If you claim work-related deductions in Australia, the Australian Taxation Office (ATO) has you on its radar, even if you don’t realise it. One of their favourite tools is the occupation benchmark, which is the “average” deduction claimed by people in your job. Stay under it, and you’re less likely to get flagged. Go over it, and you could be in line for a review or audit.

The good news? You can still maximise your tax refund without crossing the line. Here’s how to claim every deduction you’re entitled to while keeping the ATO happy and dodging the bot tactics.

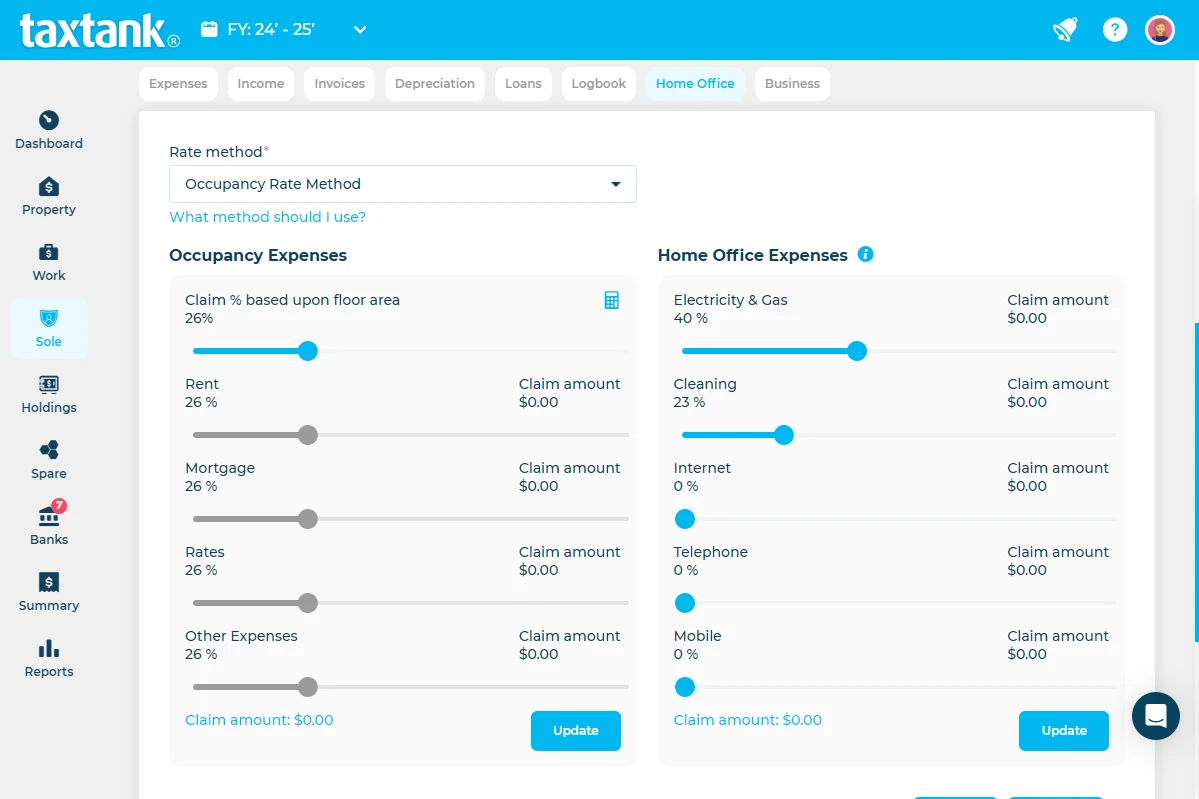

1. Track Every Home Office Hour and Expense

Whether you claim using the fixed rate method or the actual cost method, you need a daily log. The more accurate your records, the better your chance of claiming the bigger deduction at tax time. Pro tip: Track both methods during the year so you can choose the one that gives you the highest legal claim.

2. Record Actual Work-Related Deductions as They Happen

The “hunt through receipts in June” approach is a recipe for missed deductions. Faded receipts, forgotten purchases, and misplaced records can cost you real money. Treat your deductions like the ATO treats tax – manage them all year round.

3. Keep Receipts for Everything – Even Under $300

Many Australians think the $300 no receipts rule means you don’t need proof. Not true. The ATO can still ask you to show that your spending was work-related, and a bank statement may not be enough. Hold onto receipts for at least five years so you can back up every claim.

4. Match Expenses and Education to Your Role

The ATO looks for expenses that don’t match your job profile. The same goes for self-education expenses that don’t directly link to your current income-earning work. If your claim is legitimate but not obvious, keep an email or letter from your employer to show why it’s relevant. Always check your deductions against the ATO’s occupation benchmark for a reality check.

5. Apportion Private Use Correctly

Claiming 100% work use for something you also use at home is risky. The ATO’s data-matching can pick up inflated work-use percentages. Keep records of how you calculated your split, and if in doubt, use the ATO’s recommended apportionment method.

The TaxTank Advantage

TaxTank makes staying ATO-audit ready easy. With live bank feeds, permanent records, an integrated home office diary, and tools to store receipts, track expenses, and apportion private use correctly, you can claim confidently, even if your deductions are over the benchmark.

Ready to take control of your work-related deductions and stay safe from ATO audits?

Start tracking your expenses and home office hours effortlessly with TaxTank today. Sign up now and make tax time stress-free and rewarding.