Getting a great tax return can help you reach your financial goals faster. Whether it’s an overseas holiday or paying down some debt, your tax return can be used for a variety of life-affirming purposes. Think of it as a form of forced savings. In 2021, Australian taxpayers received an average tax refund of $2490 – not a bad incentive to make the most of tax time!

Maximising your tax return does not have to be complicated

Follow these ATO-approved tips and you will have a healthy tax refund in no time.

Tip #1 – Make working from home work for you

We’ve certainly seen a big shift toward the WFH/Hybrid model in the last two years. If you do still do a little (or a lot) of your work from home, you should be claiming a tax deduction for the work-related portion of your home office running costs such as:

- electricity expenses for heating/cooling and lighting

- internet/phone expenses

- depreciation costs of computers, office equipment (including furniture)

- consumables and stationery

It’s important to understand what you can or can’t claim and keep accurate records to prove your incurred expenses.

Tip #2 – Don’t forget those other work-related expenses

All industries have specific items that can be claimed so do your research; you might be surprised at what kinds of everyday items you are legitimately allowed to claim a deduction for. Some common entitlements can include:

- vehicle expenses (only for travel during work hours, not to and from work)

- work-related equipment specific to your industry (tools, safety equipment, printers and office supplies)

- software fees

- union fees, magazine subscriptions specific to your work, membership of professional organisations

- uniform and protective clothing

- dry cleaning and laundry for work clothes

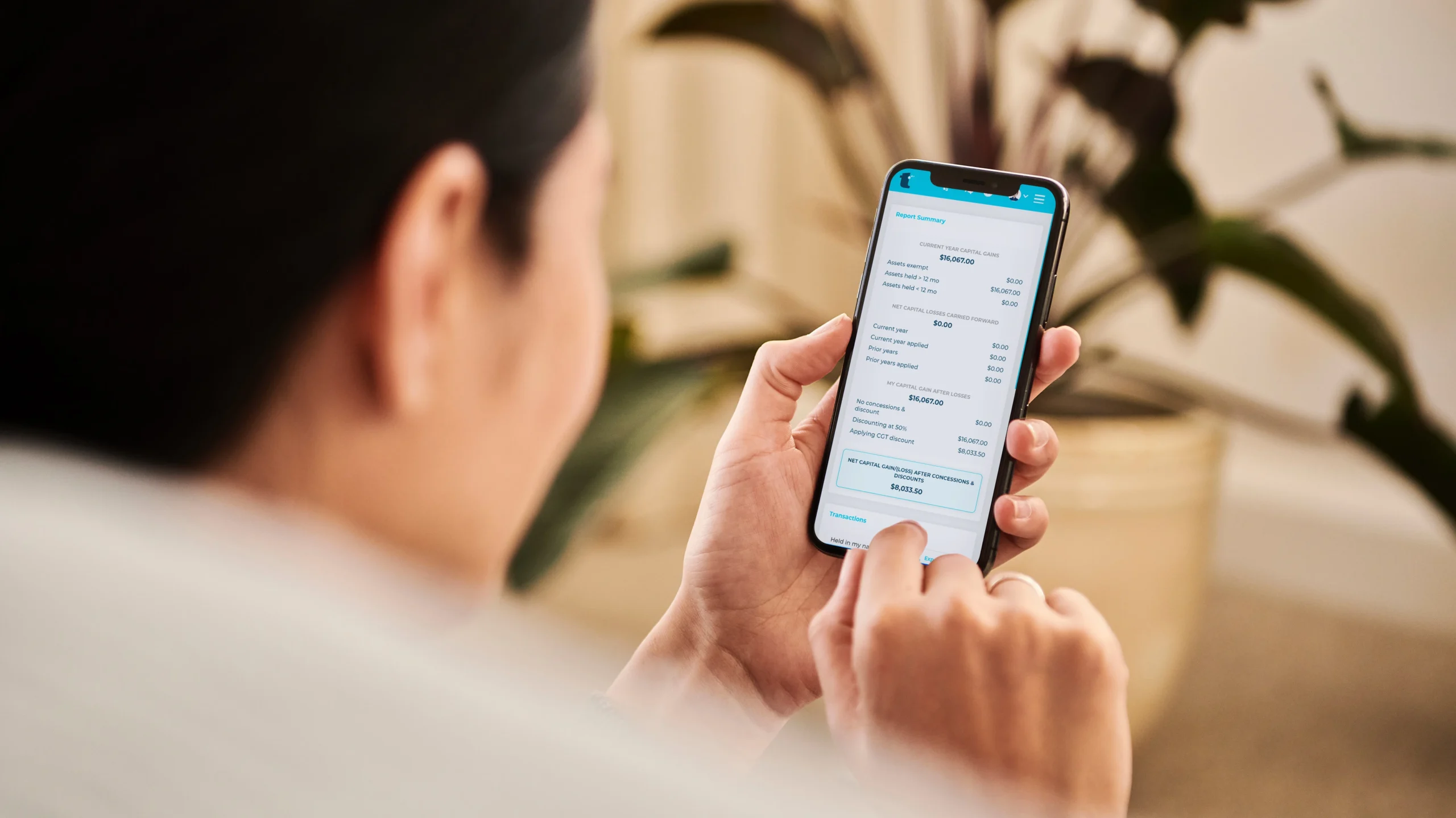

- fees incurred as part of completing your tax return (using tax help software such as TaxTank, of course!).

When including deductions for equipment that is used for both work and personally, only a percentage of the cost can be allocated as a work expense. Again, keeping those records in order helps to legitimately maximise your deductions.

Tip #3 – Claiming self-education and study expenses

If you’ve ever considered doing some further study that directly relates to your current job or profession, you will find that much of the cost of fees and textbooks is tax-deductible. Which is a bit of a win-win. Not only are you investing in your own further education to improve your skills and knowledge, but it can also lead to an increased income.

Not only can you claim course fees and associated expenses, but also home office expenses and even travel from work to seminars, lectures or the like.

Final thoughts

As you can see, there are many ways you can reduce your taxable income and increase your tax refund. By keeping good records and knowing what you can or can’t claim, tax time doesn’t have to be a stressful event. The best way to reduce tax-related stress is to get organised early and make the most of the tax help tools that TaxTank provides.

A few minutes a week to allocate transactions from live bank feeds ensures you miss nothing to claim every possible deduction. Once you trial the powerful tax help software tools available at TaxTank, the way you think about tax will be transformed forevermore.