Navigating the intricacies of tax returns can be a daunting task, especially for individuals without a background in finance. In this guide, we will explore the significance of tax return calculators and delve into advanced tools like TaxTank, which automates tax calculations and adds a layer of convenience to your tax and personal finance management.

Understanding Tax Return Calculators

What Are Tax Return Calculators?

Tax return calculators, including innovative solutions like TaxTank, are online tools designed to estimate the amount of tax you owe or the refund you may receive. These tools consider various factors, such as income and expenses providing you with a quick snapshot of your potential financial standing with the ATO.

The Importance of Accuracy

Accuracy is paramount when it comes to tax calculations. Not all calculators are the same so it’s important to ensure the tax return calculator you use leverages advanced algorithms to ensure precision, helping you avoid discrepancies that could lead to audits or unnecessary stress during tax season.

How to Access Tax Return Calculators

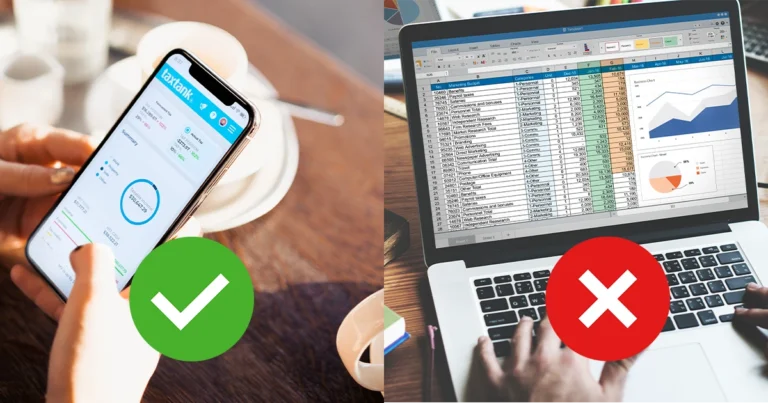

If you search for a tax return calculator on Google, there are a lot of websites that offer free, user-friendly calculators that require minimal input to generate results. It’s important to understand that most of these calculators can only give you an estimate on your tax return based on your inputs and unlike TaxTank, can’t give you a real-time view on what your current tax position is.

Advantages of Using Tax Return Calculators

Time-Efficient Financial Planning

By swiftly providing estimates, tax return calculators empower individuals to plan their finances effectively. This time-efficient approach allows for better budgeting and allocation of resources.

Identifying Potential Deductions

Tax return calculators may be able to help you recognise potential deductions. These tools may be able to highlight areas where you may be eligible for deductions, maximising your potential refund. In solutions like TaxTank, allocating transactions directly from your bank accounts means that you are less likely to miss out deductions you are entitled to claim. The added bonus is that you can upload your receipts at the same time to ensure you’re preserving substantiation in case the ATO comes knocking.

Enhanced Financial Awareness

Utilising a tax return calculator prompts users to review their financial records, fostering a better understanding of their income, expenses, and potential tax liabilities.

Being able to see your financial position in one place, provides a superior level of awareness so you can make smarter financial decisions.

Choosing the Right Tax Return Calculator

Evaluating User-Friendly Interfaces

When selecting a tax return calculator you should prioritise those with user-friendly interfaces. A seamless experience ensures that you can input your data effortlessly, eliminating any potential for errors.

Compatibility with Current Tax Laws

Tax laws evolve, and so should your chosen calculator. Opt for tools like TaxTank that regularly update their calculations to align with the latest tax regulations, ensuring your calculations remain accurate and compliant.

Security Measures

Security is paramount when dealing with financial data. Ensure that the tax return calculator employs robust security measures to protect your sensitive information from unauthorised access.

Common Misconceptions About Tax Return Calculators

Limited Scope of Calculations

Some users believe that tax return calculators, including automated ones like TaxTank, have a limited scope of calculations. In reality, these tools can handle a wide range of financial scenarios, from basic tax returns to more complex situations involving investments and deductions.

Inaccuracy of Results

Another misconception is the potential inaccuracy of results from tax return calculators. Modern solutions like TaxTank leverage sophisticated algorithms, significantly reducing the margin for error and ensuring reliable outcomes.

Tips for Maximising Tax Refunds

Documenting Every Expense

Maximising your tax refund starts with meticulous documentation. Keep track of every expense, no matter how small, as it could contribute to potential deductions. Even better, use a solution that links to your bank transactions so you never miss a thing.

Regularly Updating Financial Information

Ensure that your financial information is up-to-date. Regular updates to income, expenses, and investments guarantee that your tax return calculator provides accurate and relevant results.

Staying Informed About Tax Law Changes

Tax laws undergo changes, and staying informed is crucial. Regularly educate yourself about updates to tax regulations, enabling you to make informed decisions and optimise your tax position.

Final thoughts

In conclusion, tax return calculators, with a spotlight on automated solutions like TaxTank, are invaluable tools for individuals seeking a streamlined and efficient approach to managing their finances. By understanding their significance, advantages, and debunking common misconceptions, you can make informed decisions to maximise your tax refunds and navigate the complexities of tax season with confidence. Start using TaxTank with the first 14 days free.