Many property investors leave money on the table simply because they don’t fully understand investment property deductions. Without claiming eligible expenses, like depreciation, borrowing expenses, land tax, and maintenance costs, you could be paying thousands more in tax than necessary. This guide will help you get it right by covering:

✅ What investment property deductions are and why they matter

✅ The different types of deductions you can claim

✅ Smart strategies to maximise your tax savings

✅ Real-world examples to bring it all together

✅ Common mistakes to avoid

Let’s dive in and make sure you’re getting every dollar you deserve!

What are Investment Property Deductions?

The Short Answer

Investment property deductions are expenses you incur while owning a rental property that you can claim to reduce your taxable income. These deductions help lower the amount of tax you pay each year and, when done right, can save you thousands.

Why Do They Matter?

Without claiming deductions, you’re essentially handing over extra cash to the ATO that you could have kept in your pocket. Smart investors know that maximising investment property deductions means more money in your pocket, now or at tax time, to pay down mortgages or even funding your next property purchase.

Types of Investment Property Deductions You Can Claim

Now, let’s break down the three main categories of investment property deductions: immediate deductions, capital works deductions, and depreciation on assets.

1. Immediate Investment Property Deductions (Claimed in the Same Year)

These are expenses you can claim straight away in the financial year you incur them, including:

- Loan interest – One of the biggest investment property deductions. If you have a loan for your rental property, the interest portion is tax-deductible, plus any annual fees or monthly bank charges.

- Property management fees – If you use a real estate agent to manage tenants, you can claim their fees, plus all those extras for letting, inspecting and sundries.

- Council rates and insurance – Strata fees, landlord insurance, council and water rates and water usage are all deductible. Likewise of course, any water usage reimbursed from the tenant is considered as income.

- Repairs and maintenance – Under ATO guidelines, repairs involve restoring an asset to its original condition, like fixing a leaking tap or replacing broken tiles. These costs are generally immediately deductible, helping reduce your taxable income in the current year.

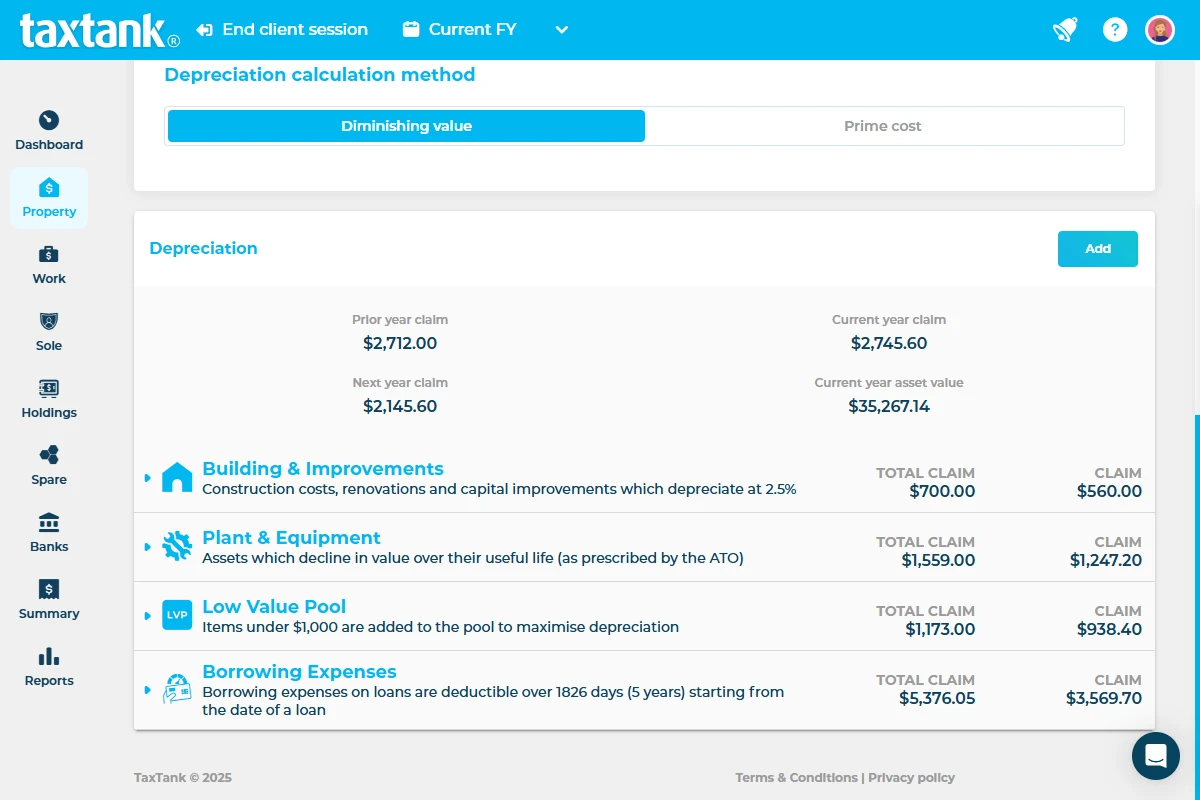

2. Capital Works Deductions (Depreciation on Buildings)

If your property was built after 16 September 1987, you can claim 2.5% of its construction costs as a deduction each year for 40 years. This is known as capital works deductions.

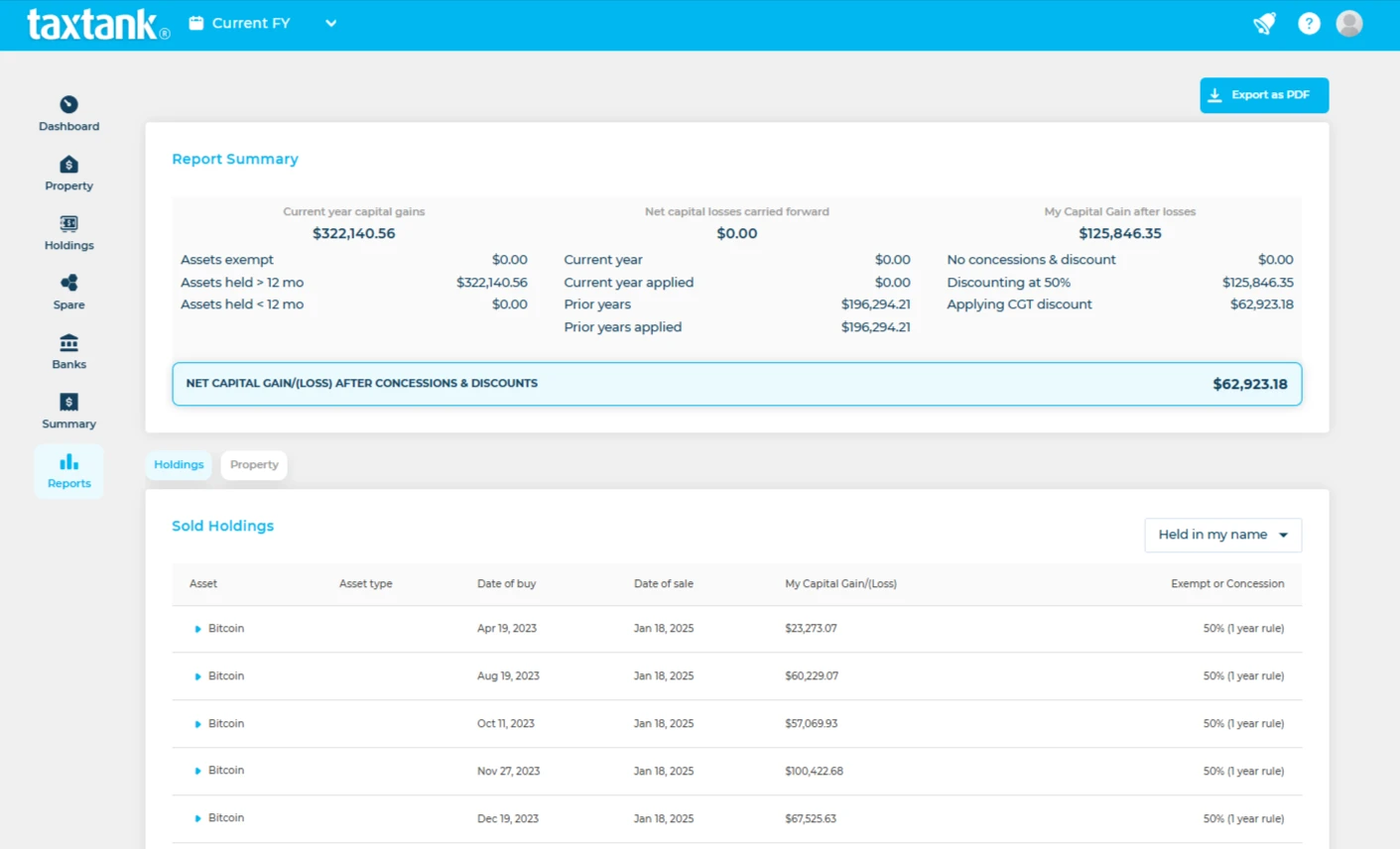

💡 Tip: When you sell, any capital works deductions you’ve claimed will be added back for CGT purposes, so keep thorough records or use a digital solution like TaxTank to seamlessly keep track.

3. Depreciation on Assets (Plant and Equipment)

Beyond the building itself, you can claim depreciation on eligible assets within the property, such as appliances and other fixtures. However, under the latest rules, second-hand assets in existing properties may no longer qualify, especially if purchased after 9 May 2017, so check with a tax professional to confirm your eligibility.

- Appliances (stoves, dishwashers, air conditioners)

- Carpets and flooring

- Blinds and curtains

The ATO has specific rules on how depreciation is calculated, but with TaxTank’s automated depreciation feature, you don’t have to worry about the complexities. TaxTank calculates and applies depreciation rules for you, ensuring you never miss a claim while staying fully compliant.

If assets are placed or added, there is no need to get a new depreciation schedule. In TaxTank you can write off the old items and add new ones in just a few clicks!

How to Maximise Your Investment Property Deductions

Want to get the most out of your deductions? Here’s how:

1. Keep Accurate Records

Without proper documentation, you risk missing out on valuable claims. Keep records of:

✅ Loan statements

✅ Receipts for repairs and maintenance

✅ Property management invoices

✅ Insurance and council rates payments

✅ Settlement letters and capital costs

2. Get a Tax Depreciation Schedule

A depreciation schedule from a qualified Quantity Surveyor will help you legally maximise your claims, ensuring you don’t miss any deductions on your building or assets.

3. Use Tax Software Like TaxTank

Managing investment property deductions manually is a pain. TaxTank makes it easy by automating record-keeping, tracking deductions, and ensuring you never miss a claim.

👉 Try TaxTank today to simplify your tax return!

Real-World Example: How One Investor Saved $8,000 in Tax

Meet Sarah, a property investor who owns a two-bedroom rental in Sydney. Here’s how she maximised her deductions:

✅ Claimed $12,000 in loan interest

✅ Deducted $2,000 in property management fees

✅ Wrote off $4,500 in capital works depreciation

✅ Claimed $1,500 in repairs and maintenance

Total deductions: $20,000

Tax saved (at a 40% tax rate): $8,000

This is why keeping track of every eligible deduction matters!

Common Mistakes to Avoid

🚫 Not keeping receipts – No receipts? No deductions.

🚫 Claiming personal expenses – Only claim expenses directly related to renting out the property. Travel expenses are not deductible for property investors.

🚫 Forgetting about depreciation – Many investors don’t realise how much depreciation can reduce their tax bill.

🚫 Only Checking Finances Once a Year

Waiting until tax time to review your property’s finances can cause missed opportunities. Regularly tracking your income, expenses, and deductions ensures you’re maximising benefits year-round.

🚫 Neglecting Tax Rule Updates

Tax laws change frequently. Staying informed or seeking expert advice can help you avoid costly mistakes and ensure full compliance.

Frequently Asked Questions

What happens if I get audited?

If the ATO sends you a letter, you’ll have 28 days to provide evidence supporting your claims. This is why good record-keeping is essential.

Can I claim deductions if my property is vacant?

Yes, but only if it was genuinely available for rent. If you took it out of the rental market for whatever reason, you usually can’t claim deductions during that time.

How far back can I claim deductions?

You can usually amend tax returns up to two years after filing to include any missed deductions or omitted income.

Can I claim travel expenses for visiting my rental property?

Not anymore. The ATO scrapped travel deductions for inspecting rental properties in 2017.

What’s the difference between repairs and capital improvements?

Repairs involve restoring an asset to its original condition (e.g., fixing a broken tap) and are immediately deductible in the year the expense is incurred.

Capital Improvements enhance or significantly extend the life of the asset (e.g., adding a new kitchen) and must be depreciated over time instead of being claimed outright.

💡 Tip: Initial Repairs, which fix problems existing at the time of purchase (e.g., replacing worn-out carpet from the previous owner), are generally considered capital and must also be depreciated over time. So dont get caught out, timing is everything 😉

Final Thoughts

Investment property deductions are a powerful way to legally reduce your tax bill and boost your investment returns. By keeping accurate records, using a depreciation schedule, and leveraging tax tools like TaxTank, you’ll ensure you never miss a claim.

🚀 Ready to take control of your property tax? Sign up for TaxTank today and simplify your tax deductions!