Accounting software built specifically for property investors

In the fast-paced world of property investment, efficiency and accuracy are paramount. Many investors find themselves bogged down by traditional accounting software like Xero, which, despite its popularity, often falls short of delivering the specialised tools needed for effective tax management and financial oversight. Sticking with Xero could mean missing out on valuable deductions. Discover how TaxTank can revolutionise your tax management experience, starting at just $15 a month.

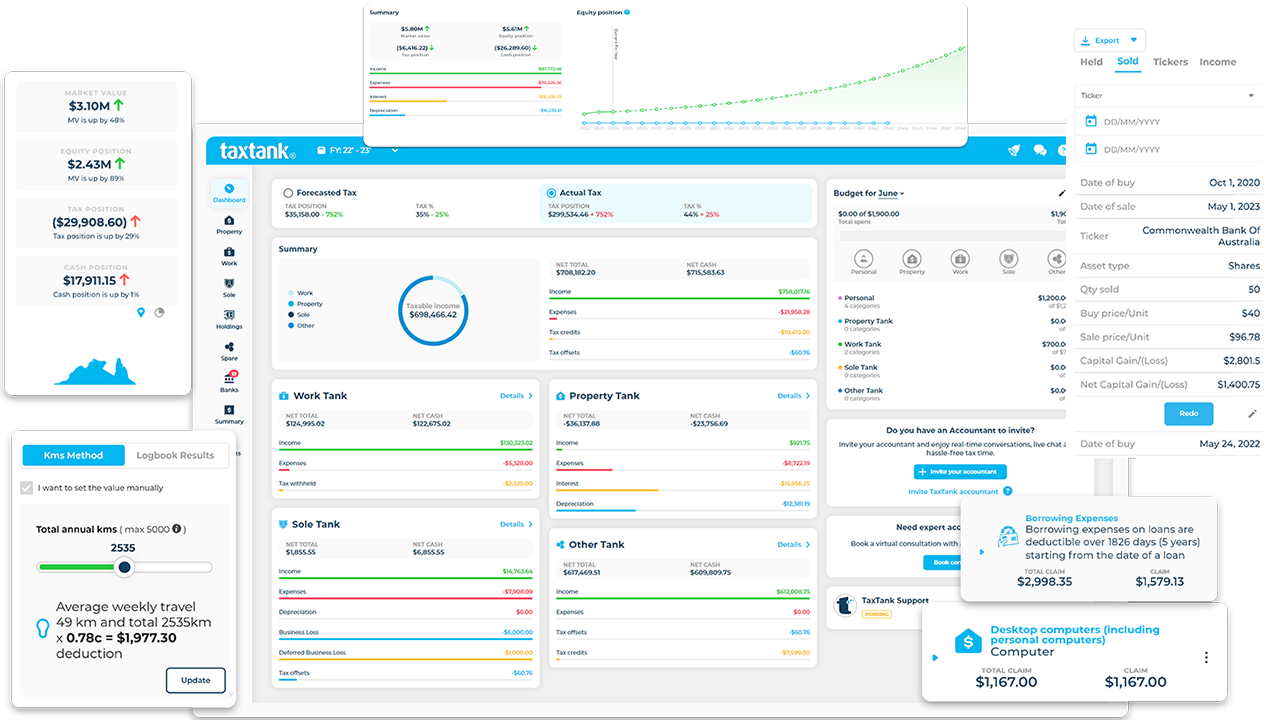

What you get with TaxTank

Based on Australian tax law, TaxTank stands out as the best alternative to Xero for property investors. Unlike Xero, which caters to a broad range of businesses, TaxTank is specifically designed to meet the unique needs of property investors. From automated data entry to real-time financial tracking, TaxTank provides a seamless experience tailored to monitoring property investments efficiently.

From just $15 a month, TaxTank offers unparalleled value. This affordable pricing ensures that all property investors can access top-tier tax management tools without breaking the bank.

- Live bank feeds and automated expense allocation

- Depreciation for properties and DIY projects

- Real time reporting on your portfolio

- Capital Gains Tax calculator if you’re looking to sell

- Borrowing power calculator to help you grow

- Document storage for receipts and important documents

- Complete financial oversight

- Plus you can manage all your other income and expenses in the one place

What you get with Xero

Xero is designed to be a one-size-fits-all business solution producing financial reports, which means it doesn’t offer the tailored features that property investors need to manage their portfolios effectively. Customising Xero to fit these needs often requires additional plugins and manual workarounds, which can be both time-consuming and costly.

- Reconciliation of bank transactions for income and expense tracking

- Automated rent invoices to help avoid late rent payments

- Cashflow reporting

You will also need;

- An accountant to calculate CGT and depreciation

- Multiple files for multiple entities

- Manage your personal finances separately

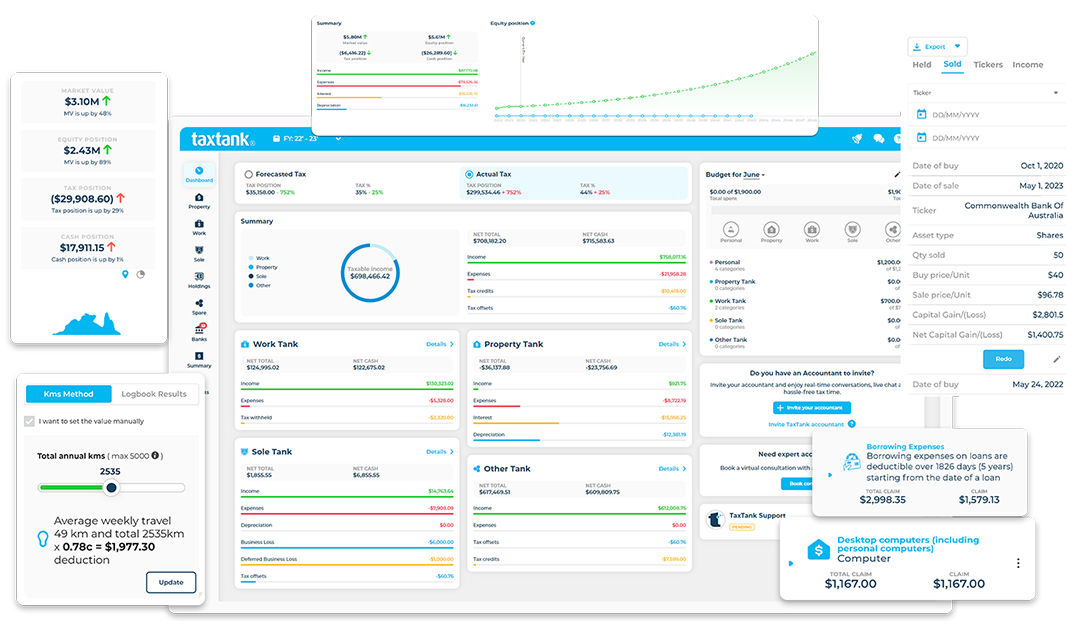

The best alternative to Xero for Property Investors

TaxTank is the only accounting software on the market tailored specifically for property investors. Here’s how we compare to using Xero for managing your investment properties.

TaxTank

- Tailored Specifically for Property Investors

- Automated Live Bank Feeds

- Manage all properties regardless of ownership in one account

- Custom portfolios for land, share properties, trusts and your home

- Capital Gains Tax Calculator

- Automated Depreciation for Property

- Integration with CoreLogic for Live Equity Forecasting

- Comprehensive Property Portfolio Reporting

- Automated Borrowing Expenses

- Permanent document storage

- Tax deductible fees

- Affordability

TaxTank

Xero

TaxTank

- Tailored Specifically for Property Investors

- Automated Live Bank Feeds

- Manage properties regardless of ownership

- Custom portfolios

- Capital Gains Tax Calculator

- Automated Depreciation for Property

- Live Equity Forecasting

- Comprehensive Property Portfolio Reporting

- Automated Borrowing Expenses

- Permanent Document Storage

- Tax Deductible Fees

- Affordability

TaxTank

Xero

TaxTank

- For Property Investors

- Automated Live Bank Feeds

- Manage Property Ownerships

- Custom Portfolios

- Capital Gains Tax Calculator

- Automated Depreciation

- Live Equity Forecasting

- Property Portfolio Reporting

- Auto Borrowing Expenses

- Document Storage

- Tax Deductible Fees

- Affordability

TaxTank

Xero

Ready to take control of your property investment tax management? Sign up for TaxTank today or switch from Xero to experience unparalleled efficiency and accuracy tailored to property investors.

It's easy to get started

Getting started with TaxTank is simple and affordable. With pricing starting from just $15* per month, you can access all the specialised tools you need to manage your property investments effectively.

- Free Trial

- No Credit Card Required

- Cancel Anytime

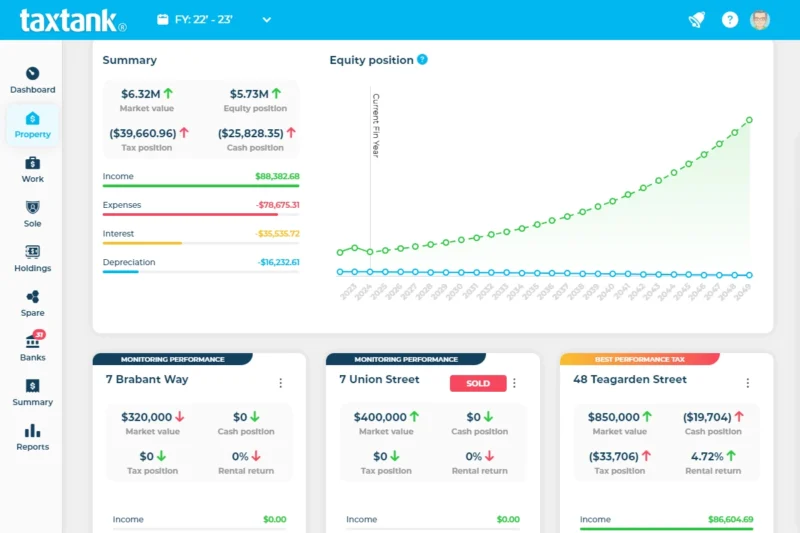

PROPERTY TANK

Simply add Property Tank so you can monitor your whole property portfolio in one place. You can manage up to 5 properties for only $15 a month.

$15/month

Paid Annually

ADDITIONAL

PROPERTIES

Have more than 5 properties? No problem, you can add as many as you like with our property add-on.

$3/month

Paid Annually

Frequently asked questions

TaxTank is specifically designed for property investors, offering features like automated bank feeds, integration with CoreLogic, and complete portfolio oversight, which are not available in Xero.

Yes, TaxTank allows you to manage multiple properties and entities within a single platform, providing comprehensive financial oversight and reporting.

Absolutely. TaxTank is designed to ensure compliance with ATO regulations, helping you track and report capital gains, loan apportioning, and accurate income reporting.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.

TaxTank’s pricing starts from just $15* per month, offering affordable access to top-tier tax management tools for property investors of all portfolio sizes.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.