Mortgage brokers have quietly seized control of Australia’s lending landscape. They now handle 76.8% of all new home loans, a record-breaking $400+ billion in annual settlements. The big banks? They’re not exactly celebrating.

Since the Banking Royal Commission rattled confidence and rewired trust, borrowers have been voting with their feet, and their thumbs. As banks shut branches (over 40% gone since 2017) and pivot to digital self-service, the “relationship manager” has been replaced by an app notification.

Brokers stepped into the gap promising transparency and choice; banks fought back with cashback lures, “loyalty” campaigns, and frictionless digital apps built to skip the middleman, and arguably your ability to negotiate.

It’s a $400 billion tug-of-war, and the prize isn’t just your mortgage, it’s your data, your loyalty, and your financial blind spots.

The Numbers Tell the Story

- 77 % broker market share, up from 52 % a decade ago (MFAA 2025)

- $121 billion in loans written by brokers in the March 2025 quarter alone

- Average savings for refinancers via brokers: 0.36 % lower interest rates (CoreLogic 2025)

- Yet the Big Four still hold roughly 70 % of Australia’s total mortgage debt, proof this fight is far from over

The Real Disruption: Digital Borrowing Power

Forget the old battle between banks and brokers, the real contest now isn’t about who writes the loan, it’s about who owns the data.

Banks are leveraging real-time insights from transaction histories, property valuations, and repayment behaviour to anticipate refinancing moments and deliver offers before you even start shopping around. It’s smart business, and when done right, it can genuinely save borrowers money.

Meanwhile, brokers are evolving too. With open banking and intelligent algorithms reshaping how borrowing power is assessed, the focus is shifting from guesswork and paperwork to real-time precision and proactive advice.

The real breakthrough? Borrowers now have access to the same data edge, transforming the power dynamic and opening the door to smarter, faster, and fairer financial decisions.

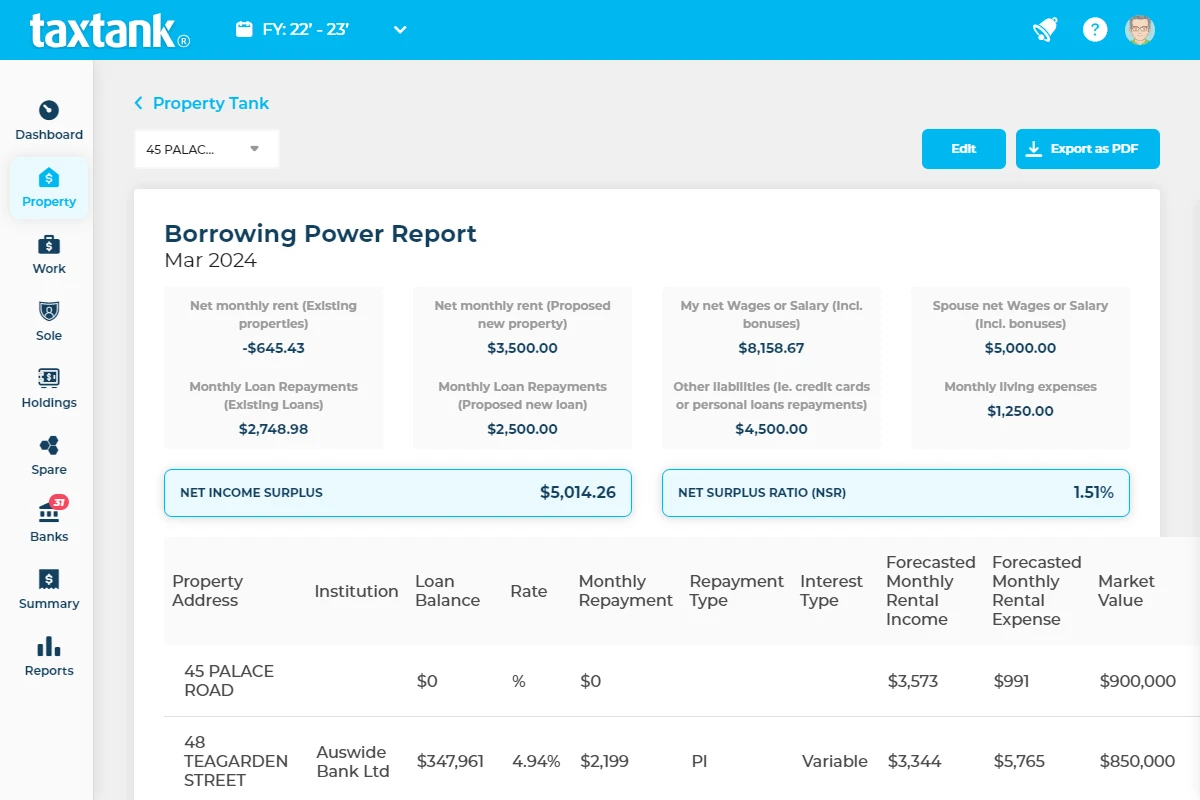

Platforms like TaxTank are reshaping the future of lending, transforming scattered financial data into a connected, intelligent ecosystem where income, expenses, assets, and liabilities work together in real time, across every aspect of tax and investment, powered by live bank feeds and market values.

Invite your bank or broker — or better yet, both — into your dashboard and let the competition work for you. With instant access to your live portfolio, structure, and lenders, they’re no longer just filling out forms; they’re racing. Faster reviews, smoother approvals, and sharper offers become the norm as each competes to win your business and land the best deal on the table.

Because in the next phase of digital lending, power won’t belong to whoever holds your loan, it’ll belong to whoever holds the best data. And with TaxTank, that’s you.

💡 TaxTank Tip

With TaxTank, every loan, property, rate, and deductible expense lives in one place. Whether a broker structures the deal or a bank automates it, you hold the advantage, the insight, the clarity, and the live tax position to negotiate on your terms.

Because while banks promise loyalty and brokers promise freedom, TaxTank delivers control — transparent, data-driven, and undeniably yours.

Negotiation Power Stats

- 40 % of Australians now spread their finances across three or more banks (RBA 2025)

- Refinancing volumes hit $21 billion a month in 2025 — the highest on record (ABS Lending Indicators 2025)

- Four in five refinancers could shave at least 0.30 % off their rate by switching (Finder Mortgage Report 2024)

- Digital lending platforms grew 42 % year-on-year, giving borrowers faster access to competitive rates (KPMG Fintech Trends 2025)

Take control of your mortgage and refinancing opportunities today. Sign up for TaxTank to see all your loans, rates, and property data in one place and make smarter financial decisions.