Cars were once considered a luxury item and only for the very rich. However, today cars are essential to our modern fast-paced lives. Can you imagine what your life would be like without your car? You would be constantly having to feed and clean up after your horse! Jokes aside, owning a car carries with it a lot of responsibility too. And the expenses can mount up. That’s why if you use your car for work-related purposes, it pays to know what to do and what to avoid when making car claims. Especially given the fact that this year the ATO has car claims firmly in its sights.

Car claims: what you can and cannot claim

In general, you can only claim car expenses if you use your car for work-related purposes. This includes using your car to travel between different work locations or to attend work-related conferences or meetings. If you use your car for both work and private purposes, you can only claim the percentage of car expenses that relate to work. For example, if you travel 100 km in a day and 50 km of that is for work, you can only claim 50% of your car expenses.

There are two main ways to calculate your car expenses: the cents per kilometre method and the logbook method.

The cents per kilometre method is the simplest way to calculate your car expenses. You can claim a set amount of 72 cents per kilometre travelled, up to a maximum of 5000 km per car in a financial year. This method covers all your car expenses, including things like fuel, oil, tyres and depreciation.

The logbook method is a little more complex. You will need to keep a logbook for at least 12 weeks to calculate your car expenses using this method. The logbook records things like the make and model of your car, the date you started using it for work purposes, the number of kilometres you’ve travelled as well as your car expenses. You can then use this information to calculate a percentage of your car expenses that can be claimed as a work-related deduction.

What the ATO is looking for

The ATO has stated that it will be closely scrutinising car claims in the 2022 financial year. So, if you are planning on making a car claim, make sure you have all your documentation in order and that you are claiming the correct amount (ie. logbook and receipts).

If you use the cents per kilometre method to calculate your car expenses, the ATO will be looking to see if the number of kilometres you are claiming is realistic for your industry and/or occupation.

Final thoughts

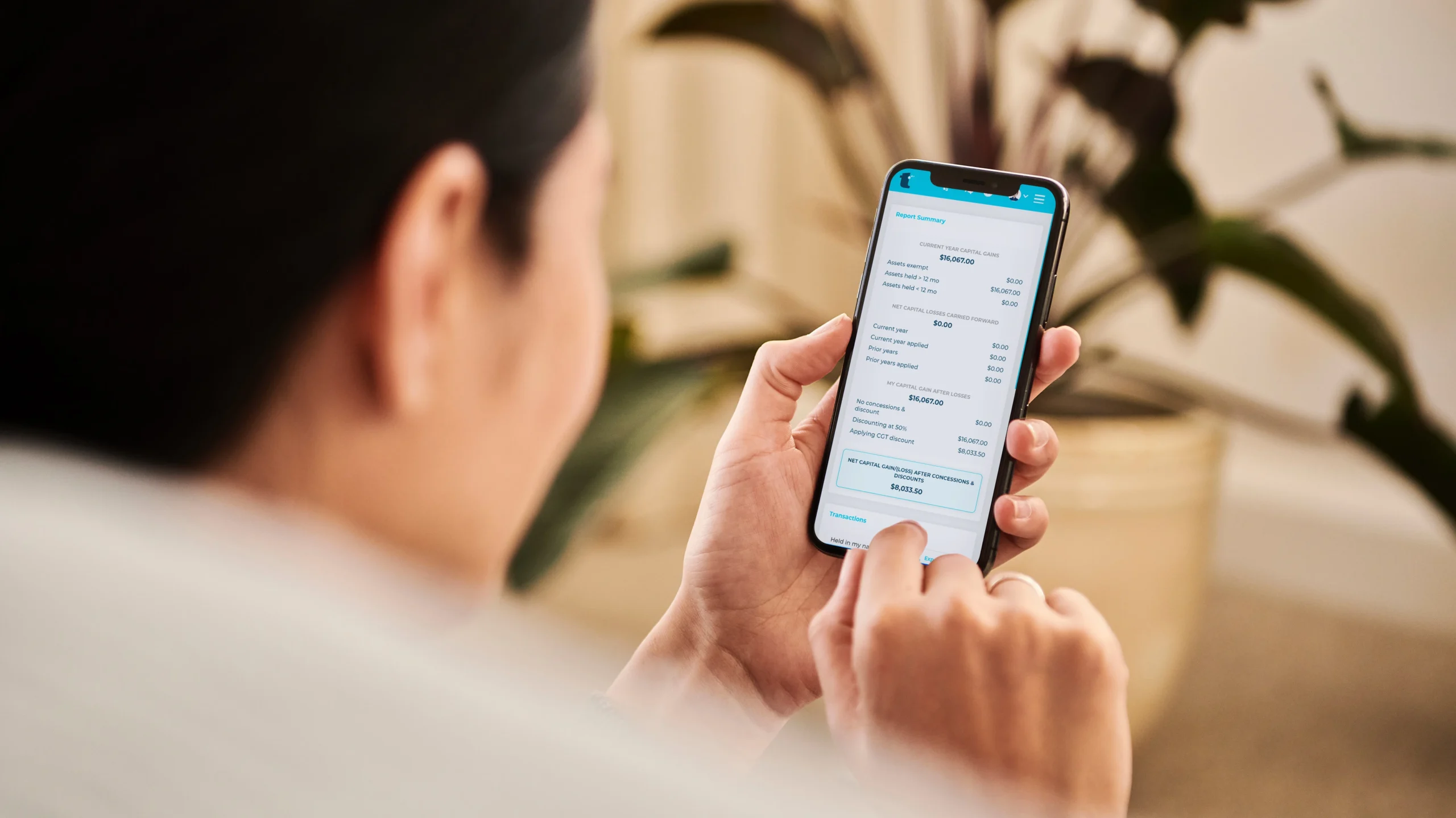

TaxTank is driving an easier and more assured way of making your car claims this tax year. Simply put, their innovative automated tax tools make it certain that your car claims are not only approved, but that they are also maximised. You don’t drive a horse and buggy anymore because of technological evolution. The same way that you don’t have to stress out about doing your own tax and missing something so as not to get the best return. Or having to pay a tax accountant. There has been a major technological breakthrough in the tax market. And that breakthrough is TaxTank. Why not see for yourself by testing out their free trial today?