Negative gearing for property investors is a popular strategy in Australia. It’s a way of using borrowed money to invest in property while reducing taxable income. While it’s an effective way to increase your portfolio and reduce taxes, there’s a lot more to understand before diving in. In this guide, we’ll break down the basics, the strategies you need to know, and how to use negative gearing in the real world to build your wealth. Ready to take your property investment strategy to the next level? Let’s jump in!

What is Negative Gearing for Property Investors?

At its core, negative gearing for property investors refers to a situation where the costs of owning and managing a property exceed the income generated from it. This often happens when you’re borrowing money to invest, and the interest on that loan, depreciaton and other expenses (like maintenance and property management fees) are higher than the rental income.

So, how does this help property investors? In Australia, the tax system allows you to deduct those losses from your taxable income, reducing your overall tax burden. Essentially, you’re using the property’s losses to offset the tax you pay on other income (like your salary). This means you could end up with a smaller tax bill (or bigger refund) at the end of the financial year.

Key Negative Gearing Strategies for Property Investors

If you’re serious about negative gearing, there are several strategies you can use to make the most of it. Let’s explore some of the most common ones:

1. Buying High-Growth Properties

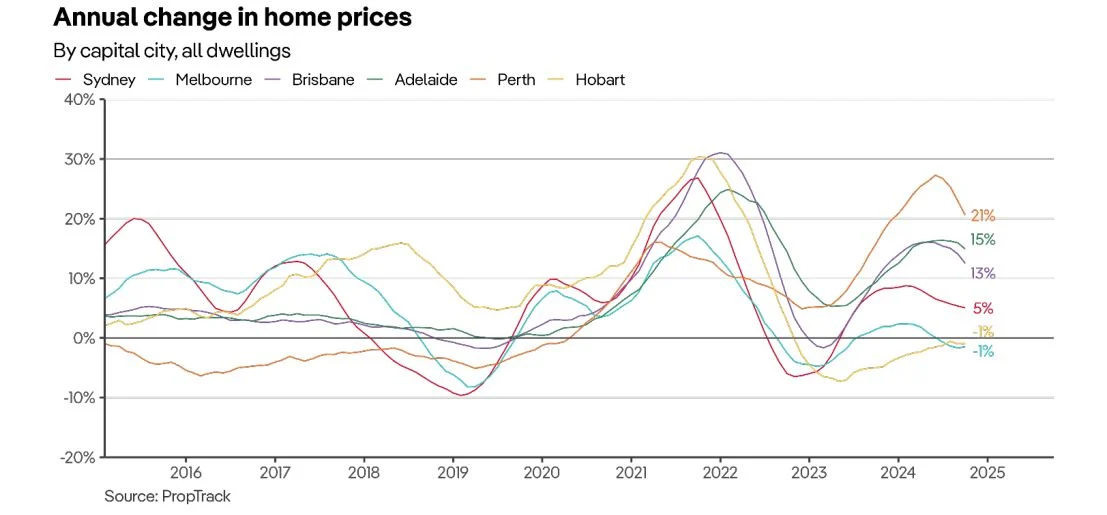

Focus on properties in high-demand areas with strong potential for long-term value growth, such as those near infrastructure developments or in regions with population increases. For example, purchasing a property in a suburb where a new school or tram line is being built could lead to significant capital appreciation over time. Negative gearing works best in these cases because short-term rental losses can offset your taxable income, while future capital gains provide substantial financial rewards when you sell or reinvest.

2. Using Leverage for Greater Investment Potential

Leverage amplifies your ability to invest in high-growth properties by allowing you to borrow funds to increase your portfolio size. For instance, instead of buying one property outright, you can use leverage to acquire multiple properties, such as putting a 20% deposit on a $1 million property instead of paying $200,000 in full. When paired with high-growth investments, the short-term losses from larger loan repayments can reduce your taxable income, while the potential for significant capital growth over time enhances your overall return. This combined strategy integrates the strengths of both approaches for optimal results.

3. Structuring Debt for Maximum Tax Efficiency

How you manage and structure your debt plays a critical role in maximising tax deductions. If you draw funds from an investment loan for personal use, even if you repay it later, that portion of the loan becomes non-deductible. This can significantly impact your ability to claim interest expenses as tax deductions.

To avoid this, ensure your loans are clearly separated for investment and personal purposes. Using tools like offset accounts is an effective strategy to manage funds without compromising the deductibility of your loan interest. For instance, instead of redrawing from an investment loan for personal use, you can place excess funds into an offset account. This reduces the interest payable without muddying the waters of deductibility, ensuring your tax efficiency remains intact.

Benefits of Negative Gearing for Property Investors

Now that we’ve covered some of the strategies, let’s look at the benefits that negative gearing can offer property investors:

Tax Deductions and Reductions

One of the key advantages of negative gearing for property investors is the ability to reduce your taxable income through deductible expenses. These include loan interest, maintenance costs, property management fees, and other costs associated with owning and maintaining the property. By offsetting these expenses against your rental income, you can lower your overall taxable income, ultimately reducing the amount of tax you owe. This not only eases your short-term financial burden but also allows you to reinvest the savings into growing your property portfolio.

Capital Growth and Asset Appreciation

Negative gearing offers more than just tax savings—it’s a long-term wealth-building strategy. As your property appreciates in value over time, the potential profit from selling it (capital gain) can far outweigh the short-term losses you’ve claimed. This increase in value not only boosts your overall wealth but also provides opportunities to reinvest and expand your portfolio, turning short-term sacrifices into long-term financial success.

Risks and Considerations with Negative Gearing for Propert Investors

While there are plenty of benefits, it’s important to remember that negative gearing also comes with some risks:

Cash Flow Strain and Interest Rate Risk

Negative gearing depends on borrowing money, which means ongoing interest payments. If interest rates rise or the rental income falls short of expectations, it can create significant cash flow challenges. To manage these risks, it’s crucial to ensure your property has the potential to generate sufficient income and that you have a financial buffer to cover unexpected costs, such as rate hikes or vacancies.

Impact on Long-Term Financial Health

Negative gearing relies on short-term losses being offset by long-term capital growth. While this strategy can be effective, it requires patience and favourable market conditions. If property values stagnate or decline, or if interest rates rise sharply, you may find yourself in financial difficulty. Careful planning, diversification, and an awareness of market trends are essential to minimise the long-term risks of this approach.

How to Implement Negative Gearing in Your Portfolio

Implementing negative gearing for property investors successfully requires careful planning and attention to detail. Here are some tips to help you get started:

Assessing Property Performance

Before jumping into a property investment, it’s crucial to assess its potential for growth. Look for areas with strong demand, low vacancy rates, and potential for future development. You’ll also want to calculate expected rental income, loan repayments, and other costs to ensure the investment will be worthwhile in the long term.

Working with Tax Advisors

Negative gearing can be complex, so it’s a good idea to work with professionals who understand the tax implications and can help structure your investments efficiently. Tax advisors can provide valuable advice on how to get the best return on your investment while minimising risk.

Case Studies: Real-World Applications of Negative Gearing for Property Investors

Now, let’s look at two real-world examples of how negative gearing works:

Example 1: Residential Property Investment

Sarah decides to invest in a property worth $500,000. She takes out a loan for $400,000 and rents the property for $25,000 a year. The annual costs (loan interest, maintenance, etc.) total $30,000, resulting in a $5,000 loss. Thanks to negative gearing, Sarah can reduce her taxable income by $5,000, lowering her tax bill.

Example 2: Commercial Property Investment

John decides to buy a small office building for $1,000,000, borrowing $800,000 to do so. The property generates $60,000 a year in rent, but the annual expenses total $75,000. He’s making a $15,000 loss each year, but with negative gearing, John can reduce his taxable income, freeing up more cash to reinvest.

| Residential Property Investment | Commercial Property Investment | |

|---|---|---|

| Purchase Price | $500,000 | $1,000,000 |

| Amount Borrowed | $400,000 | $800,000 |

| Annual Rent | $25,000 | $60,000 |

| Annual Expenses | $30,000 | $75,000 |

| Total Annual Loss | $5,000 | $15,000 |

Tools and Resources for Property Investors

If you’re considering negative gearing, it’s essential to have the right tools and resources at your disposal. Property investment calculators can help you determine whether a property is financially viable, while libraries of investor guides and tax tips can provide further insights into how to structure your investments.

TaxTank is also a great resource for property investors, offering an automated tax solution that helps you stay on top of your finances and claim eligible deductions with ease. It simplifies tax time and ensures you’re maximising your return, particularly for those using negative gearing strategies.

Conclusion: Is Negative Gearing Right for You?

Negative gearing for property investors can be a powerful strategy, offering opportunities to reduce taxable income and build wealth over time. However, it comes with risks, such as cash flow strain and market uncertainty. The key to success lies in understanding the strategies, benefits, and potential pitfalls to ensure it aligns with your financial goals.

Using a purpose-built software solution like TaxTank can make the journey smoother by providing tools specifically designed for property investors. With features to track expenses, monitor compliance, and maintain real-time oversight of your investments, TaxTank helps you stay organised and informed every step of the way. Start with free 14 day trial today.