When you’re choosing tax software in Australia, the right platform can mean the difference between a smooth, stress-free return and a last-minute scramble.

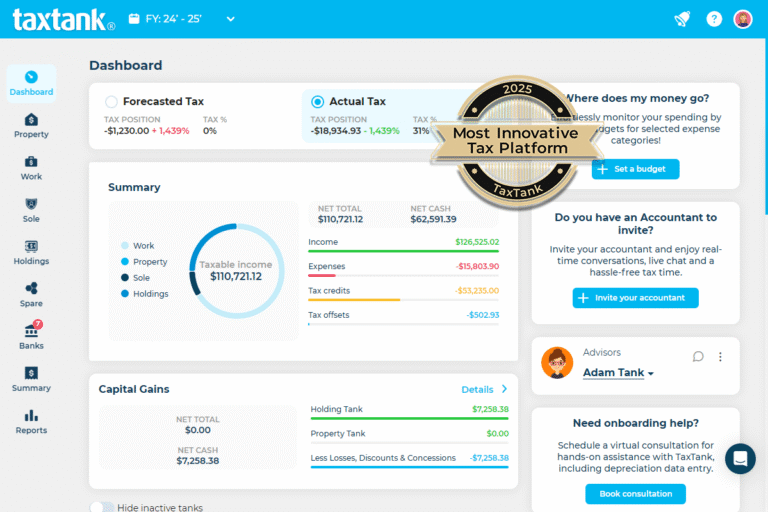

In 2025, TaxTank proudly takes the crown as WeMoney’s Most Innovative Tax Platform, solidifying its position as the leading tax software in Australia for individuals. This prestigious award recognises TaxTank’s cutting-edge features, intuitive design, and unwavering focus on simplifying tax for everyday Australians.

And unlike generic business accounting software, TaxTank is tailored for the complexities of individual tax returns. It integrates live bank feeds, real-time tax tracking, and specialised tools for property portfolios, shares, crypto assets, and sole trader businesses – all in one seamless platform.

TaxTank is built specifically for Australians, not repurposed from overseas systems, and it delivers the automation, accuracy, and ATO compliance you need to stay on top of your finances all year round.

Whether you’re lodging as an employee, sole trader, property investor, share or crypto trader, TaxTank makes tax time simple while helping you maximise your deductions.

Why TaxTank is the Best Tax Software in Australia for Individuals

Most tax software in Australia focuses on end-of-year lodgement or is designed for accountants. TaxTank is different. It’s built for everyday Australians who want to manage and optimise their tax position year-round.

Comprehensive Tax Return Management

TaxTank supports all the major income types for Australian taxpayers:

- Salary and wages

- Other incomes like Directors Fees or Tips

- Rental property income

- Dividends and interest

- Capital gains from shares and crypto

- Sole trader and side hustle income

It takes care of deductions, offsets, and has comprehensive reporting so you can self-lodge or invite your accountant or advisor — everything you’d expect from the best tax software in Australia.

Automated Bank Feeds for Effortless Accuracy

One of the standout features that makes TaxTank the best tax software in Australia is its automated bank feed integration.

- Transactions are imported automatically

- Expenses are categorised using rules you set

- All categories align directly with the ATO so it’s less error prone

With unlimited bank feeds, you can connect multiple accounts and cards without extra cost.

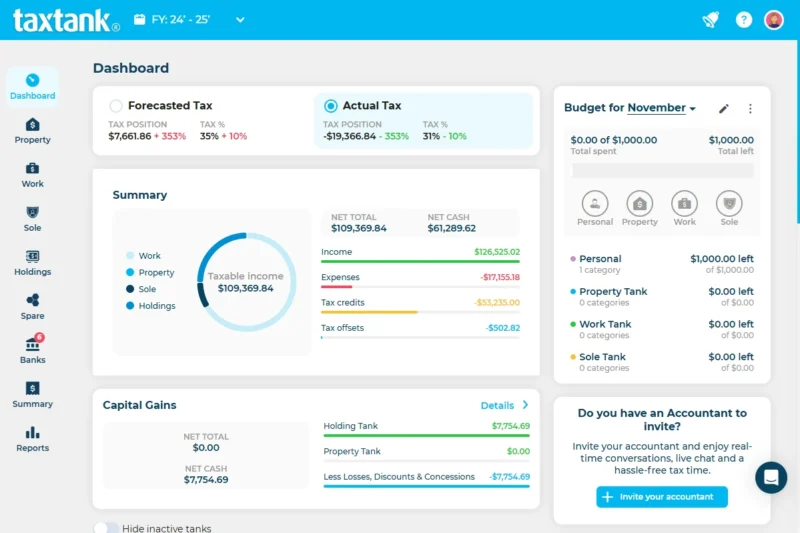

Real-Time Tax Estimates and Insights

Unlike most business tax software in Australia, TaxTank shows your live tax position at any time during the year.

- See your projected refund or bill instantly

- Plan for big expenses or investment sales with no surprises

- Adjust your finances ahead of time to optimise your outcome

Australian-First Design and Support

Some software companies adapt foreign systems for Australia, but TaxTank was built in Australia for Australians.

- Every category and form matches ATO requirements

- Guidance is written in plain English

- Support is local and understands your exact tax situation

Why TaxTank Outperforms Other Tax Software in Australia

| Feature | TaxTank | Typical Alternatives |

| Designed for individuals only | ✔ | Often business-focused |

| Automated bank feeds | ✔ | Manual entry or paid add-on |

| Real-time tax position | ✔ | End-of-year only |

| Built for side hustlers | ✔ | Cannot manage different income types together |

| CGT tracking (property, shares, crypto, and other assets) | ✔ | Limited or separate product |

| Property investment tools | ✔ | Rarely included |

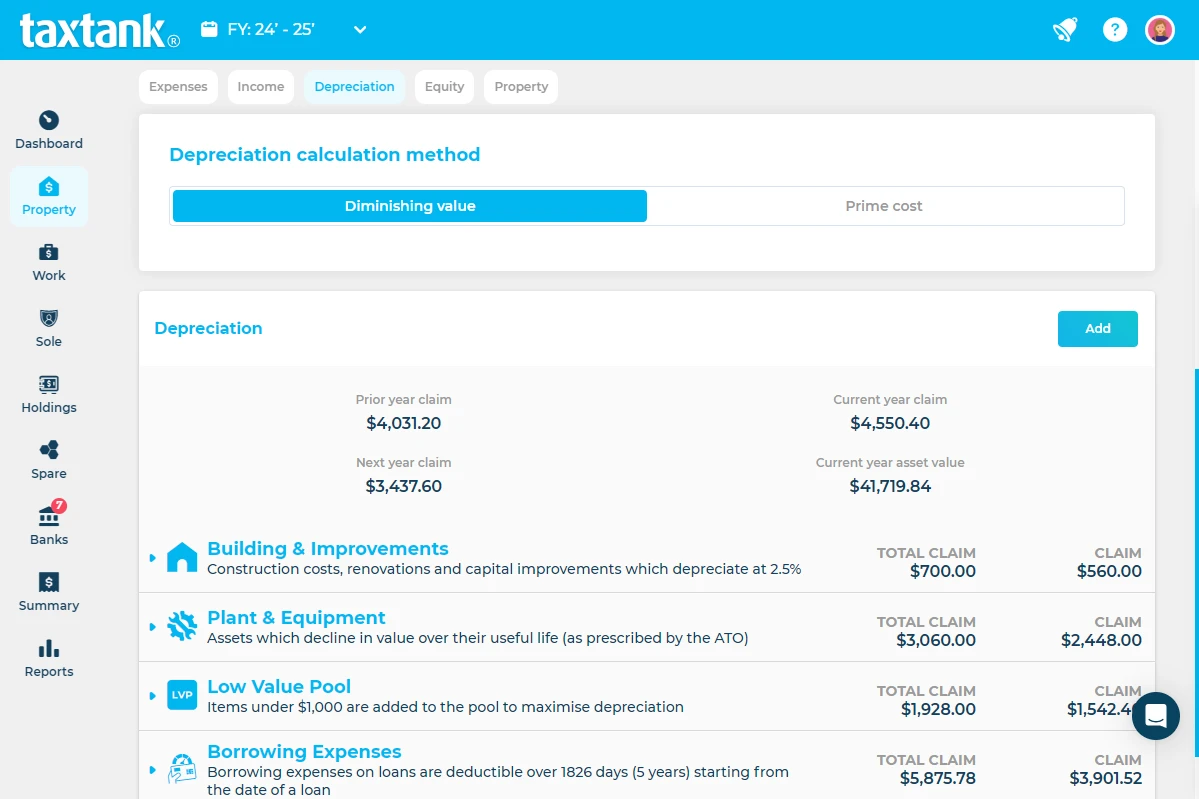

| Depreciation calculator | ✔ | Rarely included |

| Home Office Diary | ✔ | Limited or separate product |

| Vehicle Logbook | ✔ | Limited or separate product |

| Transparent, flat pricing | ✔ | Tiered or hidden fees |

Tailored for Every Type of Taxpayer in Australia

Whether you’re an employee, a property investor, a sole trader, or someone juggling shares and crypto, TaxTank has you covered with smart tools designed around your needs.

General Tax and Financial Tools

TaxTank gives you the tools to manage your everyday tax and finances with confidence, all year round:

- Know exactly how much tax you owe with live calculations

- Connect bank accounts via live feeds for real-time tracking of income and expenses

- Monitor your HECS/HELP balance and repayments effortlessly

- Plan smarter using a simple monthly budgeting tool

- Automate transaction categorisation with custom rules

- Access live tax reports whenever you need them

- Store all your documents and receipts securely in the Spare Tank

Property Investors

Keep all your property investments organised and maximise your claims with powerful automation:

- Manage all properties across different ownership structures in one place

- Track rental income, expenses, cash flow, and tax in real time

- Monitor performance indicators like capital growth, LVR, and yields

- Automate depreciation and manage DIY renovation projects

- Automate borrowing expenses for loans and refinancing

- Calculate claim percentages for shared properties, including Airbnb and room rentals

- Track expenses for properties not yet rented in a dedicated land portfolio

- Use a real-time CGT calculator to see the tax impact of sales

- Update property values and growth percentages live with CoreLogic integration

- Access instant property tax reports for accountants

- Sync live data with Sharesight

- Securely store all property documents in the Spare Tank

Shares and Crypto Investors

Manage all your shares, crypto, and other assets easily with comprehensive tracking and tax tools:

- Track performance of shares, crypto, and unlisted assets in one place

- Automatically calculate CGT for all asset types

- Manage income from dividends, interest, and staking rewards

- Create custom tickers for unlisted or unique investments

- Access live CGT reports year-round

- Automatically track and carry forward capital losses

- Connect with Sharesight for seamless trade history syncing

Employees and Contractors

Stay on top of your employment income and expenses with automated tracking and compliance tools:

- Monitor your live tax position throughout the year

- Track income from trusts, partnerships, directors’ fees, and government payments

- Manage wage adjustments, allowances, and pre-tax deductions

- Automatically allocate work-related expenses from bank feeds

- Use a compliant home office diary to log hours and expenses

- Track kilometres and expenses with a compliant vehicle logbook

- Manage work assets with automated depreciation

- Use amortisation schedules for vehicle loans and interest

- Store all work-related documents securely in the Spare Tank

Sole Traders and Side Hustlers

Run your business or side hustle efficiently with features built to simplify tax and bookkeeping:

- Track your live tax position year-round and manage multiple businesses

- Create and send professional invoices quickly

- Automatically allocate business expenses from bank feeds

- Track PSI income, labour hire, and other assessable income

- Manage business assets with depreciation and instant asset write-offs

- Use a compliant home office diary and vehicle logbook for apportioning costs

- Automate vehicle loan tracking with amortisation schedules

- Calculate non-commercial losses and carry forward losses automatically

- Access live BAS reporting and manage GST lodgements

- Separate primary production and other businesses for accurate tax reporting

- View real-time business schedules and transaction reports

- Store all business documents and receipts securely in the Spare Tank

Tax Preparation and Support

Make tax time easier and faster with collaborative tools and clear reporting:

- Use the myTax report for confident self-lodgement

- Access interactive tax reports all year round

- Invite your accountant or advisor anytime for easy collaboration

- Lodge faster with clean, complete records

Pricing: Transparent and Great Value

TaxTank is a modular pricing so you only pay for the parts you need.

There are no hidden costs and no need to buy separate add-ons — a major advantage over other tax software in Australia.

How TaxTank Makes Tax Time Easy

TaxTank turns tax time from a headache into a quick review process:

- Step-by-step, ATO-compliant guidance

- Allocate all bank transactions so no deduction is missed

- Accountant access if you want professional help

- Full tax reports so you can self-lodge through myTax

The Bottom Line on Tax Software in Australia

If you’re looking for the best tax software in Australia for 2025, the choice is simple: TaxTank. It’s secure, easy to use, and covers everything from everyday deductions to complex investments.

TaxTank isn’t just for July. It’s your year-round partner for staying organised, compliant, and in control of your tax position.

Ready to take control of your tax? Visit TaxTank today and see why more Australians are making the switch.

Frequently Asked Questions

What makes TaxTank the best tax software in Australia for individuals?

TaxTank is built specifically for Australian taxpayers, offering live bank feeds, real-time tax tracking, comprehensive tools for property, shares, crypto, and sole trader income – all in one easy-to-use platform.

Can TaxTank handle complex tax situations like property investments and crypto trading?

Absolutely. TaxTank includes dedicated features for property investors such as automated depreciation, real-time property valuations via CoreLogic, and a CGT calculator. It also tracks shares and crypto portfolios with automatic capital gains tax calculations tailored to Australian tax laws.

Is TaxTank suitable for sole traders and side hustlers?

Yes. Sole Tank, a part of TaxTank, is designed to help sole traders manage multiple businesses, track income and expenses automatically, generate professional invoices, manage GST/BAS, and calculate non-commercial losses – all in one place.

How does TaxTank make tax time easier for employees?

TaxTank automatically tracks work-related expenses through bank feeds, provides compliant home office diaries and vehicle logbooks, and shows your live tax position all year. This means no last-minute surprises and easy record-keeping.

Does TaxTank integrate with my bank accounts?

Yes. TaxTank connects securely to multiple bank accounts via Open Banking, automatically importing transactions and categorising expenses to help you maximise deductions without manual entry.

How secure is my data with TaxTank?

Your data is protected with bank-grade encryption and complies with Australian privacy laws. TaxTank uses secure Open Banking connections and stores your documents safely in the Spare Tank feature. You can also set up MFA for additional security.

Can I collaborate with my accountant using TaxTank?

Yes. You can invite your accountant or advisor at any time to review your records and reports, making collaboration seamless and reducing back-and-forth during tax time.

How much does TaxTank cost?

TaxTank offers transparent, pricing with no hidden fees, and you only pay for the Tanks you require. Unlike many competitors, all features including bank feeds, CGT tracking, and property tools are included in one subscription.

What kind of support does TaxTank offer?

TaxTank offers year-round support through interactive tax reports, helpful guides, and a team ready to assist in app. Plus, you can invite your accountant for expert advice anytime.

How is TaxTank different from business accounting software with tax features?

Unlike business accounting software that tries to serve many needs, TaxTank is built specifically for Australian individual taxpayers. It focuses on personal tax complexities like rental properties, shares, crypto, and sole trader income, delivering a tailored experience without the clutter or confusion of business-only tools.

Can I use TaxTank if I’m both an employee and a sole trader?

Absolutely. TaxTank lets you manage all your income types including salary, side hustles, investments – in one place. Most business accounting software

Why shouldn’t I just use popular business accounting software for my personal tax?

Business accounting software often lacks features designed for personal tax returns, like HECS/HELP tracking, compliant home office diaries, or detailed capital gains calculations for shares and crypto. TaxTank includes these out of the box, making tax time simpler and more accurate for individuals.

Does TaxTank include features specifically for investment properties that business software doesn’t?

Yes. TaxTank offers property portfolios, automated depreciation, live CoreLogic valuations, and specialised CGT calculators tailored to Australian property investors – features rarely found in standard business accounting packages.

How does TaxTank simplify tax for sole traders compared to business accounting software?

TaxTank’s Sole Tank module is designed with sole traders in mind, offering easy invoice creation, live BAS reporting, non-commercial loss calculations, and multiple business management under one subscription. Many business packages either miss these or require complex add-ons.

Is this an alternative to TaxTank?

No. There isn’t an alternative to TaxTank in Australia.

TaxTank is the only tax software here that actually calculates your individual tax position live, as you go. It shows you how much tax you’re paying, what your refund or bill is likely to look like, and how every income or expense decision impacts you personally.

Some platforms calculate business tax. Others are personal finance apps that let you tag transactions as “tax related.” But tagging isn’t the same as calculating. They don’t work out your individual tax in real time, and they don’t show you the true impact on your overall tax position.

TaxTank is built specifically around how individual tax is lodged in Australia. That’s what makes it different, and why there isn’t a direct substitute.