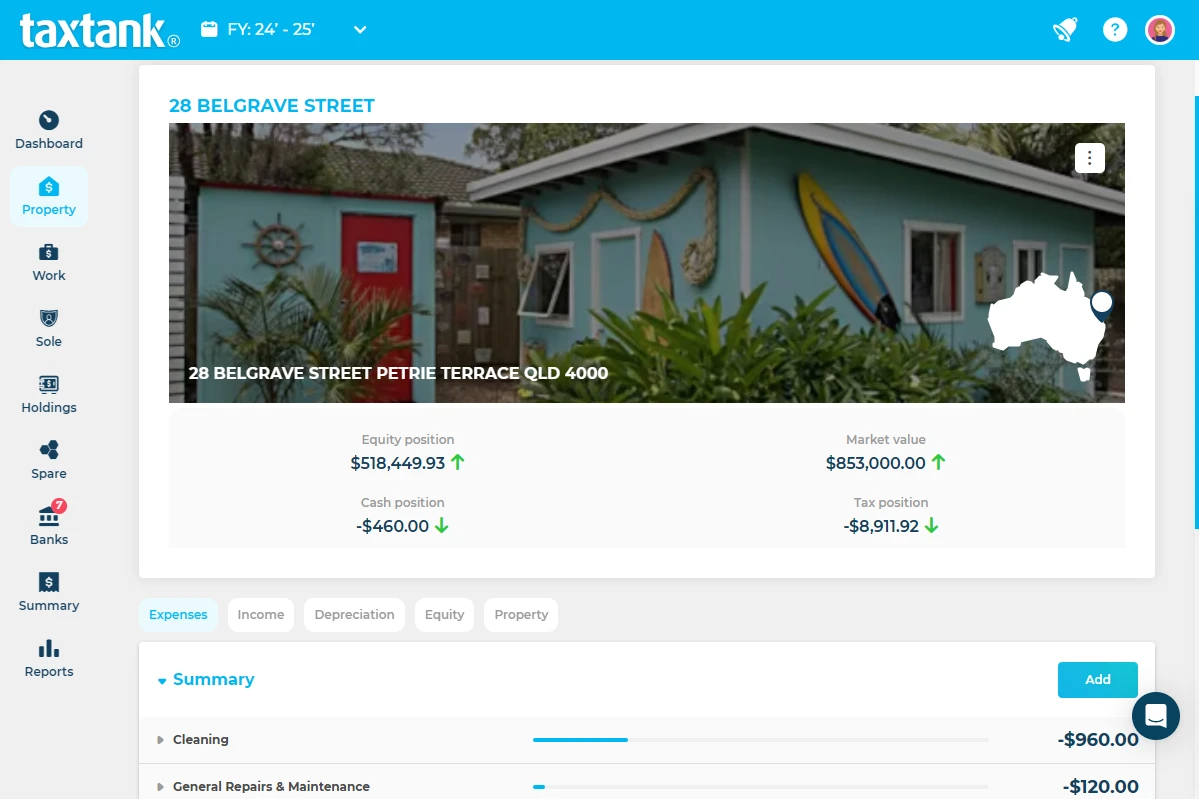

Property investors who understand their tax situation can make strategic decisions that benefit both their investments and their end-of-year tax outcomes. Tools like TaxTank provide interactive reports and real-time property investor tax data, so you always make decisions based on facts, not emotions.

3. Misplacing Important Tax Documents

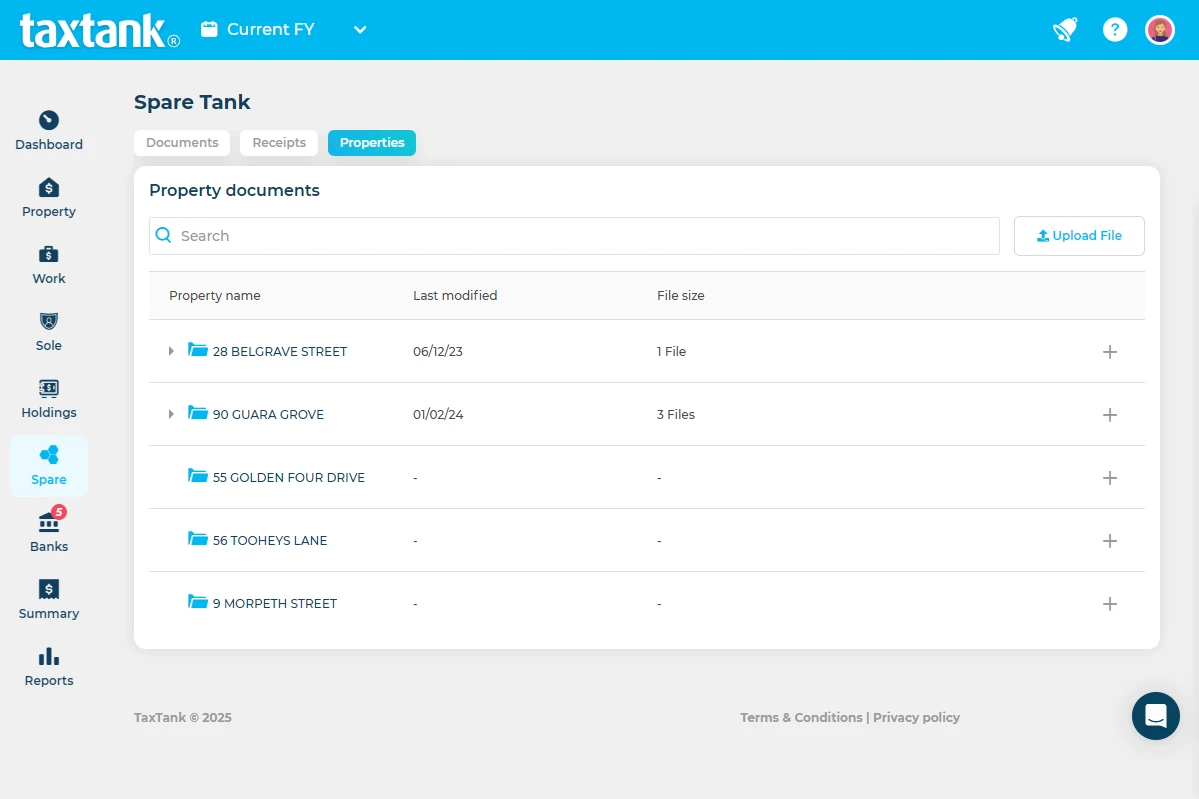

Keeping track of receipts, invoices, loan statements, and rental agreements is critical for property investor tax compliance. Lost or disorganised documents can cause errors in claims and create unnecessary stress.

Cloud-based solutions like TaxTank give property investors a secure space to store and organise all tax-related documents, making it easy to share them with your accountant.

4. Making Incorrect Tax Claims

Many property investors accidentally make incorrect claims, which can lead to ATO audits and penalties. Recent audits revealed that 90% of rental property claims had errors, contributing to a $3.3 billion gap in reported deductions.

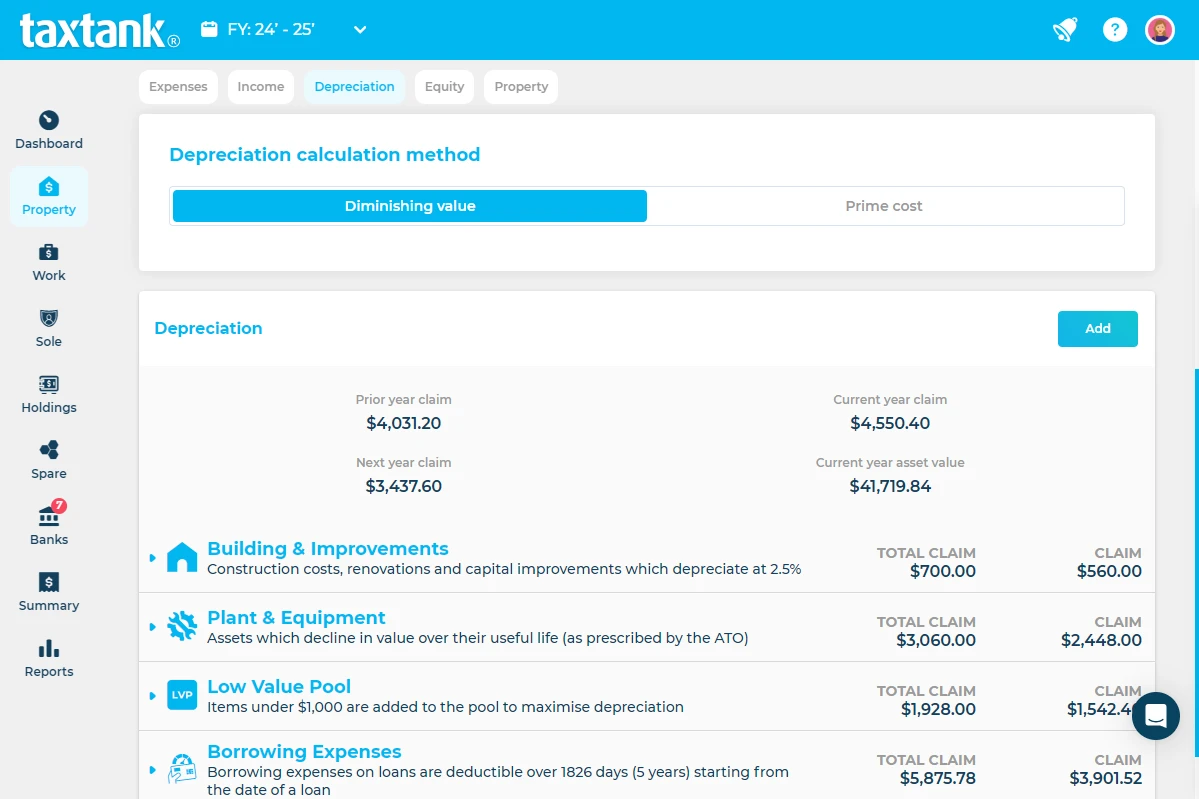

Common mistakes include incorrect interest claims, misclassifying capital works, and claiming deductions for properties not genuinely available for rent. Staying on top of your property investor tax position all year helps avoid costly mistakes and ensures every claim is correct.

5. Treating Tax as a Once-a-Year Task

For property investors, tax is not something to think about only once a year. Waiting until tax time can lead to missed deductions, poor planning, and unnecessary stress.

TaxTank provides a dedicated property investment dashboard to track income, expenses, deductions, and cash flow in real time. Stay in control of your property investor tax obligations and make smarter investment decisions all year round.

The Solution for Property Investors

Imagine having instant access to all your paperwork, income, expenses, cash position, growth forecasts, and property statistics in one place. TaxTank was designed by accountants and experienced property investors to simplify property investor tax management and take the stress out of tax time.

Sign up for a free 14-day trial and see how TaxTank can help you avoid property investor tax mistakes while taking control of your financial future.