Powerful software for industry professionals

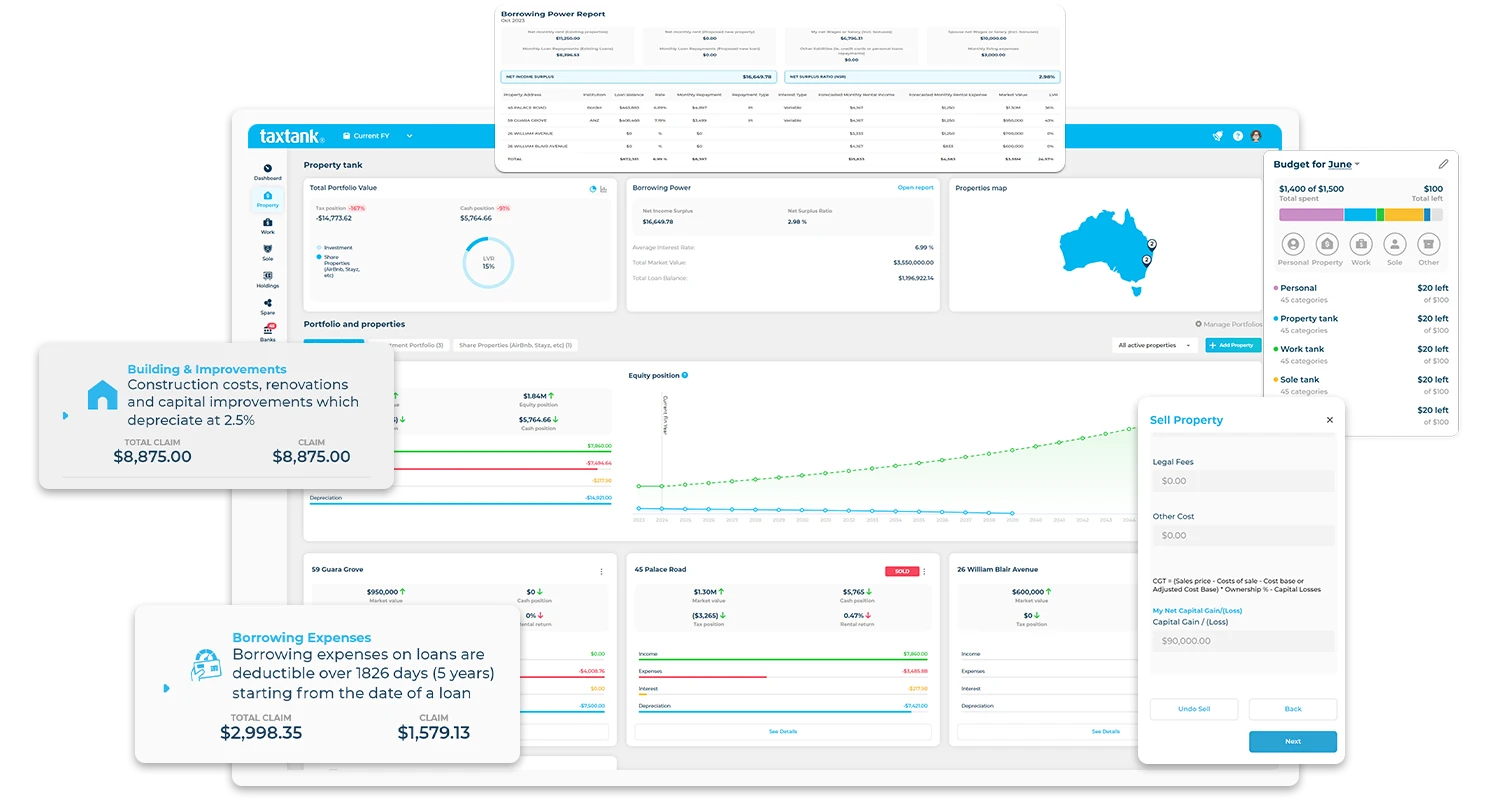

TaxTank is the all-in-one solution that seamlessly covers all income types and asset classes to ensure your clients have complete visibility over their tax and financial position.

Better still, TaxTank is FREE for industry professionals.

Real-time insights for informed decision making

Say goodbye to outdated information and static spreadsheets.

Integrated with third parties like Corelogic, TaxTank provides live market values, growth and equity forecasts, allowing you to monitor your clients’ investment performances in real-time.

With up-to-date data, you and your clients can make confident decisions to drive their financial success now and into the future.

The benefits of using TaxTank

Offer Stand Out Service

Make your services an ongoing source of valuable information to retain and grow your client base. You can monitor your clients’ position throughout the year and easily give advice when needed to proactively help them plan and make better decisions for their financial future.

Build Confidence and Trust

Built by an accountant who specialises in property, and underpinned by Australian tax law, TaxTank automatically calculates and stores capital expenses over time to minimise CGT. Together with the automated tax calculations, including depreciation and borrowing expenses, your clients will ensure they claim every possible deduction.

Access Real-Time Information

A unified solution for all income types and asset classes

TaxTank is not just another software, it’s the all-in-one solution that seamlessly covers all income types and asset classes from just $6 per month.

From property investors to sole trader business schedules, work related expenses, shares and cryptocurrencies, TaxTank offers flexible subscriptions around all areas of the individual tax return.

No need to switch between multiple platforms or complicate your workflow. Our seamless integration allows you to handle all aspects of your clients tax efficiently.

We employed TaxTank’s incredible software as an optional add on for our clients, and it has quickly become an indispensable tool for our company. Not only do we have a far better understanding of property-related tax affairs, but we can now empower our clients to take control of their own tax affairs with our assistance.

TaxTank’s user interface is intuitive, easy to navigate and is categorised by their ‘tanks’, making it effortless for clients to input, track and manage their tax information and view their tax position year-round. The platform offers a wide range of features that allow clients to track expenses, income, depreciation and equity to name a few. Using PAYG and rental income, any deductions and depreciation, the program automatically calculates an incredibly accurate real time tax projection. Not only is the platform easy to navigate, but our clients also have access to a self-service help centre, free tax tools and extensive webinars to support their tax management journey.

Underpinned by Australian tax legislation, TaxTank has assisted our clients in maximising tax deductions and minimising tax paid. Legally, of course! What we love most about TaxTank is the advocacy for and empowerment of Australian taxpayers – this tool is priceless in the fact it guides users to claiming their fair share every financial year.

Mitch Cator & Holly Macdonald

Frequently asked questions

TaxTank gives you direct access to your clients’ live data, which means no more chasing spreadsheets or waiting until the end of the year to spot issues. You can review, advise, and collaborate in real time — saving time and delivering better outcomes.

No, it’s free to register a Firm or Advisor account. Your clients pay for their subscriptions, and you gain access when they invite you. There are no hidden costs for you.

Yes. With a Firm or Advisor account, you can manage all your clients from one login. You’ll see each client’s data, activity, and tax position at a glance.

Once a client invites you, you’ll have access to their live data including income, deductions, property details, capital gains, and more – all updated in real time. No more back and forth at tax time.

Your clients get a clearer view of their finances year-round and feel more confident come tax time. They’ll be more organised, better informed, and less stressed, which makes your job easier too. Plus Accountants can manage their review WIPs directly within TaxTank to ensure excellent service during the busiest time of the year.

Yes. We offer onboarding support, how-to videos, and resources tailored for firms and advisors. We can also walk your team through setup if needed.

Yes. Firm accounts allow you to add team members and control who can see and manage client data, so everyone works within their role securely and efficiently.

It’s ideal for property investors, sole traders, side hustlers, share/crypto investors and clients with complex or mixed income. Basically anyone who wants to stay organised and optimise their tax position year-round.

Yes. TaxTank follows ATO guidelines and is built to support compliance. It doesn’t replace tax agents or accountants, it helps clients stay organised so you can do your job more efficiently.

TaxTank is designed for individuals, but many sole traders and micro businesses use it to manage income and expenses, track deductions, and prepare for year-end. For larger businesses, we recommend keeping your current business accounting software in place.