In the fast-paced world of property investment, efficiency and accuracy are paramount. Yet, many investors find themselves bogged down by traditional accounting software like Xero, which, despite its popularity, often falls short of delivering the specialised tools needed for effective tax management and financial oversight. Here’s why sticking with Xero could mean missing out on significant advantages and how TaxTank can revolutionise your tax management experience from just $15 a month.

The Limitations of Xero for Property Investors

Generic Functionality

Xero is designed to be a one-size-fits-all business solution, producing financial reports. This means it doesn’t offer the tailored features that property investors need to manage their portfolios effectively. Customising Xero to fit these needs often requires additional plugins and manual workarounds, which can be both time-consuming and costly.

Manual Data Entry

Property investors using Xero often find themselves spending countless hours on manual data entry, reconciling transactions, and ensuring their records are up-to-date. This not only increases the risk of human error but also diverts valuable time away from focusing on growth and investment opportunities.

Complex Reporting

Generating specific reports that provide insights into property performance, tax liabilities, and future planning can be cumbersome in Xero. The lack of intuitive, property-focused reporting tools makes it difficult for investors to get a clear picture of their financial standing and tax obligations.

Multiple Files for Multiple Entities

Xero manages accounts per entity, meaning that if you have individual properties, properties in trust, or other structures, you’ll need multiple Xero files. This setup results in a lack of transparency across your entire property portfolio, limiting insightful reporting and collaboration with advisors.

Limited Financial Oversight

While you can get creative with your chart of accounts to track properties, Xero falls short when considering all of the other incomes and expenses that affect personal tax. Using Xero for property investment management is like using a Swiss Army knife as a hammer: it can do the job, but not efficiently or effectively.

Introducing TaxTank: The Game-Changer for Property Investors

Tailored for Property Investors

Unlike Xero, which caters to a broad range of businesses, TaxTank is specifically designed to meet the unique needs of property investors. From automated data entry to real-time financial tracking, TaxTank provides a seamless experience tailored to managing property investments efficiently.

Automated Live Bank Feeds

Say goodbye to manual data entry. TaxTank is open banking compliant, offering access to over 140 banks and financial institutions. This allows you to link loans and offsets to specific properties, showcasing equity and implementing auto rules to streamline recurring income, expenses, and transfers across all bank accounts. This ensures that every expense and income is recorded accurately, minimising the risk of errors and saving you countless hours.

Integration with CoreLogic

TaxTank integrates with CoreLogic to provide up-to-date property valuations and market insights, helping you make informed decisions about your property investments. This integration adds another layer of precision and value to your financial tracking and reporting.

Comprehensive Reporting

With TaxTank, generating detailed property schedules and depreciation reports for your properties is a breeze. You can even calculate capital gains tax in three easy steps to understand the impact a sale could have on your tax obligations, empowering you to make informed decisions with confidence.

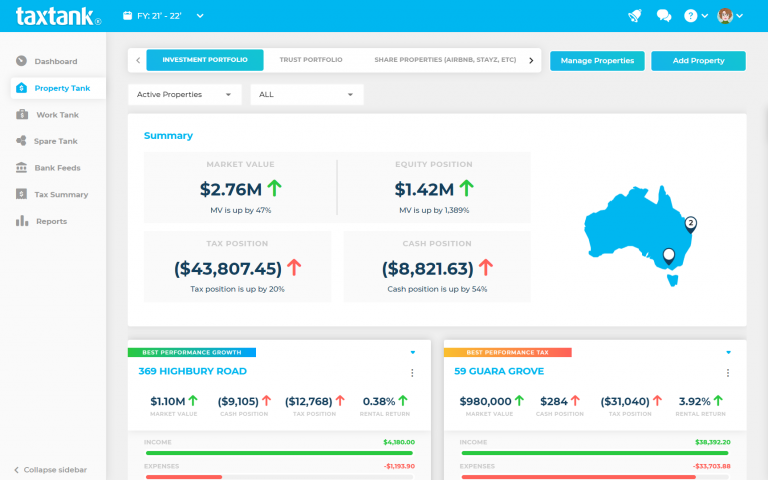

Real-Time Tax Management & Oversight

One of the standout features of TaxTank is its ability to manage taxes in real-time. You no longer have to wait until the end of the financial year to see your financial position. Even better, you can add properties to portfolios that automatically manage property tax rules, for example, the capitalisation of land holding costs, properties let through Airbnb and other share platforms, properties held in trusts or other entities, and even your home. This functionality allows you to easily track your entire portfolio in one place, providing comprehensive and up-to-date financial oversight.

Affordability

From just $15 a month, TaxTank offers unparalleled value. This affordable pricing ensures that all property investors, regardless of the size of their portfolio, can access top-tier tax management tools without breaking the bank.

Addressing ATO Compliance Focus Areas with TaxTank

Capital Gains

The ATO is increasingly scrutinising capital gains, particularly in the rapidly growing cryptocurrency market and property sales. TaxTank helps track and report capital gains accurately, ensuring compliance with ATO regulations and minimising the risk of penalties and unwanted tax-time surprises.

Loan Apportioning

Accurate loan apportioning is critical for ensuring that only deductible interest expenses are claimed. TaxTank automates this process, correctly apportioning loan interest between properties and non-deductible portions, helping to avoid errors and ATO scrutiny.

Record-Keeping and Income Reporting

The ATO emphasises meticulous record-keeping and accurate income reporting to close the tax gap. TaxTank’s automated data feeds and real-time updates ensure that all transactions are recorded accurately, supporting compliance with ATO requirements and reducing the risk of errors.

Calculate Tax Year-round

TaxTank also gives you the functionality to manage your work income and expenses, sole trader business side hustles, and investments in shares and cryptocurrencies. This makes TaxTank a comprehensive tax and financial wellness solution for just a few dollars a week (fully tax-deductible, of course).

The Verdict

Sticking with Xero might seem like the safe choice, but when it comes to property investment, it’s clear that specialised tools can make a world of difference. TaxTank’s tailored approach to tax management and financial oversight ensures that property investors have everything they need to manage their portfolios effectively and efficiently.

For just $15 a month, TaxTank not only simplifies your tax management but also empowers you to take control of your financial future. Don’t sell yourself short with generic solutions – make the switch to TaxTank and experience the revolution in property investment tax management.

For more details on how TaxTank can transform your property investment experience, visit TaxTank today.