Property investment can be hard work and fraught with risk, but understanding that the Australian government offers generous rewards for those who venture down this path makes all the difference. Becoming tax confident is the key to making your property portfolio work harder for you, so here are 7 tips for property investors to make your life easier when it comes to property tax!

1. Know the most obvious deductions

Property investors can claim many more deductions on their tax than they often realise, but making sure you’re covering the basics is the best place to start. Would you believe that 61% of respondents in a recent survey were not aware that mortgage interest payments on an investment property are tax deductible? Before you get too carried away with claiming garden gnomes and tennis courts nets, let’s take care of the most common deductions:

- Mortgage interest payments

- Property advertising fees

- Real estate management fees

- Renters insurance

- Council and water rates

- Travel expenses to inspect your investment property

- Bookkeeping fees

- Cleaning at the end of a tenancy

- Taxation advice relating to the property

- Gardening and maintenance fees

- Building and asset depreciation

2. Don’t forget working from home deductions

Do you manage your investment properties from home? If you keep a clear and accurate record of the hours spent in your home office managing your investments, then you’re eligible to claim home office running expenses. You can also claim a portion of your home internet and phone expenses, as well as the depreciation on a computer or laptop you use. Just remember that deduction claims must be apportioned to how much use is for an income-producing activity.

3. Pre-pay expenses

If you are expecting to have a lower income next year (due to factors such as maternity leave, change in business income or redundancy), there’s a way you can reduce your higher income in the current financial year. All you have to do is prepay your loan interest up to 12 months in advance. Brilliant! You can also get a deduction by pre-paying next year’s insurance premiums or bringing forward other costs that would normally come up after 30 June.

On the other hand, if have a fixed-rate loan and your annual income is on the verge of creeping into the next tax bracket, it’s might be worth pre-paying your interest for the next 12 months, as this will allow you to claim the deduction in the current income year.

You can use this approach when paying for other services, such as income protection insurance premiums, rates and levies. Some service providers even offer a discount for doing prepaying your expenses!

4. Consider a PAYG withholding variation for cashflow

If you own a negatively geared property and are struggling with cash flow this year, consider applying for a PAYG withholding variation. This is usually used by people who claim higher than normal deductions, but it’s a clever strategy that allows property investors to receive tax breaks with each salary payment they receive, rather than having to wait for a lump sum after the financial year has ended.

You’ll have to request a PAYG withholding variation from the ATO each year, and you can either lodge the application yourself or ask your property tax specialist to do it for you.

5. Saving receipts saves you money

Did you know that a clear photograph or scan of a physical receipt is an adequate record for tax purposes? Not everyone realises that digital records have been perfectly legal since 1999! If all your receipts are safely and securely stored in one place all year round, then your accountant can spend less time chasing you for documents and sorting through your records, and more time helping you improve your finances. Keeping your receipts in order means your accountant can provide a better service with lower fees.

It’s also important to remember that the ATO contacts a growing number of investment property owners every year to closely inspect their claims. The ATO has a strict ‘no receipt, no deduction’ policy, so you could be costing yourself a substantial amount of cash by not keeping those digital dockets. Be diligent when claiming deductions, and be sure to safeguard all important receipts.

6. Manage and minimise your capital gains

Selling a property that you lived in usually exempts you from paying any capital gains tax (CGT). However, if you live in property and then start to rent part or all of it out, the CGT will suddenly appear.

Even if you rent out a room in the property you currently live in, you will forfeit your right to the full CGT exemption. In this case, you’ll have to pay a portion of the CGT when you sell, and the amount will depend on how much of the property was rented, as well as the length of time it was rented for.

So you can imagine how helpful keeping records of dates and market values can be when it comes to managing your capital gains at tax time!

When it comes to selling your investment property, consider exchanging contracts after July 1st to put off your CGT payments for another year. And don’t forget – holding you investment property for at least 12 months means you automatically reduce your CGT by 50%

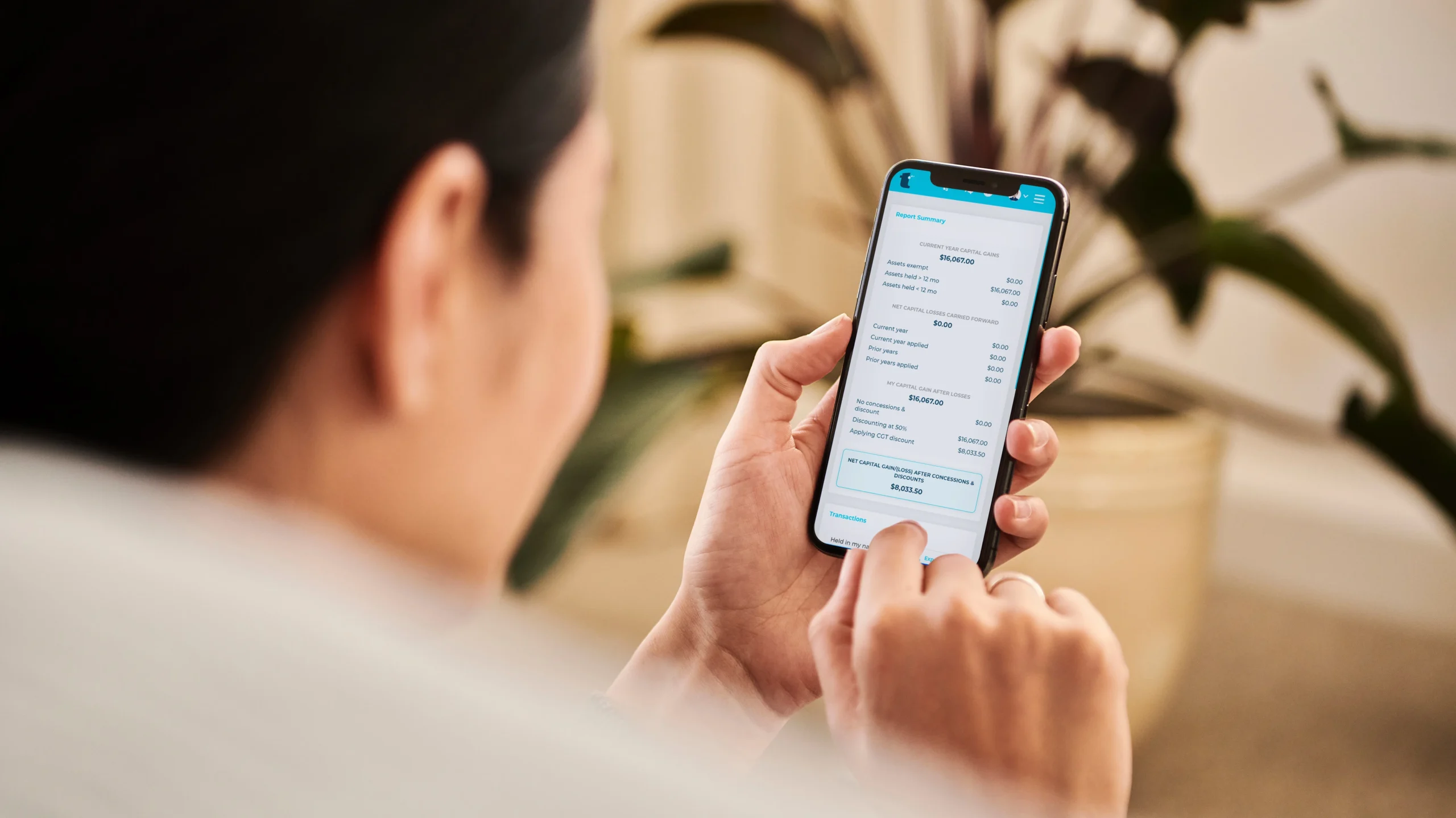

7. Manage your portfolio with smart cloud-based software

Smart, cloud-based tax software is a must have for all serious property investors. Technology and collaboration can help you feel more confident about your tax position, but the best software will transform the way you think about property tax. TaxTank is the only online tool that shows your real-time tax position all year round, to help you pay less tax with less effort.

Sign up for a free trial and find out what TaxTank can do for you and your property portfolio!