Explore Tanks

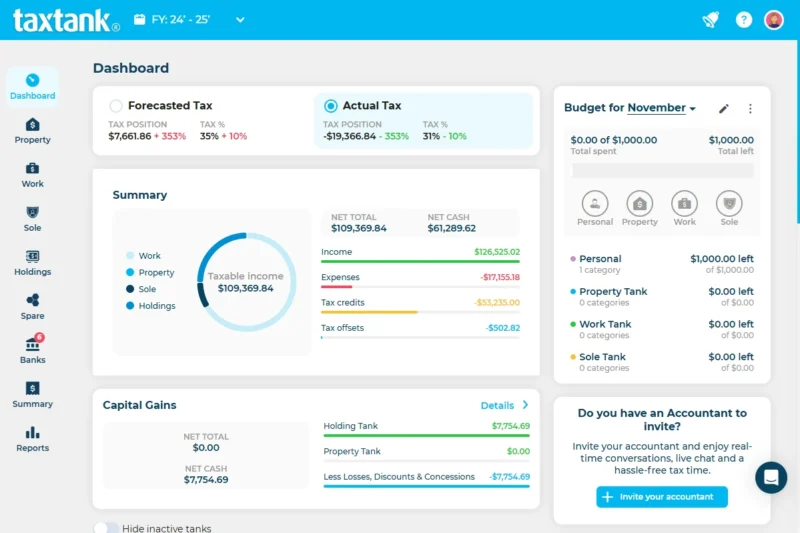

In TaxTank, your finances are organised into Tanks – digital containers that help you track income, expenses, properties, and investments, while securely storing receipts and documents year after year. Each Tank focuses on a different part of your financial life, so you can choose only the Tanks that suit your needs and avoid paying for features you don’t use.

As you allocate income and expense items, you’re not just organising your finances — you’re actively managing your tax. TaxTank calculates your adjusting tax position in real time, giving you clarity and control all year round.

Property Tank

Own property? Property Tank brings all your investments together, no matter how they’re held.

Track income, expenses, and cash flow, monitor performance like capital growth and yields, and maximise deductions automatically. Manage DIY projects, borrowing costs, and shared properties including Airbnb or Stayz rentals.

With live property values powered by CoreLogic, instant CGT calculations, and secure storage for all your documents, Property Tank makes managing your portfolio simple and stress-free.

Work Tank

Worried about minimising your income tax, even if numbers aren’t your forte? Work Tank simplifies the process so you can manage your work-related income, expenses, vehicle kilometers, work from home office expenses, pre-tax deductions, post-tax deductions, tips, work place giving or allowances and loans all in one convenient hub.

As you reconcile your income and expenses from your bank feeds, you can closely monitor your actual income tax position in real-time.

Our tax summary consolidates all your financial data, providing a clear view of how different income and expense types impact your income tax liability.

Sole Tank

Built for sole traders, freelancers, and side hustlers, Sole Tank tracks your live tax position so you always know how much tax you’ll need to pay throughout the year. It manages multiple businesses and makes invoicing effortless.

Allocate expenses, manage assets with automated depreciation, log home office and vehicle costs, and track carry-forward losses automatically. Get live BAS reporting, detailed transaction reports, and securely store all your business documents in the Spare Tank. Take the stress out of business finance and stay in control all year round.

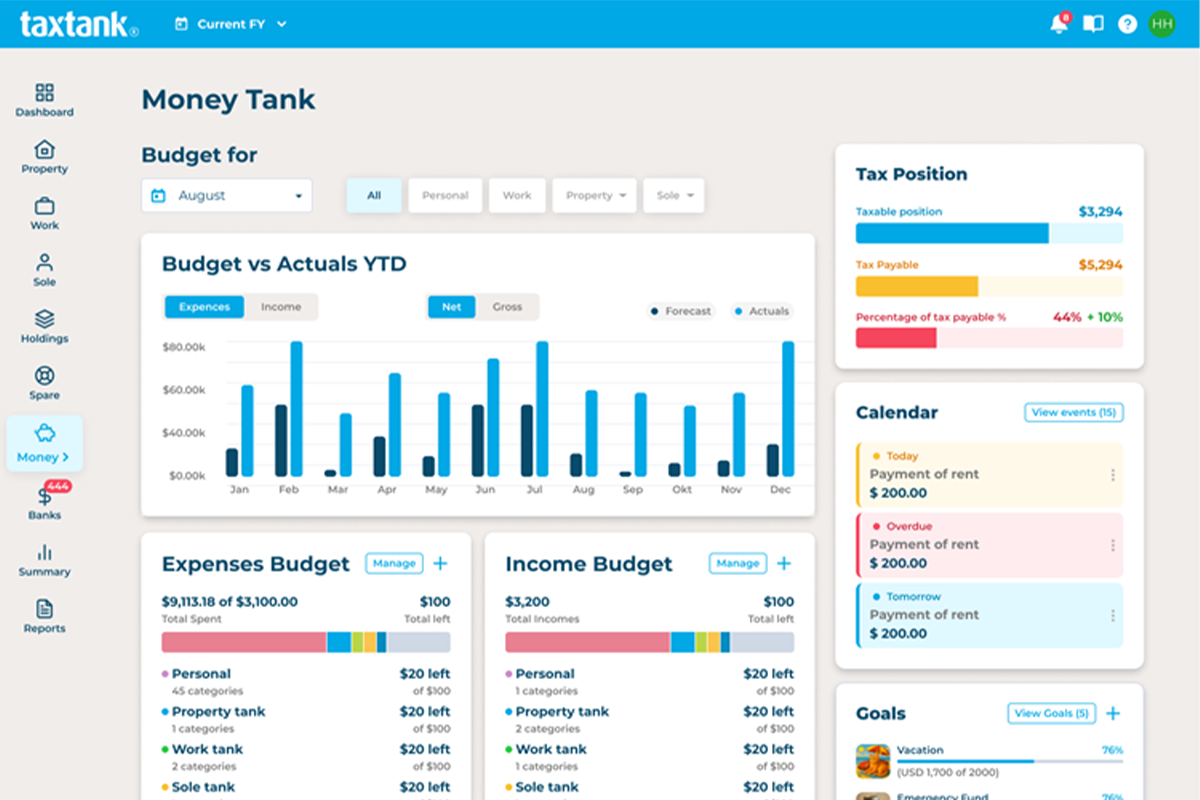

Money Tank

Money Tank is the budgeting and financial management powerhouse inside TaxTank. It brings together your personal, property, work, and business budgets, linking them with live bank feeds, tax insights, and investment data.

No more juggling apps or spreadsheets. Money Tank makes budgeting simple. Track your spending, stay on top of bills, and work toward your financial goals — whether that’s building savings, paying off debt, or hitting your ideal equity or LVR target.

From everyday expenses to property and business budgets, Money Tank pulls everything into one clear view so you can see where your money goes, how it flows, and how it builds long-term wealth.

Holdings Tank

Investments made easy. Holdings Tank tracks your shares, crypto, and unlisted assets in one place. See live portfolio performance, calculate CGT automatically, manage income like dividends or staking, and create custom tickers for any unique investments.

Connect with Sharesight to sync your trades, track losses, and access live CGT reports year round. Stay organised and make smarter investment decisions effortlessly.

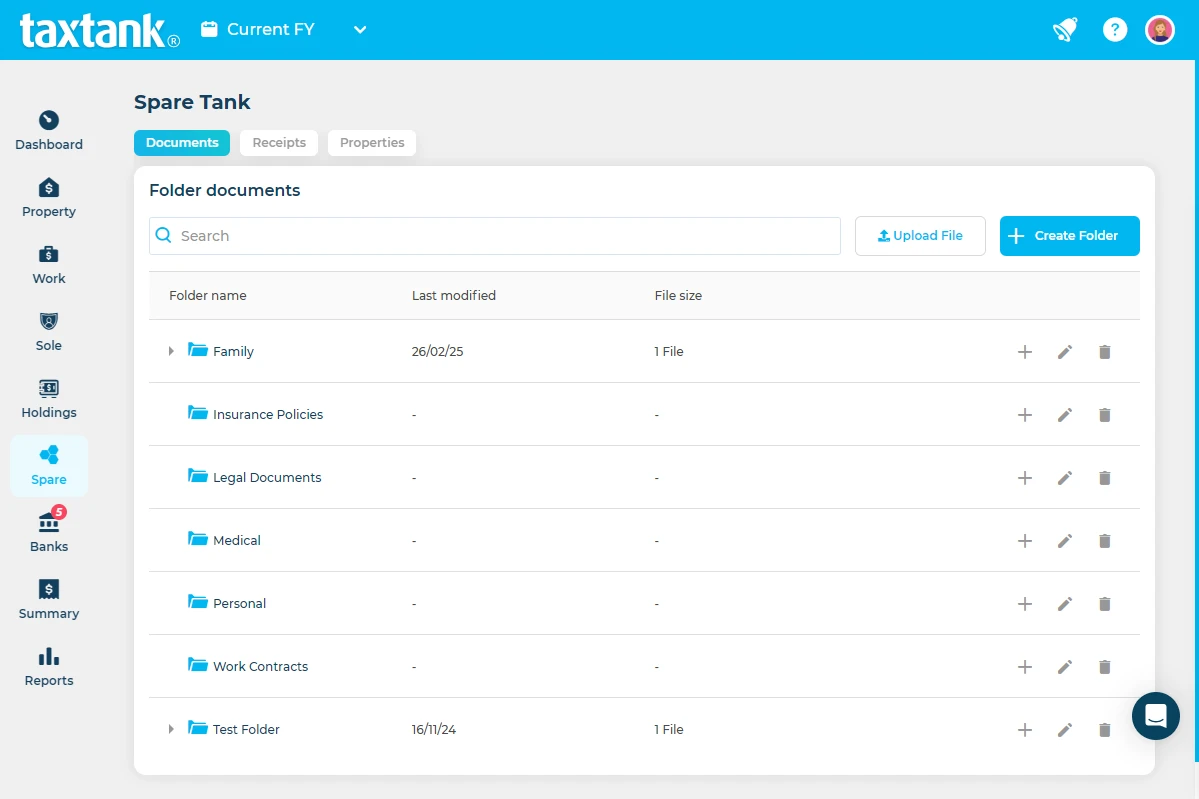

Spare Tank

Spare Tank is your secure hub for all financial documents and receipts. Connect it to any Tank to keep everything organised, accessible, and ready when you need it.

Why TaxTank?

From property to personal finance, TaxTank gives you a full view of your financial life. Track, plan, and automate with confidence, year round. Say goodbye to spreadsheets, lost documents, and tax-time stress – and take control of your money like never before.

Trusted by 9000+ Aussies

Don’t miss out on tax opportunities.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about property tax.