Concerns about rising interest rates and high cost of living has some Australian property investors considering selling their assets, but is it the right move?

New research reveals that a huge 63% of property investors are feeling concerned about rising interest rates, and with more interest rate rises projected over the next few months, the pressures aren’t going to ease any time soon. The research, commissioned by Australian fintech startup, TaxTank, also showed that 40% of property investors are concerned about the cost of living and more than one in ten fear they may have to sell.

Following the latest cash rate rise of 50 basis points to 0.85%, more and more Australians are going to be feeling the pinch of the rising cost of living, with a mortgage of $750,000 now requiring an extra $199 a month.

“With some property investors now feeling concerned about maintaining their portfolios in the current environment, it’s absolutely vital not to panic sell properties. Too often, we see clients sell properties based on the wrong criteria because they don’t have the right information,” said Nicole Kelly, TaxTank founder.

“Clients look at the mortgage they need to pay out, and the cash left over, instead of which properties are performing the best in their tax return and what cash is required from their pocket to hold that investment each week”.

Further data shows that only 34% of property investors are confident that they know their cash position well, and only 21% are confident that they know their tax position.

Commenting on this trend, Nicole said, “Understanding the performance of each property is crucial to ensure solid decision making, and let’s not forget about capital gains tax (CGT) which often catches investors off-guard. There is no getting around CGT, however knowing the tax impact of a property sale will not only enable better decision making on which property to sell, but when to sell to reduce the liability where possible.

However performance is not just about tax, knowing your suburb growth percentage and forecasted equity should be a consideration to capitalise on your investment over time.

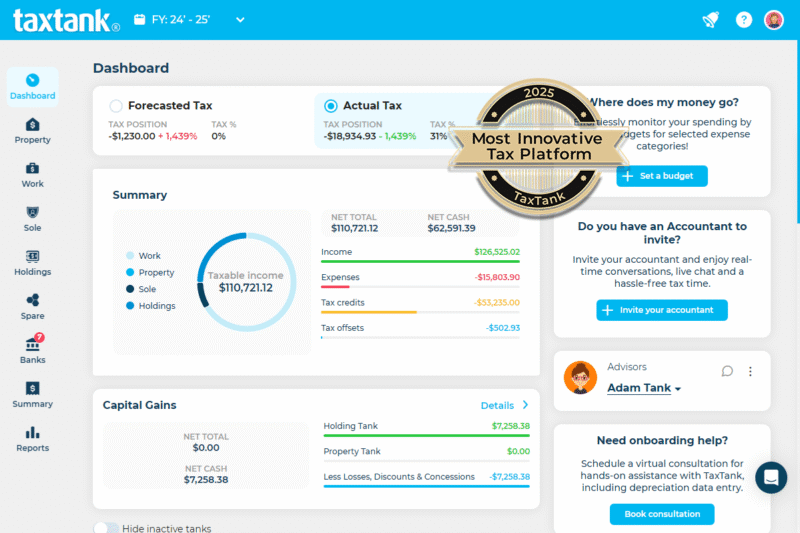

Solid record keeping is also paramount in this equation. In addition to growth forecasting, TaxTank allows property investors a transparent, real time view of their cash and tax positions for informed decision making. Calculating CGT is also quick and simple with smart tax tools.”

With property values arguably sliding and interest rates climbing, there’s no better time for property investors to assess their portfolios to manage their assets with confidence to ensure long term success.

About the survey

The survey was commissioned by TaxTank and undertaken by Octopus Group to analyse the behaviours and sentiments of Australian property investors ahead of the 2022 tax season. In May 2022, Octopus Group conducted an online quantitative survey of 606 Australian property investors. The survey is nationally representative.