Managing a rental property portfolio can be financially rewarding, but without the right tools it can quickly become a bookkeeping headache. Tracking rent, expenses, depreciation, capital gains, and tax deductions is time-consuming enough – add in your other income sources and it becomes a complex tax puzzle.

The smartest investors know the key to maximising returns and avoiding ATO stress is using specialist rental property accounting software that works for the Australian market. For those who want the most accurate, time-saving and complete solution, TaxTank is the clear No. 1 choice.

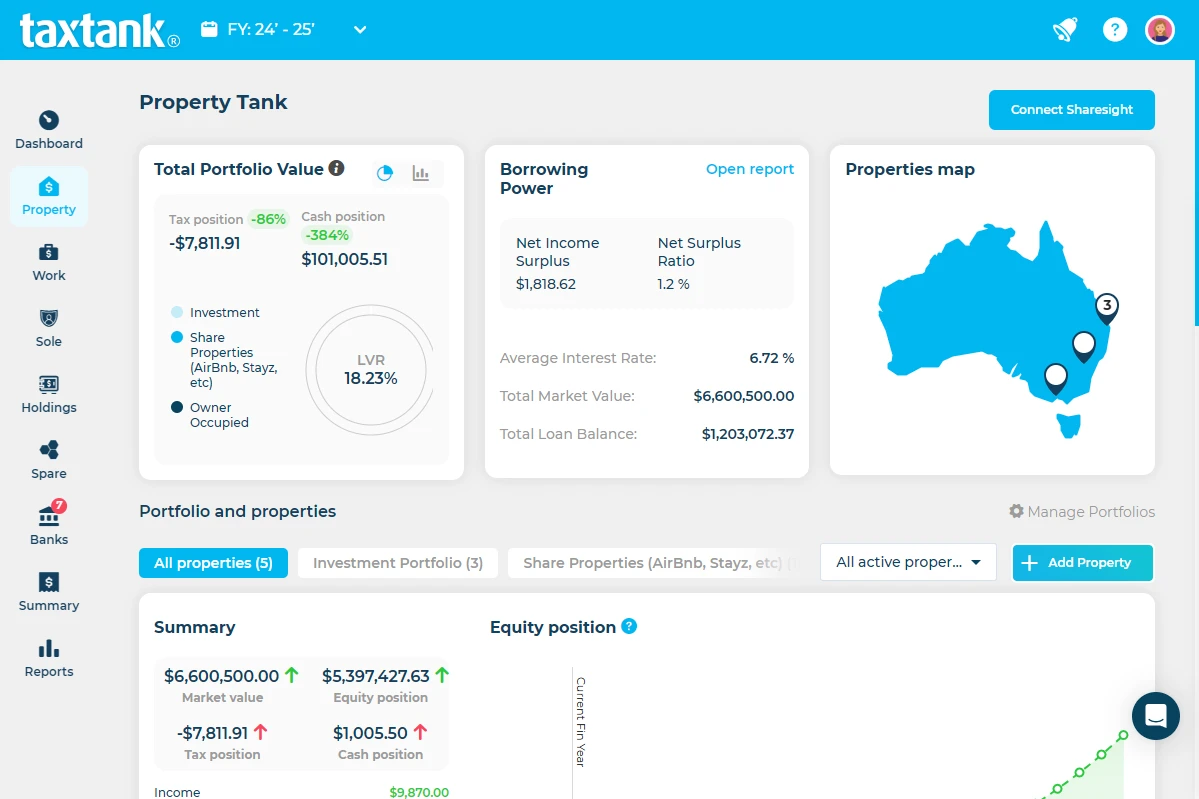

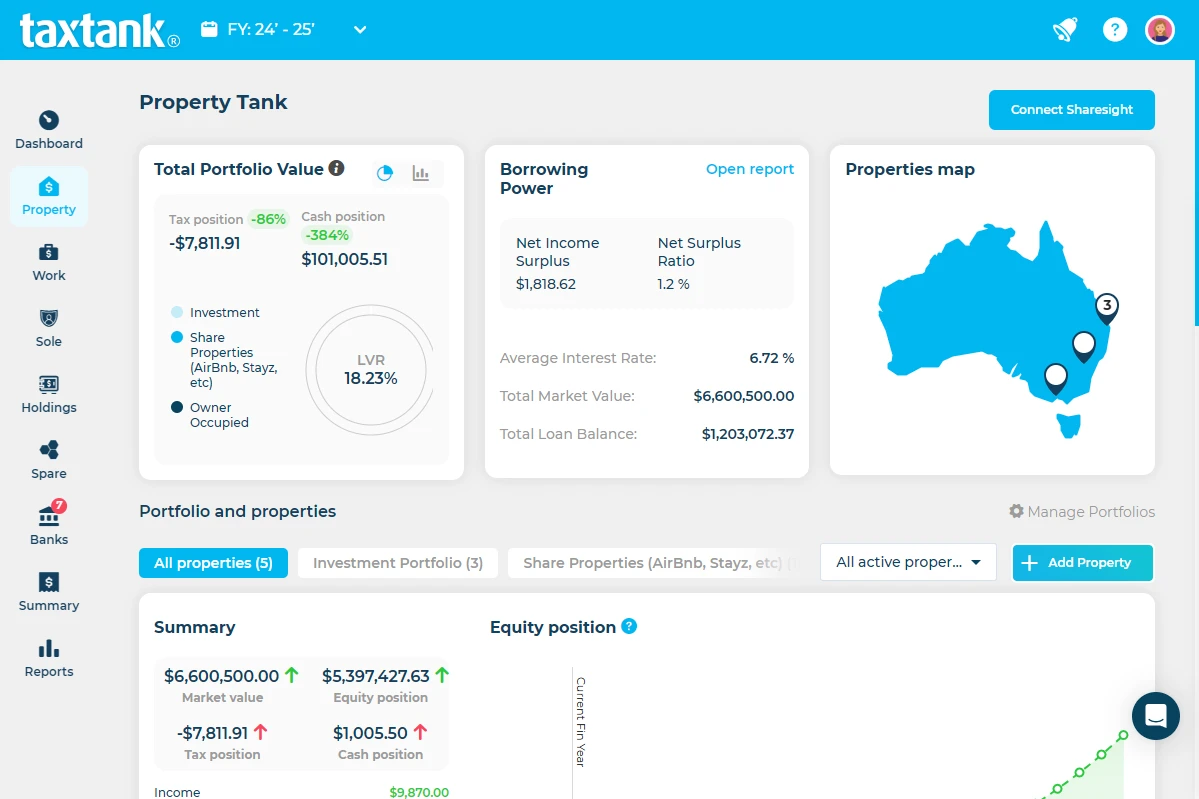

Unlike other platforms that only track rental income and expenses, TaxTank is the only rental property accounting software that manages all your income types – property, employment, sole trader, shares, crypto, and more – so you can understand your true tax position year-round.

Why You Need Specialist Rental Property Accounting Software

Owning an investment property is not like running a standard business. It involves capital gains tax (CGT), depreciation schedules, and property-specific deductions such as loan interest, repairs, insurance, and management fees.

General accounting tools like Xero and MYOB can record transactions, but they don’t:

- Track all your income sources alongside property income

- Show your true tax position in real time

- Manage CGT calculations for property sales

- Handle ATO-compliant depreciation without manual spreadsheets

- Provide property value forecasts and ownership apportionment tools

Without a rental proeprty accounting software like TaxTank, investors often:

- Miss deductions and overpay tax

- Spend hours reconciling bank statements

- Struggle to keep documents organised for the ATO

- Fail to forecast the after-tax return of their properties

- Rely on accountants to fix avoidable record-keeping mistakes

TaxTank – The Complete Rental Property Accounting Software for Australian Property Investors and Landlords

TaxTank was built by Australians for Australians. Every feature is designed to fit seamlessly within ATO rules and the realities of the Australian property market. It’s not just a ledger or a spreadsheet – it’s a complete tax management system for your entire financial life.

1. Live Bank Feeds and Automated Transactions

Secure Open Banking connections link directly to your bank accounts. Rent payments and expenses flow in automatically. Automation rules instantly categorise recurring items like loan interest or strata fees, cutting hours of manual work.

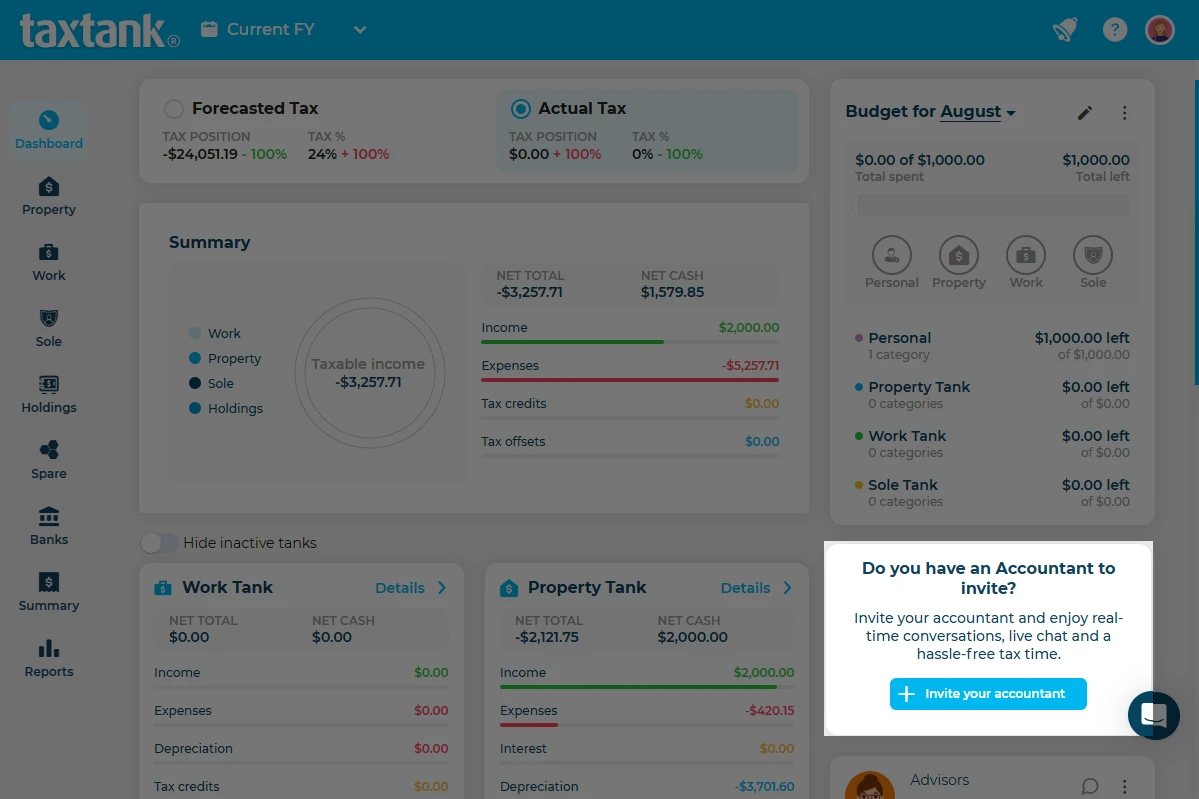

2. Real-Time True Tax Position

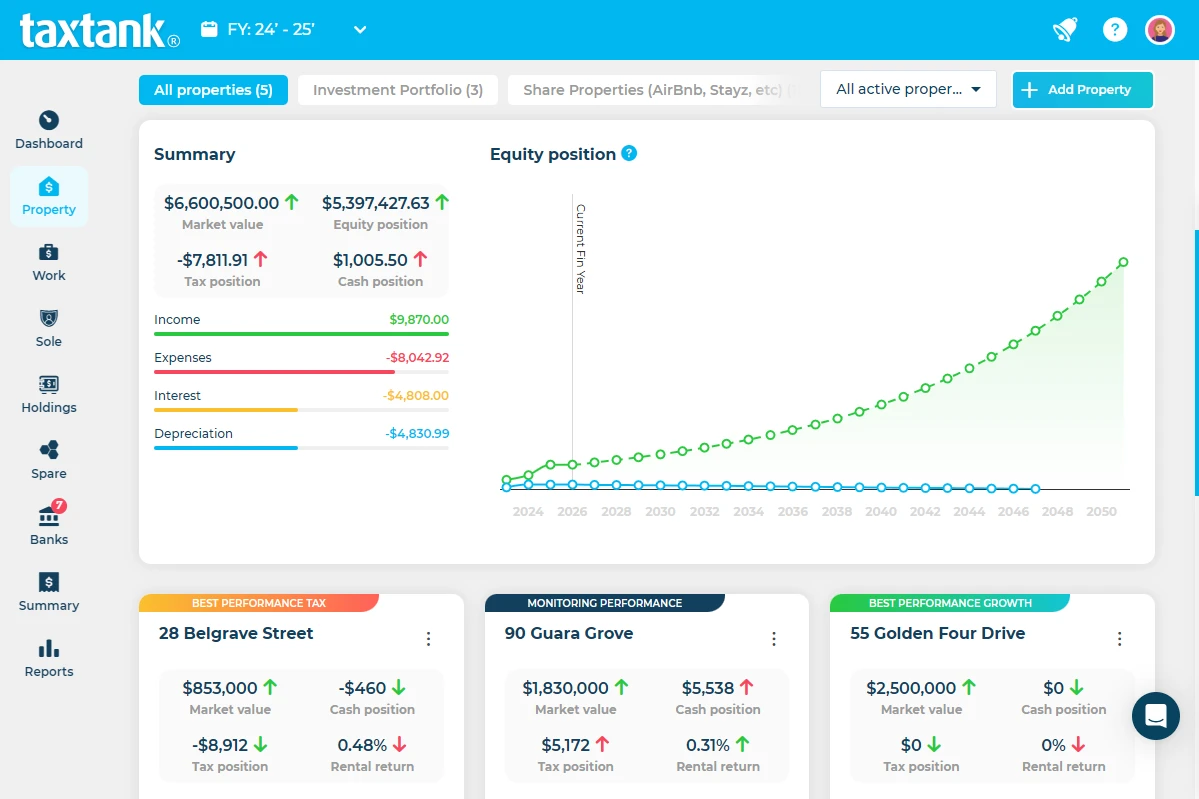

Because TaxTank tracks all your income sources – including wages, sole trader earnings, investments, and property – it shows your true after-tax position at any point in the year. You’ll see instantly if your rental properties are creating a refund or pushing you into a higher tax bracket.

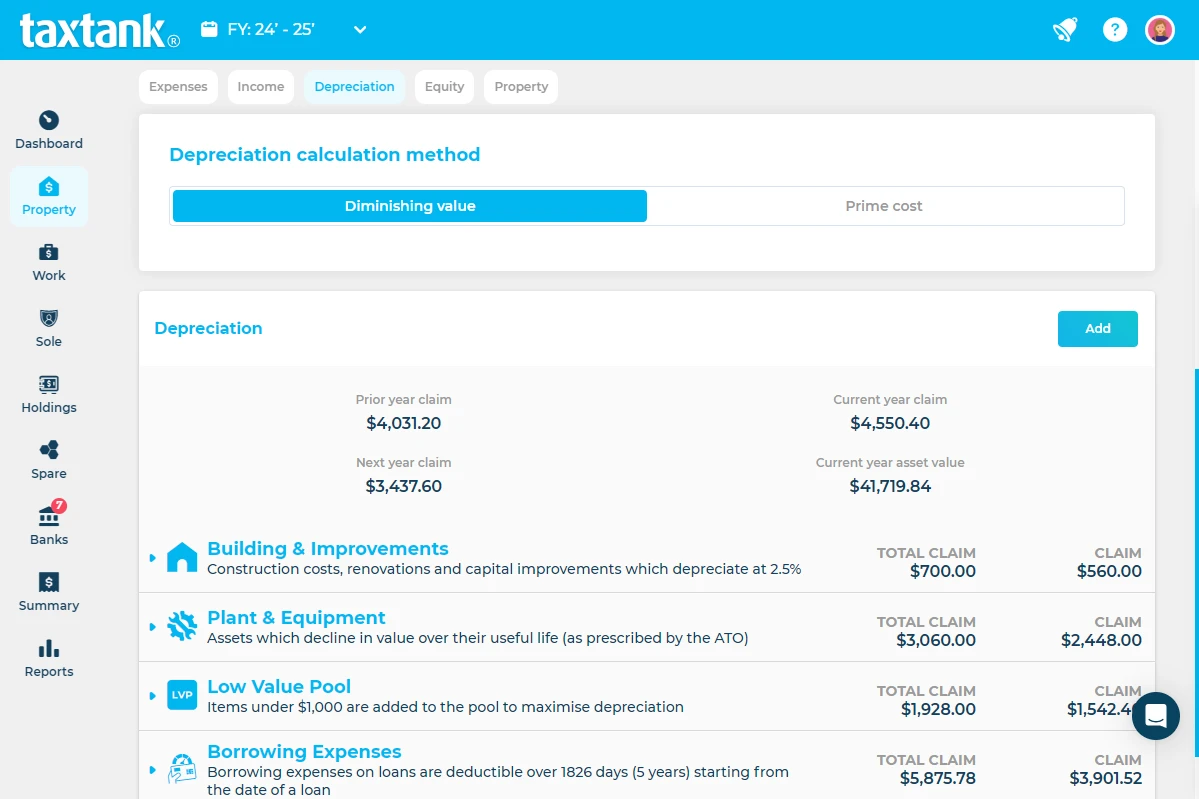

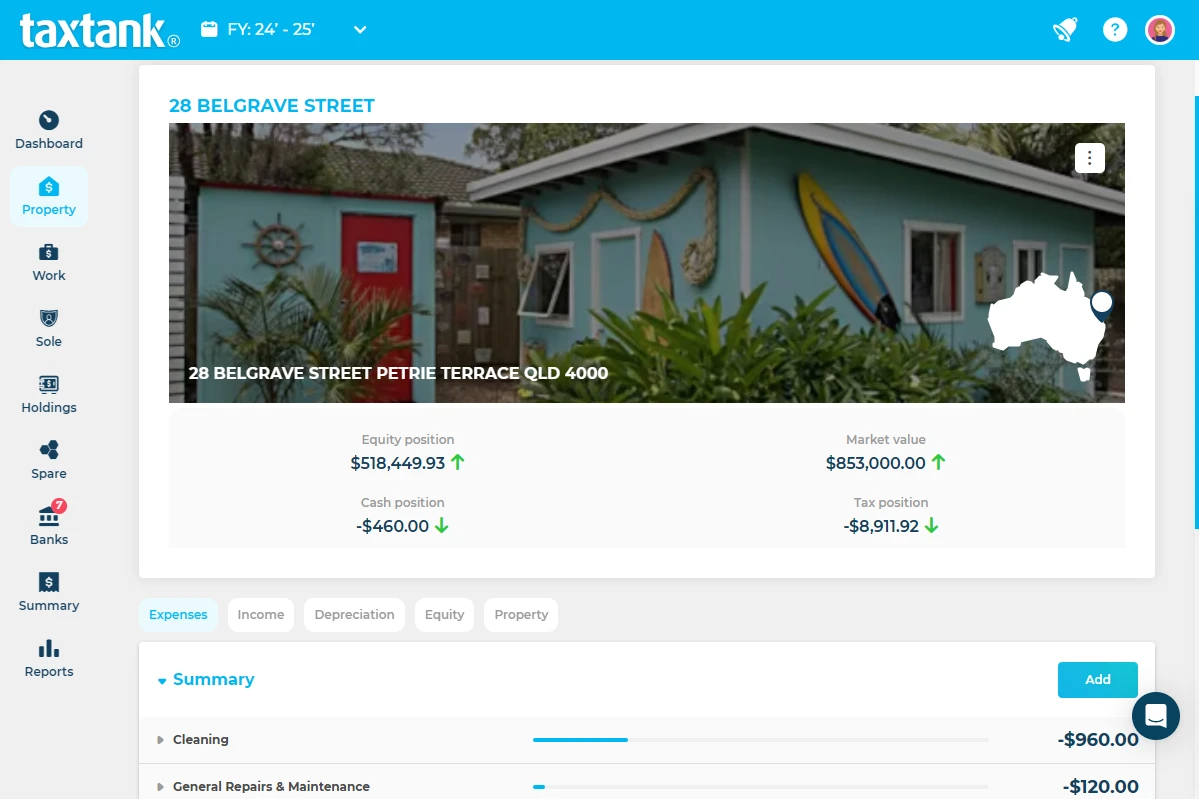

3. Depreciation and Capital Works Tracking

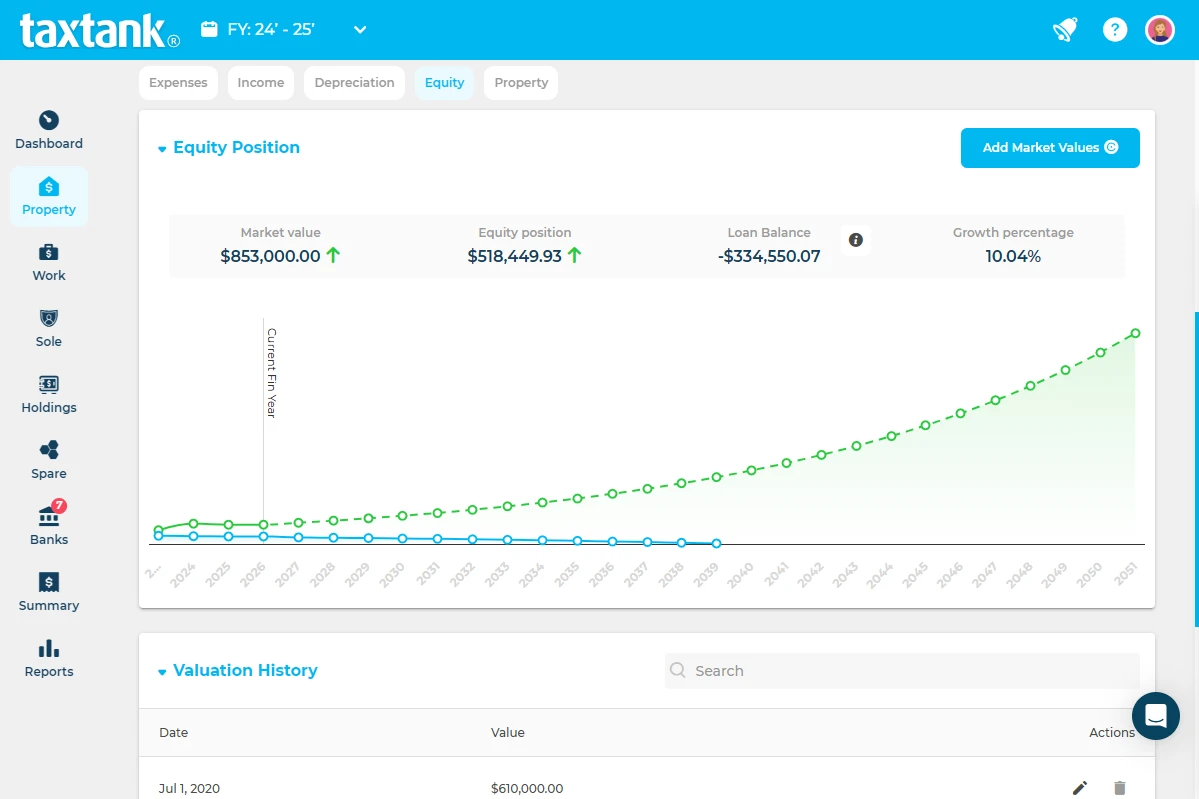

TaxTank calculates Division 40 (plant and equipment) and Division 43 (capital works) depreciation, integrating with CoreLogic for property valuations. Every asset is tracked for its full life so you never lose legitimate deductions.

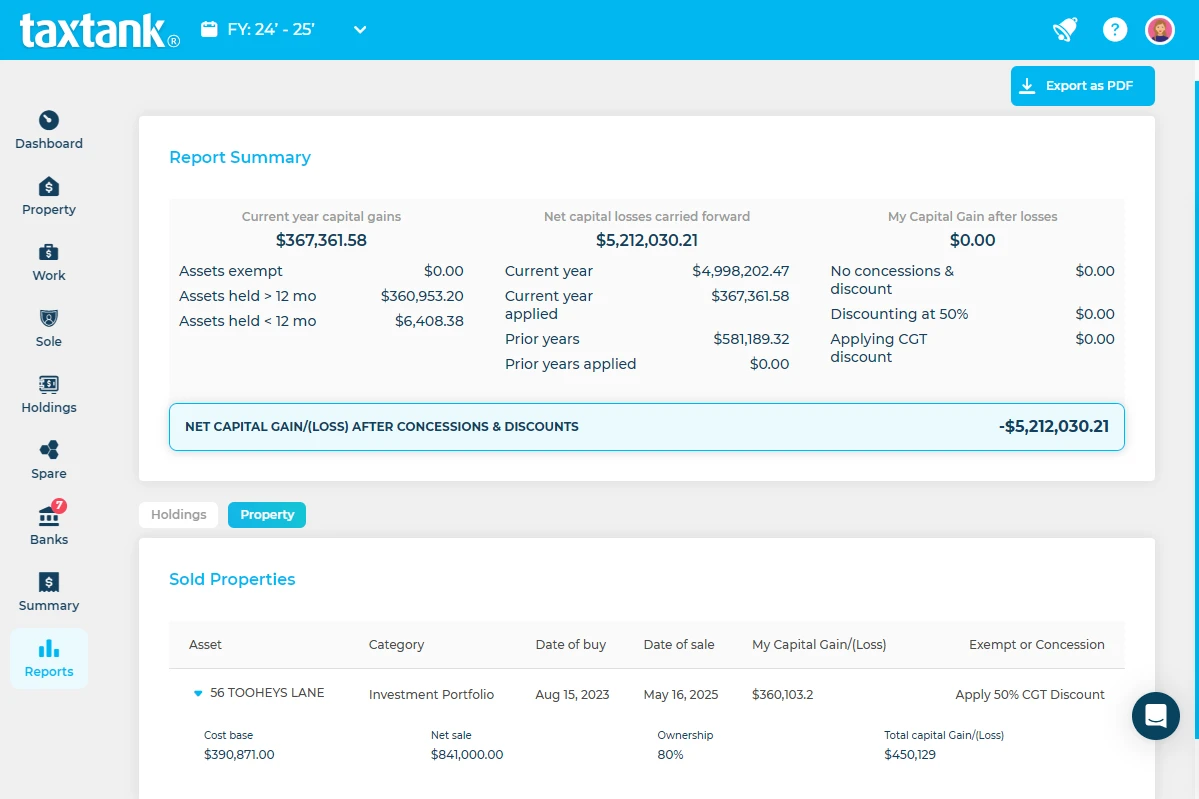

4. CGT Calculator for Property and Other Assets

Selling property, shares, or crypto? TaxTank’s CGT calculator handles cost base adjustments, ownership periods, and discounts automatically. You’ll know the after-tax result before you sell.

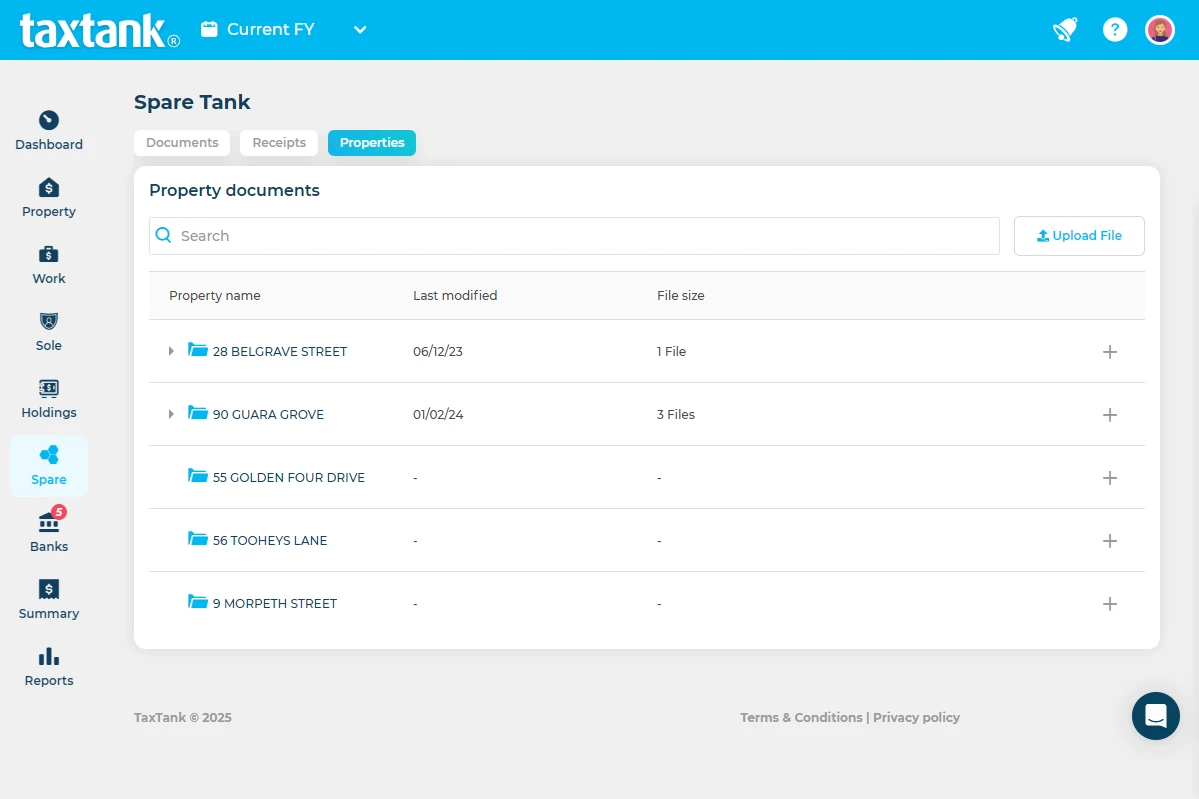

5. ATO-Compliant Record Keeping

Receipts, invoices, and supporting documents are stored securely online with a full audit trail that meets ATO substantiation rules. Accountants can access everything instantly, reducing billable hours and stress.

Key Rental Property Accounting Software Features That Put TaxTank Ahead

| Feature | TaxTank | Xero/MYOB | Excel |

|---|---|---|---|

| Live Bank Feeds | ✅ | ✅ | ❌ |

| Tracks All Income Types | ✅ | ❌ | ❌ |

| Automated True Tax Position | ✅ | ❌ | ❌ |

| CGT Calculator | ✅ | ❌ | ❌ |

| Depreciation Tracking | ✅ | ❌ | ❌ |

| ATO-Compliant Storage | ✅ | ❌ | ❌ |

| Property Value Forecasting | ✅ | ❌ | ❌ |

Designed for Every Australian Investor

TaxTank works whether you:

- Own a single rental property

- Manage a multi-property portfolio

- Run short-term rentals like Airbnb or Stayz

- Share ownership in a joint investment

- Combine property investing with a job, side hustle, or other investments

Because it manages all your income types, you can finally see the full picture — how every dollar you earn affects your overall tax position.

How TaxTank Helps You Save Money

TaxTank doesn’t just store numbers – it actively helps you plan and save:

- Interest deductions are pulled straight from bank feeds

- Expense apportionment tools split costs for shared or mixed-use properties

- Negative gearing insights show how your property impacts your personal tax

- Scenario modelling helps you decide whether to sell or hold

This proactive approach means you’re not scrambling at tax time – you’re planning all year for the best outcome.

Seamless Accountant Collaboration

Your accountant gets clean, organised, ATO-ready data directly from TaxTank. No messy spreadsheets, no missing receipts, no guesswork. This reduces both your workload and your accountant’s bill.

Built for Security and Privacy

TaxTank complies with Australian privacy laws and stores all data on secure Australian servers with bank-grade encryption. Your data is never sold to third parties. You can also add MFA for an additional layer of security.

Pricing That Delivers Value

TaxTank offers affordable subscription plans that scale with your needs. Considering the tax savings, reduced accountant fees, and time saved, most investors find the platform pays for itself several times over.

FAQs About TaxTank – Australia’s No. 1 Rental Property Accounting Software

What is the best rental property accounting software for landlords in Australia?

For Australian landlords, the best bookkeeping software is one that is purpose-built for property investors, fully compliant with the ATO, and able to track all income sources to give a true tax position. TaxTank is widely recognised as the No. 1 choice because it doesn’t just record rental income and expenses – it also handles employment income, sole trader earnings, shares, crypto, and other investments in one platform. With features like live bank feeds, automated tax calculations, CGT and depreciation tracking, and secure, ATO-compliant storage, TaxTank helps landlords maximise deductions, reduce tax, and save hours of manual bookkeeping every year.

Can TaxTank handle multiple rental properties in one account?

Yes. TaxTank is designed to manage single or multi-property portfolios. You can track income, expenses, deductions, and depreciation for each property individually, while also seeing the overall impact on your total tax position.

How does TaxTank help with negative gearing?

TaxTank automatically calculates the tax implications of negative gearing, showing how losses from rental properties offset other income. By tracking all your income streams, you get a complete view of your tax benefits and liabilities in real time.

Can I use TaxTank for short-term rentals like Airbnb?

Absolutely. TaxTank supports short-term and long-term rental properties, tracking income, expenses, and occupancy-related costs. You can also see the full tax impact alongside other income, making it ideal for hosts with multiple revenue streams.

Will TaxTank help me plan for Capital Gains Tax when selling a property?

Yes. TaxTank includes a CGT calculator that factors in purchase price, improvements, ownership period, and any discounts. It calculates the after-tax outcome so you can plan your property sale with confidence.

Does TaxTank integrate with accountants or tax agents?

Yes. TaxTank provides ATO-ready reports and digital storage, allowing your accountant to access clean, organised data. This reduces errors, saves time, and ensures you receive accurate advice and tax preparation. You can also invite them for free so they can access your account throughout the year so they can provide live advice.

Can TaxTank handle past financial years?

Yes. TaxTank goes all the way back to 2021/2022 Financial year so you can mport previous years’ transactions and property data to create a complete tax history, ready for CGT and performance analysis. TaxTank also grandfathers any tax changes so you can stay confident every year has the correct tax law applied.

Does TaxTank replace my accountant?

No. TaxTank keeps perfect records so your accountant can focus on advice and strategy, not fixing errors. If you do want to lodge yourself, then you can also use the interactive, live reports to claim with confidence.

Is it worth it if I only own one property?

Absolutely. Even with one property, TaxTank’s deduction tracking and true tax position view can save you hundreds.

Can I track my work income, shares, crypto, and sole trader income too?

Yes. TaxTank is the only property accounting software in Australia that also manages work income, sole trader earnings, and investment income.

Is my data secure?

Yes. All data is encrypted, stored in Australia, and protected by local privacy laws.

The Bottom Line – The Only Property Accounting Software That Truly Manages Everything

For Australian landlords who want more than basic record-keeping, TaxTank is the only choice. By tracking all income types alongside your rental properties, it gives you the full tax picture you need to make smarter financial decisions.

With real-time true tax position tracking, automated bank feeds, depreciation and CGT tools, and ATO-compliant storage, TaxTank is the No. 1 rental property accounting software in Australia – and the only one that truly manages everything.

Start today with TaxTank and see exactly where you stand – across property, work, business, and investments – every single day of the year.