Key Takeaways

- TaxTank is the number one Property Accounting Software for Australian property investors, offering far more than property-only solutions by combining real-time tax, finance, and property management in one platform.

- The Property Accountant is focused solely on property with more limited funcationality for property investors. It’s even further limited for investors with other income streams.

- PropertyMe is designed for property managers and agencies, not individual investors.

- Excel and Google Sheets can work for very small portfolios but require manual effort and are error-prone.

- Xero is a strong general accounting tool but not built for property investment and often needs extra help from a bookkeeper or additional plugins that still aren’t purpose built.

Managing your investment property finances is no small task. Between tracking rental income, mortgage interest, depreciation, maintenance, and tax implications, it’s easy to lose clarity without the right property accounting tools. That’s where property accounting software comes in.

In this guide, we’ll cover the top 5 property accounting software options for Australian investors in 2025, breaking down their strengths and weaknesses so you can choose the one that best suits your needs.

1. TaxTank – The Best All-in-One Property Accounting Software

Best for: Property investors who want detailed, real-time insight into every aspect of their investments, especially those managing complex portfolios, including Trusts and SMSFs. Also ideal for sole traders, crypto and share traders, employees, or anyone who wants to manage their tax in real time.

TaxTank is more than property accounting software – it’s a complete tax and property accounting platform built for Australians. Unlike other tools that only track rental income and expenses, TaxTank gives property investors full control: it connects directly to your bank feeds, automatically applies deductions, updates property values in real time, and calculates tax across your entire portfolio – not just property. For property accounting and overall tax management, it removes the need for multiple spreadsheets and manual tracking.

With TaxTank, you can see your live tax position all year, not just at tax time. Whether you own multiple investment properties, run a side business, trade shares, or manage a Trust or SMSF, it gives you the full picture so you can make smarter decisions and keep more money in your pocket.

Features:

Automated Bank Feeds

Link your accounts and let automation rules categorise expenses for you, saving hours on manual data entry.

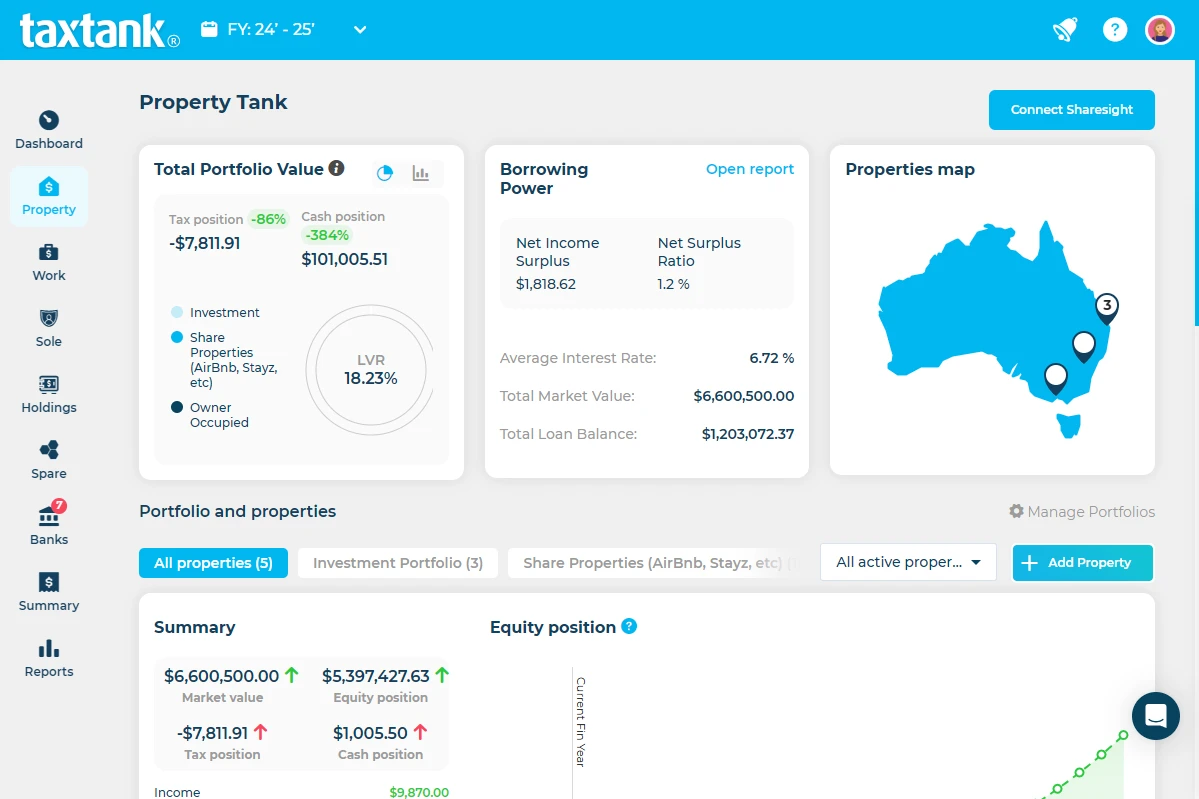

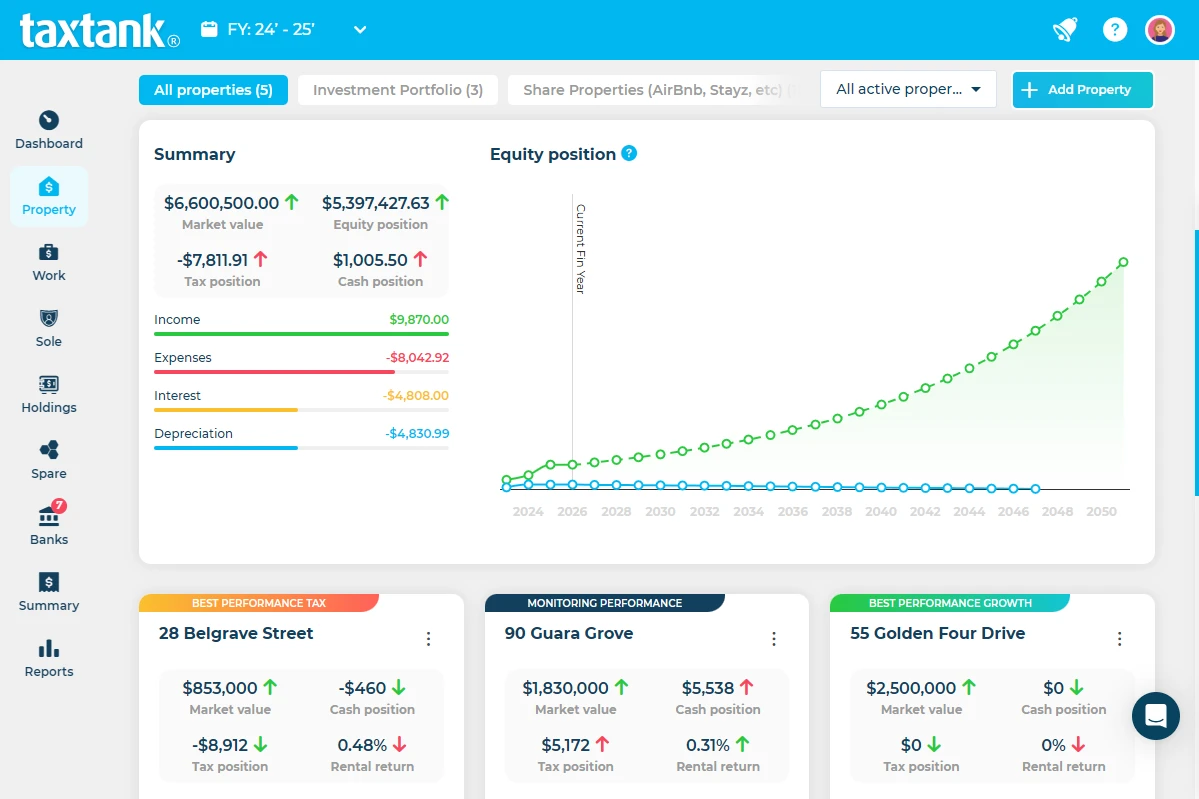

Property Tank

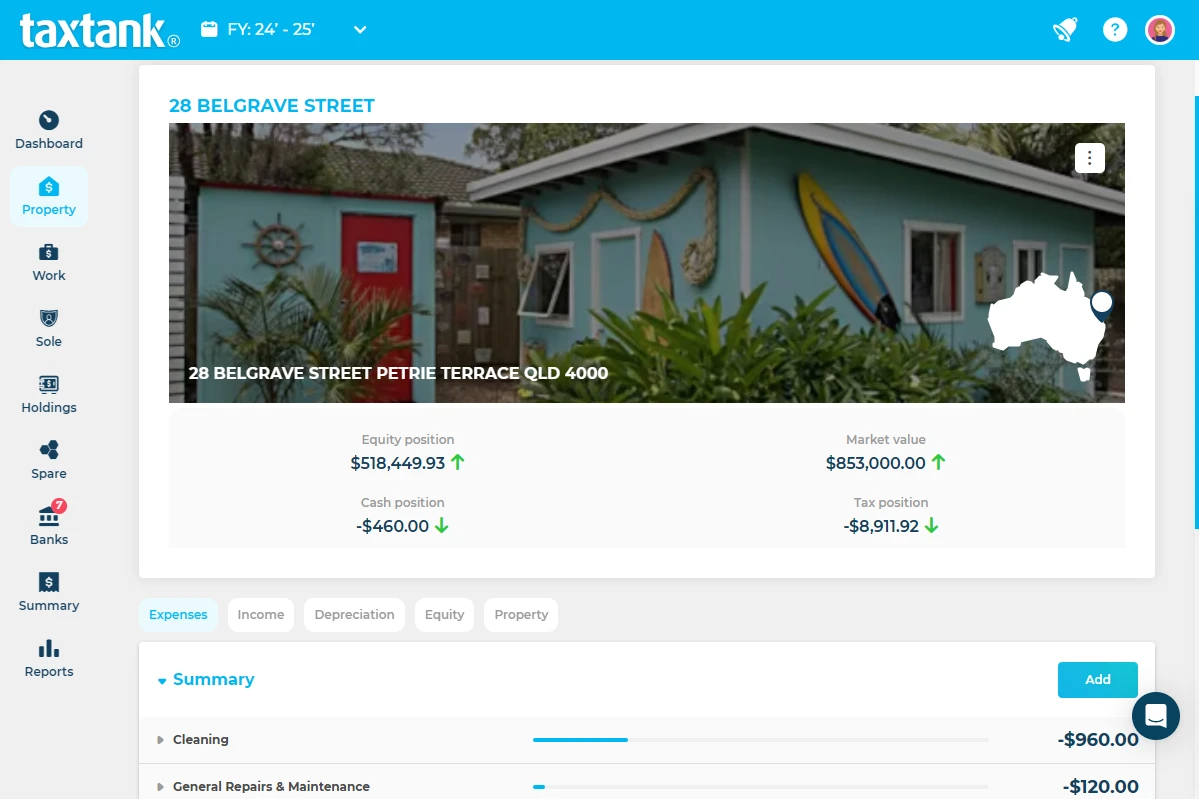

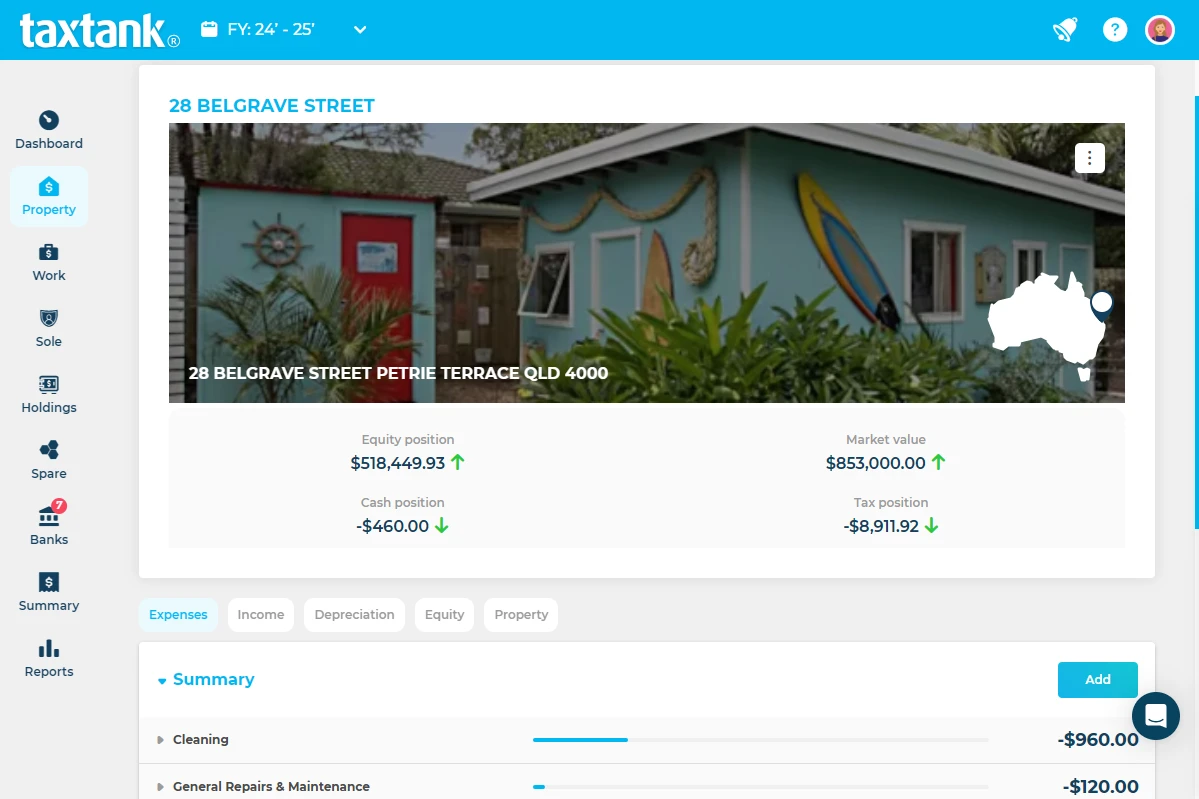

Manage all your properties in one place, no matter the ownership structure, with real-time tracking of income, expenses, tax, and cash positions. Features include:

- Live CoreLogic property values and growth percentages

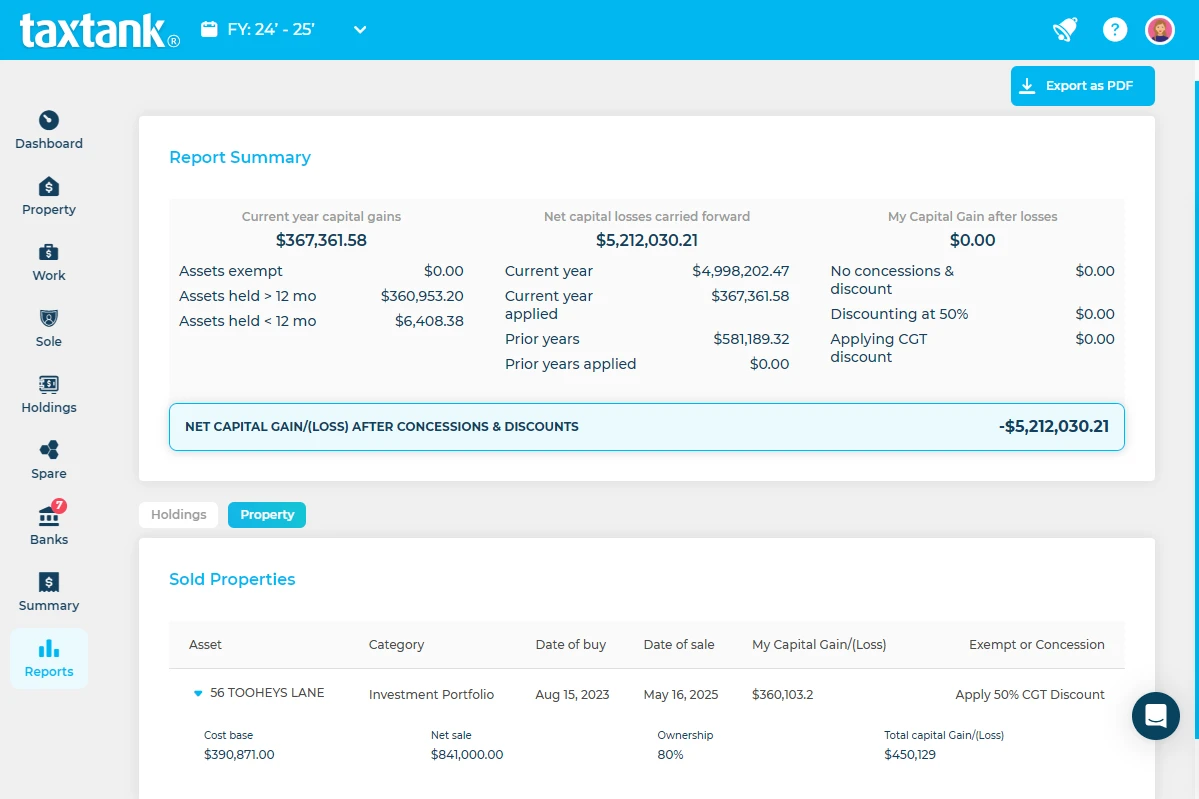

- Instant CGT calculations and real-time impact on tax returns

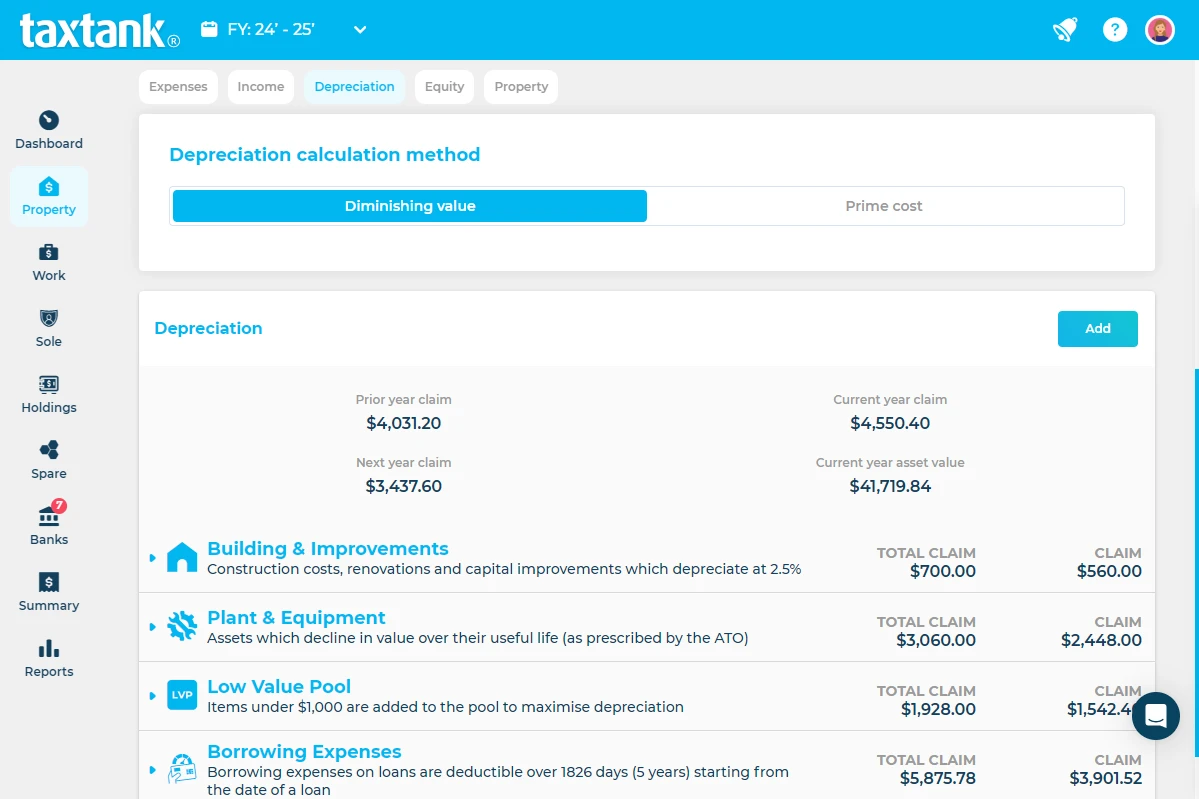

- Depreciation schedules with automated low-value pool and asset write-offs

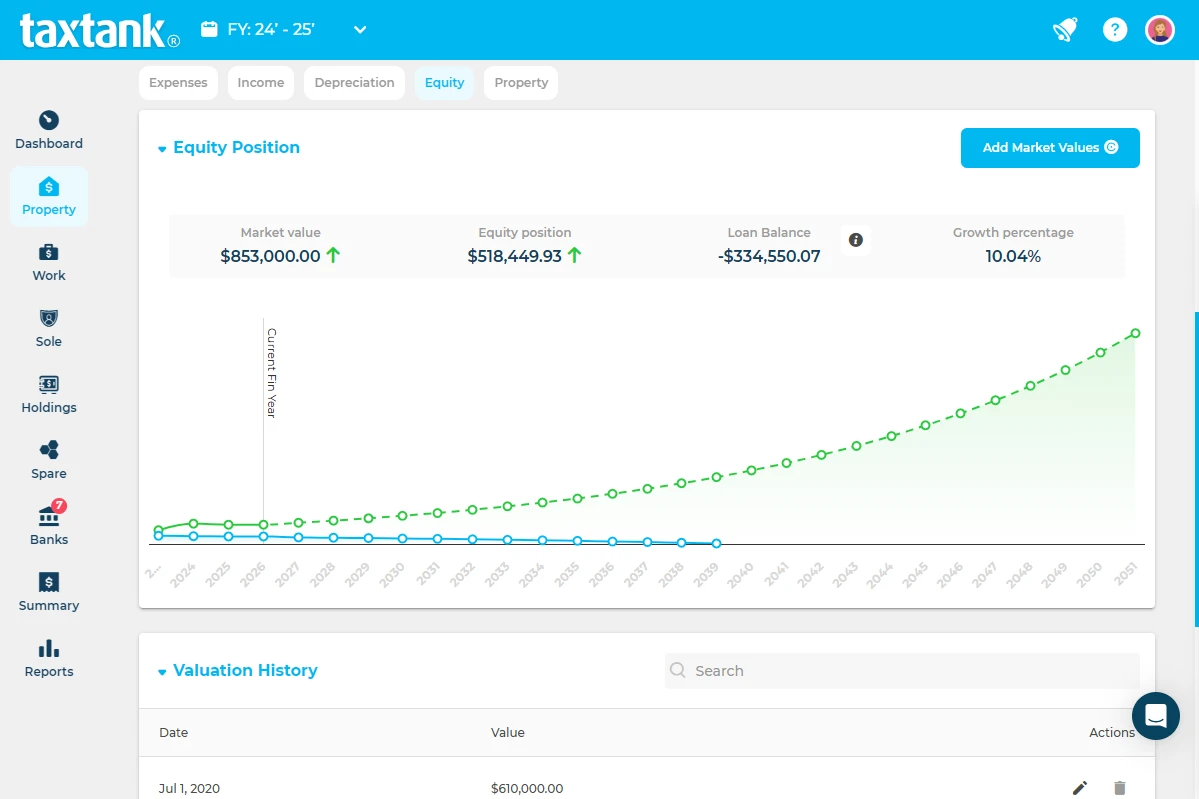

- Loan balances, equity tracking, and borrowing power analysis via the Net Surplus Ratio report

- Performance monitoring, including capital growth, LVR, and yields

- DIY project tracking for structural improvements

- Automated allocation of borrowing expenses for loans and refinancing

- Custom portfolios for properties in Trusts, companies, or SMSFs

- Claim percentage calculations for shared properties, including Airbnb, Stayz, and room rentals

- Pre-rental expense tracking for properties not yet generating income

- Instant property tax reports for accountants

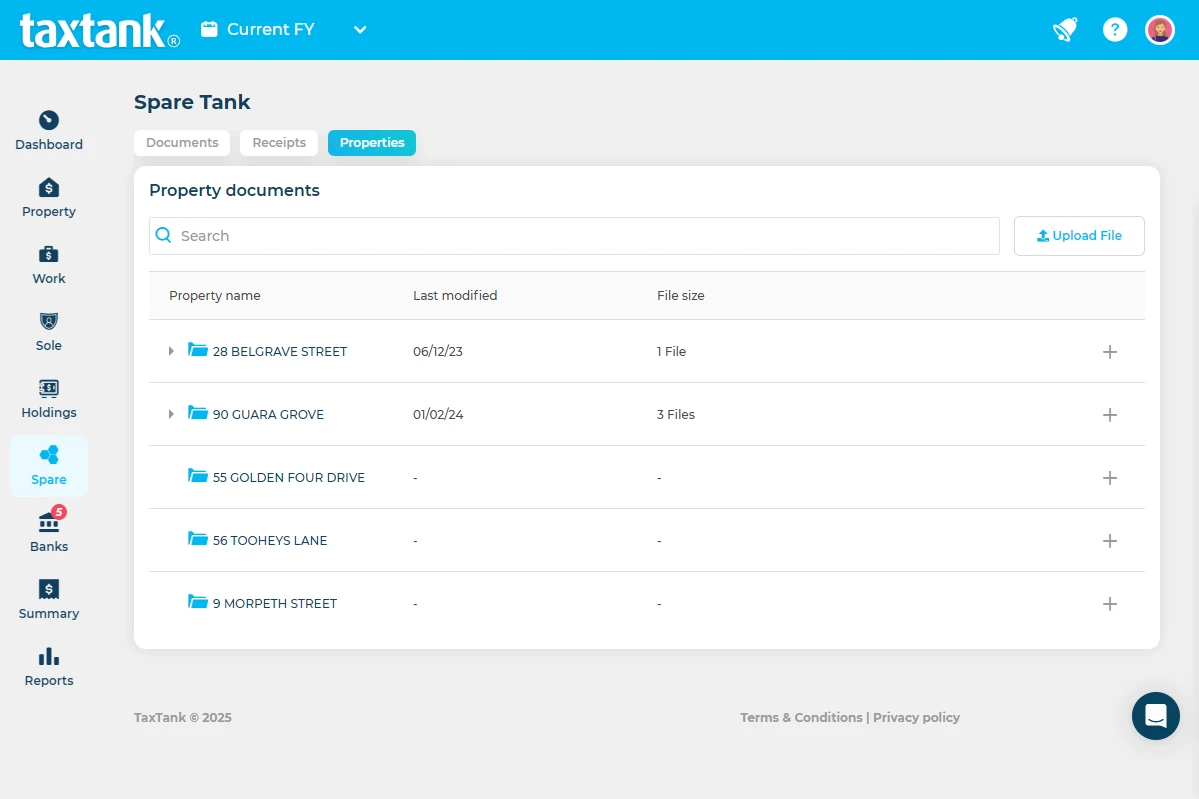

- Secure document storage in the Spare Tank’s dedicated property folder

- Integration with Sharesight for live property data sync

Holdings Tank

Manage crypto, shares, and unlisted assets with real-time performance tracking and built-in CGT calculations.

Sole Tank

Designed for sole traders and freelancers to track income, expenses, and deductions instantly, with smart automation.

Work Tank

Keep tabs on income and work-related expenses, including:

- Home Office Diary for remote workers

- Vehicle logbook with automatic calculation of deductions

Real-Time Tax Dashboard

See exactly how much tax you owe or the refund you can expect, updated live as your finances change. Track HECS/HELP balances, net worth, and tax forecasts year-round.

Seamless Integrations

Two-way sync with Sharesight and a growing list of partners ensures your data flows effortlessly.

Document Management

Store and manage all your documents and receipts securely in the Spare Tank.

Pros:

- Covers more than just property – handles tax across all income types.

- Live visibility of tax position all year, not just at EOFY.

- Designed by Australian accountants and property investors.

- Removes spreadsheets and manual record-keeping.

- Transparent pricing with free CGT calculator for property, shares and crypto.

- Excellent for both DIY investors and accountants/advisors.

Cons:

- Setting up your bank feeds may take a few minutes initially, particularly if your investment property loans are held in a trust or SMSF, as the bank may require additional authorisation to access this data.

- Some accountants used to Xero may be slow to switch, even if new software could offer their clients better features or savings.

✅ Verdict: TaxTank is the clear winner for property investors who also have other income sources or want full control of their tax. It goes far beyond property-only tools by giving you the complete financial picture.

2. The Property Accountant

Best for: Property investors who only want to track their property income and expenses.

The Property Accountant is a niche property accounting platform designed specifically for property investors in Australia. It allows the management of many property-related financial tasks, such as recording settlement statements and depreciation schedules, and provides visibility into loan balances and equity.

Features:

- Simple Property Oversight

- Manual income and expense tracking.

- Integration with 100+ banks via open banking for loan accounts only.

- Simple Depreciation Calculator

- Mobile app and web portal.

Pros:

- Tailored for Australian property investors.

- Good for manually tracking property-specific income and expenses.

- Affordable with a short free trial.

Cons:

- Focused on property only and doesn’t cover other tax areas like shares, crypto, sole trader income, or employee deductions.

- Live bank feeds aren’t available for transaction accounts or credit cards, so not all transactions are captured automatically.

- No live property valuations or integrations.

- No automation rules for allocating expenses from live bank feeds.

- Depreciation calculations are limited and don’t automatically manage low-value pool assets or instant write-offs for items under $300.

- Pricing varies by property type, which can get costly for moderate or larger investment portfolios.

- Capital Gains Tax features are basic and may not cover more complex scenarios.

✅ Verdict: Ok for property-only investors, but restrictive if your finances extend beyond real estate.

3. PropertyMe

Best for: Property managers and real estate agencies.

PropertyMe is cloud-based property management software that helps agencies and property managers run their rent rolls. While it has accounting features, it’s not designed for individual investors managing their own portfolio.

Features:

- Live bank feeds and reconciliation.

- Trust accounting.

- Automated rent collection.

- Tenant portal for payments and maintenance.

Pros:

- Strong tool for property managers.

- Automates rent collection and reporting.

- Cloud-based access.

Cons:

- Not designed for individual investors.

- No free trial.

- Pricing may be too high for small landlords.

✅ Verdict: Excellent for agencies, but not the right fit for DIY investors.

4. Excel & Google Sheets

Best for: Very small portfolios or beginner landlords.

Spreadsheets are often the first stop for new landlords. They’re a low-cost property accounting solution for very small portfolios, but they come with serious limitations. All income and expense tracking is manual, which can quickly get messy and prone to errors.

Features:

- Manual recording of rental income, mortgage payments, and expenses.

- Basic financial calculations.

- Custom reporting and charts (if you know your formulas).

Pros:

- Low cost or free.

- Familiar for most users.

Cons:

- Manual entry takes time and invites mistakes.

- No automation, no integrations, and no real-time insights.

- Limited tax support.

✅ Verdict: Fine for one property and a tight budget, but not sustainable as your portfolio grows.

5. Xero

Best for: Landlords who already use Xero for business.

Xero is a general accounting tool that can handle property accounting, but often requires additional apps or a bookkeeper. It integrates with some property management apps and provides automated bank feeds and reporting. However, it’s a general accounting tool, not tailored for property investment or Australian tax rules.

Features:

- Automated bank feeds and reconciliation.

- Income and expense tracking.

- Integration with apps like Re-Leased and Landlord Studio.

Pros:

- Powerful accounting tool with strong reporting.

- Good integrations.

- Free 30-day trial.

Cons:

- May require a bookkeeper or accountant.

- May also require additional plugins to get required functionality.

- Not built specifically for property or Australian investors so add ons are required

- Pricing starts higher than dedicated property tools.

✅ Verdict: Great general accounting software, but less efficient for property tax compared to purpose-built solutions.

Final Thoughts

When it comes to property accounting, having the right software makes a huge difference for Australian investors. While The Property Accountant, PropertyMe, Excel, and Xero each serve a purpose, they all fall short when it comes to giving investors a complete tax and property solution.

TaxTank takes the top spot because it combines everything investors need in one platform – property, shares, crypto, sole trader income, deductions, and real-time tax visibility. It’s designed for Australians, by Australians, and removes the stress of managing tax at the end of the year.

👉 Best overall choice in 2025: TaxTank.

👉 Ready to ditch spreadsheets and get real-time tax insights? Start with TaxTank today and see why thousands of Australians trust us as their #1 choice.

Frequently Asked Questions About Property Accounting Software in Australia

What is the best property accounting software in Australia?

The best property accounting software in Australia for 2025 is TaxTank. Unlike property-only tools or standard accounting software, TaxTank gives investors full visibility of their tax position across property, shares, crypto, work and sole trader income. It’s designed for Australians, by accountants and investors, and removes the need for spreadsheets.

Is Xero good for property investors?

Xero can be used by property investors, but it isn’t built specifically for property. Many investors find they still need a bookkeeper to manage it and the cost can become excessive if more than one Xero file is required. For property-specific features like depreciation, loan balances, and rental performance, a dedicated platform like TaxTank is better suited.

Can Excel or Google Sheets be used for property accounting?

Yes, Excel and Google Sheets are low-cost options, but everything has to be entered manually, which makes them error-prone and time-consuming. They don’t offer the automation, integrations, or real-time tax visibility that platforms like TaxTank provide.

What makes TaxTank different from The Property Accountant?

The Property Accountant is focused solely on property, while TaxTank covers all income types – property, shares, crypto, salary and wages, and sole trader businesses. TaxTank also shows your real-time tax position, not just property performance, making it a complete tax management solution rather than just property software.

Do I need property accounting software as a landlord in Australia?

If you own more than one property or want to stay on top of tax obligations, property accounting software is highly recommended. It saves time, reduces errors, and helps you claim every deduction you’re entitled to. TaxTank goes a step further by showing your live tax position, so you’re never caught off guard at EOFY.

What is property accounting and why is it important?

Property accounting involves tracking income, expenses, depreciation, loan balances, and tax obligations related to property investments. Using dedicated property accounting software ensures accurate financial reporting, maximises deductions, and helps investors make better decisions. With the ATO’s hyper focus on property investors, using property accounting software to help manage your obligations has never been more important.

What features should I look for in property accounting software?

Key features include bank feed integration for all account types, automated expense categorisation, CGT and depreciation calculators, loan tracking, real-time tax dashboards, and multi-asset management.

Can property accounting software track multiple types of investments?

Yes. Platforms like TaxTank allow investors to track property, shares, crypto, salaries and wages, and sole trader income all in one place, giving a complete picture of your financial position.