Tax time is stressful for a lot of people. But if you’re a property investor, it can be even more so. Beyond the usual return concerns, heightened scrutiny from the ATO now involves direct access to your bank details and transactional data.

With sophisticated data matching programs, you can face autonomous scrutiny, decisions can be made without your input, and you will only have 28 days to prove your innocence. Now is the time to protect yourself and get ahead of the game.

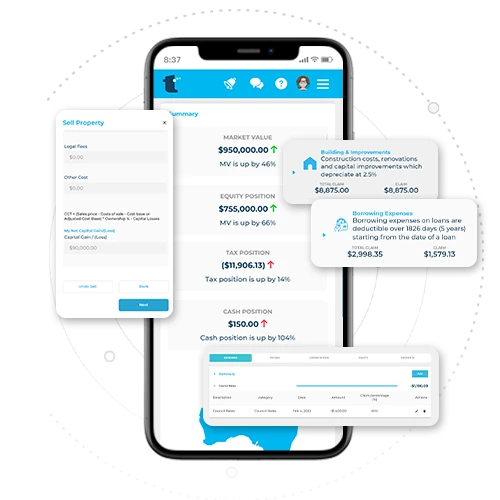

Borrowing expenses, Lenders Mortgage Insurance and depreciation are just some of the biggest deductions that are often missed so it’s important to ensure you are keeping track of everything to back up your claims.

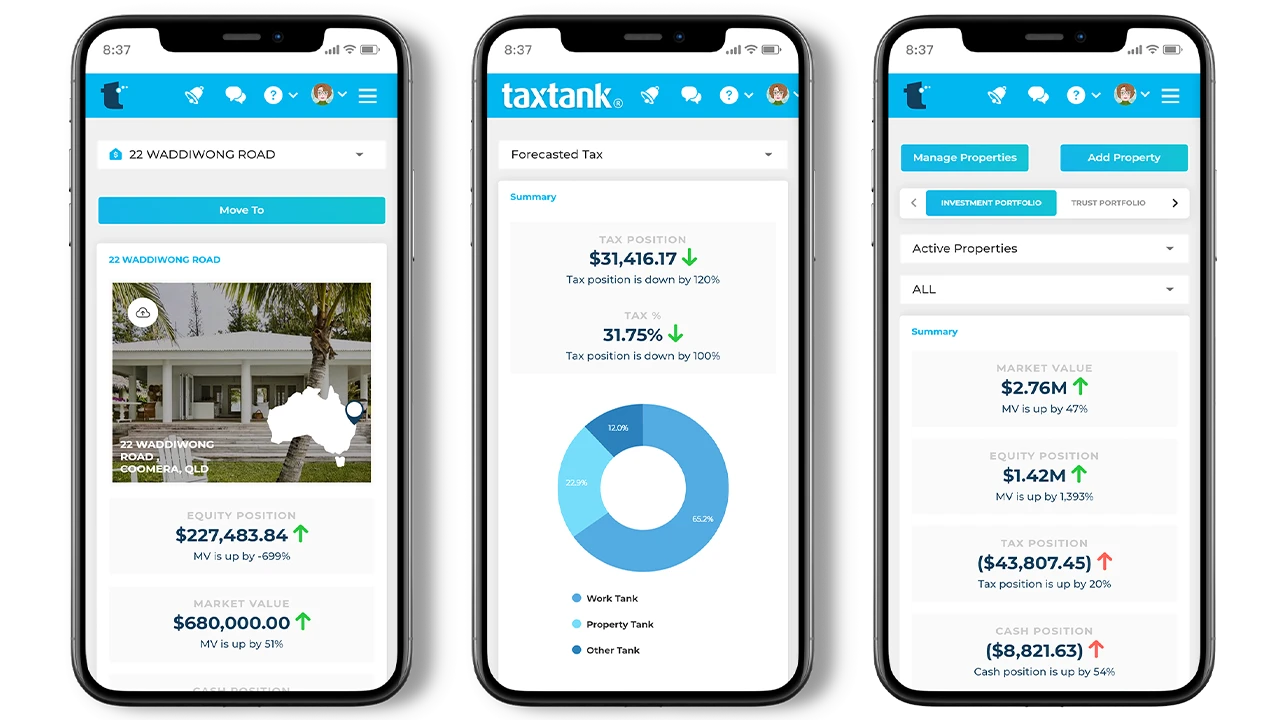

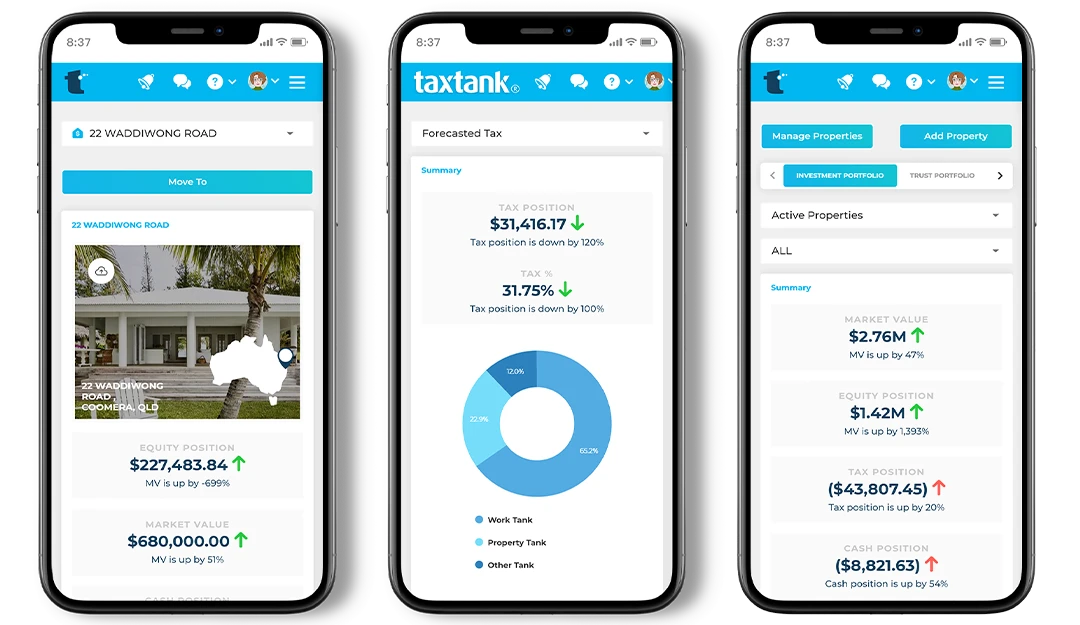

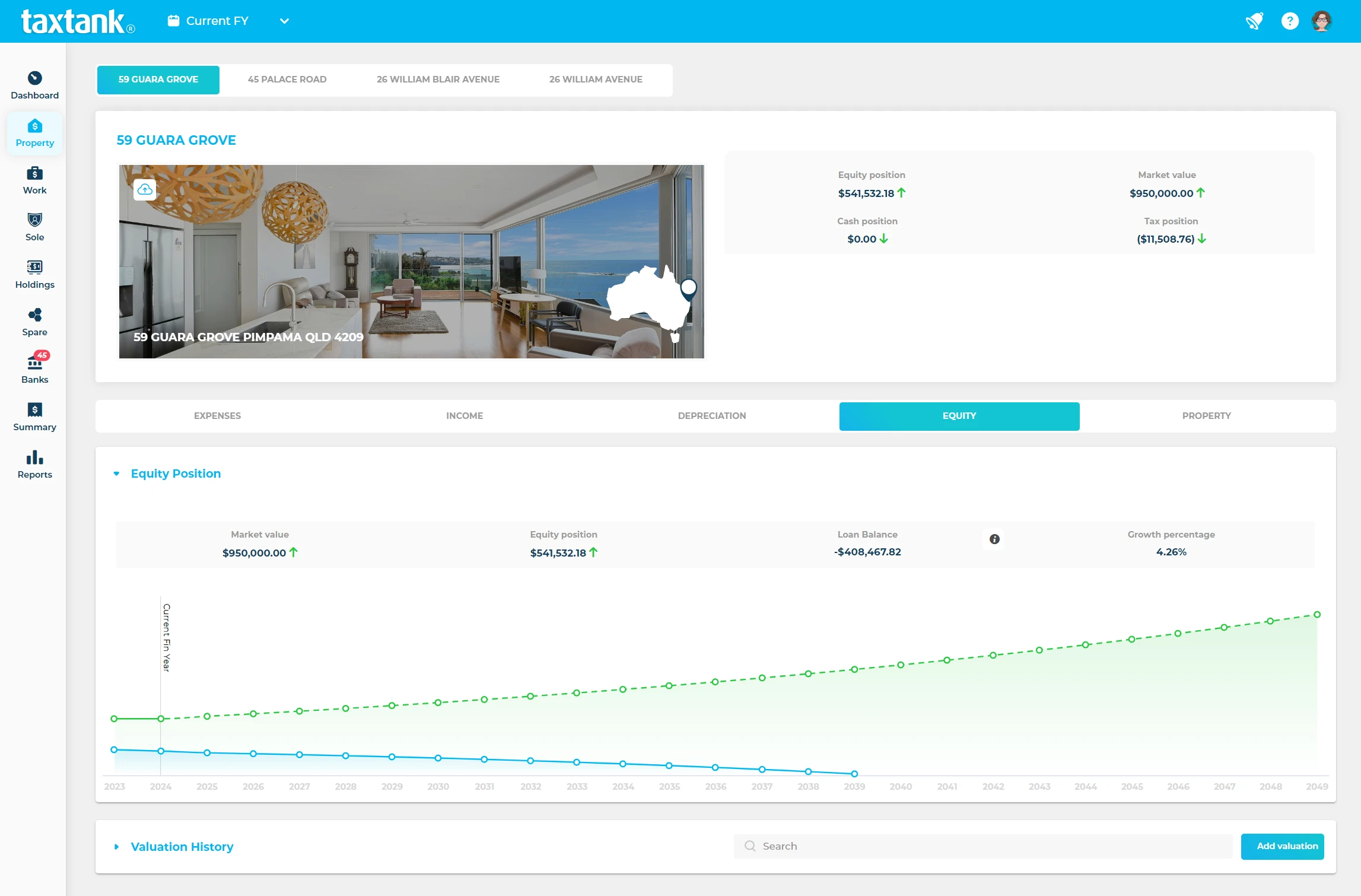

TaxTank lets you take control of your property portfolio with live bank feeds, built in capital gains tax calculators, depreciation schedules, smart tax tools and permanent document storage.

You’ll know exactly what’s happening with each property so you can make the best decisions for your financial future while maximising your deductions and minimising your property tax.

As seen in RealEstate.com.au, TaxTank is changing the game with live bank feeds to capture every possible deduction, and built-in smart tools to calculate claims correctly so you can be confident you’re getting it right.

Our software provides a centralised platform to store and organise all your financial records related to your investment properties and streamlines the process of retrieving information if the ATO comes knocking requesting an audit.

TaxTank goes above and beyond by offering features to manage investment properties, property portfolio oversight, and real-time property schedules. The Automated Depreciation for Property and Capital Gains Tax Calculator make tax planning a breeze. Check out our full suite of software features to see how TaxTank could work for you.

Underpinned by Australian tax law, and built by accountants, our automated smart calculations ensure you claim everything you are entitled to without worrying that you’re making a mistake or missing out.

Nicole Kelly, Founder of TaxTank says, “We wanted to develop a software that gives the property investors the ability to not only manage their taxes more effectively but provides a transparent view of their real-time tax and financial position, 365 days a year to protect them against audit,” Nicole added.

Ditch the property spreadsheets and see how you can manage your whole property portfolio in one place – including investment properties, your home and properties owned in trusts.

Try TaxTank for a free 14 day trial to feel confident about your tax position and transform the way you think about property tax.

TaxTank is the ONLY personal finance software on the market that shows you your real-time tax position 365 days a year, whilst providing a permanent archive for receipts and documents to protect you from ATO adjustments year after year. We’ve built in heaps of tax smart tools and features to ensure you claim everything you are entitled to, accurately!

See your financial position all year round so you can make informed decisions about your money.

Ensure nothing is missed with automated bank feeds using Open Banking.

Automatically produce your tax return for fast, accurate lodgement through myTax.

Avoid stress at the end of the financial year and know your tax position all year round.

Enjoy tax benefits without the hassle, using TaxTank’s simple and smart depreciation and CGT calculators.

Automatic calculations of your estimated tax position to highlight ways to maximise deductions.

Attach receipts, statements and even warranties for a secure record – that never fades.

Share properties with co-owners, accountants and advisors to chat live so you can keep on top of everything all year round.

TaxTank is built as a modular system so you only pay for what you need.

Property Tank is just $15 a month to manage 5 properties. Have more than 5, no problem you can include as many as you need for an extra $3 per property per month.

PROPERTY TANK

Simply add Property Tank so you can monitor your whole property portfolio in one place. You can manage up to 5 properties for only $15 a month.

$15/month

ADDITIONAL

PROPERTIES

Have more than 5 properties? No problem, you can add as many as you like with our property add-on.

$3/month

Don’t just take our word for it.

See what our customers have to say about TaxTank.

Support

Resources

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation.

Copyright © 2024 TaxTank | All Rights Reserved.

Get 50% OFF your first 3 months. Hurry, offer ends October 31, 2024!