Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is crucial for maximising returns and staying compliant with Australian tax laws. In this comprehensive guide, we will delve into the various tax considerations for property investors in Australia, covering everything from rental income and deductions to capital gains tax and depreciation.

Rental Income and Deductions

What is Rental Income?

Rental income is any payment you receive from tenants for the use of your property. This includes income from sub-letting, short-term tenancies, and boarding. Beyond regular rent payments, rental income also covers additional fees such as lease premiums and reimbursements for expenses like water and electricity.

Mastering Allowable Property Investment Tax Deductions

One of the most significant advantages of property investment is the ability to claim various deductions, reducing your taxable income and enhancing your financial return. Here’s a closer look at some key deductions:

- Interest on Loans: One of the most substantial deductions you can claim is the interest on loans taken to purchase, construct, or improve your investment property. This interest is fully deductible, helping you manage your cash flow more effectively.

- Repairs and Maintenance: Regular upkeep is essential for maintaining your property’s value. Costs incurred for repairs and maintenance are deductible, provided they aren’t for initial repairs when you first acquired the property.

- Property Management Fees: If you hire a property manager or agent to handle the day-to-day operations, their fees are deductible, easing the burden of property management.

- Depreciation: Depreciation allows you to claim a portion of the property’s value and its fittings and fixtures each year. For newer properties, the benefits are more significant, but even older properties offer some depreciation advantages.

- Travel Expenses: Previously, travel expenses for property inspections were deductible. However, as of 1 July 2017, this deduction is no longer available for residential rental properties.

- Borrowing Expenses: The costs associated with taking out a loan, such as loan establishment fees, lenders mortgage insurance LMI, title search fees, and the costs of preparing and filing mortgage documents, are deductible. These expenses are usually spread over the life of the loan or five years, whichever is shorter. Tip: If you refinance don’t forget to claim any residual borrowing expenses in the same year!

- Prepaid Expenses: If you prepay expenses like insurance or interest for up to 12 months in advance, you can claim these as deductions in the year they are paid. This can be a useful strategy for managing taxable income.

- Land Tax: Land tax is a state or territory levy on the unimproved value of your land. Often misunderstood and mistakenly confused with capital expenses, land tax is a legitimate and deductible expense that should not be overlooked by property investors.

Understanding the Little Rules: Navigating the intricacies of property investment tax means understanding the specific rules that apply to different property types. For instance, vacant land has limited deduction capabilities, and the tax benefits can vary significantly for properties that are co-owned or let through short term accommodation platforms like AirBnB. Being aware of these nuances can help you maximise your deductions and avoid any compliance issues.

Importance of Apportioning Personal Use: The ATO closely scrutinises loans for mixed-use properties (ie. those that serve both personal and investment purposes). It’s crucial to accurately apportion personal and investment use. Only the portion of loan interest and expenses related to the investment is deductible. Properly separating these ensures compliance and avoids potential penalties.

Negative Gearing

What is Negative Gearing?

As you dive deeper into property investment, you may encounter the concept of negative gearing. Negative gearing occurs when the cost of owning a rental property exceeds the income it generates. The resulting loss can be offset against other income, such as your salary or wages, effectively reducing your overall taxable income.

Benefits of Negative Gearing

- Tax Deductions: The primary benefit of negative gearing is the ability to claim deductions on interest payments, maintenance, and other expenses. This can significantly reduce your taxable income, providing immediate financial relief.

- Long-term Growth: Many investors accept short-term losses for potential long-term capital gains, expecting property values to appreciate over time. This strategy can lead to substantial financial rewards if property prices rise, enhancing your overall investment returns.

Maximising Negative Gearing with Depreciation

Understanding depreciation is key to maximising the benefits of negative gearing. Unlike out-of-pocket expenses, depreciation is a non-cash deduction that reflects the wear and tear on the property and its fixtures over time. This means you can claim depreciation without affecting your cash flow, further increasing your property investment tax deductible expenses and amplifying the benefits of negative gearing.

What is Depreciation?

Depreciation allows investors to claim the reduction in value of the property’s structure and assets over time. There are two main types of depreciation allowances:

- Capital Works Deductions: These cover the building’s structure and fixed items such as walls, floors, and roofs. Typically, the deduction rate is 2.5% per year over 40 years.

- Plant and Equipment Deductions: These cover removable items like appliances and carpet. The depreciation rates vary depending on the item’s expected lifespan. .

How to Claim Depreciation

To claim depreciation, investors should obtain a depreciation schedule prepared by a qualified quantity surveyor. This schedule outlines the depreciable items and their rates, ensuring that investors maximise their deductions. It’s important to note recent law changes: for properties purchased after May 9, 2017, investors can no longer claim depreciation on previously used plant and equipment. This means that if you buy an existing property, you can only claim depreciation on the new assets you purchase for that property. These changes make having a professional depreciation schedule even more critical to ensure compliance and maximise your allowable deductions.

Capital Gains Tax (CGT)

What is Capital Gains Tax?

If you’re thinking about selling your investment property, it’s essential to understand Capital Gains Tax (CGT) and its implications. CGT applies to the profit made from the sale of an investment property. The capital gain is the difference between the property’s selling price and its original purchase price, adjusted for certain expenses and depreciation.

CGT Discount

Australian residents for tax purposes can benefit from a CGT discount of 50% if the property has been held for more than 12 months. This means only half of the capital gain is included in your taxable income, significantly reducing your tax liability on the sale.

Tip: The 12 months is calculated from contract date to contract date (not the settlement date) so don’t get caught out!!

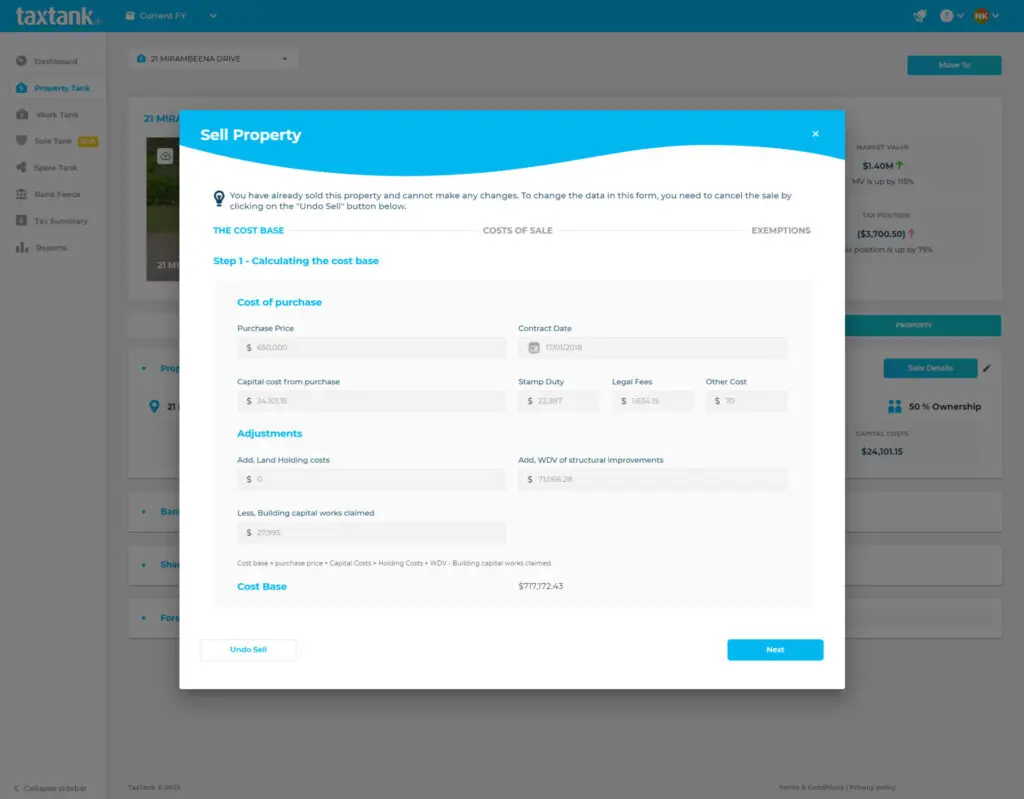

Calculating CGT

Calculating CGT involves:

- Determining the cost base: This includes the purchase price, stamp duty, legal fees, and any capital improvements made to the property.

- Subtracting the cost base from the selling price to determine the capital gain.

- Applying any eligible discounts or exemptions to the capital gain.

Tax Implications of Property Investment Structures

How you hold your investment property can also significantly impact your property investment tax obligations and benefits:

Individual Ownership

Owning property as an individual is straightforward, but it means that all income and deductions flow directly through to your personal tax return. This can be beneficial for claiming negative gearing losses but may expose you to higher tax rates on capital gains.

Joint Ownership

When property is owned jointly, the income and deductions are split according to the ownership percentage. For example, if you and a partner each own 50% of the property, each of you will report 50% of the rental income and 50% of the allowable deductions on your tax returns. This can be advantageous if one owner is in a lower tax bracket, as it can reduce the overall tax liability. However, it’s important to plan for the future, as Capital Gains Tax (CGT) will also be allocated according to the ownership percentage.

Company Ownership

Holding property in a company can offer asset protection and potentially lower tax rates, but it may limit the ability to access CGT discounts. Companies do not qualify for the 50% CGT discount available to individuals and trusts.

Trust Ownership

Trusts offer remarkable flexibility in distributing income and capital gains to beneficiaries, which can be highly tax-effective if the beneficiaries fall into lower tax brackets. An important aspect of managing a trust is that trustees must prepare minutes for the distribution of income before June 30 to ensure compliance, making real-time record-keeping crucial. Trusts also benefit from the Capital Gains Tax (CGT) discount, enhancing their appeal for property investment. However, exercise caution with land tax, particularly with a corporate trustee involved, as you might face higher land tax rates or different thresholds applicable to trusts, potentially catching you off guard.

Record Keeping and Compliance

Importance of Record Keeping

The ATO has had a sharp focus on property investors since 2017, claiming that 9 out of 10 investors make errors on their tax returns. Accurate record keeping is crucial to substantiate claims and comply with tax obligations, as the ATO cites lack of substantiation as the biggest cause for adjustments. The ATO uses data matching from insurance companies, real estate agencies, banks, and other financial institutions to cross-check information, making meticulous record-keeping even more important. Here’s what you need to know:

- Loan Statements and Refinancing Documents: Maintain comprehensive records of loan statements and any refinancing documents. This is crucial for verifying the apportioning of tax-deductible interest, ensuring that only the interest related to the investment portion of the property is claimed.

- Capital Expenses: Keep detailed records of all capital expenses and related contracts, such as renovations and improvements. These records are essential for substantiating your cost base calculations for Capital Gains Tax (CGT) purposes, potentially reducing your CGT liability when you sell the property.

- Receipts and Invoices: Collect and organise all receipts and invoices for property-related expenses. These documents are your primary evidence to support deduction claims and must be kept for at least five years from the date you lodge your tax return for expenses, and five years from sale for capital claims.

- Change of Use: If your property’s usage changes (e.g., from rental to personal use or vice versa), keep a solid record of the dates and market values at those times. This documentation is crucial for accurate Capital Gains Tax (CGT) calculations, as it can significantly impact your CGT liability when you sell the property.

Lodging Tax Returns

With the rising costs of compliance and accounting fees, being organised is more critical than ever for property investors. Reporting all rental income and deductions in your annual tax return is non-negotiable. Failure to do so can result in hefty penalties and interest charges. Embracing a digital solution to manage your records can streamline this process, making it easier to ensure all claims are accurately reported and compliant with Australian tax laws. Stay ahead of the game by staying organised!

Conclusion

Understanding property investment tax in Australia is crucial for maximising returns and ensuring compliance. From rental income and deductions to capital gains tax and depreciation, navigating these complexities requires careful planning and accurate record keeping.

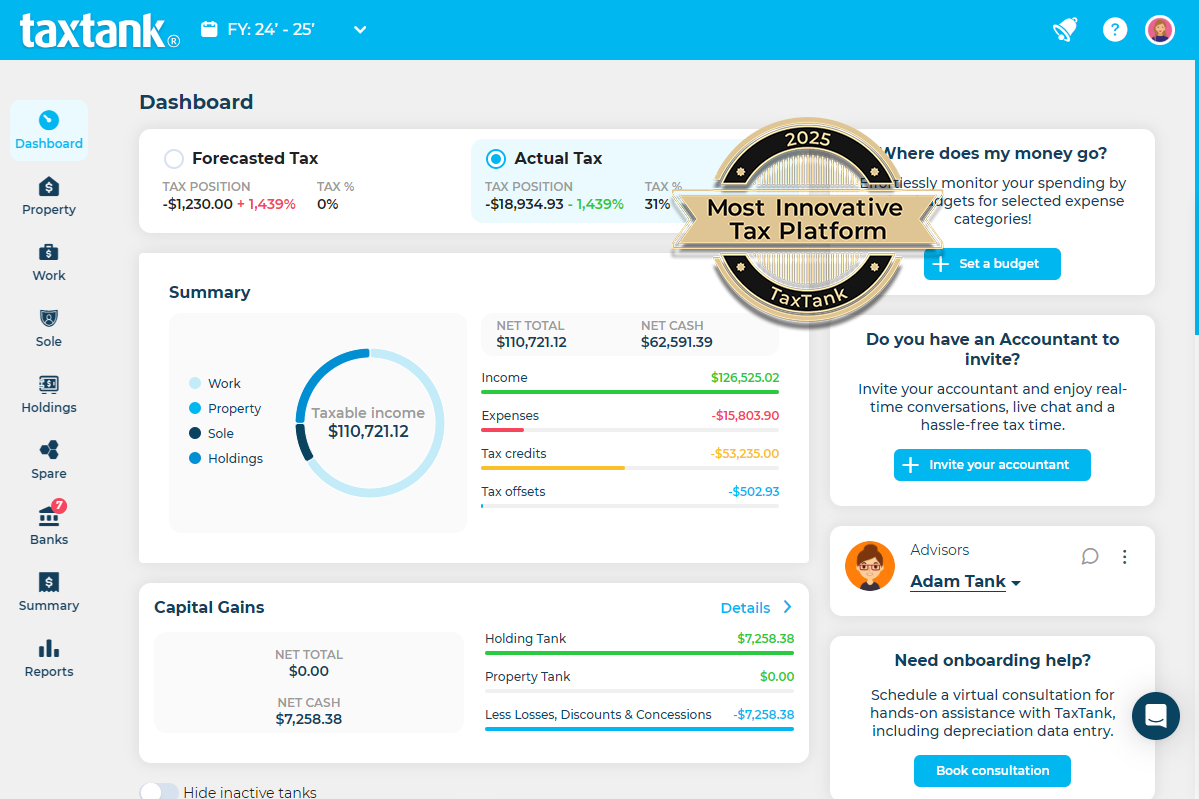

Take control of your property investment tax management with TaxTank. As the only software built specifically for property investors, TaxTank empowers you to manage your tax obligations live throughout the year. Experience the power of real-time tracking, automated calculations, and comprehensive reports that ensure you maximise your deductions and stay compliant. Simplify your tax management, reduce the risk of costly errors, and focus on growing your investment portfolio with confidence. TaxTank is your partner in making property investment not only profitable but also stress-free. Join the savvy investors who trust TaxTank to turn tax time into a seamless, efficient process. Your path to smarter property investment starts here!