A Beginner's Guide to Starting a Side Hustle

This book is designed to help aspiring side hustlers navigate the challenges and uncertainties of starting a new business venture. Whether you want to earn some extra cash, pursue a passion project, or start a full-fledged business, this guide will provide you with the tools, strategies, and inspiration to get started.

We've made tax simple for sole traders

We get it. Running a side hustle or managing your sole trader income can be stressful! Not only are you trying to get your business idea running smoothly, but you’re also trying to manage the paperwork and figure out how much tax you need to pay.

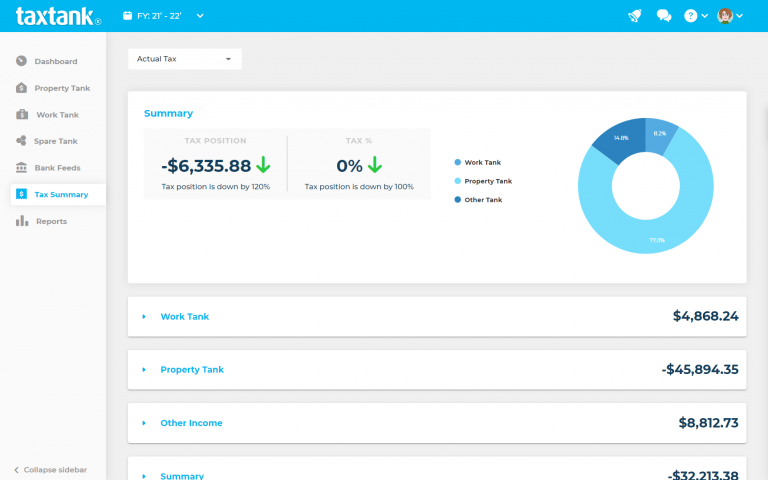

TaxTank helps you manage your sole trader business or side hustle while giving you complete oversight on your tax position all year round.

With everything in one place, you’ll know exactly where you stand – from your income and expenses to your unpaid invoices, BAS, roll forward losses and everything in between.

Download eBook

To download the Beginner’s Guide to Starting a Side Hustle, please enter your name and email address and we will send you a copy to your email address.

No more tax surprises

We’ve made it easy to instantly find and match your invoices directly to your bank transactions to ensure you’re keeping track of monies paid and outstanding to manage business cashflow.

You can also allocate business expense transactions from live bank feeds to ensure nothing is ever missed or forgotten, plus you can even attach receipts for sound tax management.

And with our tax summary, you’ll be able to see exactly where you stand throughout the year so you don’t have to dread tax time.

What you get with Sole Tank

You can now manage your side hustle seamlessly with auto invoicing, business reporting and integrated logbooks, as well as smart tax tools to manage deferred losses and the ATO rules to offset tax.

Instant Invoicing

Draft invoices, approve and email directly to your clients. Allocate paid invoices from bank feeds to update your invoice status and keep track of monies owing.

Simple BAS reporting

Registered for GST? No stress, just select your reporting period to see how much GST you’ve collected and paid for simple BAS reporting in seconds.

Maximum depreciation

Automated tools to manage all depreciation types, including accelerated depreciation in general pools and instant asset write off concessions.

Track prior year losses

Track prior year business losses to reduce current year profit. Better still, test losses against the ATO rules to potentially offset your other taxable income in a few easy steps.

Manage multiple business

Have more than one business running with your ABN? No problem, you can manage up to 6 businesses the ATO currently allows you to operate with.

Match invoice payments

Find and match invoices and expenses from live bank feeds to keep on top of clients and your business cashflow.

Simple vehicle expense claims

Record travel in your logbook and update your vehicle expenses and claims automatically.

Secure document storage

Attach receipts, statements and even warranties for a secure record – that never fades.

Peace of mind

Avoid stress at the end of the financial year and know your tax position all year round.

Sole Tank is just $9 per month

For as little as $9 per month you could be managing your side hustle and know exactly where you stand with your tax obligations. TaxTank is also 100% tax deductible

What our customers say

Don’t just take our word for it.

See what our customers have to say about TaxTank.

Don’t miss out on tax opportunities.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about tax.