Managing your personal finances has never been more important. Whether you’re a sole trader, property investor, crypto trader, or simply an employee looking to stay on top of your tax obligations, having a reliable, easy-to-use personal accounting software can make all the difference. TaxTank stands out as one of the most robust and versatile personal accounting tools available in Australia, designed to simplify your financial life and ensure you stay compliant with the Australian Taxation Office (ATO) requirements.

Why TaxTank is the Top Personal Accounting Software for Australians

Australians are increasingly turning to digital solutions to manage their finances. Unlike generic accounting software, TaxTank has been specifically built with the Australian market in mind. This means it accommodates local tax laws, compliance standards, and reporting requirements. With automatic integration with bank feeds and intelligent tax calculations, TaxTank is not just software; it’s a financial companion that keeps you ahead.

Key benefits include:

- Automated tax reporting that ensures accuracy and reduces errors

- Intuitive dashboards to monitor income, expenses, and investments

- Seamless integration with banks through Open Banking, Sharesight, CoreLogic, and more

- Customisable alerts for bills, payments, and other deadlines

These features combine to create an all-in-one solution that caters to every aspect of your financial life.

Comprehensive Tax Management Made Easy

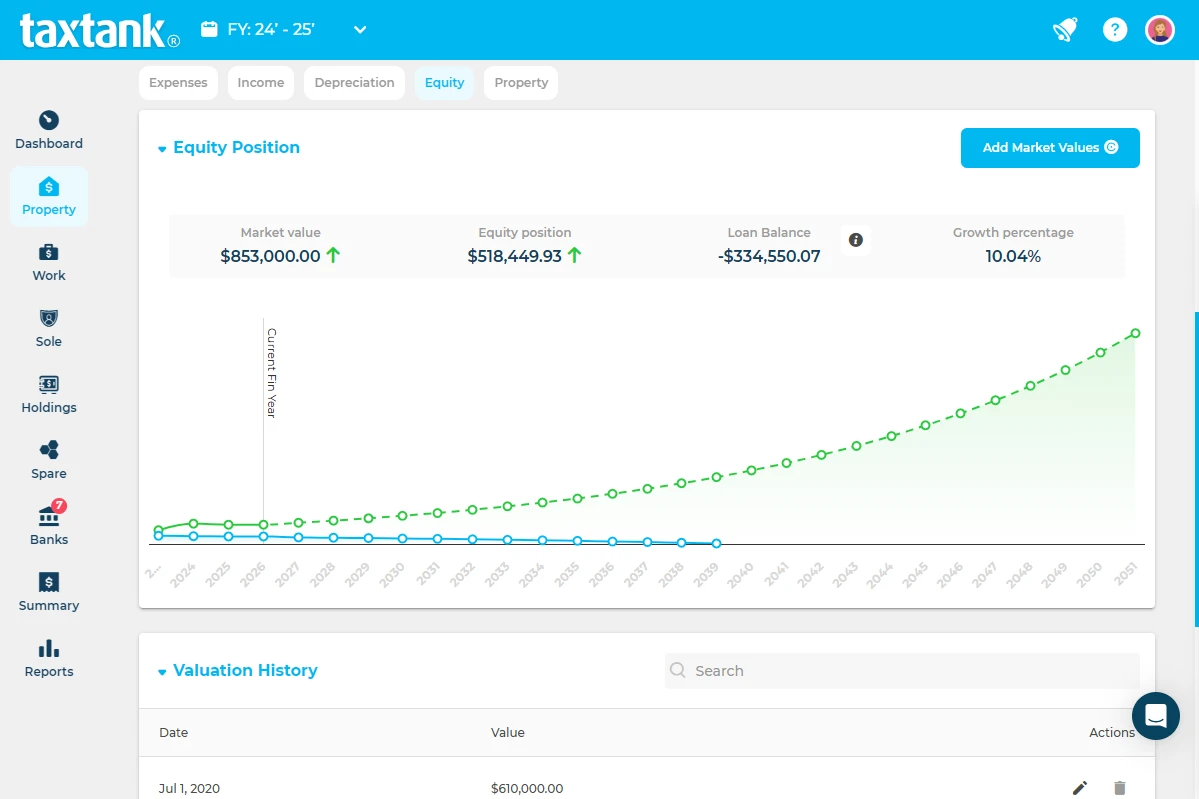

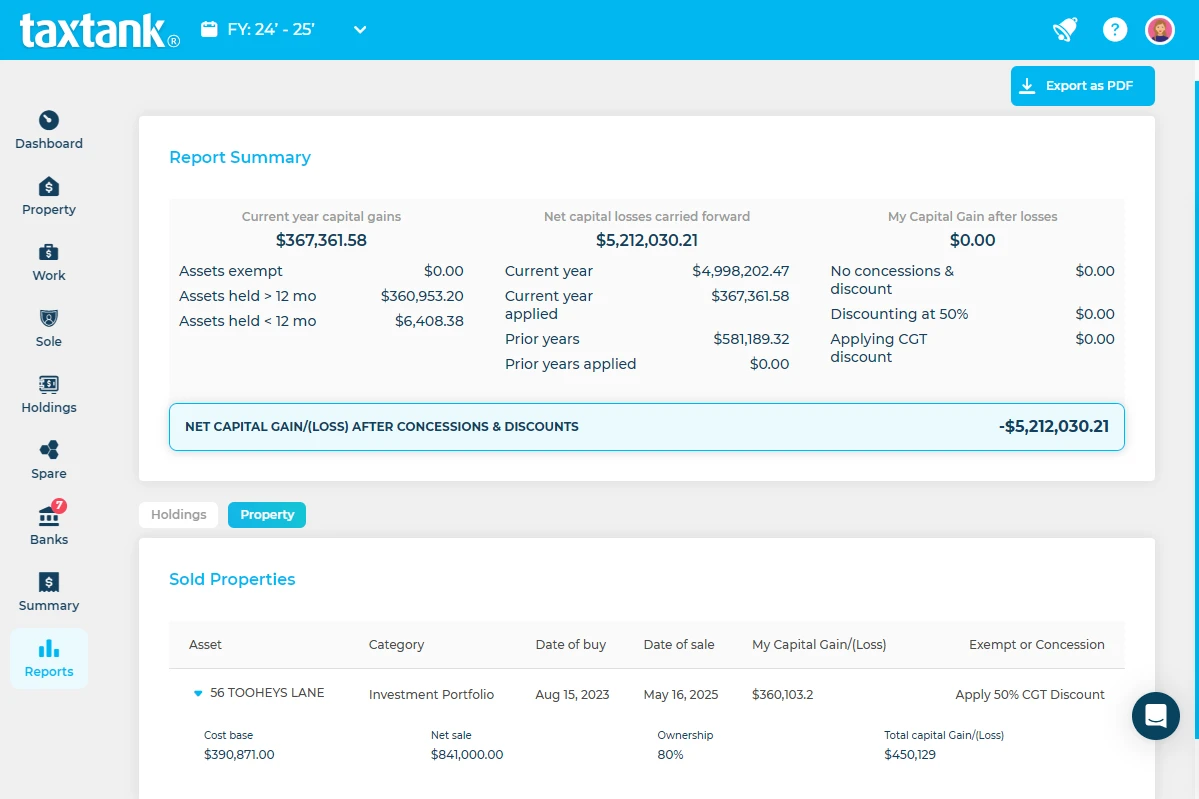

One of the standout features of TaxTank is its ability to handle tax management effortlessly. Australian tax rules can be complex, with different rules applying for income, property investments, and capital gains. TaxTank simplifies this with automated depreciation, capital gains tax calculations, detailed tax reports, and easy tracking of income and expenses. This ensures you never miss a claim and optimise your tax return.

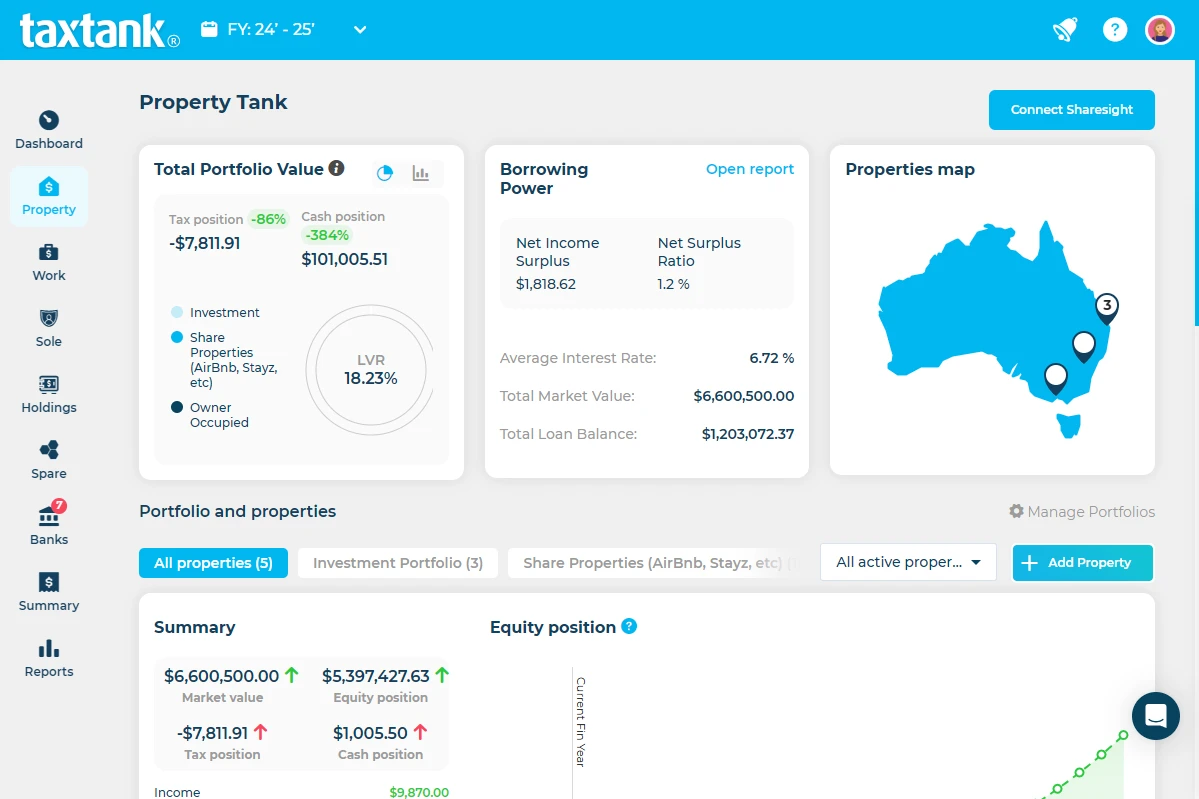

With the Holdings Tank feature, TaxTank takes tax management a step further by allowing users to track shares, crypto, and other unlisted assets in real time. Every transaction is captured and categorised automatically, making end-of-financial-year preparation quick and stress-free. For property investors, features like CoreLogic integration provide live property value updates and address verification, helping you accurately calculate depreciation and capital gains.

Real-Time Financial Insights

Knowing where your money is going is essential. TaxTank provides real-time insights into your financial health through its comprehensive dashboard. You can see:

- Income vs expenses trends over any period

- Investment performance for shares, crypto, and property

- Budgeting and complete financial oversight

This level of detail enables informed financial decisions, allowing you to budget better, invest wisely, and minimise tax liabilities. The dashboard’s visual tools, such as charts and graphs, make complex financial data easy to digest, even for users who are not accounting-savvy.

Automation That Saves Time

Time is money, and TaxTank understands that. Its automation features eliminate repetitive tasks:

- Bank feed imports automatically capture transactions

- Intelligent categorisation rules assign transactions correctly

- Customisable automation rules adjust for personal financial nuances

For example, you can set up rules to manage all of your regular transactions in TaxTank so it automatically classify your transactions as soon as they sync from bank feeds. These automation capabilities reduce manual data entry, prevent errors, and free up time for users to focus on growing their wealth.

Perfect for Sole Traders and Small Businesses

Sole traders and small business owners often face the dual challenge of managing personal finances and business accounts. TaxTank addresses this with dedicated features for sole traders, including:

- GST tracking and BAS preparation

- Invoice generation and expense management

- Integration with bank feeds for real-time reconciliation

- Home Office deductions management

- Vehicle management with logbooks and chattel mortgages

- Small business asset write-offs and depreciation, including small business pool

With TaxTank, you can separate personal and business finances seamlessly. This not only helps with accurate tax reporting but also gives a clearer picture of business performance, enabling smarter decision-making.

Integration with Investment Platforms

Investors demand precise tracking and reporting. TaxTank connects with major Australian investment platforms like Sharesight to provide live updates on trades and portfolio values. This integration means:

- Automatic retrieval of trade history

- Real-time calculation of capital gains and losses

- Easy preparation of tax reports for share trading

Crypto investors benefit too. TaxTank’s Holdings Tank allows for tracking of popular Australian crypto exchanges, helping calculate taxable gains and losses accurately. This is particularly crucial in Australia, where the ATO requires detailed reporting for digital assets.

User-Friendly Interface and Experience

A powerful tool is only effective if it’s easy to use. TaxTank excels in delivering a user-friendly interface that balances functionality with simplicity. Key elements include:

- Clean, intuitive navigation that reduces learning curves

- Searchable transaction history for quick audits

- Customisable dashboards tailored to your financial priorities

Even users with minimal accounting experience can confidently navigate the platform, manage investments, and complete their tax obligations without frustration.

Security and Data Protection

In today’s digital environment, security is paramount. TaxTank employs bank-grade encryption, multi-factor authentication, and strict data protection protocols to ensure your financial information remains safe. Users can confidently link bank accounts and investment platforms knowing that sensitive information is secure.

Support and Expertise

A unique aspect of TaxTank is its focus on support and expert guidance. Whether you have a question about categorising expenses, claiming deductions, or navigating investment tracking, TaxTank’s AI chat and real-life team are ready to assist.

Why Australians Choose TaxTank Over Competitors

While there are many accounting software options on the market, TaxTank stands out for its localisation, depth, and automation. Features that set it apart include:

- Tailored for Australian tax law

- Integrated property, crypto, and share tracking

- Automated reporting for effortless EOFY preparation

- Smart AI chat support for proactive support

These capabilities provide a level of accuracy and convenience unmatched by generic international accounting platforms.

Conclusion: Elevate Your Personal Accounting

TaxTank is more than just an accounting tool; it’s an all-in-one personal accounting software for Australians who want clarity, control, and confidence over their finances. From automated tax calculations and real-time portfolio tracking to user-friendly dashboards and AI support, it caters to every financial need, whether personal or small business-related.

For anyone serious about managing their money efficiently, optimising tax returns, and keeping up with the fast-paced financial landscape in Australia, TaxTank delivers a complete solution. By combining powerful automation, intelligent reporting, and an intuitive user experience, it ensures that Australians stay compliant, informed, and ahead of the curve.

With TaxTank, you’re not just managing money; you’re taking control of your financial future with the most advanced personal accounting software available in Australia.

Take Control of Your Finances Today

Don’t settle for basic budgeting apps that only let you tag transactions. Take control of your finances with TaxTank, the only personal accounting software in Australia with built-in tax law. Track your income, expenses, investments, and capital gains with confidence, and prepare ATO-compliant reports effortlessly.

Sign up for TaxTank today and experience smarter, stress-free personal accounting. Your financial future starts now.

Frequently Asked Questions – Personal Accounting Software

What is personal accounting software?

Personal accounting software is a digital tool that helps you manage your money, track income and expenses, and organise your financial life. Unlike basic budgeting apps, TaxTank is the only personal accounting software built specifically with Australian tax law in mind, so your tax obligations are managed automatically, not just tracked manually.

Why should I use TaxTank instead of other personal accounting software?

Most budgeting and finance apps allow you to tag transactions or create simple categories, but they don’t calculate tax obligations, track deductions, or handle capital gains properly. TaxTank is different: it has Australian tax law built in, meaning it automatically calculates tax on income, investments, shares, crypto, and property, giving you a full, compliant view of your finances.

Why should I use TaxTank instead of traditional accounting software?

Traditional accounting software like Xero, MYOB and QuickBooks are great for running a business, but they’re not built for individual tax. They focus on invoicing, payroll and GST which is perfect for larger operations but not much help when you’re trying to manage your own tax position.

TaxTank fills that gap. It has individual Australian tax rules built in so it can calculate your tax in real time across wages, sole trader income, investments, property, shares and crypto. You get proper tax deductions, capital gains tracking, and a clear view of what you owe or can claim. It’s personal accounting software, not business software, which means it’s designed for the way real people manage money.

Can other apps prepare my tax return?

No. Traditional budgeting apps can help you see where your money goes, but they cannot prepare a tax return or calculate what you owe to the ATO. TaxTank does this automatically, including tracking capital gains, depreciation, deductions, and all other tax-related calculations, making EOFY preparation stress-free and accurate.

How does TaxTank handle investments differently?

For shares, crypto, and property, other personal finance tools only allow you to label transactions or note purchases. TaxTank goes further: it calculates capital gains, losses, and tax implications automatically, and generates reports ready for the ATO. This is crucial for Australians who invest, as every trade can affect your tax obligations.

Is TaxTank suitable for sole traders?

Yes. Sole traders need more than a budgeting app. While other platforms can track expenses, TaxTank automatically calculates GST, prepares BAS, tracks income vs expenses, and integrates directly with bank feeds. It’s the only personal accounting software that truly manages your finances in line with Australian tax law.

What makes TaxTank better for Australian taxpayers?

* Built-in Australian tax law ensures accuracy and compliance

* Automated tax reporting for income, property, shares, and crypto

* End-of-financial-year readiness with reports and statements ready to lodge

Other apps may let you track spending or tag transactions, but they cannot replace real tax accounting, which is what makes TaxTank unique.

Can I trust TaxTank with my financial data?

Yes. TaxTank uses bank-grade encryption and strong security protocols. Your linked bank accounts, investments, and tax calculations are safe, while the software ensures your data is accurate and compliant with Australian law.

Do I need accounting knowledge to use TaxTank?

No. Even though TaxTank is highly sophisticated, it’s designed for everyday Australians. You don’t need accounting experience to track investments, manage expenses, or lodge your tax return -TaxTank does the heavy lifting for you.

Why is TaxTank the only real personal accounting software in Australia?

Because unlike other finance and budgeting apps, TaxTank has full Australian tax law integrated into the platform. Other platforms only let you tag income or expenses -they cannot calculate your tax obligations, manage depreciation or capital gains, or prepare ATO-compliant reports. TaxTank is the only solution that genuinely combines personal finance management with Australian tax compliance.

How does TaxTank compare to other personal accounting software in Australia?

TaxTank is designed specifically for Australian users. Unlike generic international software, it includes:

* Local tax law compliance for income, property, and capital gains

* Integration with Australian banks and investment platforms

* Automated capital gains and tax calculations

* Real-time dashboards for personal finances and investments

This makes TaxTank a standout choice for anyone looking for a reliable and complete personal accounting software in Australia.

How do I choose the best personal accounting software in Australia?

When selecting personal accounting software consider:

* Compliance with Australian tax law

* Integration with banks, property, and investment platforms

* Automation of recurring tasks

* Ease of use and intuitive interface

* Quality of customer support and guidance

TaxTank meets all these criteria, making it a top choice for Australians seeking a complete personal accounting solution.