Refinancing is booming. According to the Australian Bureau of Statistics, more than $21 billion in investor home loans were refinanced in a single month this year, as Australians scramble to outrun rising interest rates and lender loyalty penalties. It’s a smart financial move — but many investors are missing another opportunity hiding in the fine print: a sizable tax deduction.

When you borrow for an income-producing property, certain costs can be claimed over time:

- Loan establishment or application fees

- Legal documentation costs

- Valuation fees

- Lender’s Mortgage Insurance (LMI)

Normally, these borrowing expenses are spread evenly over five years. But here’s the kicker — if you refinance or repay the loan early, you can claim the entire remaining balance in that same year.

💡 Example

You paid $3,000 in borrowing expenses in 2022–23.

By 2025, you’ve claimed $1,200.

You refinance this year — and the remaining $1,800 becomes immediately deductible.

That’s real money left on the table for most property owners — simply because no one told them it was there.

🧾 Why it Matters

The ATO estimates that nearly 40% of property investors either underclaim or miss legitimate deductions related to borrowing costs each year. Combine that with the current refinancing surge, and it’s a silent tax gap worth hundreds of millions of dollars.

Yet, you won’t find a friendly ATO reminder tucked into your MyTax portal. Their stance is simple: you can claim it, but you’d better know about it first.

And while the banks are quick to celebrate your new interest rate, the ATO stays politely silent about the deduction you just triggered.

💡 TaxTank Tip

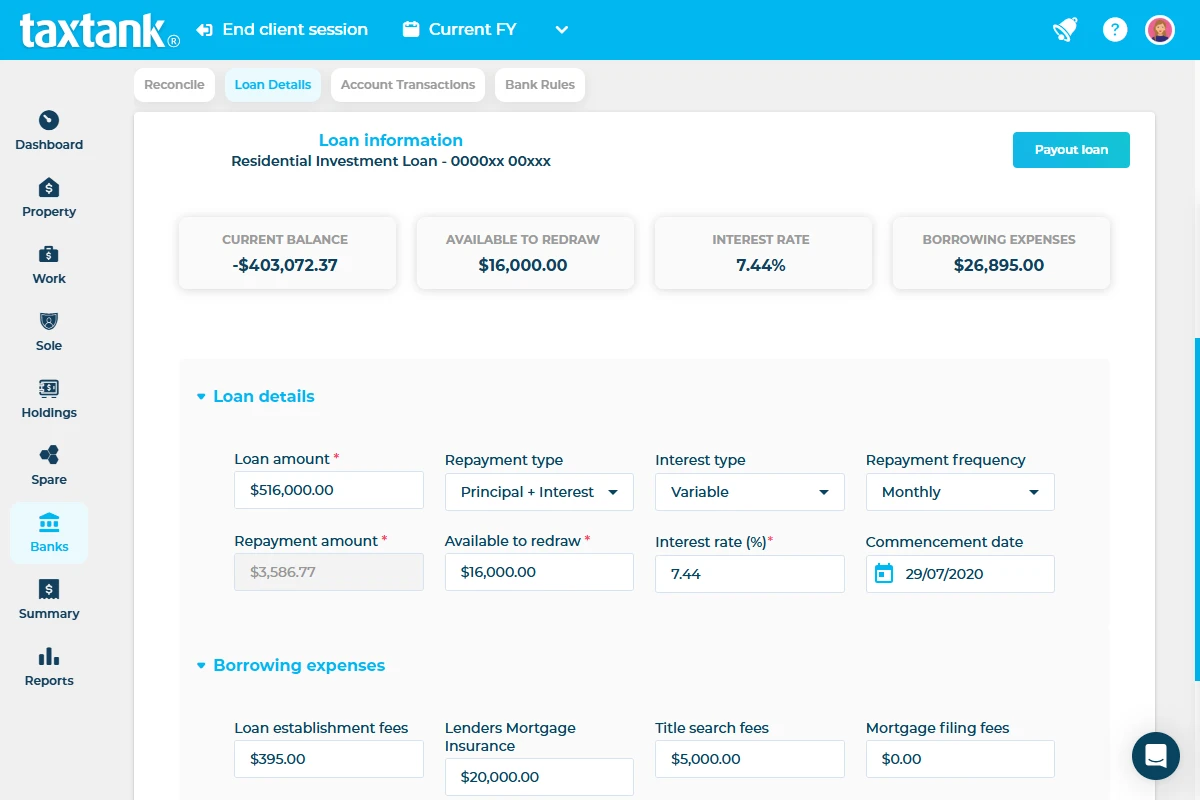

In Property Tank, you enter your borrowing expenses once. TaxTank automatically tracks the five-year spread and, when you refinance, flags the residual deduction instantly. No spreadsheet gymnastics. No accountant memory test. Just live logic that ensures you never miss a cent you’re entitled to.

Because while the banks might give you a sharper rate, if you’re not tracking your deductions properly, the ATO gets the better deal.

Did You Know?

- More than $1.8 trillion in Australian home loans are on variable or short-term fixed rates — making refinancing an ongoing trend. (RBA, 2025)

- The average investor refinancing saves around 0.45% in interest, but could gain thousands more in unclaimed deductions. (Finder, 2024)

- The ATO has flagged $1 billion+ in annual errors across property, shares, and digital asset CGT reporting — and borrowing deductions are a growing part of that gap.

Don’t leave money on the table. Use Property Tank to track your borrowing expenses and other property tax deductions automatically and never miss a cent.

FAQs

What is a Refinancing Tax Deduction?

A Refinancing Tax Deduction allows property investors to claim remaining borrowing costs immediately if they refinance or repay a loan early, rather than spreading them over five years.

Which costs can I include?

You can claim loan establishment fees, legal documentation costs, valuation fees, and Lender’s Mortgage Insurance (LMI).

Who can claim a Refinancing Tax Deduction?

Only investors borrowing for an income-producing property can claim these deductions. Homeowners for their primary residence cannot.

When should I claim it?

You can claim the remaining balance of borrowing costs in the same year you refinance or repay your loan.

How can TaxTank help?

TaxTank’s Property Tank automatically tracks borrowing expenses and flags the remaining deduction when you refinance, so you don’t need to calculate it manually.