Most people don’t have a single financial identity.

There’s the personal you.

There’s you as a sole trader.

There’s you with properties, but in a trust, SMSF or company.

And sometimes there’s you, jointly, with someone else entirely.

Everyone understands this in theory. Banks do. Tax law definitely does. Open banking, however, has historically been far more limited, typically working off a single profile at a time.

Which usually leaves users doing small but annoying things to make it all work reconnecting bank feeds, keeping mental notes about which login is which, or explaining (again) why the same person has multiple accounts.

It works. Mostly. But it’s not exactly elegant.

Where things got messy

Open banking doesn’t see “one person”. It sees profiles.

A personal login here.

A business login there.

A separate one again for trusts or companies.

Until now, that meant those profiles had to be managed separately, even though, in real life, it’s all one financial picture.

That disconnect was never ideal, and it didn’t reflect how people actually operate.

The fix: Multiple IDs

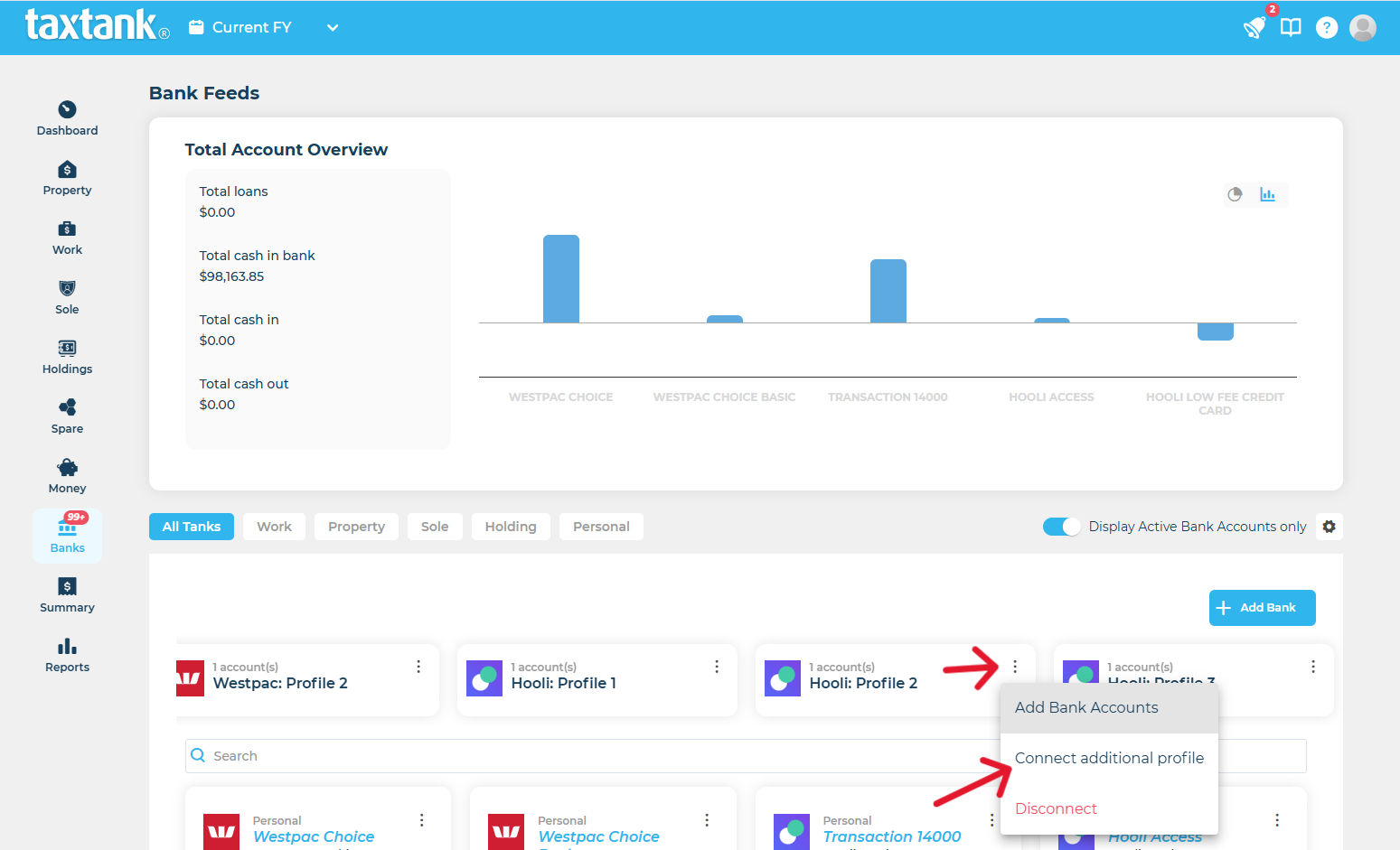

We’ve released Multiple IDs to solve exactly that problem.

You can now connect more than one bank profile to a single TaxTank account, cleanly and intentionally, without breaking existing feeds or starting again.

From the dashboard, just select the three dots on a bank tile and choose “Connect another profile”, then follow the prompts as usual.

Each profile:

- connects independently

- has its own open banking consent

- can be managed without affecting the others

Which means fewer workarounds, and far less mental bookkeeping.

Why this matters

This isn’t just about convenience (although it definitely helps).

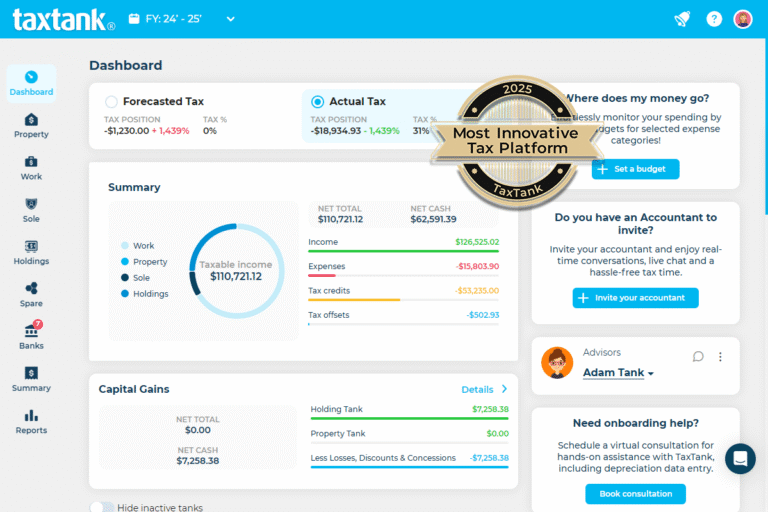

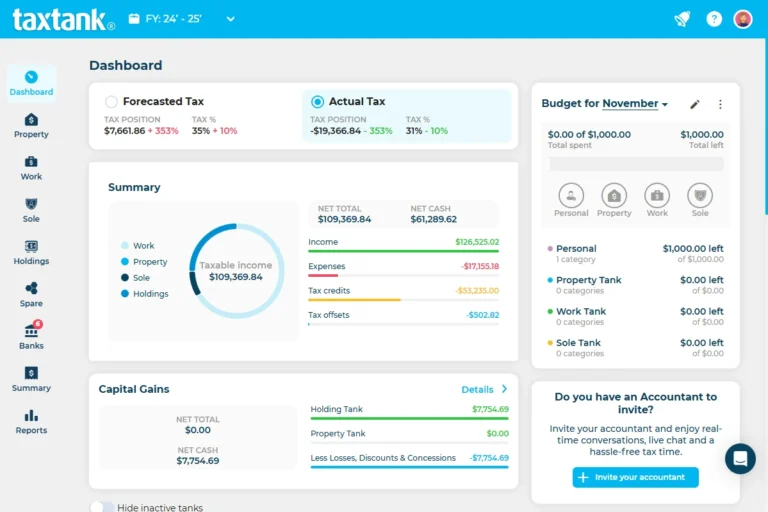

It means your TaxTank account can finally reflect how your financial life actually works. Personal, business and entity accounts can sit side by side, with clean allocations, clearer reporting, and far fewer “why is this here?” moments.

Budgeting becomes easier. Tax reporting makes more sense. And everything stays connected without being tangled.

Built for real people, not perfect examples

Most people don’t fit neatly into one box, and neither should their software.

Multiple IDs lets your TaxTank account adapt as your situation changes, without extra admin or duplicated setups. It’s a small change that removes a lot of friction.

Which is exactly how good features should work.

If your finances don’t fit neatly into one box, your software shouldn’t either. Get started with to TaxTank and connect another profile today.