Many people start a side hustle while still working a full-time job or juggling other responsibilities such as family and education. While having a side hustle can be fulfilling and lucrative, balancing it with other responsibilities can be challenging. Here are some tips on how to find balance and avoid burnout.

Set realistic expectations for your side hustle

It’s important to be realistic about what you can achieve in the time you have available. Be honest with yourself about how much time and energy you have to devote to your side hustle, and set achievable goals. Don’t try to do too much too quickly or you may become overwhelmed and discouraged.

Create a schedule

Creating a schedule can help you manage your time effectively and ensure that you are making progress on your side hustle while still meeting your other commitments. Block out time in your calendar and treat that time as sacred. Be disciplined about sticking to your schedule, but also be flexible enough to adjust it when necessary.

Focus on high-value activities

When you have limited time available, it’s important to focus on high-value activities that will have the biggest impact on what you’re trying to achieve. Identify the key tasks that will move your business forward, and prioritise those over less important tasks. This will help you make the most of the time you have available and avoid wasting time on activities that won’t contribute to your success.

Leverage technology

Technology can be a powerful tool for scaling up your side hustle. Consider implementing automation tools, customer relationship management systems, and other software that can help you streamline processes and improve efficiency.

Manage your finances online

Managing finances is a crucial aspect of running a successful side hustle. You’ll need to have a good understanding of your income, expenses, and overall financial performance to make informed decisions about your business. Tracking your income and expenses, creating and sending invoices, and generating financial reports is vitally important to ensure you know what’s happening in your business.

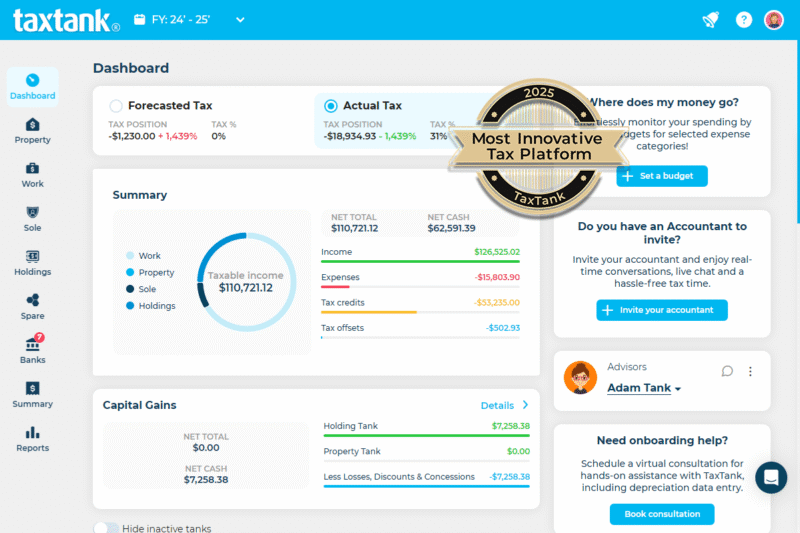

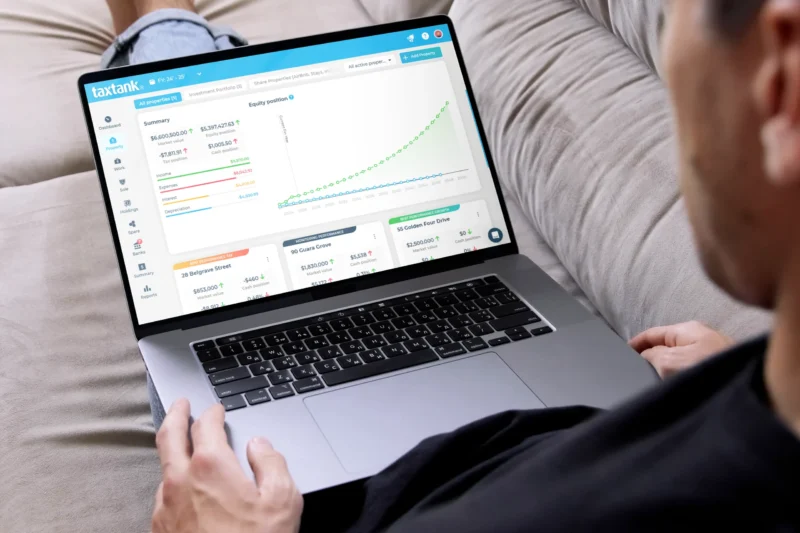

You can look to utilise a software like TaxTank’s innovative sole trader tax platform. TaxTank provides all the features you need to make sure your side hustle or sole trader tax obligations are under control. With auto invoicing, business reporting, and smart tools that help you track income, expenses and tax obligations. you’ll never have to worry about tax time ever again!. Rather than stressing about the numbers, TaxTank helps you focus on expanding your business and earning more money.

Learn to say no

One of the biggest challenges of balancing a side hustle with other responsibilities is learning to say no. It can be tempting to take on every opportunity that comes your way, but if you spread yourself too thin, you may end up compromising the quality of your work or burning out. Learn to say no to opportunities that aren’t aligned with your goals or that you don’t have time for.

Take care of yourself

It’s easy to neglect self-care when you’re juggling multiple responsibilities, but taking care of yourself is essential if you want to avoid burnout and perform at your best. Make time for exercise, relaxation, and activities that bring you joy. Prioritising self-care will not only help you manage stress, but it will also help you perform better in all areas of your life.

Ask for help

Finally, don’t be afraid to ask for help when you need it. Whether it’s asking a friend or family member to help with childcare, hiring a virtual assistant to handle administrative tasks, or reaching out to a mentor for advice, asking for help can make a big difference in your ability to balance your side hustle with other responsibilities.

Final Thoughts

Balancing a side hustle with other responsibilities can be challenging, but it’s not impossible. By setting realistic expectations, creating a schedule, focusing on high-value activities, learning to say no, taking care of yourself, and asking for help when you need it, you can find the balance you need to succeed both in your side hustle and in other areas of your life.

Ready to take your side hustle seriously?

Start with the right tools. TaxTank helps sole traders stay in control of their income, expenses and tax — so you can focus on growing your business, not stressing about the numbers.

Try TaxTank today and make tax one less thing to juggle.