When it comes to managing investment properties, finding the right property accountant is as important as choosing the right property. With ever-changing ATO regulations, complex deductions, and increasing audit activity, property investors need more than just basic tax advice, they need a strategic partner backed by smart software.

What Makes a Good Property Accountant?

Not all accountants are created equal. Choosing the wrong one could mean missed deductions, poor compliance, and unnecessary stress at tax time. The right property accountant will offer:

1. Specialisation in Property Tax

Look for accountants who specialise in property, not just general tax returns. Property tax has unique rules that require specific knowledge in areas like:

- Negative gearing

- Depreciation and capital works

- CGT exemptions and discounts

- Property structures (trusts, SMSFs, company ownership)

- Rental income and expense reporting

2. Tech-Driven Processes

A forward-thinking accountant will embrace technology to:

- Eliminate manual spreadsheets

- Integrate real-time data from bank feeds

- Track deductions year-round

- Provide proactive advice (not just end-of-year summaries)

This is where software like TaxTank changes the game.

Why a Software-Backed Property Accountant Is the Future

Traditional accounting is reactive. You hand over receipts in June, and hope your accountant finds enough deductions to reduce your tax bill.

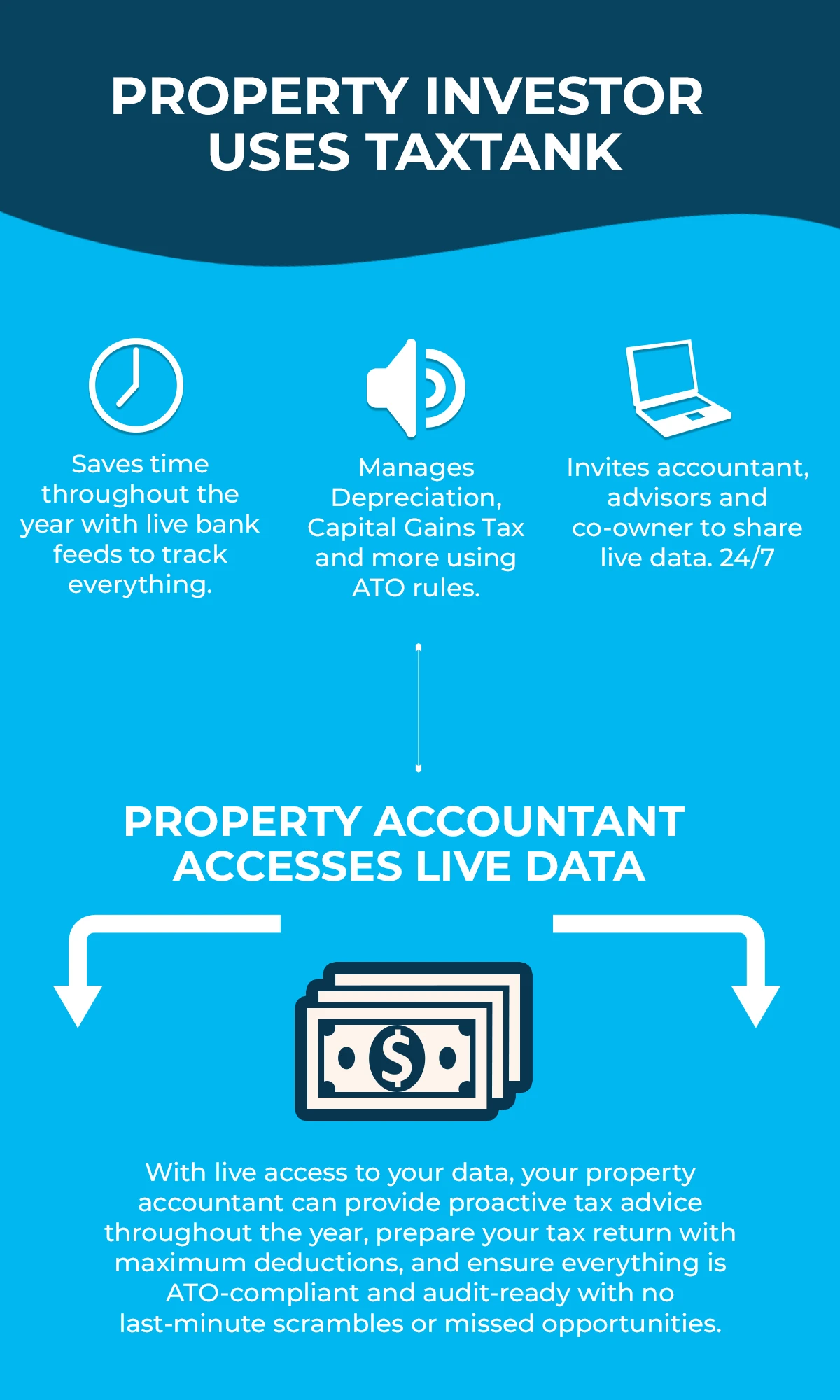

With TaxTank, property investors move from reactive to proactive. You stay in control of your numbers throughout the year, while your accountant has live access to your data—meaning smarter advice, fewer errors, and less back and forth.

Key Benefits of Using TaxTank:

- Real-time bank feeds: Income and expenses are tracked live, not weeks later

- ATO-friendly automation: Categorisation rules match ATO expectations

- Home office & depreciation diaries: Claim every dollar, correctly

- Property dashboards: Monitor performance, tax position, and equity

- Audit-ready recordkeeping: No more lost receipts or last-minute chaos

The Smart Way to Work With a Property Accountant

Here’s how modern property investors should manage tax with their accountant:

This system means your property accountant isn’t wasting time chasing documents or correcting errors, they’re focused on strategy.

Red Flags to Avoid When Choosing a Property Accountant

- ❌ No property experience – If they can’t explain CGT discount rules or depreciation schedules, walk away.

- ❌ Manual processes – If you’re emailing spreadsheets or scanning receipts, you’re doing too much.

- ❌ Once-a-year contact – Good property accountants provide year-round guidance, not just a tax return.

- ❌ Poor tech stack – If they’re not using smart tools like TaxTank, they’re probably missing deductions.

What Questions Should You Ask a Potential Property Accountant?

Before engaging any accountant, ask:

- “What’s your experience with investment properties?”

- “How do you help clients track deductions throughout the year?”

- “Do you support TaxTank or similar software?”

- “Can you help with property structure reviews or CGT forecasting?”

- “How do you keep clients audit-ready?”

If they can’t answer these with clarity and confidence, keep looking.

The TaxTank Advantage: Property Accounting, Evolved

At TaxTank, we believe the future of property accounting is live, transparent and automated. Our system puts you and your accountant on the same page—with none of the usual friction.

What makes TaxTank stand out:

| Feature | Traditional Accountant | TaxTank + Accountant |

| Live bank feeds | ❌ | ✅ |

| Real-time tax position | ❌ | ✅ |

| Built-in depreciation tools | ❌ | ✅ |

| Automatic CGT tracking | ❌ | ✅ |

| Year-round visibility | ❌ | ✅ |

| Full ATO compliance | ✅ | ✅ |

We’re not here to replace your accountant, we’re here to make them better 😉.

FAQs

What is a property accountant and how is it different from a regular accountant?

A property accountant specialises in tax matters related specifically to investment properties. Unlike general accountants, they understand the complexities of negative gearing, depreciation, capital gains tax (CGT), and property ownership structures.

Why is it important to choose an accountant who uses property-specific software?

Software like TaxTank allows your accountant to access real-time financial data, track deductions year-round, and deliver proactive tax advice. Saving you time, money and reducing errors compared to traditional, manual methods.

Can I still use my current accountant if I switch to TaxTank?

Yes! You can invite your current accountant to access your TaxTank data. The platform is designed to enhance their work, not replace it. It’s all about making collaboration smoother and more effective.

How does TaxTank help with ATO compliance?

TaxTank has translated approximately 6000 pages of Australian tax legislation to match ATO expectations for categorisation, deduction tracking, and recordkeeping. Features like real-time bank feeds and audit-ready logs help keep everything above board and stress-free.

What should I look for when interviewing a new property accountant?

Ask about their experience with property investments, their use of technology, their year-round support strategy, and how they help clients stay audit-ready. Bonus points if they already work with TaxTank.

How often should I be in contact with my property accountant?

Ideally, you should have ongoing communication throughout the year and not just at tax time. Regular check-ins ensure deductions are captured in real time and strategic decisions can be made proactively.

What if my accountant doesn’t support TaxTank?

If your accountant is hesitant about using software like TaxTank, it may indicate they’re behind on tech-driven best practices. Consider finding one who embraces digital tools and modern workflows or encourage them to try TaxTank.

Can TaxTank handle multiple properties?

Yes. TaxTank is designed for property investors with one or many properties. You’ll get separate dashboards for each, complete with performance tracking, deduction management, and tax visibility.

Is TaxTank suitable for first-time property investors?

Absolutely. Whether you own one investment property or ten, TaxTank simplifies property tax and makes it easier to understand your numbers, stay compliant, and maximise returns

Choosing the Right Property Accountant Starts With the Right Tools

Your accountant should want you to use software like TaxTank. It means better data, better decisions, and better outcomes. If they don’t, it may be time to find one that does.

So, if you’re serious about growing wealth through property—and staying on the right side of the ATO—pair expert advice with smart software.

Get started with TaxTank today and invite your accountant to a smarter way of working.