Understanding Property Investment Tax in Australia

Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is

Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is

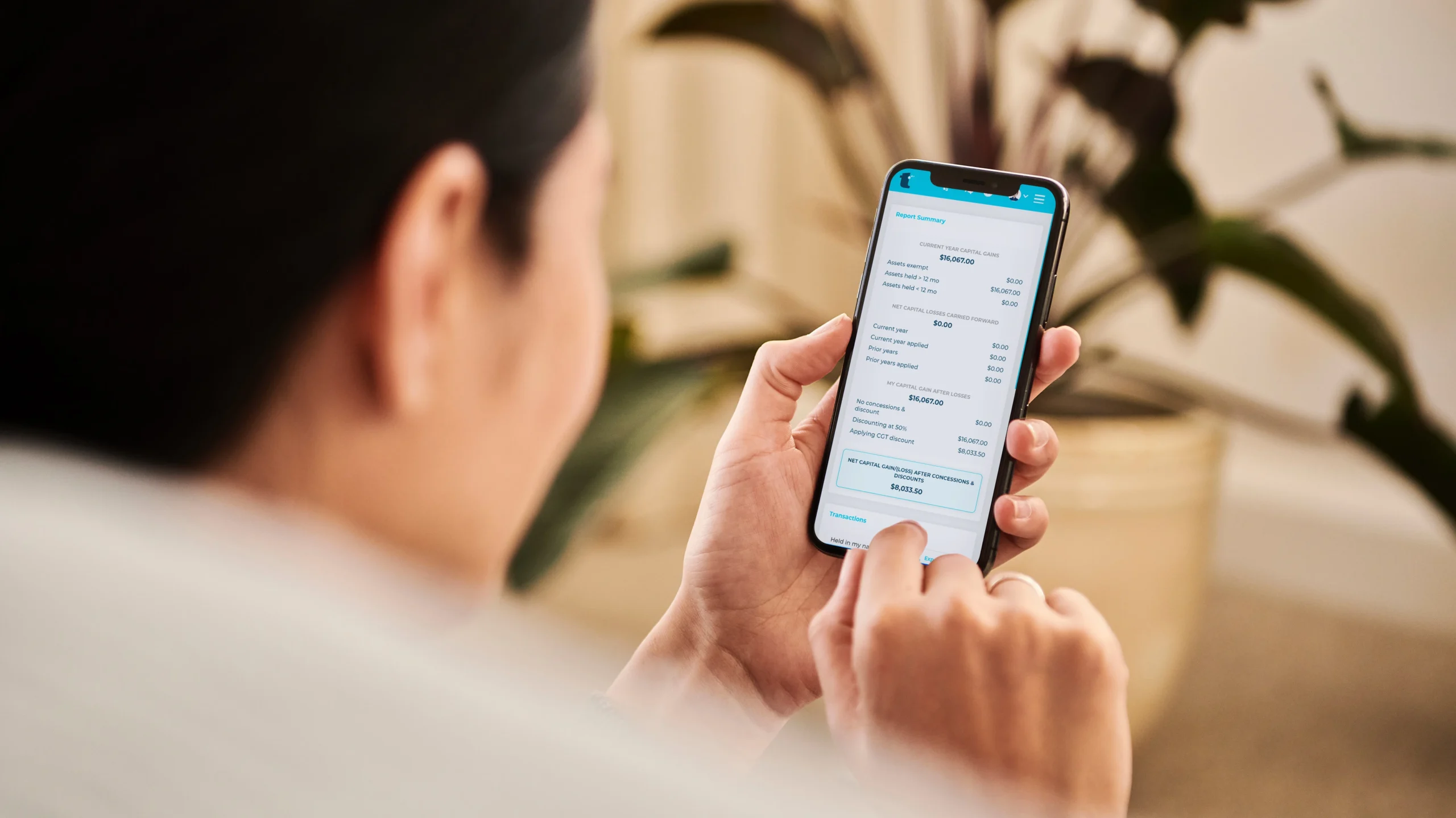

Every end of financial year, Australians eagerly await a potential tax refund, yet billions of dollars in unclaimed expenses remain on the table. A tax app could be the key to ensuring you claim the right amount and maximise your refund.

Gone are the days of drowning in paperwork and battling confusing tax forms. With the magical powers of the tax app, managing your finances becomes a breeze. Picture this: no more late-night stress sessions, no more headache-inducing calculations, just pure, unadulterated financial joy!

Capital Gains Tax (CGT) can often be a source of confusion for many taxpayers. With various misconceptions surrounding CGT, it’s important to separate fact from fiction. In this blog, we debunk 10 common myths about Capital Gains Tax and provide clarity on this crucial aspect of taxation.

Explore the impact of Airbnb on property rental in Australia and master the essentials of tax for short-term rentals with TaxTank. Optimise your earnings seamlessly.

Navigating the tax landscape as an Uber driver doesn’t have to be daunting. In this comprehensive guide, we’ll walk you through everything you need to know about managing tax for Uber drivers in Australia.

Investing in real estate has always been a popular strategy for Australians to build wealth. Two key concepts that play a significant role in property investment are Capital Gains Tax

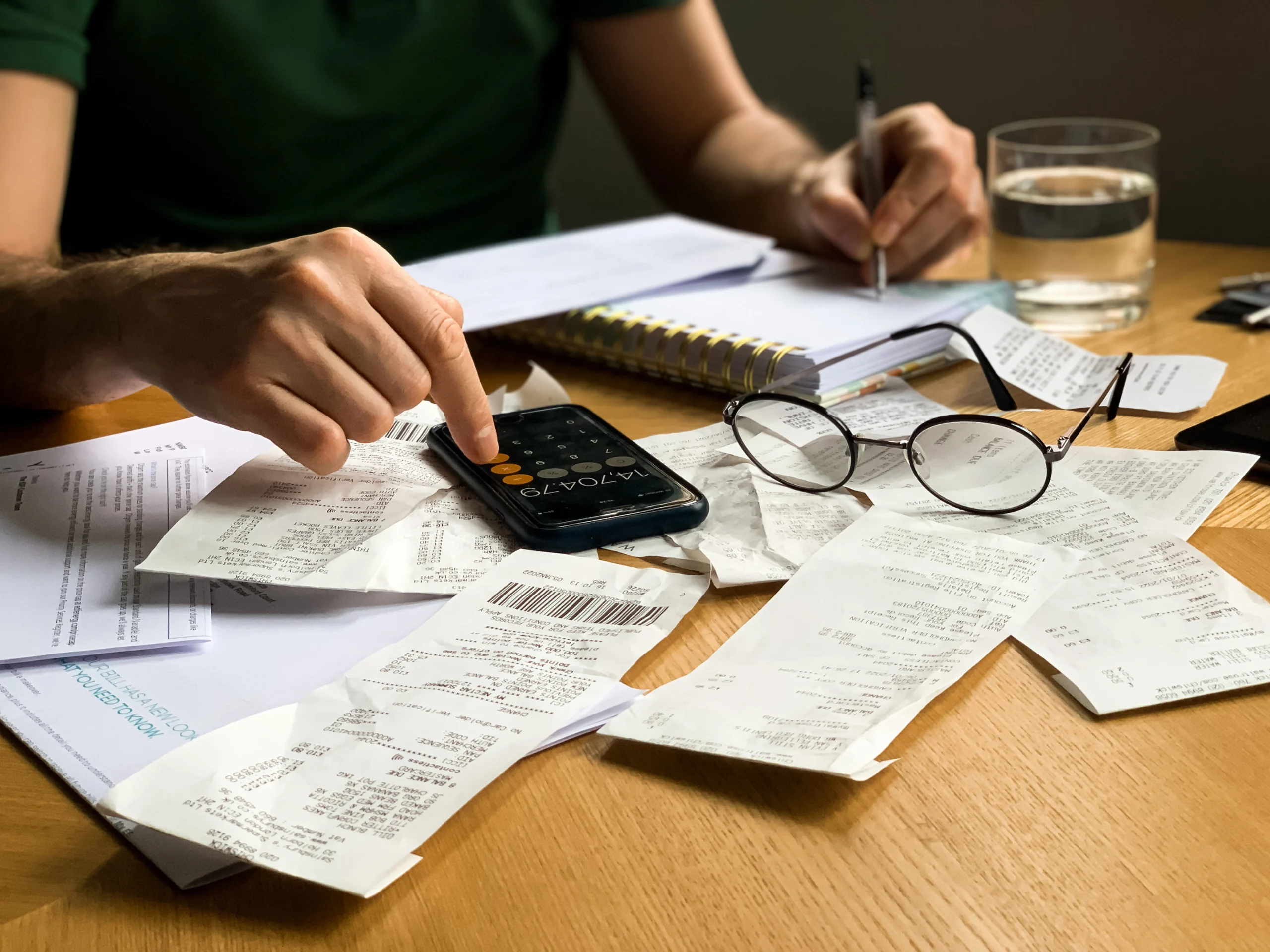

In this article, we will provide you with a comprehensive guide on sole trader expenses in Australia, aimed at helping you manage your finances better, reduce your tax bill, and

Navigating a divorce can be a challenging experience, especially when it comes to understanding the financial implications. Among these, the impact of Capital Gains Tax (CGT) is often overlooked or misunderstood. In this blog, we uncover five lesser-known aspects of how CGT applies in the context of divorce.

As a savvy property investor, you need more than just a good sense of timing; you need the right tools at your disposal. In this article, we’ll dive into the

Managing your financial records and receipts is an important aspect of running a business or personal finances. It is essential to have an organised record-keeping system to avoid any complications or a knock on the door from the ATO. In this article, we will guide you on how to organise your financial records and receipts so you can start the year off on the right foot and be ready well ahead of tax time this June.

Support

Resources

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation.

Copyright © 2024 TaxTank | All Rights Reserved.